Blockchain Byte - Week 33 FAT Protocol

Table of Contents

- Recap

- Internet Protocol

- Blockchain Protocol

- Going Forward

Recap

During Week 32, we explored layers that make up the Blockchain architecture as below :

- Layer 0 - Hardware & Networking

- Layer 1 - Protocol Layer

- Layer 3 - Transaction Layer

- Layer 4 - Application Layer

This week, we get into the aspect of value capture in a Blockchain. For any application, Blockchain or otherwise, there has to be a value which can be monetized by the owner of the application.

The Fat Protocol Thesis was first articulated by Joel Monegro in 2016.

We start with the current application architecture in Web 2.0 & then move on to Web 3.0

Internet Protocol

Let us first understand the underlying structure of the internet and it's source of monetary value. We will then compare this with the underlying structure & protocols in a Blockchain & the source of its monetary value.

We discussed this briefly in one of my earlier blogs. We will get into more details now.

Image by Thomas Ulrich from Pixabay

First of all, what is the internet?

Very simply, the internet is a global network of billions of computers & other electronic devices. (Source : here)

What happens when billions of computers get connected to each other? There is flow of information across these billions of computer. Information can be text, images, videos etc. Now, how does this information travel across the internet?

This is made possible through something known as Internet Protocols. A protocol is a language that is used between computers & is a set of rules that governs communication of data over the internet.

Data that is transmitted over the internet is broken down into smaller packets at the source computer. These packets then travel from source to destination using the shortest and most efficient path over the network. Once these packets reach the destination computer(s), these packets are then put back together at the destination computer(s) and the data is displayed accordingly. This is all done using the TCP / IP protocols.

There are multiple protocols governing this transfer of data & information like SMTP / POP3 (for emails), TCP / IP (for data transfer), HTTP / HTTPs (for hyperlinks) etc. No one "owns" the internet and the underlying protocols. The infrastructure is available to all at no cost.

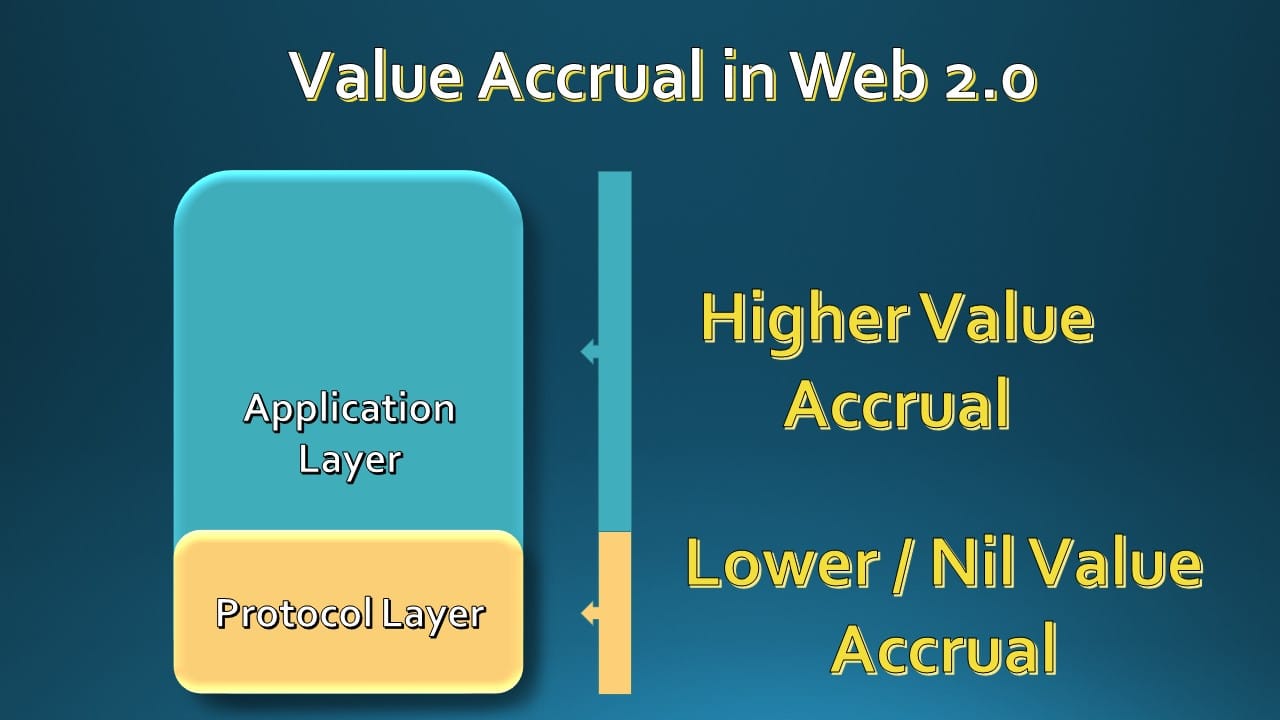

Companies like Google, Microsoft, Meta, Twitter etc build their applications on these protocols & monetize them. In other words, the monetary value is accrued in the application layer rather than the underlying protocols.

Check out the market cap of these companies (as of today):

- Google - $ 2.01 Trillion

- Apple - $ 3.19 Trillion

- Amazon - $ 2.05 Trillion

- Meta - $ 1.51 Trillion

(Source : here)

So, we can see the application layer taking most of the value space of the current web (Web 2.0).

Blockchain Protocol

In a Blockchain, this relationship between applications & protocols is reversed. Let us take the example of the two big platforms in crypto world - Bitcoin & Ethereum. The market cap of these companies as of date is

Let us see the market cap of some applications on Ethereum :

- USD Coin- $ 58.5 Billion

- BNB - $ 82.85 Billion

etc

(Source :here)

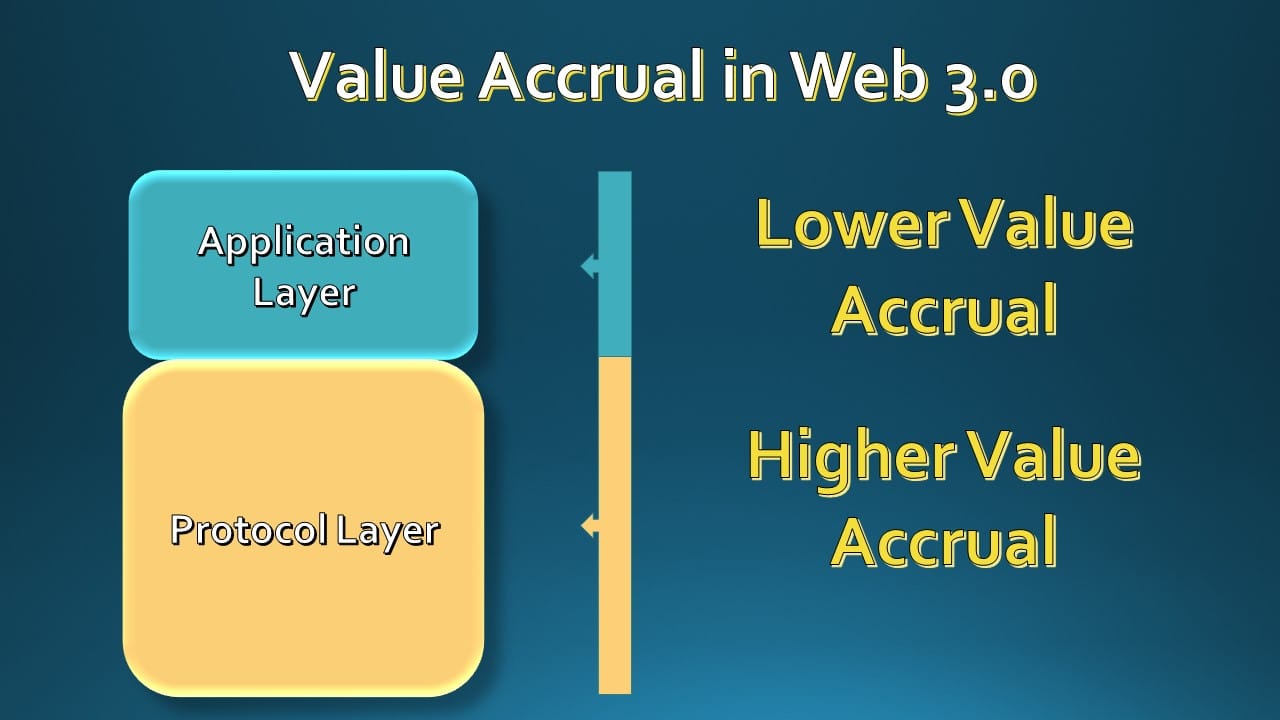

It can be seen that the market cap of applications on the Ethereum base (We will get into Ethereum soon!) is far less than that of Ethereum itself on which these applications are built.

Now, who benefits from this? The investors who invested in Eth (the token or "currency" of Ethereum Blockchain) who will see their investment value increase as more applications are built on the Ethereum platform & usage increases. (We will see why later in this blog)

In Bitcoin Blockchain, customers pay transaction fees in Bitcoin for funds transfer which are paid to the validators & miners who maintain the infrastructure for transaction processing & proof of work.

Hence, unlike Web 2, the investors of the protocols also see positive value addition from their investments in the protocol platforms more than the investors of the applications on those platforms.

This can be visualized as below :

It is posited that there are two reasons why the value extraction dynamic got flipped where the protocol layer accrues more value compared to the application layer :

- Shared Data & Network

- Introduction of Tokens

Shared Data & Network

The transactions in a Blockchain are stored in decentralized ledgers maintained by individual nodes and not in centralized servers. Hence, the applications being built on top of these protocols need not worry about data servers or infrastructure for maintaining the data.

However, the above depends on the types of data which can be accessed publicly and those that need to be kept private. That is a discussion for later!!

Introduction of Tokens

Let us take this opportunity to introduce the concept of Tokens or more appropriately protocol tokens which are required to access the services provided by the protocol.

For example, let us consider a funds transfer from one account to another in Ethereum . In this case, some Eth (the protocol token for Ethereum) would be paid as commission to the underlying protocol for data storage, transaction processing, computing power etc).

Thus, more applications mean more services taken from the underlying protocol which means more protocol tokens issued & used which increases the network effect for both the application and the underlying protocol.

Going Forward

How will this value capture look like in the future? There are some features which can flip this equation :

- Rise of Layer 2 solutions - The rise of layer 2 solutions can potentially redistribute value from Layer 1 to other layers as these take on the transaction load from the base layer.

- Impact of Hard Forks - Hard Forks (when certain users copy the original architecture of the Blockchain with some changes & open a new one) can fragment protocol value between the original & forked networks.

Fat protocols form a defining feature of blockchain economics, where value is created in the foundation layers from shared data infrastructure and native tokens. However, as the ecosystem evolves with Layer 2 solutions and expanding app ecosystems, the dynamics of value distribution can shift from the base to the apps in the future.