Blockchain Byte - Week 3 : Cryptocurrency - a new paradigm

Table of Contents

- Recap

- Cryptocurrency

- What is Cryptography?

- Encryption & Decryption

- Bank Accounts & Centralized Databases

- Decentralization

- Inflation

- The First Whitepaper

Recap

Last week, we discussed about money and its three basic functions. Money serves the following three functions:

- A medium of exchange

- A unit of account

- A store of value

We started with money because the first, most popular and largest use case of blockchain is BITCOIN - a cryptocurrency with its own store of value.

First, a disclaimer - this is neither investment advise nor a blog to promote bitcoin or any cryptocurrency.

The underlying infrastructure of Bitcoin is a blockchain and explaining one requires understanding the other and hence we cannot exclude one from the other though not all blockchains need a digital currency or token (more on that later!)

Let us explore what is a cryptocurrency?

Cryptocurrency

Cryptocurrencies are digital currencies which are secured using cryptography and combining that aspect with their role as a currency gives us CRYPTO CURRENCY

Cryptocurrencies consist of two words - CRYPTO & CURRENCY

What is cryptography?

Cryptography is a technique of securing communication through use of codes so that only the person for whom the information is intended can access that communication and use it. This prevents unauthorized access.

The process of securing communication is called Encryption.

Encryption & Decryption

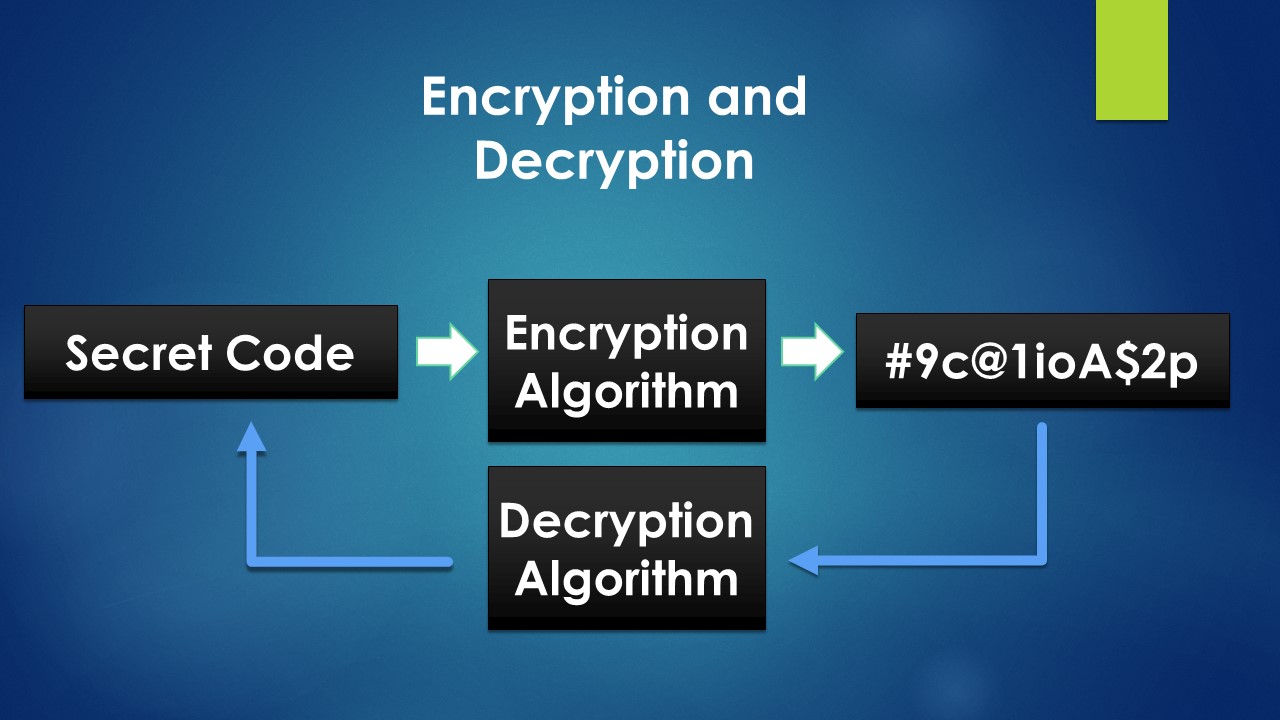

Encryption is the process by which data is scrambled so that only authorized parties can understand the relevant information and no one else.

In technical terms, it is the process of converting human-readable plaintext to incomprehensible text, known as cipher text.

Only the intended recipient of the communication can decode the cipher text. The process of conversion of cipher text to plain text is known as DECRYPTION.

The below diagram is a simple representation of encryption & decryption

Currently, among others, encryption is mostly used in verification to protect data privacy, digital signing, to protect confidential transactions such as credit card, online transactions, online banking etc.

We will come back to cryptography and its concepts later. For more details on cryptography, please refer here

Now we know that crypto currency is a digital currency which uses cryptography. But is this a complete definition? No. Then what is missing? - Decentralization

Before we go further, lets check some aspects of Bank accounts.

Bank Accounts & Centralized Databases

In my earlier post, I referred to money in bank accounts as entries in the bank's ledger. These ledgers are part of the Bank's database.

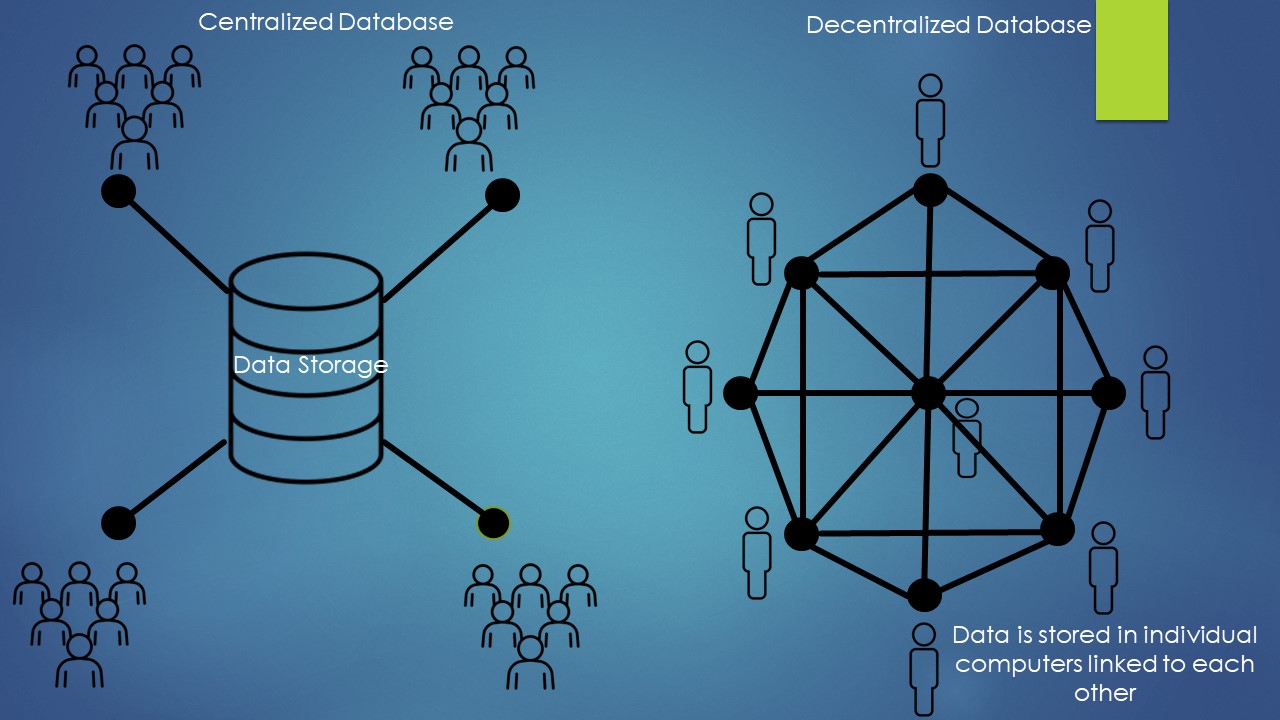

This database is a centralized repository of customer & account data maintained by the bank. Actually, it not only accounts but all information collected at the time of on-boarding a customer (bringing in a new customer) is maintained in the bank's database. E.g., customer address, education qualifications, employment details etc.

What is a database ? Database is defined (as per oracle) as an organized collection of structured information, or data, typically stored electronically in a computer system.

Almost all of us in financial services are familiar with spreadsheets like excel where data is collected in a structured format. In excel, each row represents a data (e.g., a customer) & each column represents an attribute of that data ( e.g., customer name, age, residency, contact details, account number, balance etc).

Any change or modification to customer data can happen only with the express authorization from the customer and based on various controls put in by the bank to ensure regulatory compliance with regard to customer data.

Decentralization

Now, like watching a sci-fi movie, imagine a scenario where

- We do not have a bank with a centralized database to maintain our data, verify & authorize transactions and all we have is cryptographic algorithms ( all written in code) to provide the same verification and security and

- The customer database is not in one central location but is spread across multiple computers over the internet linked with one another. This aspect of a database stored across multiple computers over the internet is called decentralization.

The below diagram explains it clearly

So, cryptocurrency is a medium of exchange that is digital, encrypted and decentralized.

Some salient features of cryptocurrencies:

- Unlike fiat currencies, there is no central authority that manages & maintains the value of a cryptocurrency. This aspect of managing a cryptocurrency is distributed amongst its users via the internet (Decentralization!!).

- Unlike fiat currencies, cryptocurrencies are not issued by Governments. They are created and controlled by computer programs & algorithms (the underlying protocol). These algorithms lay out how transactions are made and recorded and how new coins are released.

- Unlike conventional currencies, the total amount of crypto currencies that can ever be in circulation is limited. Conventional currencies work on an inflationary model, which means as the economy grows, more dollars or fiat currencies are created or printed to allow for that growth.

What happens when more fiat currency is printed?

Inflation

Generally printing more fiat currency notes reduces the value of that currency resulting in prices becoming higher over a period of time.It is known as INFLATION.

Inflation is basically represented by an increase in price of goods and services, while deflation has the opposite effect. Both inflation & deflation is dependent on the Central Bank's monetary policy. To be more precise, inflation or deflation depends on how actively Central Banks print new currency.

More on inflation here

Cryptocurrencies work on a deflationary model. This is because the total supply of a cryptocurrency is restricted and pre-determined as per the algorithm.

(More on cryptocurrency here)

The First Whitepaper

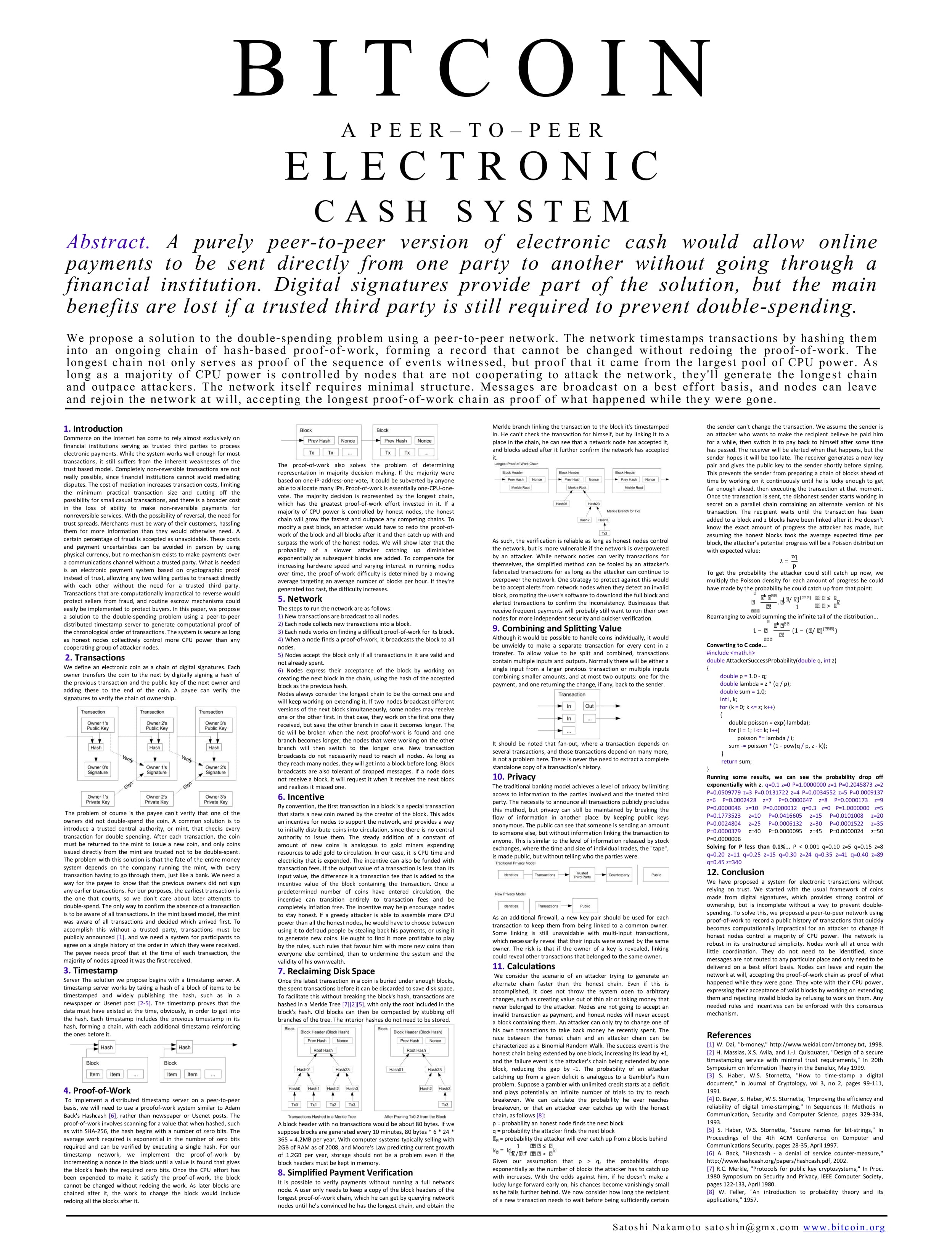

All of this started with an obscure white paper released ironically during the heights of the financial crisis in 2008 by a pseudonymous person or persons named Satoshi Nakamoto. On 31st October, 2008 Nakamoto published a white paper on a cryptography mailing list describing a digital cryptocurrency, titled "Bitcoin : A Peer-to-Peer Electronic Cash System". This little known email opened the doors to a new paradigm. The original email can be found here

What was in that white paper which brought in this new paradigm? and where does cryptocurrency gets its value from?