Finance Byte - Week 14 Unit Economics - Intro

Table of Contents

- Recap

- Unit Economics

- Importance of Unit Economics

- Unit

- Customer Based Unit

- Product Based Unit

Recap

During Week 13, we discussed Breakeven Analysis & defined it as below:

Breakeven Point refers to the point at which total revenue & total costs are equal. A breakeven analysis is used to determine the number of units or dollars of revenue needed to cover total costs.

The formula for calculating Breakeven Point (BEP) is :

BEP = Fixed costs / Contribution margin per unit.

In simple terms,

- It is the total units sold

- to exactly cover the total fixed costs

- at a particular contribution margin.

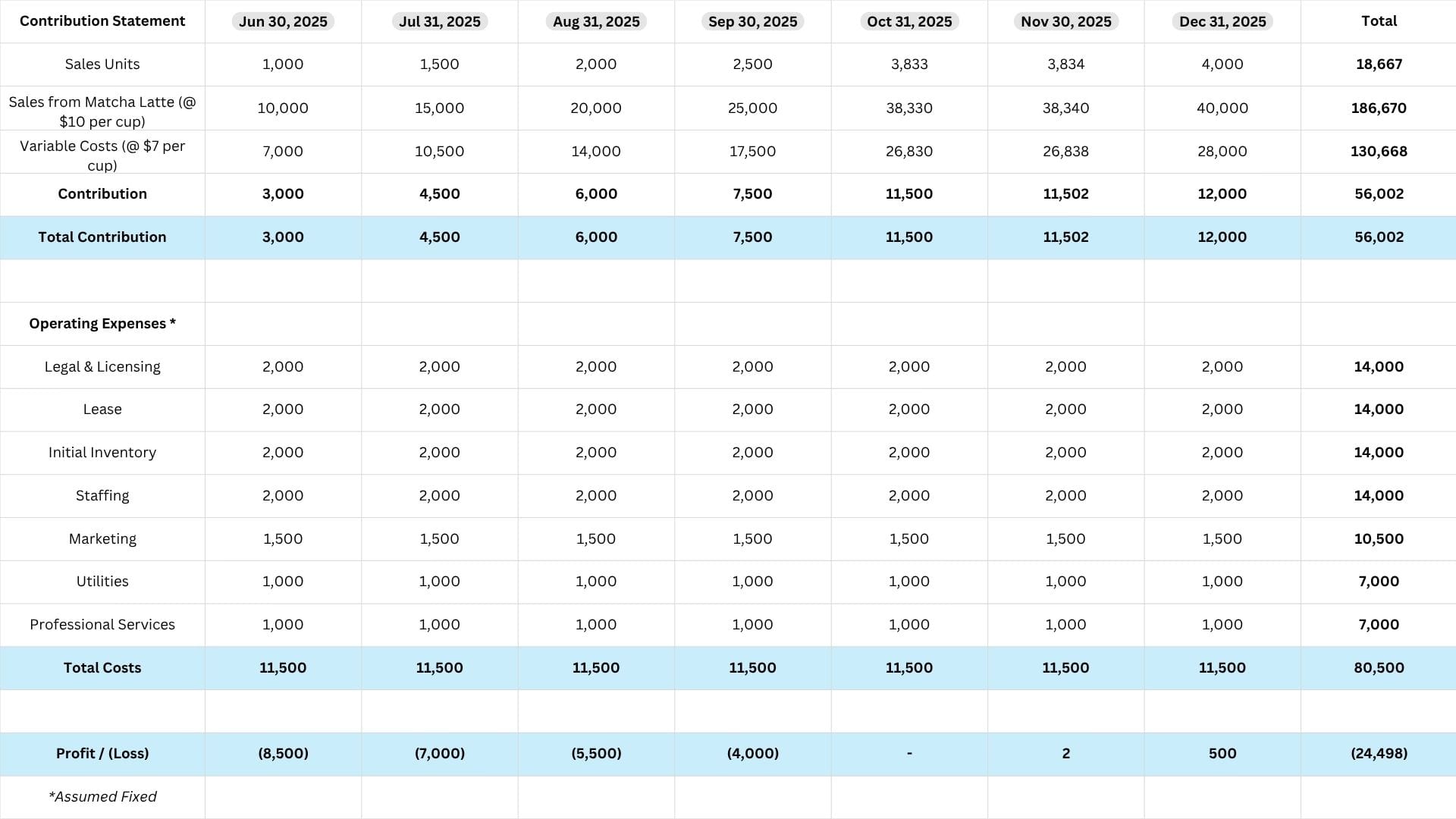

We then analyzed Jack's sales of Matcha Latte to identify the revenue, contribution & costs to arrive at the net results at different levels of sale volume. It starts with loss at 1,000 units & as the units keep increasing, the loss reduces & ultimately ends up in profit at 4,000 units.

In between at 3,833 units, the loss becomes zero. This point at which the revenue or contribution covers the total costs, is called the Break Even Point.

Refer visualization below:

So, as Jack sells only Matcha Latte, he knows exactly how many units he needs to sell to ensure he covers his costs & make profit.

Of course, doing such analysis is not easy. Why?

Reason no 1 - Costs do not remain at the same levels. Jack has to keep a vigilant eye on costs as they keep changing. For e.g., raw material costs like milk or coffee beans could fluctuate changing the contribution margin. If he has to maintain the same margin, he has to increase his pricing.

Reason no 2 - Demand fluctuation. If he sells only Matcha Latte without any improvements, customers may get bored of the same taste & sales volume will drop. It requires that he innovates on the Matcha Latte or introduce new items in his menu.

Introducing other items on the menu is a business decision which involves answering questions like :

- Will the new products improve profitability through higher contribution margin which will cover fixed costs faster with lower sales volumes bringing down the break even point & improving profitability

- Whether demand will be there for those new products at the newly set price?

This week we carry the above analysis further under the broad umbrella called "Unit Economics". What is it & why is it important? Let us dive in...

Unit Economics

We calculated the contribution per cup of Matcha Latte and multiplied with number of units sold to identify the breakeven point when the cafe would turn from loss making to breaking even (zero profits) & then to net positive profitability (Refer Week 13).

Here, the unit used for analysis is one cup of Matcha Latte & the analysis used here for that one cup is called "Unit Economics". Let us define it now.

Unit Economics describes a specific business model's revenues & costs in relation to an individual unit. A unit refers to any basic quantifiable item that creates value for a business. (Source : here)

So, unit economics is about identifying the smallest unit responsible for creating value for that business or from where the business earns it's revenues. Why is this important as finance professionals & more important at CFO level?

Importance of Unit Economics

As a finance professional or a CFO, it is important to identify

- How the business generates value?

- Is it through selling products which customers value or

- Is it by delivering services to customers?

- What is the unit of that product or service?

- How can this value be quantified at the lowest level to then roll it up to the overall business?

Once the above value generating "unit" is identified, the CFO then can identify products which contribute to profits & their margin, analyze the margins & increase production of those products after reducing or removing products with low or negative margins.

The CFO can also identify whether there is scope for improving margin through

- Improved pricing

- Reducing costs through efficiencies or negotiations with vendors

Unit economics also helps to optimize the pricing in line with market & then identify whether these products are profitable & the level of profitability. If the products are loss making, then decision can be taken to reprice these products to increase their margin.

However, this has to be done in line with market demand. If the increased pricing reduces demand, then the product's contribution to the overall profitability reduces.

In other words, understanding unit economics in terms of margins and costs allows businesses to

- Identify profitable products,

- Optimize pricing &

- Ensure long-term sustainability of the business through changing product mix in line with market demands & optimal margins.

Let us now understand what a "unit" actually means.

Unit

Now, "unit" will have different meanings depending on the industry. We can classify this broadly under two heads :

- Customer Based Unit

- Product Based Unit

Let us explore each of the above :

Customer Based Unit

In this case, the "unit" under analysis is a single customer. Unit economics at the customer level focuses on the

- Direct Revenues &

- Costs

associated with acquiring, serving & retaining a single customer.

Here, the analysis focusses on a single customer to identify their contribution to the profitability & long-term sustainability of the business.

In very simple terms, its measuring revenues from a single customer vs cost of acquiring & maintaining that customer.

Can you think of any industry where customer based unit economics is applicable? I can think of two out of many (which we will dive deep into later):

- Banking & Financial Services

- Netflix

Understanding unit economics at the customer level ensures that smarter decisions are taken about costs to acquire & retain customers like marketing, scaling costs etc & pricing. It ensures that each new customer contributes positively to the business’s bottom line.

Product Based Unit

In this case, the "unit" under analysis is a single product. Unit economics at the product level focuses on the

- Direct Revenues through pricing &

- Unit Costs

associated with producing / manufacturing & selling a single unit of a product.

Here, the analysis focusses on a single product to identify their contribution to the profitability & long-term sustainability of the business.

In very simple terms, its measuring revenues from a single product vs cost of producing & selling that product.

Any industry selling products like phones, laptops etc can do unit economic analysis to understand whether each product sold contributes to the profitability of the overall business & guide in pricing & production decisions.

We will explore & go deep into the forests of unit economics next week.