Finance Byte - Week 17 Customer Journey

Table of Contents

- Recap

- The KPIs

- MoviePass

- The Venn Connection

Recap

During Week 16, we started our journey exploring customer unit economics. In simple terms, customer unit economics denotes

Measuring revenues from a single customer vs. costs of acquiring & maintaining that customer.

Then we defined some key terms in order to get some context. These are :

Customer Acquisition Cost (CAC)

Customer Acquisition Cost (CAC) is the cost of acquiring a single new customer.

CAC = Total Marketing & Sales costs / No. of new customers acquired

Average Revenue Per User (ARPU)

ARPU is the average revenue generated per user over a specific period.

Gross Margin Per User

Gross Margin Per customer is the percentage of revenue per customer remaining after deducting direct costs (Cost of Goods Sold or Service Delivery)

Customer Lifetime Value (CLV) or Lifetime Value (LTV)

CLV or LTV is the gross profit a customer delivers to your business during their entire relationship with the business.

LTV = Average Revenue Per User (ARPU) * Gross Margin * Customer Lifespan

Churn Rate

The churn rate refers to the percentage of customers that discontinue their use of a product or service over a specific period of time.

Payback Period

Payback refers to the length of time it takes for the profits a company makes from a given set of customers to recoup their acquisition costs.

Normally, the numbers related to customer unit economics can be computed & analyzed using the above performance indicators. But then, is that enough?

Customer Life Cycle

It is important to identify the key drivers & story behind these numbers. All the above KPIs are defined & shaped by customer action. Ensuring optimal product &/ or service quality will result in positive customer experience & feedback which in turn will reflect positively in the KPIs (low churn rate, higher gross margin per user or higher CLV etc).

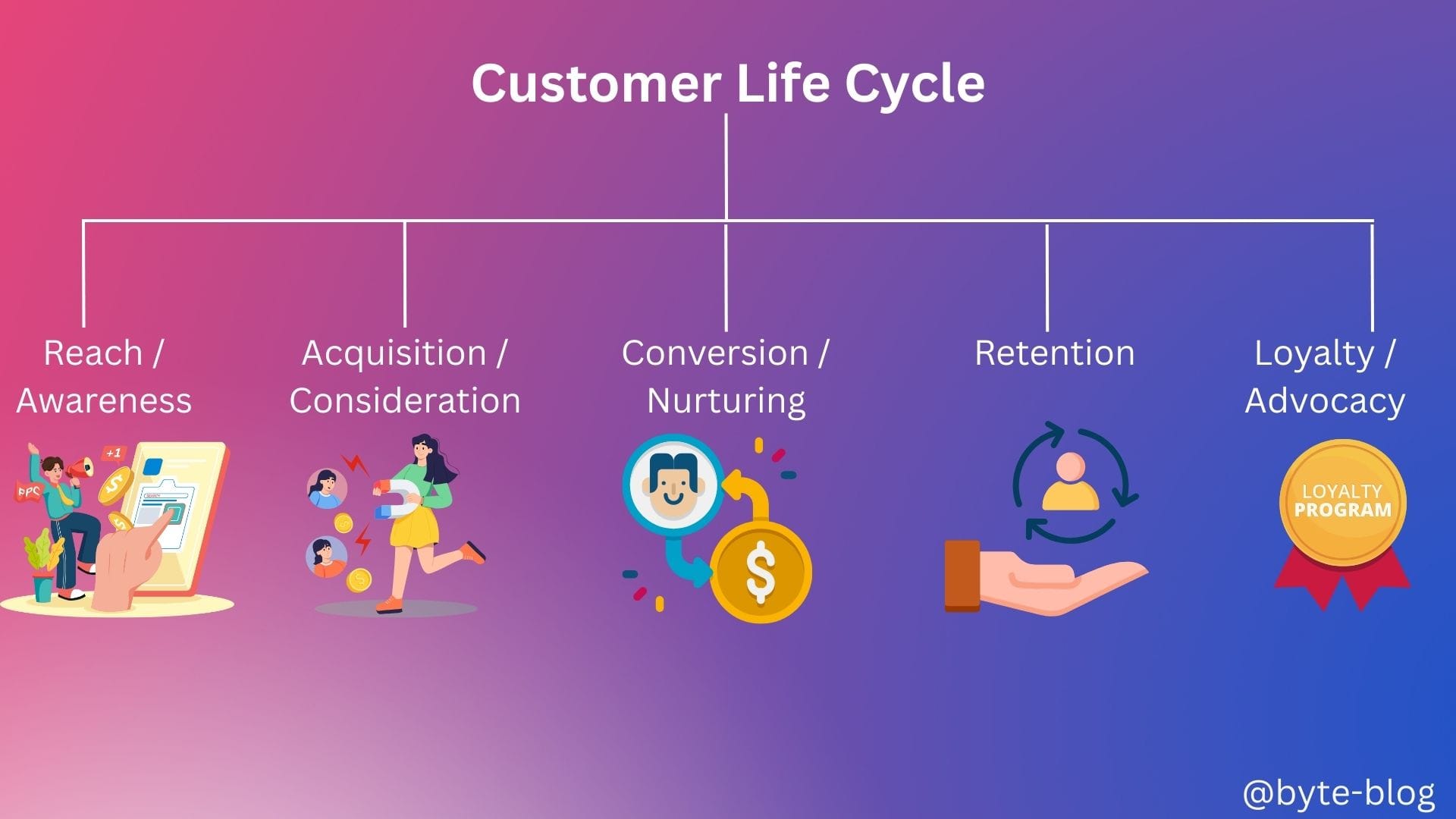

Visualizing the customer life cycle :

There are lot of good write ups on customer life cycle & unit economics. Without repeating what has already been written, I just want to highlight some key points which we finance professionals normally don't get an opportunity to reflect on during analysis.

We finance nerds think in terms of numbers & KPIs and report them accordingly. But we never get the opportunity to think in terms of what drives those numbers. Though it's not our responsibility as finance professionals to go deep into the drivers of customer happiness, it is important to understand them to ensure we understand the drivers behind the LTV, CAC, churn etc numbers.

The driver comes from one key term - Customer Journey or Customer Life Cycle. It is important to understand the customer journey to ensure a company's internal operations & processes are crafted keeping their best experience in mind which ultimately results in positive customer unit economics.

The KPIs

From a unit economics perspective, the objective for any company is to maximize the Customer LTV (Customer Lifetime Value) with minimal CAC (Customer Acquisition Cost). That means optimal LTV to CAC ratio.

In terms of Industry Benchmarks, for growing SaaS (Software as a Service) companies, the industry standard for this ratio is 3x or higher (Source : here). This means you have to earn at least 3 times what you are spending for acquiring a unit which can be a product or a customer. However, just because your LTV / CAC ratio is greater than 3x doesn't mean you have excellent unit economics. It could signify:

- You are underspending on sales & marketing which gives your competitors a chance to take those customers & increase their market share or

- You are growing faster which requires additional spends to maintain the additional customers

There are many examples of companies which shut down because of bad or unsustainable unit economics. Let us take one example - MoviePass:

MoviePass

Background

MoviePass was founded in 2011 to create a Netflix style subscription service for movie theaters, giving customers unlimited access to cinemas for a monthly fee while Movie Pass covered the full ticket cost.

The subscription model promised consistent revenue stream for MoviePass & the participating cinemas.

Originally subscribers paid $29 - $50 per month depending on location.

What Happened?

In 2017, Helios & Matheson Analytics took over MoviePass & slashed the monthly subscription to $9.95 for unlimited movies. The price drop triggered explosive growth. MoviePass gained 150,000 new subscribers in just 48 hours. Within a year, membership soared to over 3 million users.

Unsustainable Unit Economics

With this new pricing, MoviePass was losing money on every customer. How?

MoviePass offered subscription to unlimited movies for a flat fee of $9.95 per month while the average ticket cost was $9.00 (Source : here). On top of this, they had to cover their CAC & other operational costs which led to negative unit economics as the subscription income was insufficient to cover the ticket costs plus operational costs. The soaring membership led to significant cash burn which ultimately led to the company filing for bankruptcy in 2020.

The LTV to CAC ratio was negative in this case instead of 3x - 5x which is standard requirement for a sustainable business.

The Venn Connection

From the above, we can see that it's important for any company, especially start ups to have a grip on their unit economics - whether at customer or product level. At the customer level, this tracking boils down to understanding :

- The total number of customers a company has

- The total spend per customer

- The frequency of that spending

- How many customers are leaving the company or what is the customer churn?

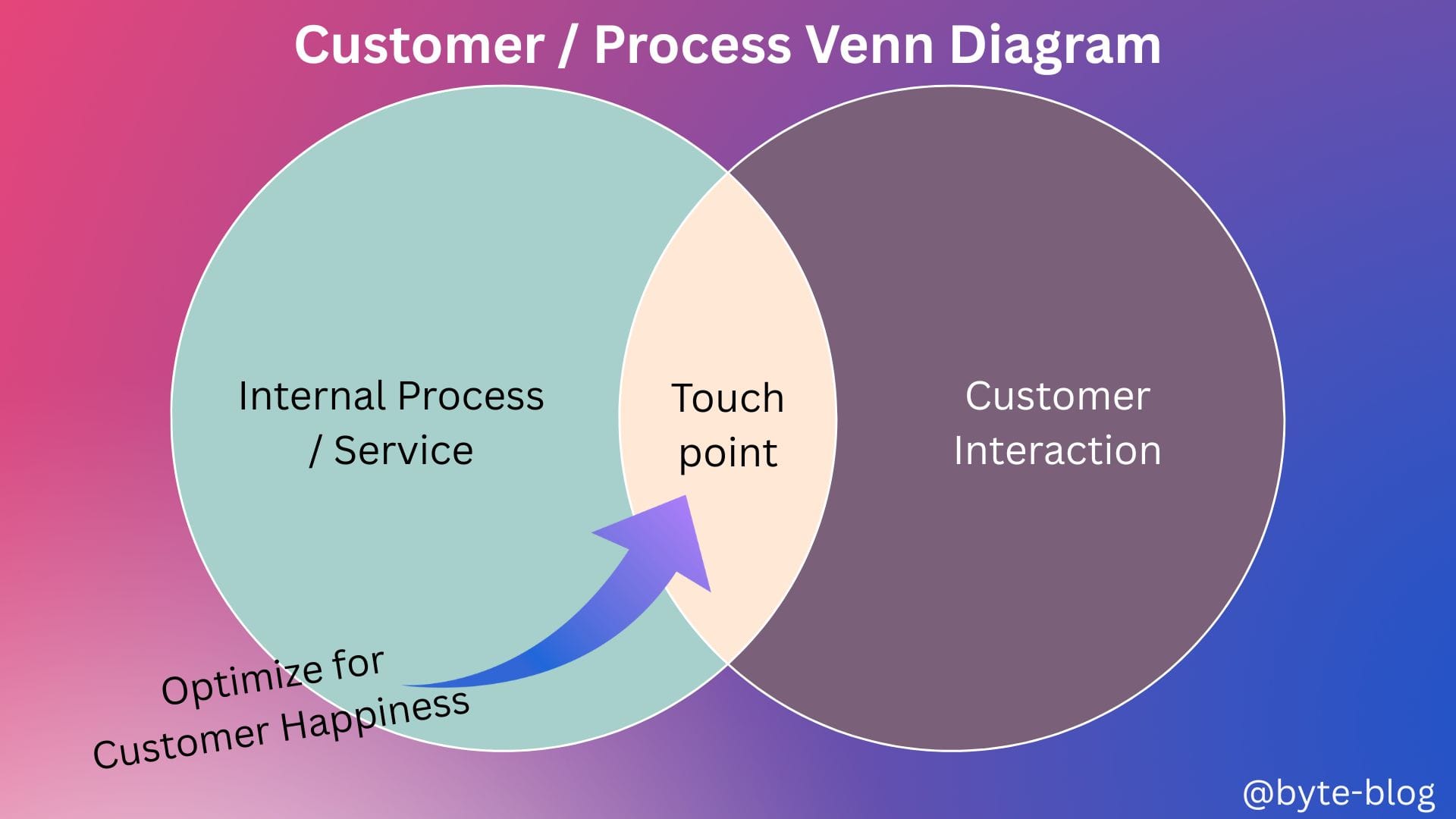

It is important to keep track of these customer behaviors at an individual or a group level at various stages of the customer life cycle. At each stage, there is a touch point at which a customer interacts with the company when purchasing or using the company's product or service. For e.g., for a bank, the various customer touch points are :

- When a customer is onboarded (either online or manually through a service branch)

- When a customer logs into an app or visits a service branch

- When a customer does a transaction with the bank's product. For e.g., credit or debit card

- When a customer calls or chats with a customer service & so on

When a customer interacts with a bank, they indirectly are drawn into the process or function within the bank responsible for delivering that service to the customer. This means the process or service should be optimized for customer happiness by

- Having the systems & data to look at one customer or group of customers & their behaviors as they pass through the different stages of their journey with the company &

- Also as they interact with the different internal processes & experience of your business at various touch points.

This complete view of a customer journey is what gives you a picture into their lifetime value & identify ways to optimize it.

But the disconnect happens when the internal process / service is structurally set up to be optimized for the bottom line & that structure may or may not be optimal to deliver customer happiness.

In such a case, flip the view & think from the customer's point of view on what would be an optimal process from the customer's side & to deliver optimal customer happiness with sufficient controls & efficiencies in place.

Another aspect which is also related to company strategy is the customer experience in product / service delivery.

- You have to deliver what everyone else delivers but in a exceptionally different way or in other words, You need to differentiate yourself from your competitors by delivering exceptional product / service.

- You have to deliver products / services that no one else delivers.