Strategy Byte - Week 15 : GDP - Net Exports

Table of Contents

- Recap

- Net Exports

- Relevance of Trade Surplus

- Relevance of Strategy

Recap

Last week, we delved into how GDP can factor into a company's decision to expand it's business either locally or internationally. For e.g., if consumption constitutes a major portion of GDP, then any event which causes consumers to spend less (like student loan payments) can impact a retail company's strategy to navigate the way forward.

We then assessed the impact of a country's spending on infrastructure & capital outlays on GDP growth.

GDP growth means the rate at which actual production of goods & services grew. However, the rate of GDP growth, which is the capacity to produce ADDITIONAL goods & services is what tells us about the future growth prospects of the economy.

We ended with the example of Apple outsourcing all it's manufacturing to China in it's initial stages. It is one of the factors driving Apple's decision to find an alternative to China in India, Vietnam etc.

Let us now move to the last component of GDP which defines a country's interaction with other nations through it's trade policies or in other words - imports & exports.

We can in simple terms see GDP like a family producing & spending for itself. We can assume this family grows & sells their produce to generate income & spend it within themselves either for present consumption or future savings. Everything is within the family.

Imagine when they buy groceries from outside, they are using external resources & when they sell their produce to outside parties , they have to pay external parties in their currency. The below points are worth noting.

- They cannot purchase more than they earn unless they borrow.

- If the grocer sells in another currency than the one used by the family, they have to decide on an exchange rate at which they accept each other's currency.

- Will there be any change in that exchange rate? What could cause the rate to change?

- Is the family's produce meeting the quality standards as required by the grocer meaning does the family maintain it's competitive edge?

With the above analogy & questions, let us now expand our discussion to a nation.

Net Exports

Net Exports in simple terms = Exports - Imports.

Exports are what a country sells to other nations & imports are what a country buys from other nations.

The reason imports is reduced from exports for arriving at GDP is because imports is from other nations (like the grocers above) & not from resources within the country. Hence, it is reduced from exports to remove the element of resources used from other nations. Recall that there are two sources from where a country gets it's resources to produce goods & services :

- GDP = What a nation makes within itself &

- Imports = What a nation purchases from other nations

Let us revisit our logic of GDP as a cash flow:

GDP means resources being produced & consumed within the country either for current consumption or for future outlays. Hence, the cash flows for these activities will be in local currency. In other words, GDP is like a cash flow statement in local currency.

But when a country imports from other nations to produce goods & services & when these are also used for exporting goods & services to other nations, that's when the cash flow logic changes. Now, the country has to deal in foreign currency (mostly US dollars).

- If a country exports more than it imports, it earns more foreign currency which it can use

- to pay for imports or

- to increase it's capital outlay using foreign currency by purchasing assets from abroad.

- If a country imports more than it exports, it is paying for the imports in foreign currency. Hence, it has to part with it's domestic currency reserves to buy that foreign currency.

- So, it effectively means that the Government of a country which imports more than it exports is borrowing capital from other nations for it's spending purpose.

A country which exports more than it imports has a Trade Surplus & a country which imports more than it exports has a Trade Deficit.

Relevance of Trade Surplus

In a country with trade surplus,

- Revenue from exports is higher than the cost of importing items from other countries.

- It is expected to improve a country's manufacturing base which results in increase in the volume of goods sold to other countries & higher employment.

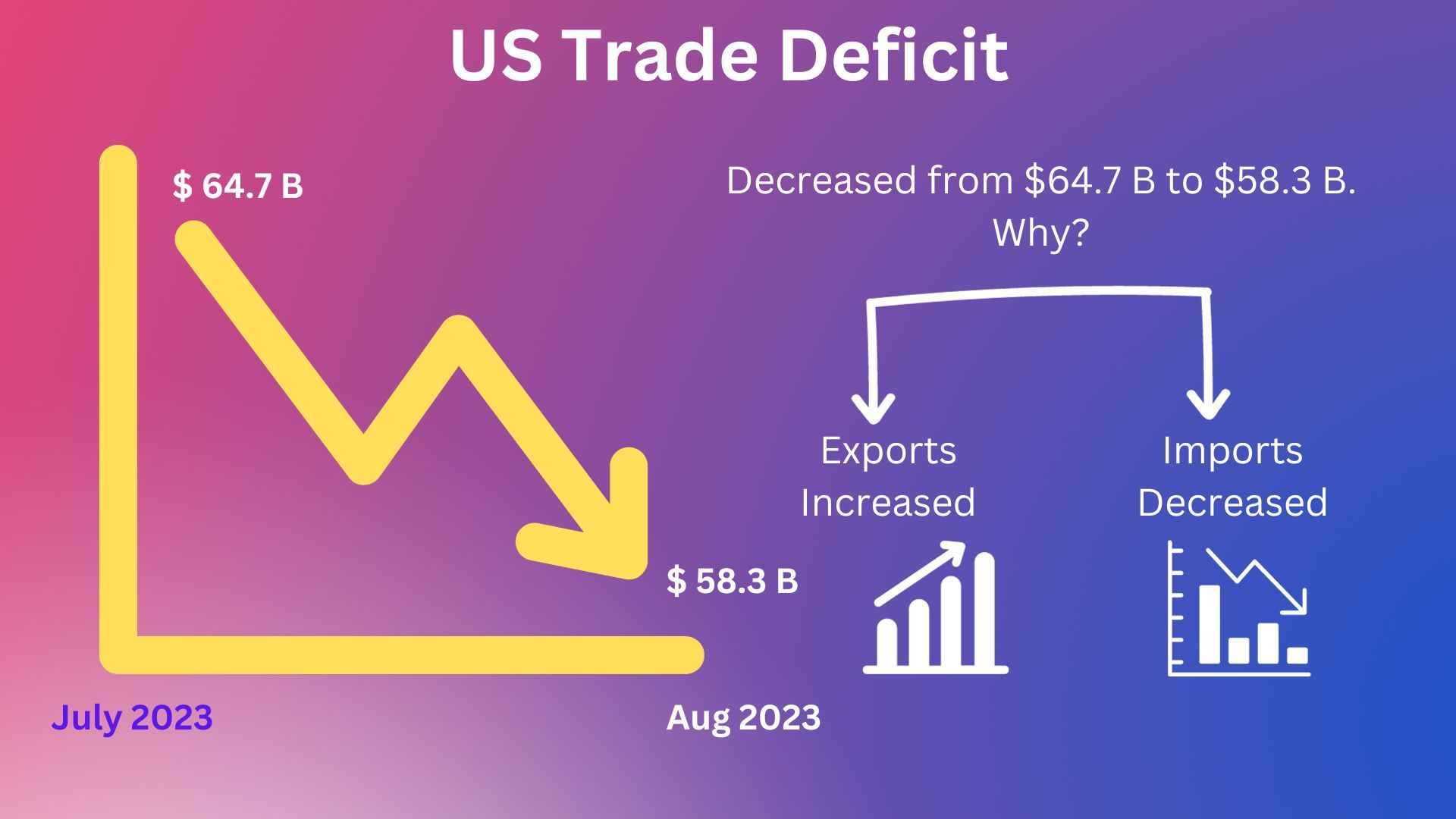

Let us see the below extract from Bureau of Economic Analysis (BEA), on U.S. International Trade in Goods and Services, August 2023

August 2023

|

-$58.3 B

|

|

July 2023

|

-$64.7 B

|

The U.S. monthly international trade deficit decreased in August 2023 according to the U.S. Bureau of Economic Analysis and the U.S. Census Bureau. The deficit decreased from $64.7 billion in July (revised) to $58.3 billion in August as exports increased and imports decreased. The goods deficit decreased $5.5 billion in August to $84.5 billion. The services surplus increased $1.0 billion in August to $26.2 billion.

We can understand from the above that

- When exports increased & imports decreased in August 2023, the trade deficit decreased from USD 64.7 Billion to USD 58.3 Billion.

- If we further break down the USD 58.3 trade deficit, it is net of

- USD 84.5 Million goods deficit &

- USD 26.2 Billion services surplus.

- There was an increase in goods & services export resulting in reduction in trade deficit.

The below visualization makes it more clear.

Thus,we can see from above that there is exports & imports & if one exceeds the other, it can result in trade surplus or trade deficit. Is one better or worse than the other?

The answer is it depends. The United States has run persistent trade deficits since the late 1970s while Germany has had trade surpluses since the 1990s (Source : here). We will revisit this question later.

How is a country's international trade policy & decisions relevant to a company's strategy?

Relevance to Strategy

For a company which wants to expand internationally, a country with open trade policies is preferable compared to one with closed trade policies. Some relevant points to consider here :

- Is a country's trade policies open or closed? Does it invest in infrastructure to encourage foreign trade?

- Is the market for a country's exported goods & services strong or weak?

- Is the country's competitive advantage in International Trade growing stronger or weaker?

- Is the country importing more than it exports?

- How is the country using it's export earnings?

- How is the exchange rate being impacted due to the international market as well as trade policies of the Government? (We will explore this point again in the coming weeks)

- Is the trade balance trending towards surplus or deficit & how is it expected to impact the exchange rate?

If we expand our vision from GDP (within country) to incorporate trade with other countries, it brings a mix of what part of production of finished goods & services are sourced through imports.

The other side of the coin is how much foreign resources the country is earning from it's exports & how is that being utilized - for capital outlays for increasing output or for consumption? How important is net exports to GDP? If we recap our visualizations from Week 13 & summarize the comparison as below, we can see that exports & imports constitute a sizeable proportion of GDP for China, India & Germany (sample countries) compared to US.

Source : CIA World Fact-book

Source : US Bureau of Labor Statistics

However, just looking at exports or imports of goods & services does not give a full picture of a country's international currency position.

- Are US dollar inflows & outflows only from trade? Are there any other sources of US dollar inflows & outflows?

- How does a country utilize it's foreign currency resources?

- What is the balance of US dollar resources a country has as of a particular date?

We mentioned above that GDP is like a cash flow in local currency. Do we have anything similar to record the US dollar cash flows & balances resulting from a country's trade policies?