Strategy Byte - Week 18 : Exchange Rate

Recap

During Week 17, we discussed Balance of Payments (BoP) where we explained how total inflows of dollars into a country must equal total outflows & to balance the transaction, surplus in capital account must equal deficit in capital account & vice versa.

Then we saw how "Net Exports" is one of the components under Future / Orientation outlook under GDP meaning

- A country which is future oriented & runs a current account surplus & invests or saves it's foreign exchange earnings can expect a return on these investments or savings in the future & on the other hand,

- A country which runs a current account deficit to finance consumption is like a family using credit card borrowings to spend on daily expenses & has to find ways to repay the deficit in future.

When goods are imported or exported between countries as part of international trade, a critical component is foreign exchange. Why?

Because it determines the exchange value of goods &/or services between countries. However, foreign exchange is not restricted only to international trade. Let us see what it is.

Exchange

Before we explore Foreign exchange, what is exchange? It is

The act of giving something to someone & them giving you something else (Source : here)

So, if we give something to someone that they need & they give you something else that you need, that is an exchange.

Let us imagine two scenarios of exchanging oranges vs apple.

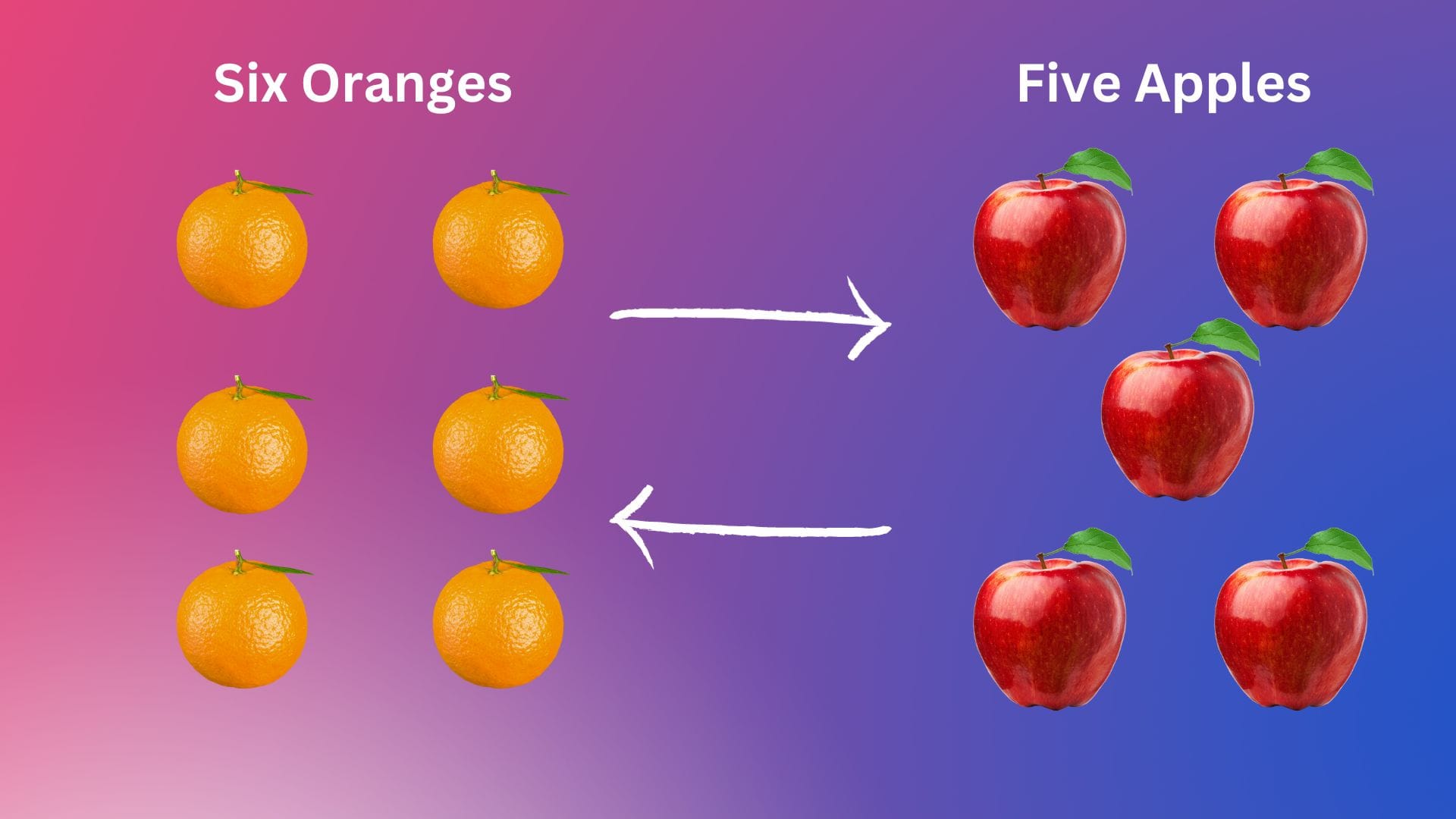

Scenario 1 - 6 oranges for 5 apples

Imagine we have six oranges & we want apples? What do we do?

We have to find someone willing to give us some apples for the six oranges that we have & how many apples would we get?

On the other side, there is someone who has five apples & wants oranges. Where do people who have something to sell in exchange for something else go? To a market.

What is a market?

In economics, a market is a composition of systems, institutions, procedures, social relations or infrastructures whereby parties engage in exchange. (Source : here)

So our friends go to a market & find each other where they want what the other has to sell. Now, to the next problem. How many apples should be accepted for six oranges?

If these two are the only ones in the market with apples & oranges to sell & buy, they will accept what they get & be on their way. So, it means six oranges will be exchanged for five apples.

Mathematically

6 oranges = 5 apples or 1 orange = 5 / 6 or 0.83 apple

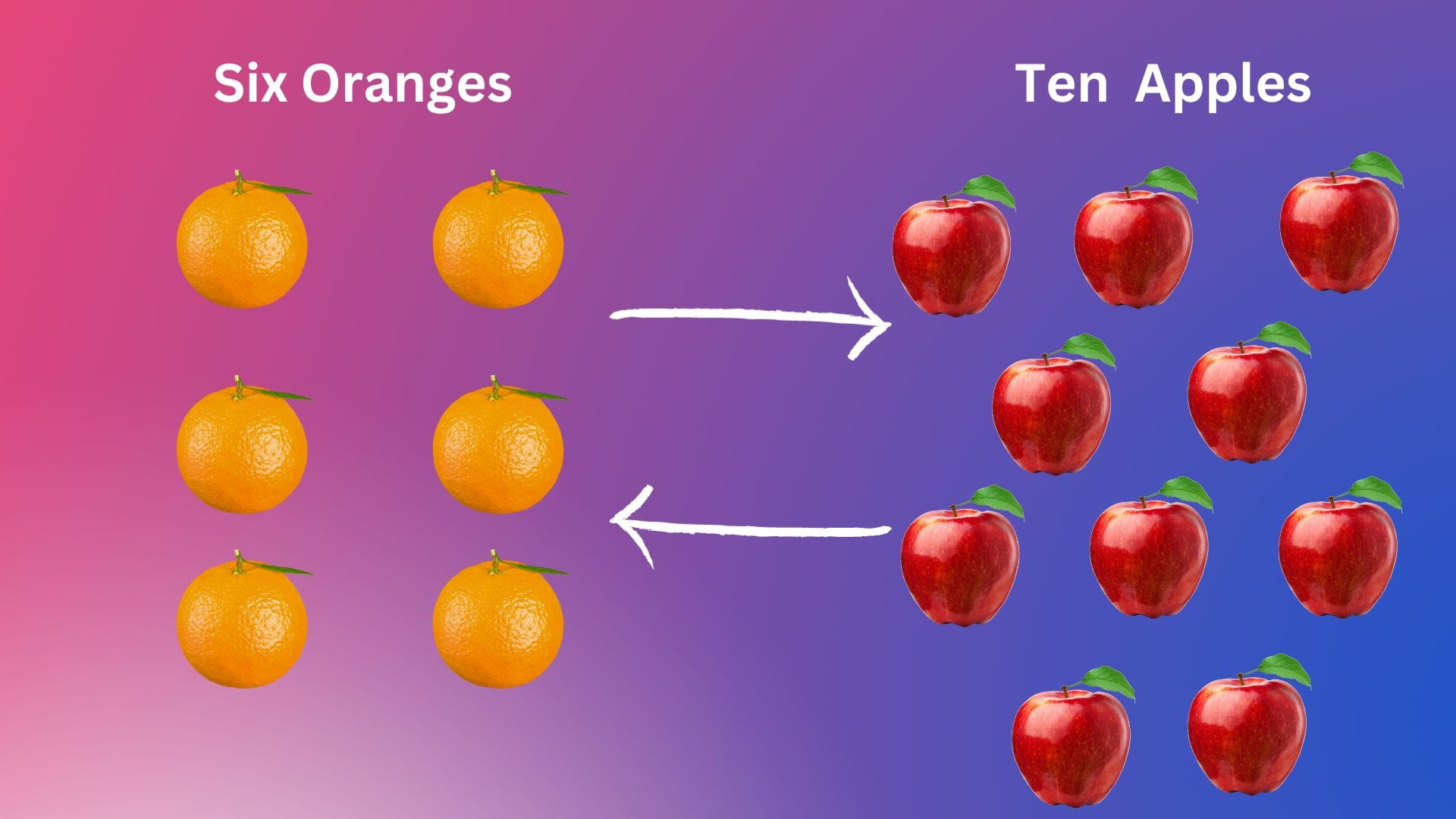

Scenario 2 - 6 oranges for 10 apples

Now, assume people found out oranges were more healthy than apples (not true!! for example sake) & growing oranges takes more time than apples. Thus there are more apple sellers who wants oranges but there is only one orange seller. They would give more apples for the same quantity of oranges.

Assume the apple sellers sell 10 apples for 6 oranges.

Now,

6 oranges = 10 apples or 1 orange = 10 / 6 or 1.67 apple

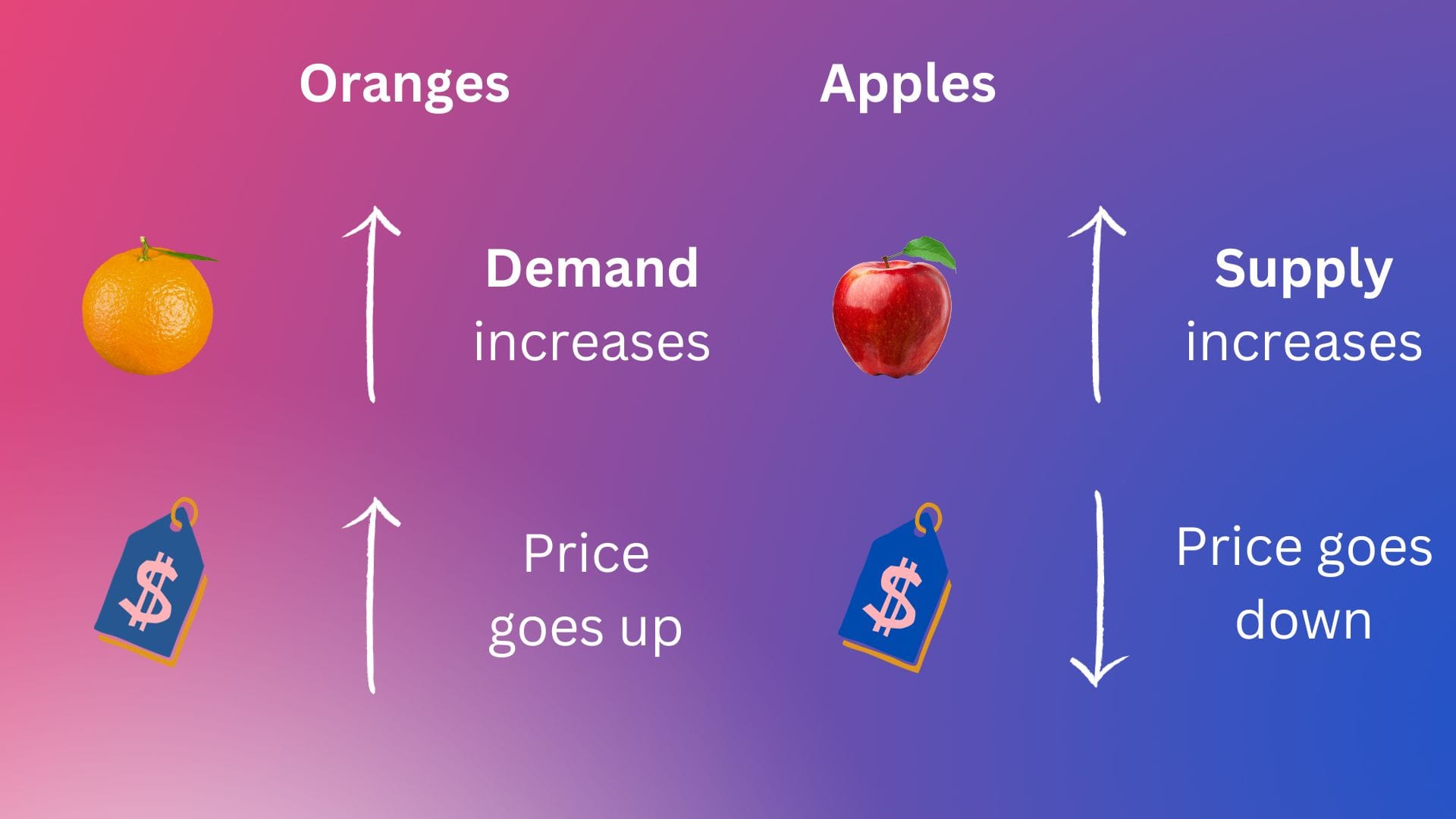

Summarizing both scenarios above :

What changed from scenario 1 to 2? The value of oranges increased. Why? In economics terms:

- Demand for oranges increased with no corresponding increase in supply

- Supply of apples increased with no corresponding increase in demand

This change in demand & supply of apples & oranges changed the price. In a nutshell, more apples had to be exchanged for the same number of oranges.

Instead of barter trade between apples & oranges, if we bring money as the mode of exchange between these apples & oranges,

- Price of oranges increased when demand increased with no corresponding increase in supply

- Price of apples decreased when supply increased with no corresponding increase in demand

If we substitute apples & oranges above with currencies like USD, CNY, EUR, INR, JPY etc. this is how a foreign exchange market works.

Foreign Exchange

Foreign exchange or Forex in short is nothing but exchanging one currency for another. Just like the example of apples & oranges above, in a free economy, currency values are normally dictated by supply & demand. But generally, the supply & demand are influenced by a lot of external factors which we will get into later.

Certain countries peg their currency to another currency like USD or a basket of currencies in line with their broad economic policies. Hence such currency's value remains the same vis-a-vis USD or the relevant basket of currencies over the time frame the peg is maintained.

Forex Market

A foreign exchange market is where currencies are bought & sold. In other words, it is where one currency is exchanged for another. For example, in the market for USD, the USD is what is bought or sold using another currency in exchange (say, JPY).

The major participants in a forex market are Banks, Exchange Houses, Global Corporations & Financial Institutions, Hedge funds etc.

Below definition from Wikipedia,

The foreign exchange market (FX, forex or currency market) is a global, decentralized or over-the-counter (OTC) market for the trading of currencies.

This market determines the foreign exchange rate of every currency.

It includes all aspects of buying, selling & exchanging currencies at current & determined prices.

Below is a daily currency exchange table which we normally see in banks or currency exchange houses:

This shows the exchange rate of other currencies against GBP (British Pound).

We saw in our example above that oranges being more healthy drove the value of oranges up compared to apple. Similarly, what drives the value of one currency in relation to another?