Strategy Byte - Week 17 : Balance of Payments.. Cont'd

Table of Contents

- Recap

- Current Account & Capital Account

- Present - Future Orientation

- A Question to Ponder

- UNCTAD Statistics

- Foreign Exchange Rate - a Teaser

Recap

Last week, we introduced a new variable called "Balance of Payments" in analyzing a country's economic position vis-a-vis other countries.

Balance of Payments is

- The method countries use to monitor all international monetary transactions in a specific period &

- is a record of all international financial transactions made by the residents of a country.

It basically summarizes all transactions between citizens & residents of a country with foreign citizens.

Such transactions are summarized as :

- Inflows - Transactions that result in cash inflows of US dollars

- Outflows - Transactions that result in cash outflows of US dollars

We then bifurcated the transactions into :

- Transactions which are short term in nature & recurring known as Current Transactions.

- Transactions which are long term in nature & deal in assets / liabilities known as Capital Transactions.

Current Account contains a listing of transactions involving purchase & sale of goods & services with other countries or in other words - Imports & Exports

Capital Account contains a listing of transactions involving foreign cash reserves, purchase & sale of assets or investments or incurring long term liabilities.

We ended with the below statement :

Total Inflow of Dollars must equal Total Outflows of Dollars and hence to balance the transactions, surplus in current account must equal to deficit in capital account & vice - versa.

What does this mean? Let us explore..

Current Account & Capital Account

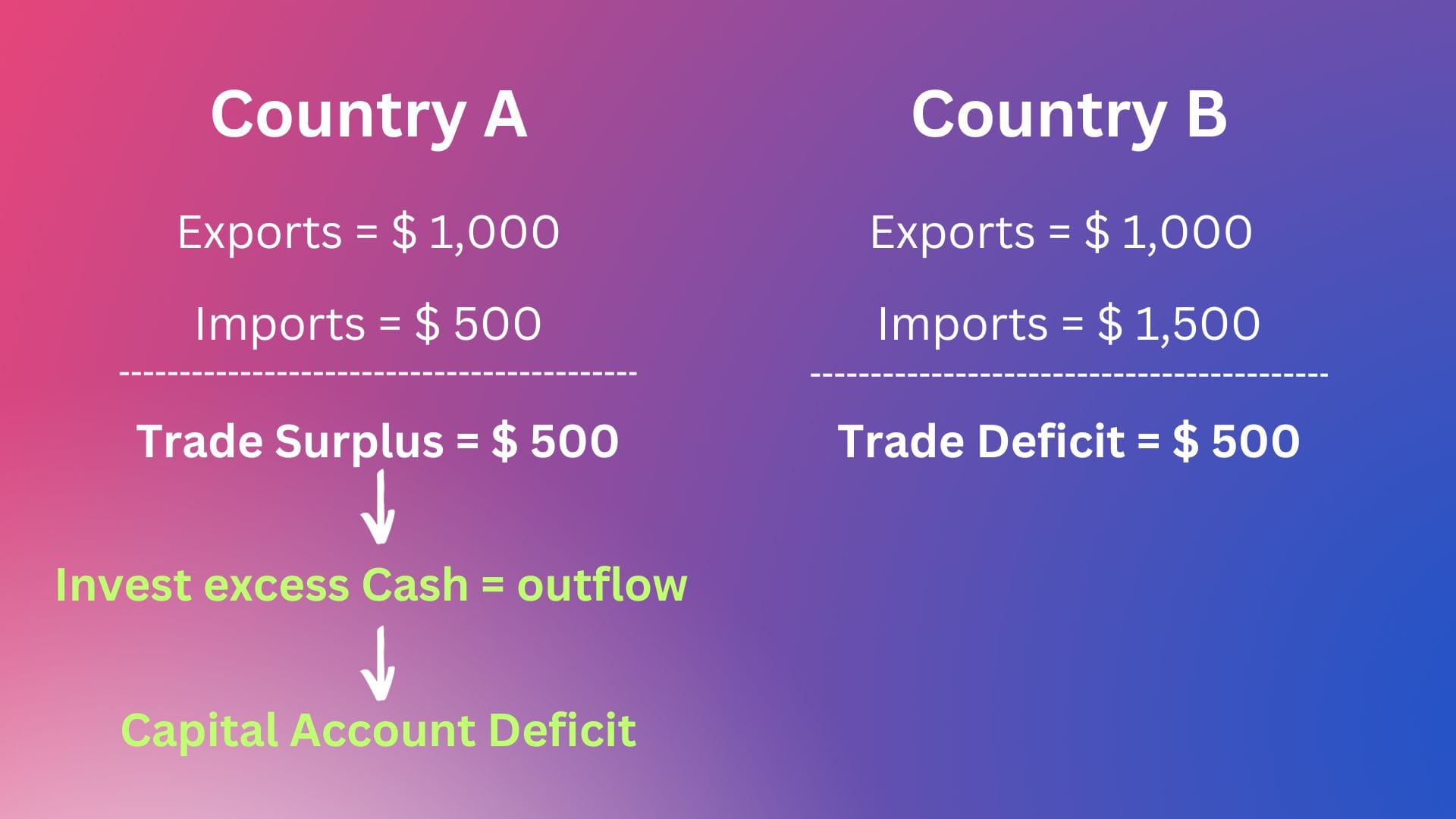

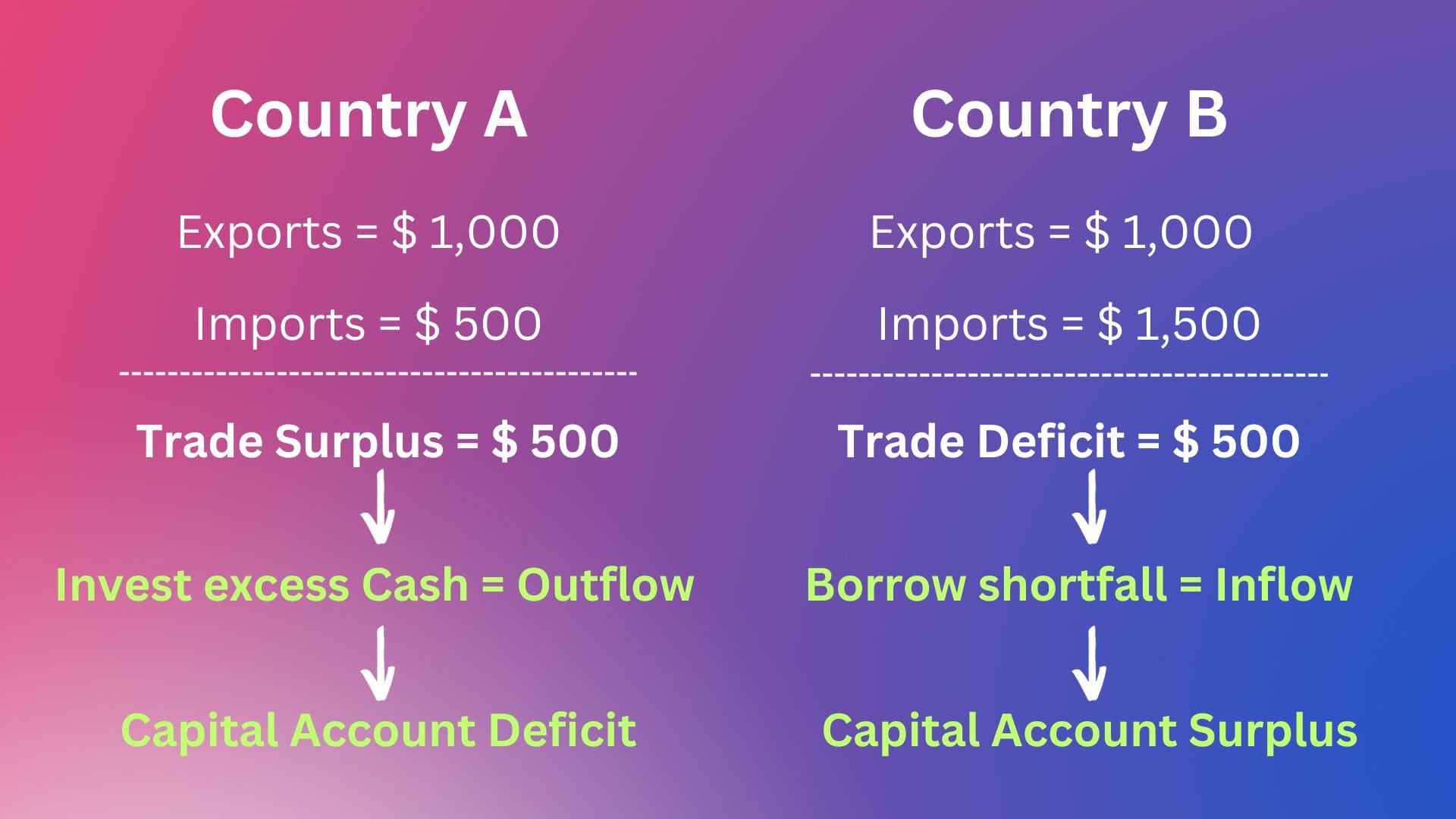

Consider two countries - Country A & Country B with the below export & import data:

From the above data, we can see that

- Country A has a trade surplus of $ 500 as it's exports are higher than imports &

- Country B has a trade deficit of $ 500 as it's imports are higher than exports

Country A will have a net excess of $ 500 in it's current account. What would it normally do with this balance? It could for example.,

- Invest that amount in building factories locally or in another country to expand it's production capacity improving it's export standing

- Invest in stock or bonds in US dollars or

- Just retain it as foreign cash reserves.

Hence, the amount earned is again put to use for some purpose. This is like a family which saves any excess earned over that spent. This amount invested or spent for building factories or investing in other countries is what is reflected in the Capital Account.

Since there is an outflow of US Dollars to invest from that country, this results in a Capital Account Deficit.

Depicting the above visually,

Let us now go to Country B which has a trade deficit. To pay for it's imports, it has to borrow US dollars from International Sources as it does not earn sufficient dollars from it's exports to meet its import bill. Hence, there is an inflow of dollars into the economy through borrowings.

This inflow of dollars through borrowings results in a Capital Account Surplus.

Depicting the above visually

Thus, Current Account & Capital Account are two sides of the same coin called Balance of Payments. Going back to our statement last week :

Total Inflow of Dollars must equal Total Outflows of Dollars and hence to balance the transactions, surplus in current account must equal to deficit in capital account & vice - versa.

Present - Future Orientation

But why do we care of the above when thinking about strategy?

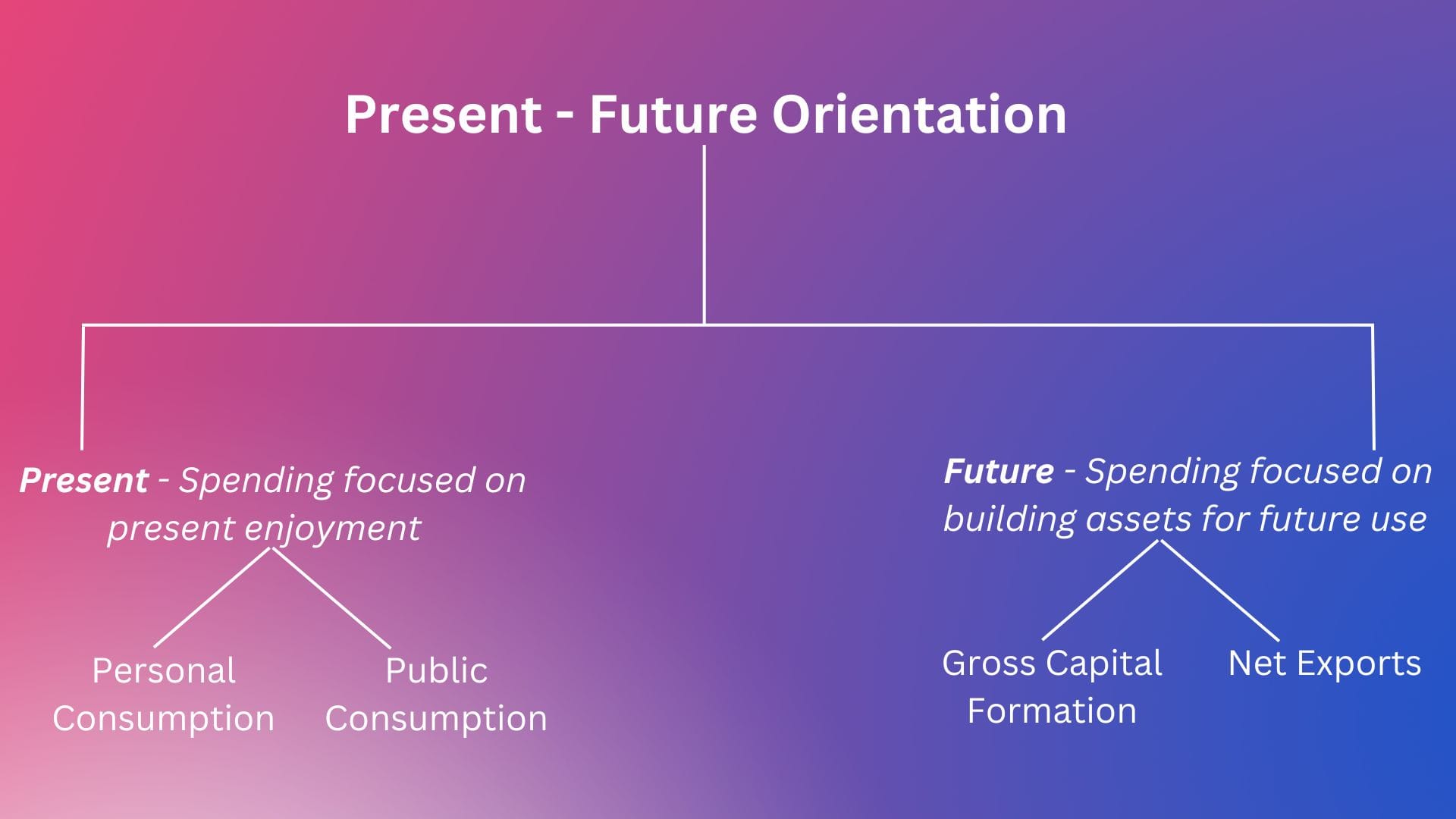

Exploring this question takes us back to our discussion during Week 13 on Present - Future orientation. Let us revisit the below visual from Week 13:

We can see one of the components under Future orientation is "Net Exports". Why? Because a country which invests or saves it's foreign earnings can expect a return on these investments or savings in the future. Thus, this reflects a country's (in effect the aggregate population's) desire to save for the future.

On the other hand, a country which runs a current account deficit to finance consumption is like a family using credit card borrowings to spend on daily expenses.

They will have to find ways to repay that deficit in the future & hence the policies encouraging deficits may be unstable in the long run.

There could be other factors affecting current account balance like

- Outlook of the population (pessimistic outlook - save more)

- Demographics (greying population - save more)

- Investment Outlook (countries with deep financial markets attract foreign funds - like United States)

which we will not get into.

Balance of Payments (BoP) data shows the openness of a country's foreign exchange policies & exchange controls.

BoP as % of GDP shows how important trade is to a country's total economic development

A Question to Ponder

If we consider a country as a business, would you invest in Country A or Country B or in international trade, which country would be considered more stable & with long term prospects - Country A or Country B?

UNCTAD Statistics

Some main takeaways from UNCTAD (United Nations Conference on Trade & Development) statistics (Source : here)

- In 2021, for most economies in the Americas, Africa, South - Eastern Europe & Central & West Asia, payments exceeded receipts, leading to negative current account balances.

- Higher surpluses were found mainly in Central & Northern Europe, Eastern Asia & Oceania.

- Most economies in Europe & South Eastern Asia recorded relatively balanced current accounts.

- In 2021, Guinea and Papua New Guinea recorded the highest current account surpluses relative to GDP (above 20 per cent). Singapore, Kiribati, Kuwait, and Azerbaijan enjoyed surpluses of over 15 per cent of their respective GDP.

- In absolute terms, the United States of America (US$822 billion) and the United Kingdom (US$83 billion) ran the world’s largest current account deficits. China (US$317 billion) recorded the largest absolute surplus, followed by Germany (US$314 billion) and Japan (US$142 billion).

Foreign Exchange Rate - a Teaser

In foreign trade, another critical component to be analyzed is the rate at which goods & services are exchanged between countries. At what foreign exchange rate does a country export or import goods / services from other countries & how does this rate move?

What are the factors contributing to exchange rate movement & how does it impact a country's economy & it's domestic & foreign trade policies.

Let us go down another rabbit hole next week!!