Strategy Byte - Week 14 : GDP Drivers

Recap

Last week, we delved deeper into consumption side of GDP by starting with the analogy of a family & the "spend vs. save" mentality where a family saves more than it spends or spends more than it saves.

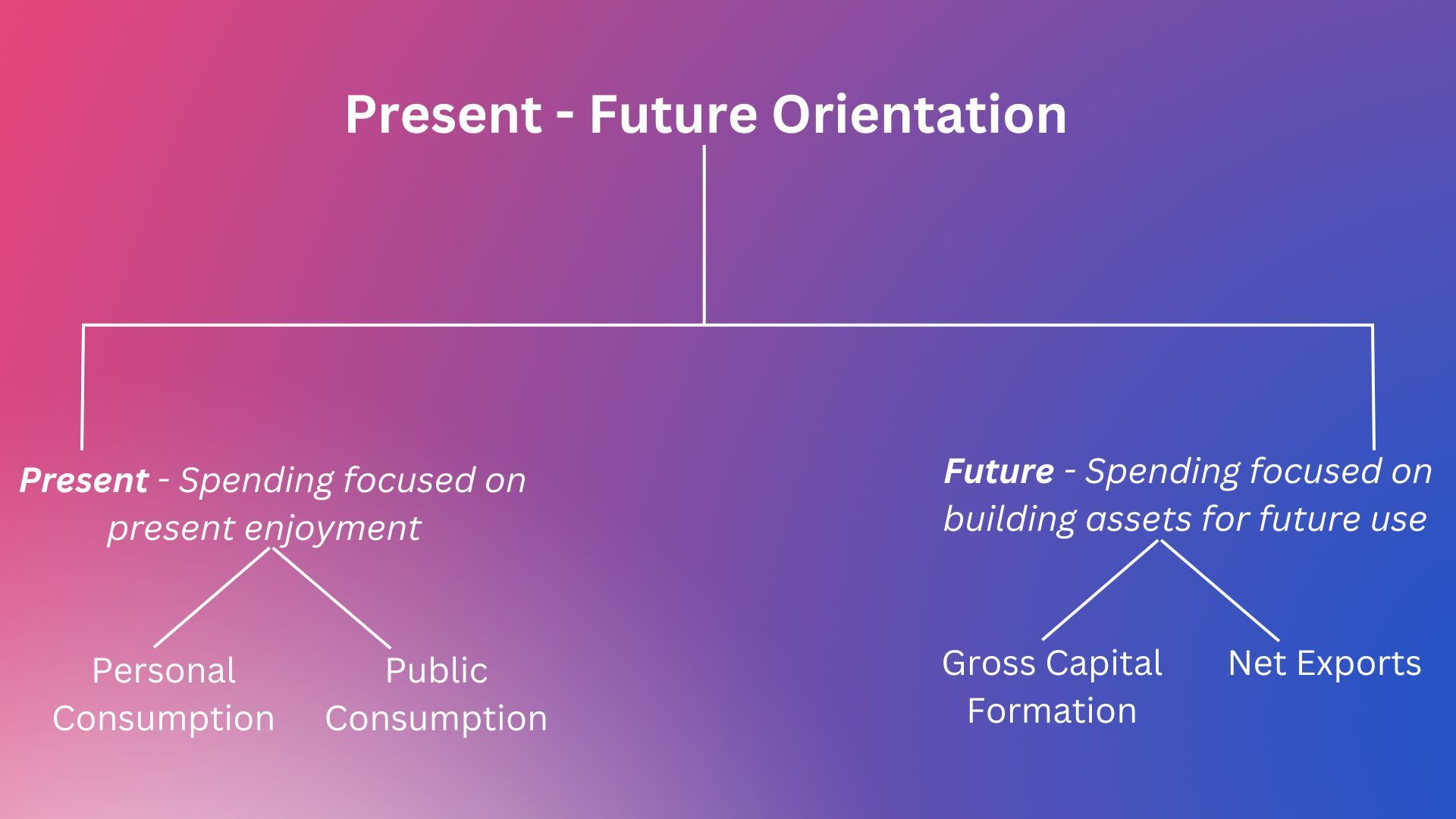

We then extrapolated it to a country where it spends it's resources for

- Present consumption (Present - orientation) or

- Future investment (Future - orientation)

We then linked it to strategy through a set of sample questions on local & international markets. We now move forward with the below question :

Which GDP component drives a country's growth or decline?

Why is this question relevant? It is mainly to cut out the noise amongst the signals. Only certain key drivers in GDP may be relevant to a company's strategy while the rest can be ignored or maybe all the drivers need to be considered but in what proportion?

For example, let us consider the impact of reduction in consumer spending on the US economy. If consumer spending slows, retail sales will slow. For a new retail business trying to enter the US, how will this impact their international expansion plans?

Even for a US based retail business trying to expand their market share, how will this impact their expansion plans?

Let us explore with the below news extract from Business Insider:

Student Loan payments in US:

"Student loan payments are about to drain $8 billion a month from consumers, and spending will start contracting early next year"

Student loan payments resume next month, draining billions of dollars a month from consumers, who will start pulling back sharply on spending, Fitch Ratings forecast in a Wednesday report.

That means real consumer spending will contract by 0.8% in the first quarter of 2024 and by 3% in the second quarter, reversing from the estimated growth of 3% and 1.2% in the third and fourth quarters, respectively, in 2023.

"Strong income growth has been largely responsible for the recent strength in consumer spending. However, wage income – the dominant driver of household income dynamics – looks set to slow as employment and wage growth weaken," said Olu Sonola, head of US regional economics at Fitch. "Debt service is expected to trend higher in the coming quarters as student loan payments resume and higher financing costs take hold for much longer."

Last week we saw that Personal Consumption comprise around 68.2% of US GDP in 2022. Any reduction in personal consumption could significantly reduce the GDP growth & necessary measures need to be taken by Central Banks to boost the economy.

To recap again, GDP is composed of the below components on the demand side,

- Personal consumption

- Public / Government Consumption

- Gross Capital Formation

- Net Exports (Exports - Imports)

Thus, the yearly growth rate of GDP is a weighted average of the growth rate of the individual components & the weights are allocated based on the relative importance of that component to GDP.

For economies where personal consumption has higher weight, reduction in consumer spending can result in a higher reduction in GDP growth compared to reduction in other components.

Let us now move to resource or supply side of GDP.

GDP - Supply Side

It is not only what you are doing today that matters but what you are creating for tomorrow (Unknown)

GDP is nothing but resources produced within a nation which are

- Saved for future use or

- Consumed.

Resources can be classified under :

- Resources produced within a nation &

- Resources imported from other nations.

In addition to the above, the capacity to produce resources is also a key criteria to GDP growth. Increase in capacity to produce resources can result in GDP growth.

Using resources to produce output requires an entity to engage in an economic activity.

Consider a factory which produces 500 units of some finished good. It's capacity can be increased to produce say, 750 units by investing in new production facilities or open more factories.

Similarly, a nation increases it's capacity to produce goods & services by investing in capital outlays like roads, ports, airports, other infrastructure etc.

Engaging in any economic activity requires capital irrespective of whether that economic activity is run by a business or a country. Let us explore the economic aspect of capital.

Capital

Capital is a broad term that can describe anything that confers value or benefit to its owners, such as a factory and its machinery, intellectual property like patents, or the financial assets of a business or an individual. (Source : here)

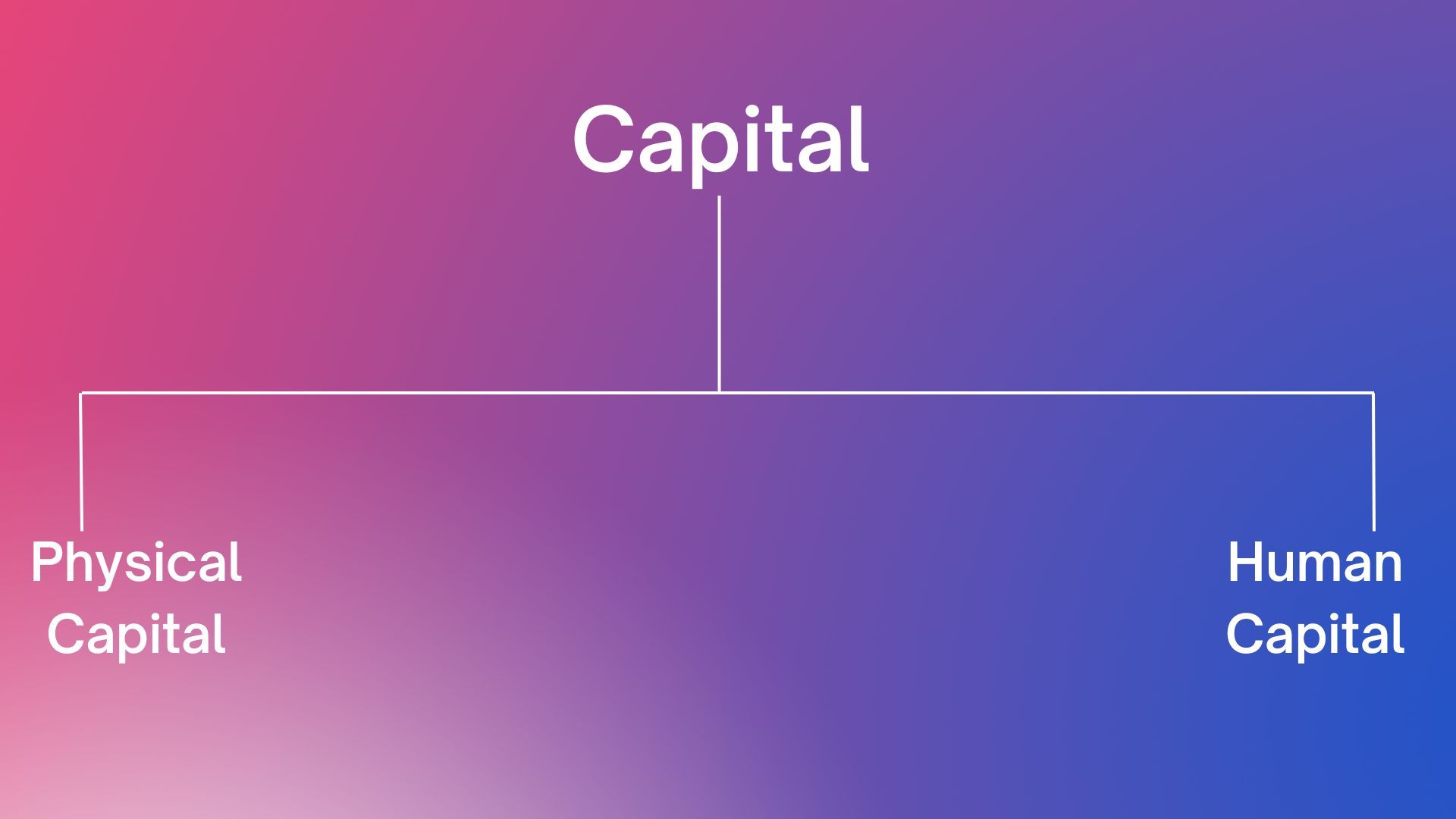

In the context of economics, capital is divided into two

- Physical Capital

- Human Capital

Physical Capital

As per Wikipedia,

- Physical capital represents in economics, one of the three primary factors of production.

- Physical capital is the apparatus used to produce a good or service.

- Capital is the equipment & structures used to produce goods & services.

E.g., machinery, office buildings, vehicles etc are considered part of physical capital.

Human Capital

As per Wikipedia,

- Human Capital is a concept used by economists to designate personal attributes considered useful in the production process.

- It encompasses employee knowledge, skills, know-how, good health & education.

The utilization of both the above decides the growth of a country's capacity to produce more goods & services thus improving it's GDP.

How do we know whether a country has more capacity to increase GDP ? This is where the "Future - oriented" portion of spending - Gross Capital Formation is relevant. Let us explore that next.

Gross Capital Formation (Savings & Investments)

Again, revisiting our analogy of household spending,

- Save more to invest or buy some asset which will make our future more productive, secure & sustainable.

- Spend more which makes us focused on our present & less on the future.

The first option - saving more to invest or buy new assets is how a nation increases it's capacity to produce more goods & services and as a result increase it's GDP.

Imagine if a high proportion of the population saves more than it spends.

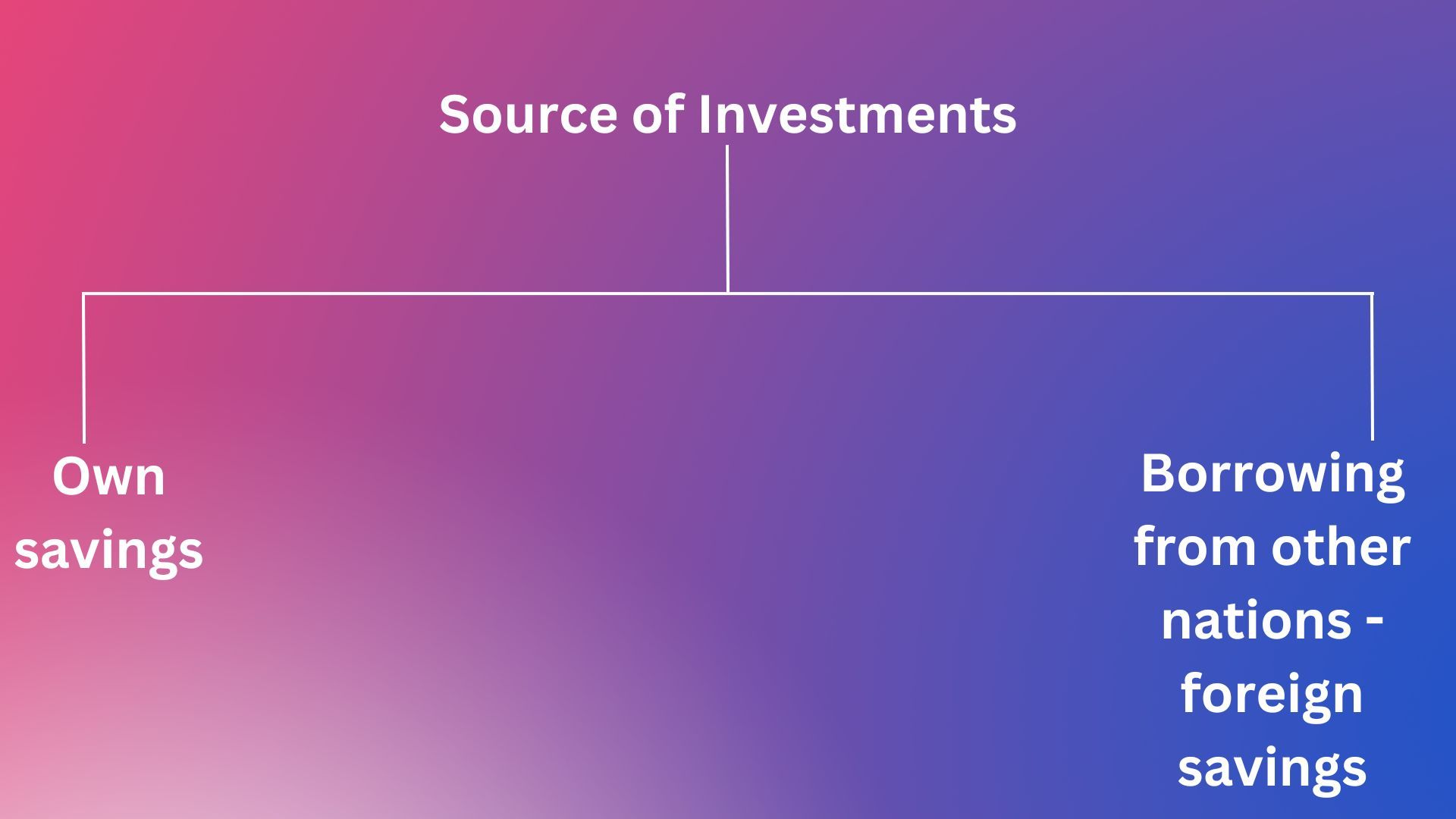

Where does this savings come from? This is the total savings all the individuals & households in an economy. For an economy as a whole, savings is what is used to finance investments as banks use consumer savings to hand out loans. Most of these loans are provided to businesses that need to finance their investments. Thus,

But what if a country's savings is not enough to finance it's investments or Gross Capital Formation, then it has to turn outward to foreigners for capital. So, an important criteria to be noted is how foreigners perceive the country as an investment destination? High Risk, low risk or Investment grade or High Investment Grade?

The below visual makes the savings aspect more clear :

Let us see the below statistic (Source : here) :

In China, the infrastructure projects in development or execution of over 25 million U.S. dollars as of May 2022 were worth over 5 trillion U.S. dollars. The United States and India were the following countries in the list, with around 2 trillion U.S. dollars worth of infrastructure projects. In contrast, the country with the highest number of big infrastructure projects was India.

Thus, countries like China & India are executing various infrastructure projects to enhance their capacity to grow & if we see China over the past several decades, they have been doing exactly this & still continues to invest for future growth.

See below (Source : here)

From the late 1990s to 2005, 100 million Chinese benefited from power and telecommunications upgrades. Between 2001 and 2004, investment in rural roads grew by a massive 51 percent annually. And in recent years, the government has used substantial infrastructure spending to hedge against flagging economic growth.

China’s leadership has charted equally ambitious plans for the future. Its goal is to bring the entire nation’s urban infrastructure up to the level of infrastructure in a middle-income country, while using increasingly efficient transport logistics to tie the country together. What follows is a by-the-numbers portrait of this dynamic sector.

Looking at it from the production side, what does GDP growth mean?

GDP growth means the rate at which the ACTUAL PRODUCTION of goods & services grew.

However, if we analyze the rate of GDP growth, it measures the rate of growth of the capacity to produce additional goods & services or in other words, the ABILITY OF A NATION to produce additional goods & services.

The relevant questions to consider here is (Not an exhaustive list) -

- How large is a country's spend on capital outlays for infrastructure growth?

- Is a country borrowing to fund it's infrastructure growth or using local savings of it's population?

- How fast is a country's capacity to produce goods & services (GDP) growing?

- How do foreigners perceive the country as a long - term investment destination to help in it's infrastructure push?

- Can a company invest millions of dollars of capital on overseas facilities on the assumption of better infrastructure resulting in lower cost or more value added?

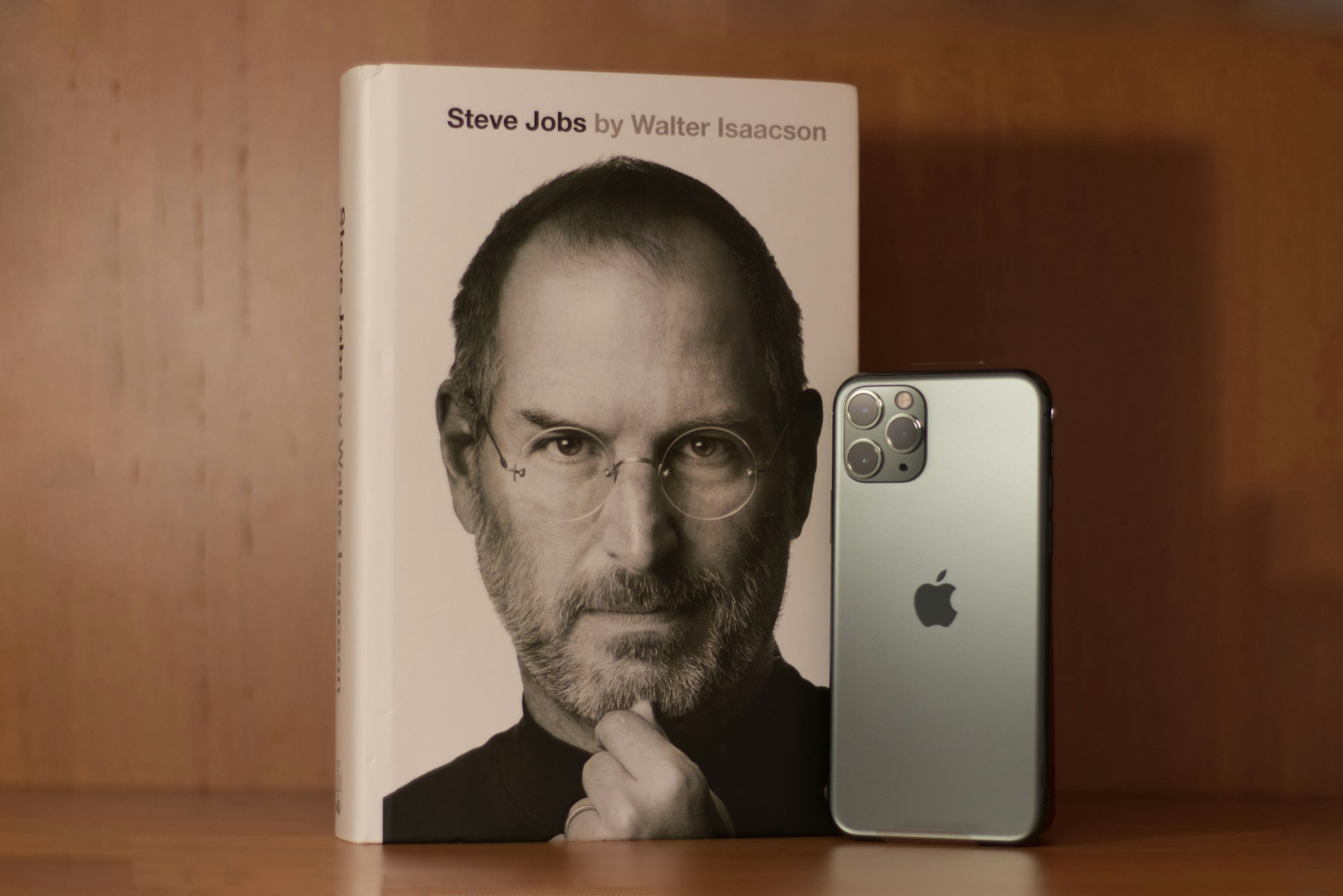

Apple outsourcing all their manufacturing to China in it's initial stages is a good example for this (Source : here)

Although everyone assumes Apple products are made in China because labor is cheap there, that’s only part of the story – and an increasingly small part, as the company’s assembly partners move toward more and more automated operations.

Steve Jobs originally transferred most Apple manufacturing to China because it was the only country in the world with a huge ready-made supply-chain network, and the ability to scale up production almost overnight. There are three main reasons China – and specifically the Shenzhen area – is such a powerful manufacturing center.

First, the city is strategically placed, serving as the gateway between mainland China and Hong Kong. It is one of the largest shipping centers in the world, with a massive container port.

Second, the Chinese government established Shenzhen as the first Special Economic Zone (SEZ) in the country. SEZs are designed to encourage enterprise through relaxed planning regulations and generous tax incentives – and crucially, to facilitate foreign investment in local companies. It is this, as much as its geographical advantages, which has enabled it to grow at such a pace.

Third, that SEZ was established way back in 1980, meaning that the city has had over 40 years to grow into the manufacturing center of the tech world. Apple relies on a huge network of suppliers and sub-contractors, some of which may make just a single tiny component. The majority of them are based in Shenzhen and its immediate surrounds, so the logistics of bringing everything together in one place for assembly are straightforward.

We discussed GDP over the last couple of weeks which refers to resources produced within a country. Just like a company cannot do business in isolation, a country needs to deal with other countries to import items not available or produced within that country or export items to other nations. This is also the last component of GDP referred to as Net Exports.

We will explore trade & foreign exchange (forex) from next week.