Finance Byte - Week 19 Netflix Episode 2

Table of. Contents

- Recap

- Business Model & BMC

- Netflix DVD Business Model

- References & Citations

Recap

During Week 18, we started our journey to understand unit economics by using the streaming industry with specific reference to Netflix.

Below is the learning path we laid last week :

- Brief history of Netflix in the context of understanding their unit economics

- Explore business model used in both eras - DVD & streaming

- Using each business model, deep dive into their individual unit economics

- We will then understand how Netflix drives their unit economics

- We will compare Netflix unit economics with peers & competitors

We started with the history of Netflix summarized as below :

1997 - Founding

- DVD-by-mail rental with online catalog

- Pay-per-rental + late fees model

1999-2000 - Subscription Model

- Monthly unlimited rentals ($19.95/month)

- Eliminated late fees and per-movie charges

2007+ - Streaming Era

- Launched online streaming (2007)

- International expansion (2010)

- Original content production (2013)

Today

- 190+ countries, hundreds of millions of subscribers

- Leading global streaming and content creator

Now, let us explore the business model of Netflix in both DVD & streaming eras. But before we get into Netflix DVD business model, let us understand what the word "Business Model" actually means & how it can be represented in a simple manner through Business Model Canvas (BMC).

Business Model & BMC

Business Model

A business model is a high-level plan for profitably operating a business in a specific marketplace. (Source : here)

So, the key words here are

- Profitable operation &

- Specific marketplace

To operate a business profitably, you must have control over two points of leverage which are :

- Pricing &

- Costs

From a pricing perspective, to serve a specific set of customers, you must have a value proposition. What is value proposition? As per Roger L Martin,

For a defined set of customers, it is the value to them of your offer (whether product &/or service) versus the cost of you producing & delivering it to them.

The value is measured by the price the customer is willing to pay for your offer.

So, this circles back to pricing which should reflect value from the customer's perspective. As Roger mentioned, it doesn't matter what you think the value is, it matters what the customer thinks.

Another point he raised is that if you are not selling directly to end customers but through a channel, you have to think both about end customers & the channel when considering & understanding your value proposition.

For e.g., multinational companies like P & G, Johnson & Johnson typically sell their products through stores which is one of their channels for distribution. In that case, they have to consider the costs of distribution & maintain relationship with partners in addition to considering customer happiness unlike companies which sell directly to customers like Warby Parker.

With that understanding, let us design Netflix DVD business plan into something called a "Business Model Canvas".

(I know I am throwing too much technical stuff one after another, but please bear with me as I am trying to develop a structure around the thinking process to understand business models & not just throw theory around as it is).

Business Model Canvas or BMC

The Business Model Canvas is a strategic management & visualization tool that helps organizations design, describe & analyze their business models in a single page. It was created by Alexander Osterwalder & Yves Pigneur as part of the book "Business Model Generation".

The format of the Business Model Canvas is as visualized below :

As you can see from the above, the business model canvas captures three key elements of a business model :

- Operational Focus - How the business is designed to operate profitably by identifying

- Key Activities

- Key Resources &

- Key Partners

- Customer Focus - captured by

- Value Creation - What does the organization offer - value propositions

- Value Delivery - Channels of reaching customers - Channel

- Value Capture - How revenue is earned - Revenue Streams

- Financial Focus - Costs incurred in delivering value to customers measured through

- Revenue Streams - Value Capture

- Cost Structure

We will not go deep into Business Model Canvas. For those interested in diving deep, follow this link for a good explainer.

We will discuss the specific points related to Netflix business model & in the end incorporate it into the Business Model Canvas.

Netflix DVD Business Model

The first business model was to let people rent videos by selecting it online & having it delivered to their door. A year later, Netflix introduced the subscription model, where customers could rent DVDs online for a fixed fee per month.

We will now look at the economics of the business model

DVD Acquisition

Netflix obtained it's DVDs from film distribution companies

- Through risk sharing agreements with distributors where Netflix received DVDs for little or no upfront fees but shared a percentage of the rental income for the first 12 months following the movie's release or

- Purchased the DVDs outright.

Distribution

Netflix used US Postal service to deliver DVDs to customers through regional centers.

Pricing

- When Netflix began as a DVD-by-mail service in 1997, it cost $ 4 per rental plus shipping. In 1999, they launched a monthly subscription plan for $ 15.95. This plan let users rent unlimited DVDs.

- Netflix priced it's DVD subscription plan using a flat rate, tiered subscription model that allowed for unlimited subscriptions per month, with different price points based on the number of DVDs a customer could have out at a time.

- Tiered Plans (by Number Out):

Customers chose plans based on how many DVDs they wanted to have at home simultaneously. Examples:

• 1 DVD out at a time: Typically $7.99–$9.99 per month

• 2 DVDs out: ~$13.99 per month

• 3 DVDs out: $15.95–$17.99 per month (most popular in the early 2000s)

• Additional plans supported up to 8 DVDs out at once at higher prices.

The unit economics centered around per-disc cost versus rental or subscription revenue. The profitability around this model depended on :

- Shipping frequency

- Usage intensity &

- Disc longevity

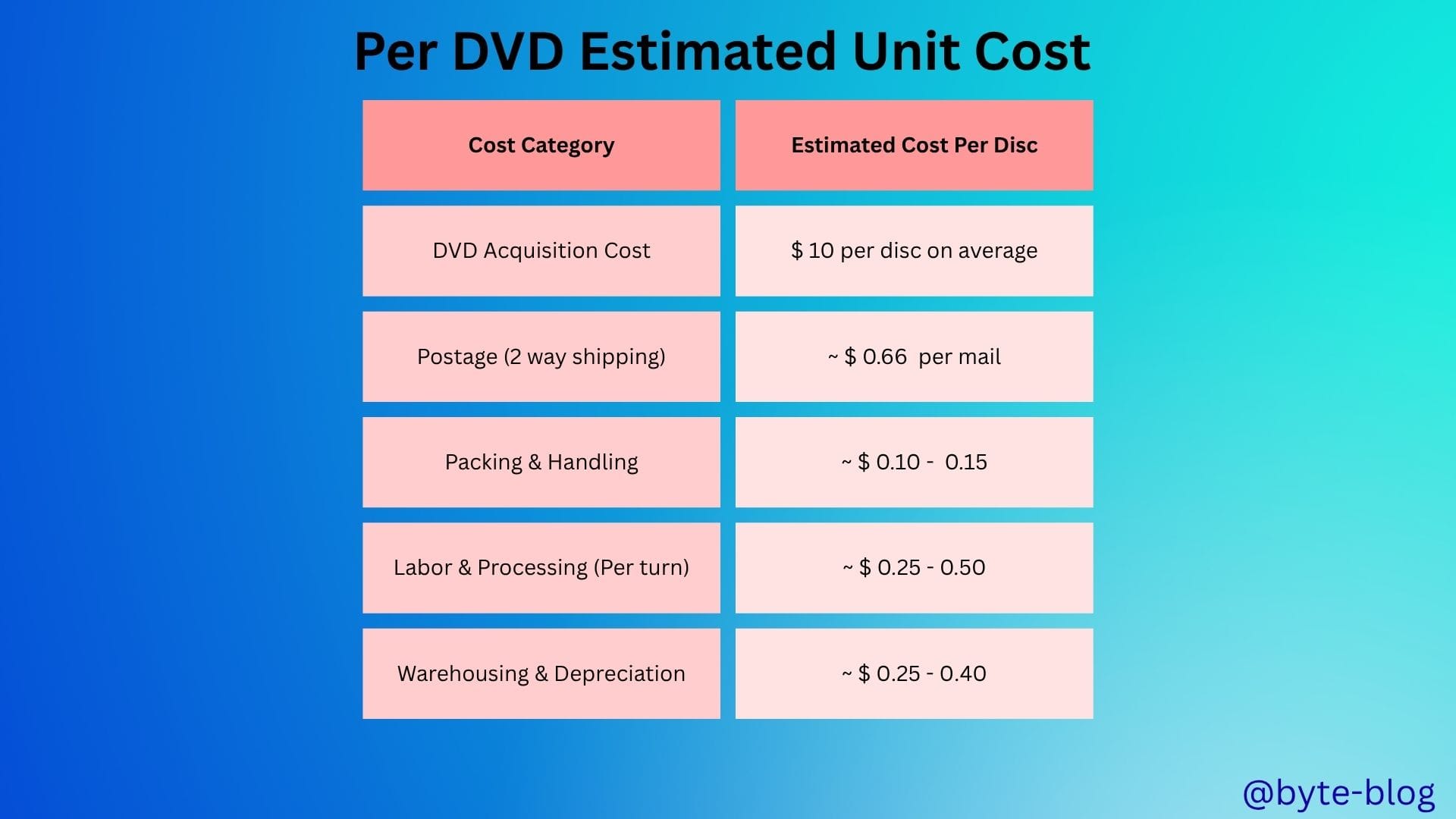

The cost estimates per disc are visualized below :

The total shipment cost per disc comes to approx $ 1.20 - 1.50 per rental transaction.

Remember our definition of Break Even Point (BEP) ?

BEP = Fixed Cost / Contribution Margin per unit

Contribution Margin = Selling Price - Variable Cost

Applying this definition here,

Break Even Rentals = DVD Acquisition Cost / (Subscription Revenue per Rental - Variable Cost per Rental)

Assuming subscription revenue of $ 17.99 per month & 5 rentals per user per month, approximate per rental revenue = 17.99 /5 ~ $ 3.60

Hence, Break Even Rentals = 10 / (3.60 - 1.30) ~ 4.35 rentals to break even

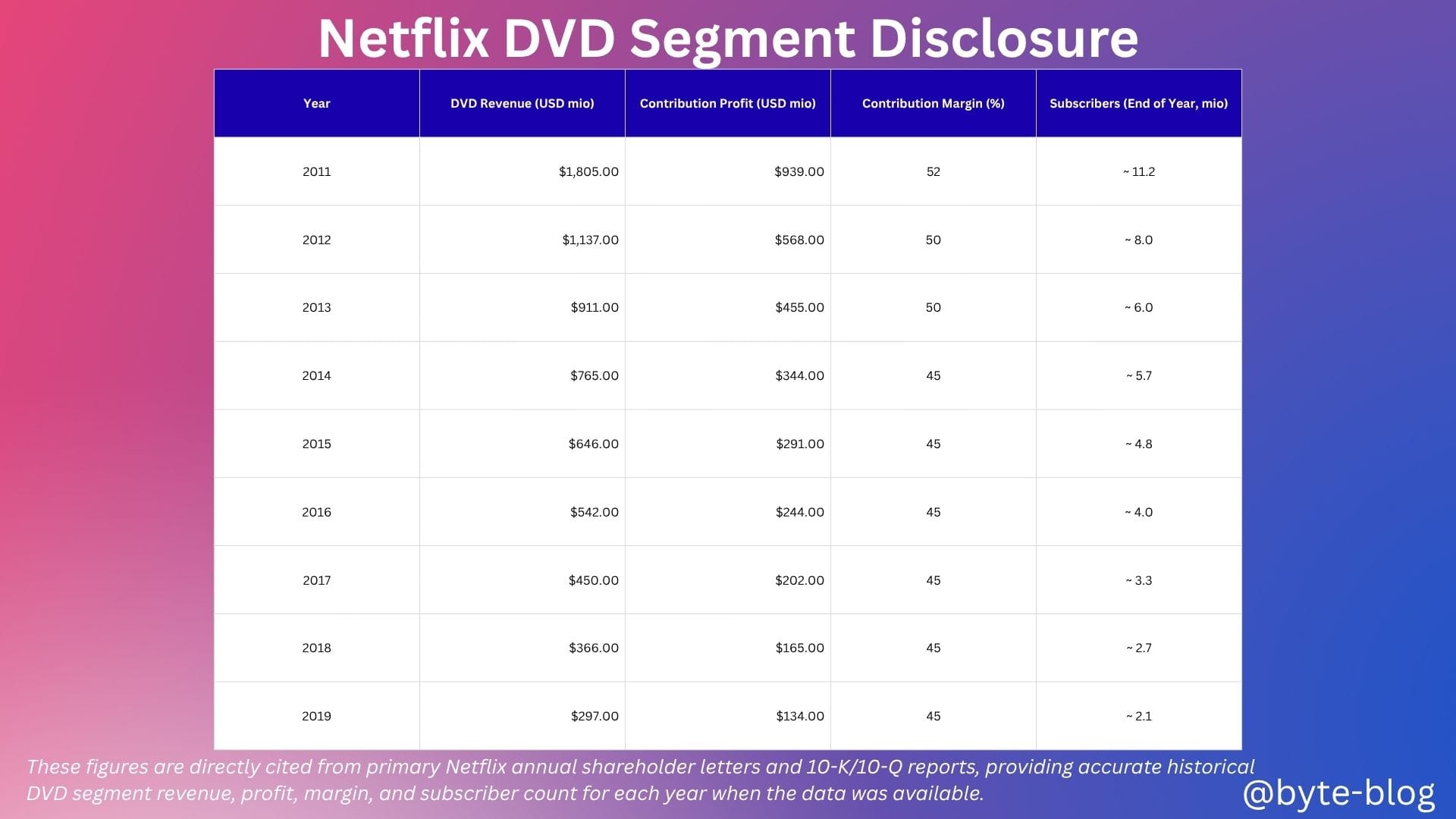

Unfortunately, there is no official disclosure or sources for actual breakeven numbers for Netflix DVD business. But we can see how profitable their DVD business was prior to winding down.

This shows how they efficiently they managed their unit economics & operations. But how did they drive their unit economics? What was their value proposition? How did they reduce customer acquisition costs & increase LTV? How did they manage customer churn & many more questions.

Let us tackle each of the above next & see them all together in the Business Model Canvas.