Finance Byte - Week 20 Netflix Episode 3

Table of Contents

- Recap

- Business Drivers - DVD Sales

- Business Model - Streaming

- Unit Economics - Streaming

- References

Recap

During Week 19, we introduced the business model of Netflix during it's DVD sales era. We defined "Business Model" as

a high level plan for profitably operating a business in a specific marketplace.

To operate a business profitably, a company must have control over two leverage points -

- Pricing &

- Costs

From a pricing perspective, to serve a specific set of customers, the company must have a value proposition.

We then defined value proposition as (Source : Roger L Martin)

For a defined set of customers, it is the value to them of your offer (whether product &/or service) versus the cost of you producing & delivering it to them. And the value is measured by the price the customer is willing to pay for your offer.

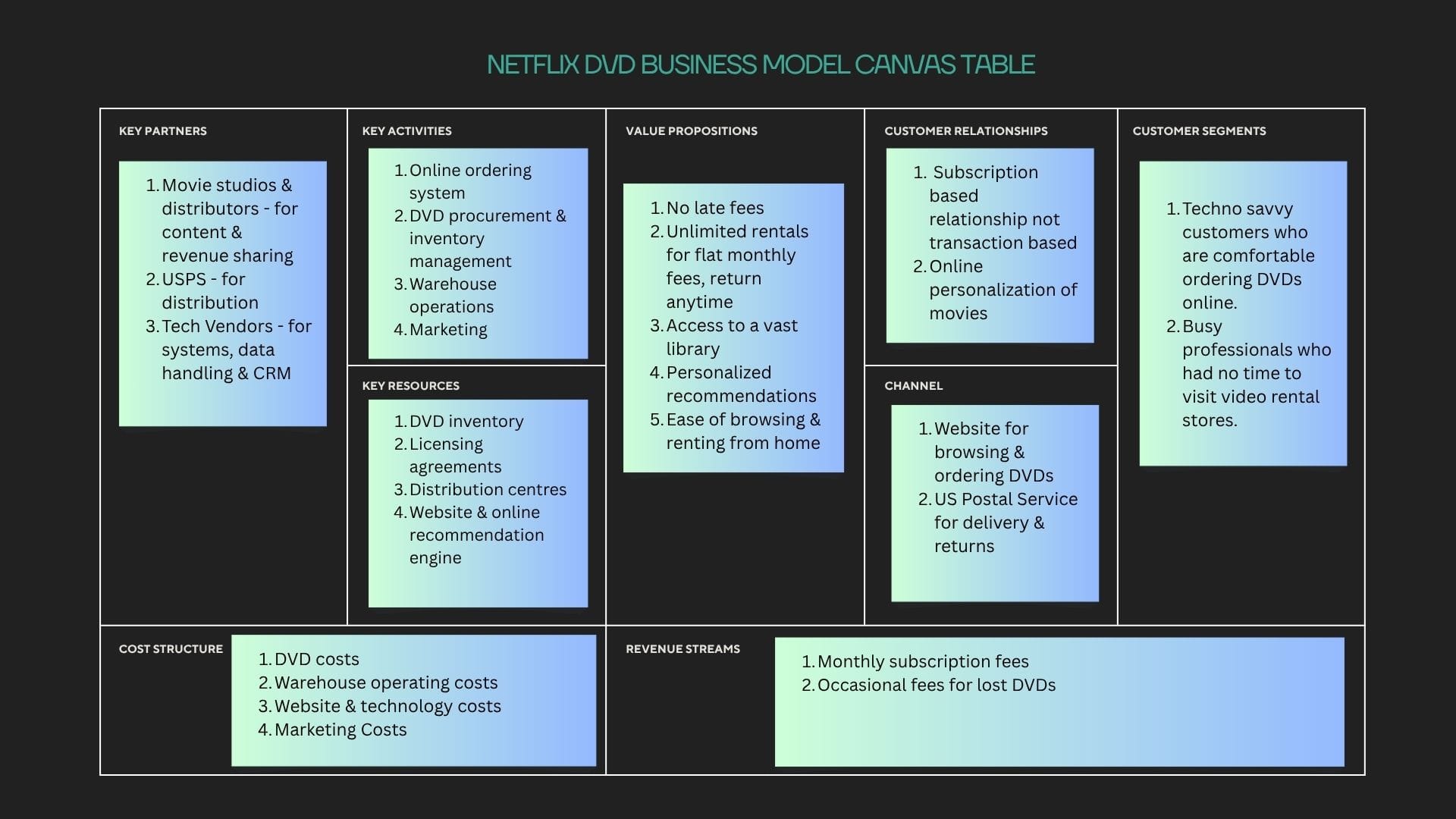

Then we defined Business Model Canvas (BMC) which is a strategic management & visualization tool that helps organizations design, describe & analyze their business models in a single page.

We then deep dived into the Netflix DVD Business Model which was to let people rent videos by selecting it online & having it delivered to their door. Initially the prices charged were transaction based which means customer paid based on DVDs rented.

Then, a year later, Netflix introduced the subscription model, where customers could rent DVDs online for a fixed fee per month. This made the revenue stream more predicable & customers would see the next movie in their queue as & when they returned the old DVDs.

We deep dived into their unit economics & saw how profitable their DVD business was prior to winding down.

This week we go behind the scenes to understand

- How did Netflix drive it's unit economics in the DVD business

- What was their value proposition?

- How did they reduce their CAC or Customer Acquisition Costs & increase LTV or customer Life Time Value?

- How did they manage churn?

After that, we explore the next stage of their journey into online streaming.

Business Drivers - DVD Sales

When we discuss Netflix's success in their DVD business, we have to understand the existing business models of traditional video rental market which was dominated by Blockbuster & local stores. Below was how video rentals thrived :

- Customers visit video rental store

- They browse for movies & select the video cassettes or DVDs they want

- They pay for the movies taken with a due date of return

- They go back to the video rental store to return the video cassette or DVD

- If they fail to return within due date, they are charged late fees

Blockbuster's business model centered around large video rental stores with a vast selection of movies & games. They generated a large portion of their revenue from late fees which was around USD 800 million annually (Source : here)

Netflix DVD business model centered around subscription-based DVD rental by mail service. It's unit economics focused on

- Per subscriber profitability &

- Profitability per rental

where the focus was on increasing average rentals per subscriber, reducing shipping costs & lengthening customer LTVs. Each disc had to be rented at least 15 - 20 times to recover acquisition costs.

So, what was Netflix's unique value proposition compared to Blockbuster to improve it's unit economics which ultimately led to increased profitability of their DVD business?

- Movies were delivered directly to customer - no physical visits to any store, queues or store opening / closing hours.

- Free postage for both delivery & returns simplified the process for customers.

- Subscribers could manage their DVD queue online anytime.

- The biggest value proposition came from eliminating late fees & making it Unlimited rental WITHOUT late fees. This immediately generated customer loyalty when the market practice was to collect late fees.

- Customers could keep DVDs as long as they want.

- Deeper movie catalog - upto 15,000 titles by 2004 enabling customers to access hard-to-find titles.

- Movie recommendations made by "Recommendation Algorithm" which resulted in personalized movie recommendations.

- Transparent subscription model ensured customers stayed loyal & for longer increasing their LTV.

Thus, Netflix business model & value propositions as stated above dramatically improved customer experience while driving unit economics by improving LTV. Also, better logistics facilities by opening new delivery centers, using US postal services kept costs under control & ensuring increased profitability.

Let us now create the Business Model Canvas for Netflix DVD business :

Now, let us explore the streaming business model followed by Netflix:

Business Model - Streaming

In 2007, Netflix introduced video streaming, marking a major shift from mail order DVDs. It invested heavily in content generation & delivery infrastructure for online delivery of movies & other content.

With a strong customer base from the DVD era & their existing subscription business model, Netflix was in a perfect position to ride the streaming era.

We will now look at the economics of the streaming business model by understanding revenue & cost drivers.

Revenue - Streaming & Advertisements

The business model of Netflix is built around subscription based streaming. This is complemented by ad-supported revenue for certain subscription tiers. There are multiple subscription tiers in line with customer segmentation & usage.

Netflix subscription revenue accounted for most of it's USD 39 billion revenue in 2024.

Costs & Investments

- Content Creation & Licensing - Netflix invests billions in original programming & exclusive content along with purchasing rights from other content providers. Netflix content spending is expected to be around USD 18 billion in 2025.

- Personalization - Netflix employs advanced recommendation algorithms to deliver personalized contents to customers

- Technology - Netflix technology investments include global-scale cloud infrastructure, AI-driven content delivery, data-driven personalization etc.

- Other Operating Costs - Includes all other operating costs.

Let us now understand the unit economics of Netflix streaming business.

Unit Economics - Streaming

The unit economics of streaming companies like Netflix is driven by customer-centered profitability & value derived from each subscriber over their lifetime with the company.

ARPU (Average Revenue Per User)

Comprising the monthly / annual revenue per subscriber, the ARPU of Netflix in 2024 is around USD 16.64.

CAC (Customer Acquisition Cost)

This is the total sales & marketing costs divided by no. of new subscribers which for 2023 was reported at approximately USD 88.60 per subscriber.

Netflix optimizes their CAC by data driven marketing & leveraging their brand where potential customers know the value proposition of Netflix prior to subscribing.

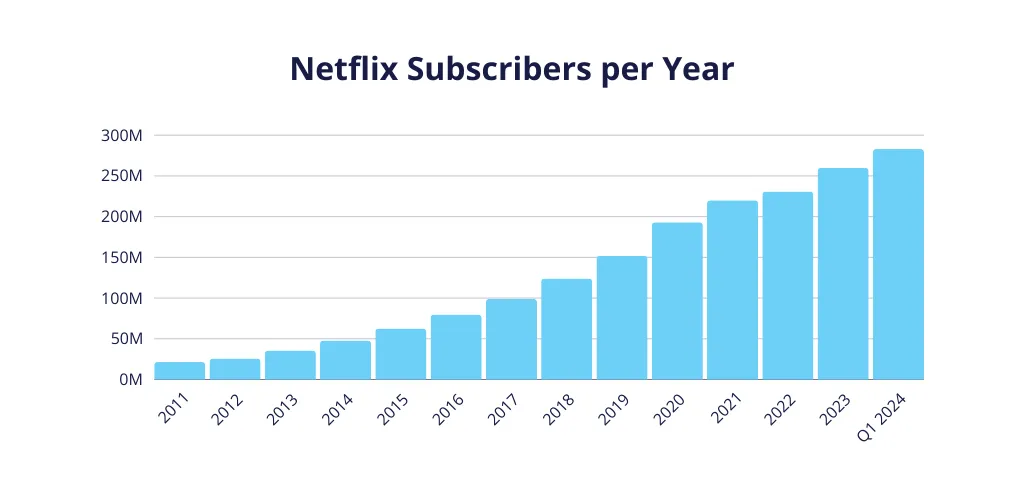

The below visual shows the increase in Netflix subscribers from 2011 to Q1 2024. (Source : here)

Churn Rate

This is the percentage of subscribers who cancel in a given month. Netflix has the lowest churn rate in the industry globally at around 2.17% in 2024. (Source : here)

Gross Margin

Calculated by reducing direct costs from from revenue, Netflix gross margin from streaming is around 50%. (Source : here)

Customer LTV

There are no official reported numbers for customer LTV for Netflix. Based on industry analyst estimates, assuming average subscription period of 25 months, the average LTV per subscriber is approx. USD 291.25. (Source : here)

CAC / LTV Ratio

Using the above numbers, the CAC / LTV ratio comes to approx ~ 88.60 / 291.25 = 0.30 which means Netflix invests USD 0.30 to generate USD 1 of gross margin per customer which is highly efficient.

We will conclude this series next week by answering how Netflix drives their impressive unit economic numbers in streaming & how do we know it is impressive in comparison with competitors?