Finance Byte - Week 4 Jack's Coffee

Table of Contents

- Recap

- The Differentiation

- Jack, the Dreamer

- Transaction - Capital

- Transaction Breakup

Recap

During Week 3, we explored a paradigm called "The System Mindset". This is something which helps our thinking in any aspect of life - not just finance. We defined System as

"an interconnected set of elements that is coherently organized in a way that achieves something"_. (Source : Thinking in Systems)

So a system consists of :

- Elements

- Interconnections &

- A Purpose

We used the human body as an example of a perfect system where

- Element = organs, skin, blood

- Interconnections = bones, tissues, muscles

- A Purpose = Be Alive!!

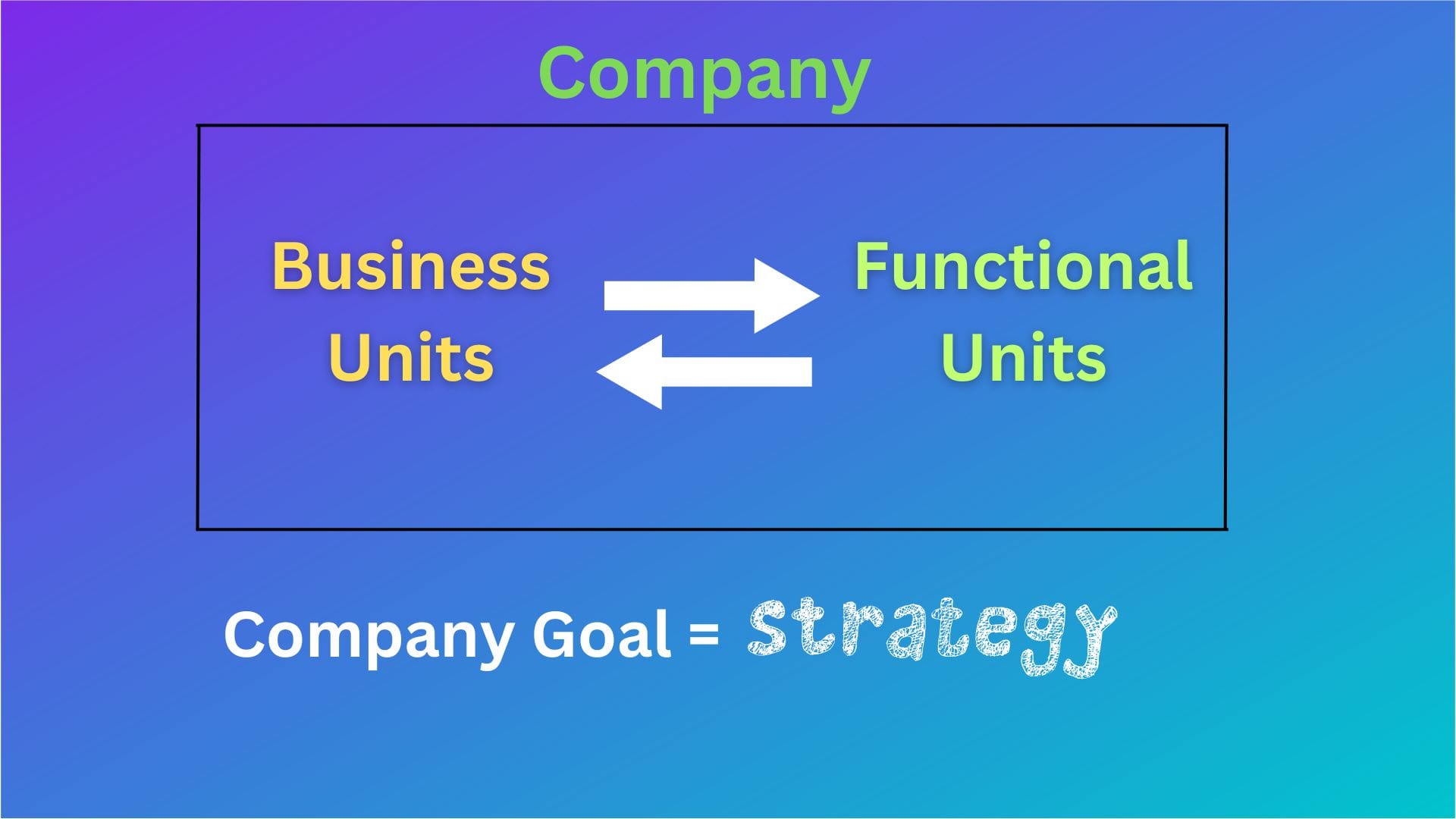

We then went on to explain how a company or a legal entity can be considered as a system with the below visual :

Where Business Units are revenue generating serving customer needs & Functional Units support the Business Units (Finance, HR, Operations etc). These units perform specific activities & interact with each other to achieve the common purpose denoted by the company's goal or Strategy.

How do we measure the results of these interactions to see whether the company is achieving it's strategy or not? Through the holy trinity of

- Balance Sheet

- Income Statement &

- Cash Flow

Any resources that goes into the company (Capital, labor etc) goes through a process which generates an output. This output generates surplus (revenue minus costs).

- The resources used to generate the output as well as run the company is reflected in the Balance Sheet

- Amount spent to generate the output as well as revenue earned from the output is reflected in the Income statement

- The difference in cash balances from the start of the year to the year end is reflected in the Cash flow statement

As finance professionals, it is our job to ensure resources are being put to efficient use to generate revenue, ensure costs are in control, working capital is optimal etc. How do we go about doing that? Let's dive in. It's going to be a long journey ahead of us......

The Differentiation

There are numerous resources (Books, online, courses, blogs, newsletters etc) giving deep insights & knowledge on finance. I follow some of them myself - each one of them explaining concepts in their own way colored by their individual experiences & knowledge.

I learn from each one of them & their insights are invaluable in providing new perspectives & ways of thinking.

What am I going to do here? Instead of explaining concepts just like that, I will take you on a journey from the rock bottom - explaining where it all starts & work our way up. This way of learning is called "First Principles Thinking". It is the single best approach to learn how to think for yourself. (You can read more about First Principles Thinking here)

The best analogy I can think of is someone teaching rock climbing. To a novice, the rock looks very intimidating or impossible to climb but an expert can see lots of small spaces & protrusions which they grip to climb up. Each small space or protrusion takes them up one level.

I will show you the small gaps & protrusions by using systems thinking & we will go from ground up explaining concepts using First Principles & then explore more complicated aspects. You should do be able to do your own climbing.

This is more of a thought experiment which I will refine as we move forward.

We are going to follow an entrepreneur named "Jack" whose dream is to start a coffee shop & we will build on the concepts brick by brick, dream by dream & follow him as he embarks on his entrepreneurial adventure.

So, lets go....

Jack, The Dreamer

Our friend Jack dreams of starting a coffee shop called "Jack's Coffee Shop". What does he need first for making his dream a reality? Money... or Cash.

He takes his savings & puts in $ 100,000 into the business. This means he has bootstrapped the business (he invested his own funds & is not relying on outside investors (for now)).

Transaction - Capital

The amount Jack invested into his business is called "Capital".

In economics, "Capital" refers to assets or resources that are used to produce goods & services.

This is the first "transaction". Ray Dalio said on transactions:

An economy is simply the sum of the transactions that make it up & a transaction is a very simple thing. You make transactions all the time. Every time you buy something, you create a transaction.

Each transaction consists of a buyer exchanging money or credit with a seller of goods, services or financial assets.

So, Jack's coffee shop's first transaction was the introduction of capital.

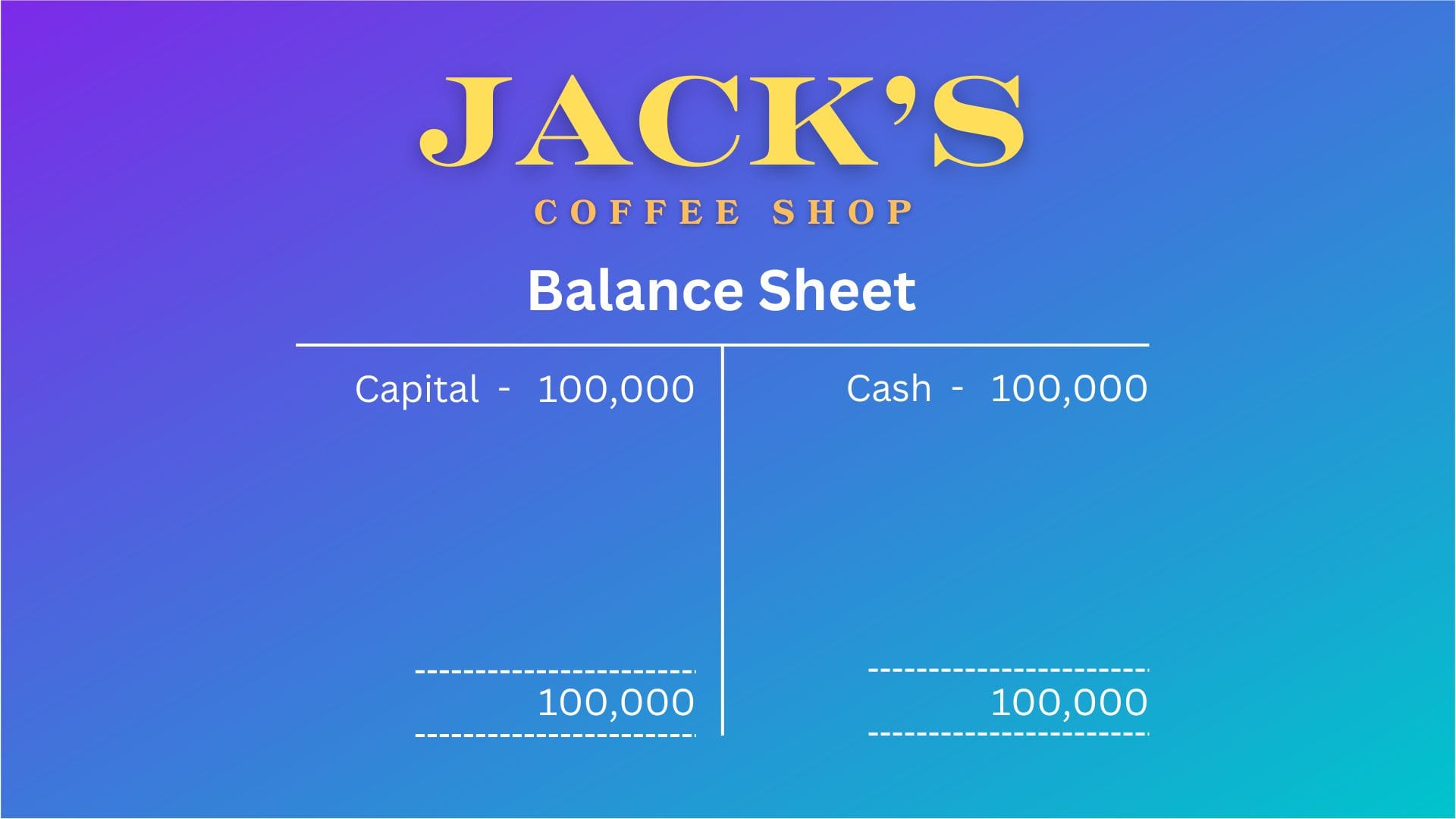

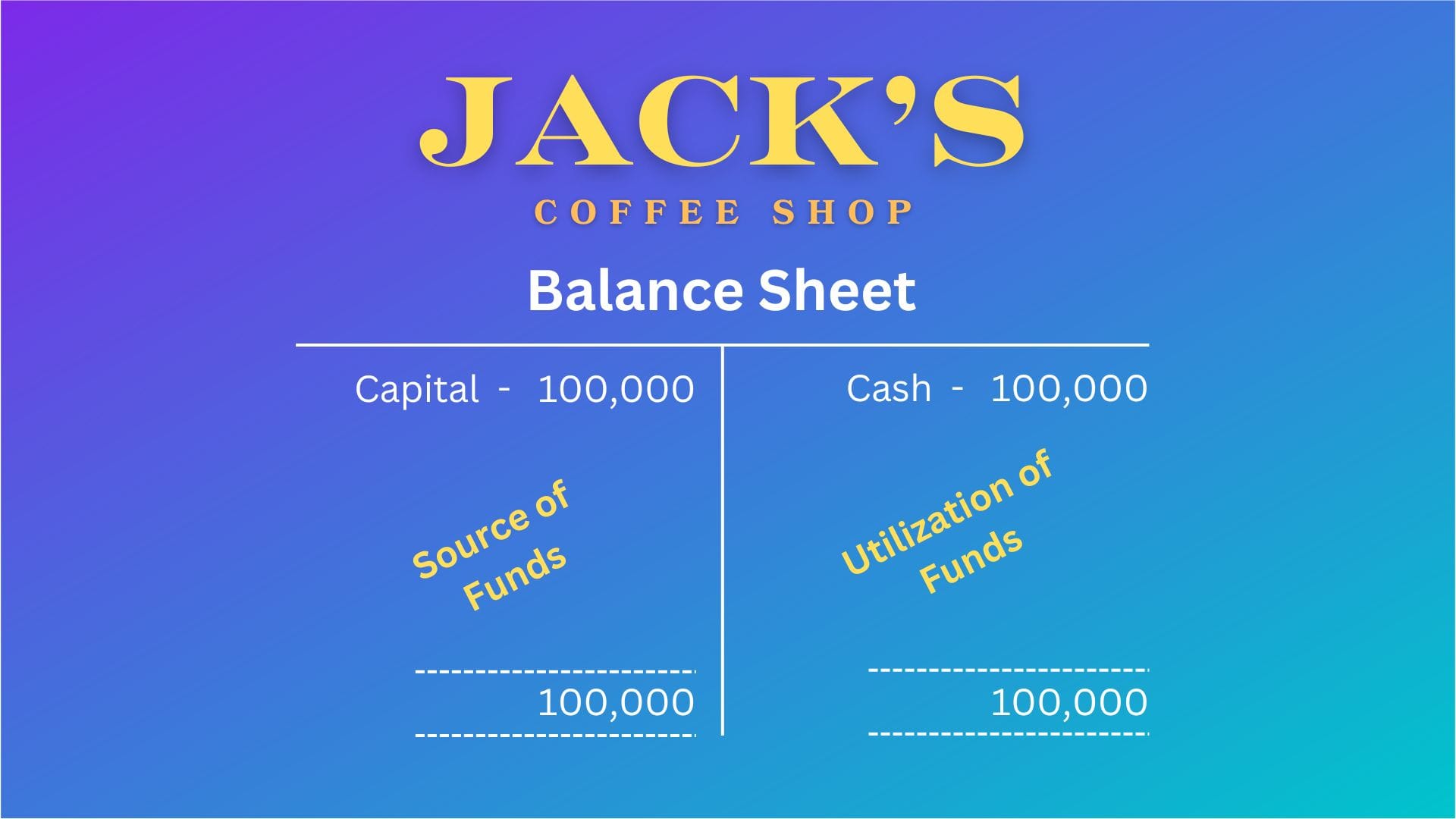

His first balance sheet will look like the visual below:

The left side of the balance sheet shows the source of funds (from where he gets the money) & the right side shows how & where those funds are placed or utilized (Utilization of funds)

This capital of $ 100,000 is going to be used for running & developing his coffee shop.

The Capital is assumed to be in cash. What is he going to use this cash for ?

He will use this cash to make & sell coffee. For that, he enters into multiple transactions to achieve the objective. These can be classified broadly as :

- He has to do certain activities to make & sell coffee

- He has do other activities to run & maintain the coffee shop

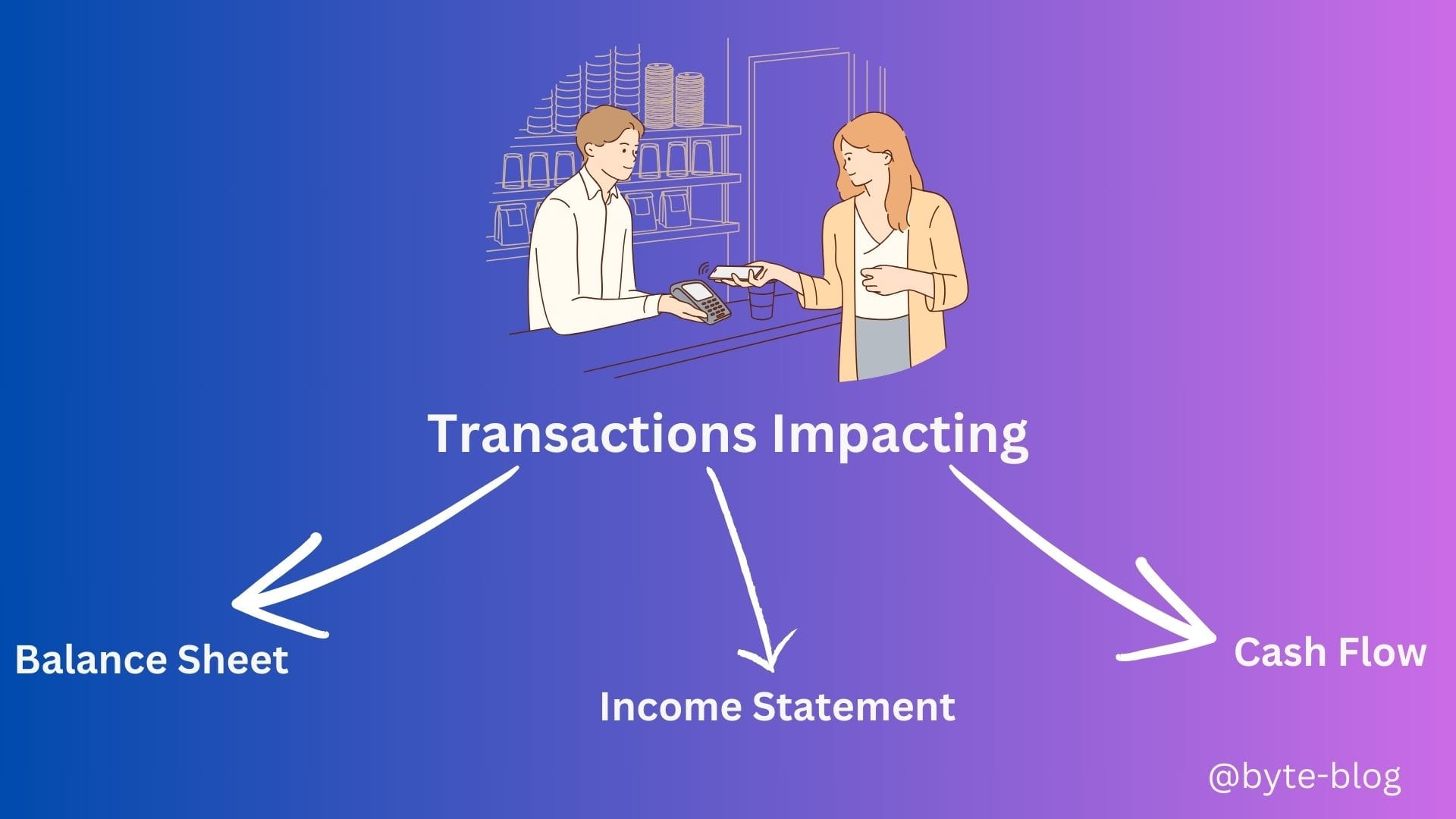

First thing we need to understand is that a transaction can impact more than one of the below statements depending on it's nature:

- The Balance Sheet

- The Income Statement &

- The Cash Flow

Visualizing the above :

Transaction Breakup

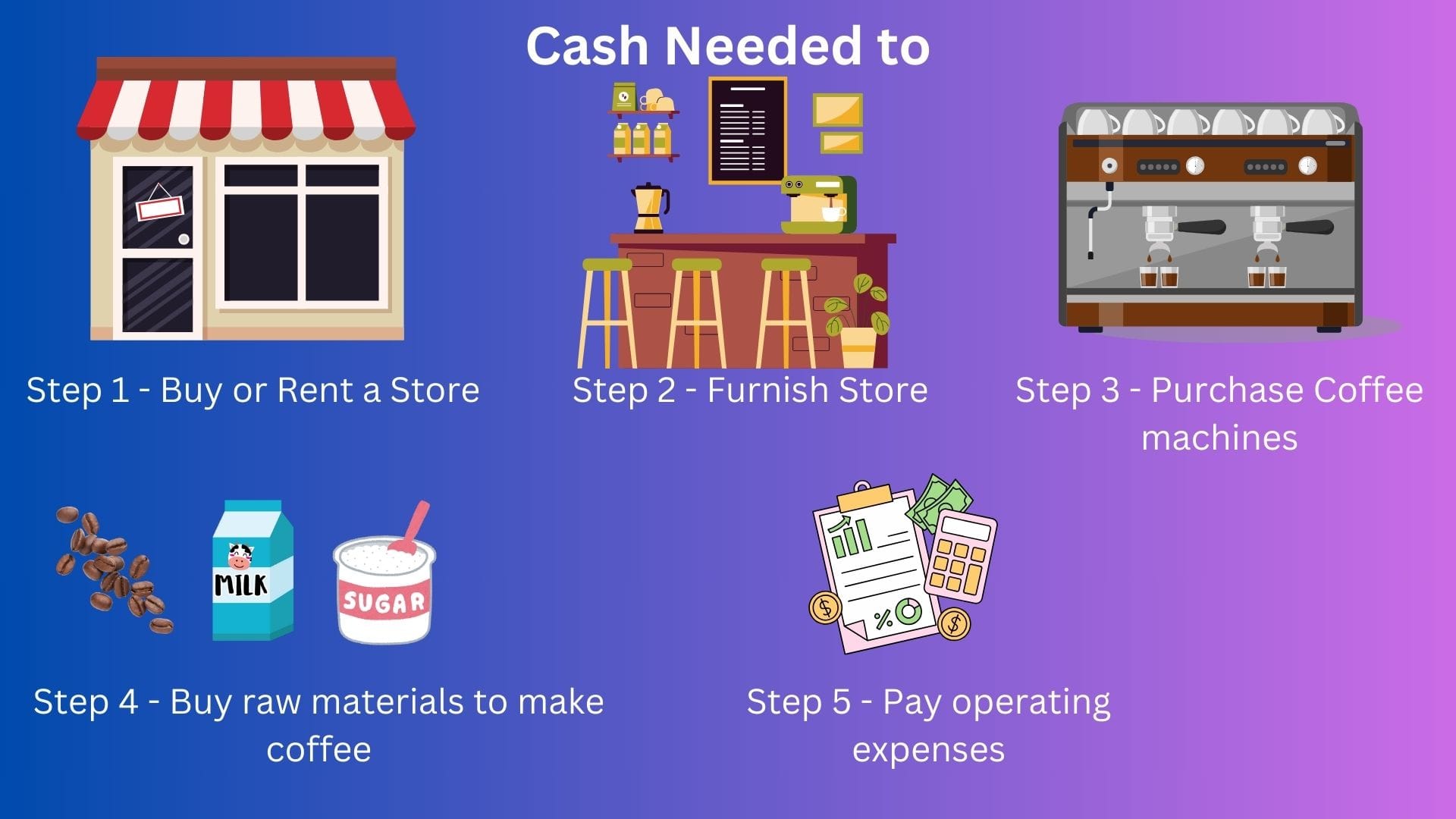

Let us break down the transactions that he enters into with others :

Step 1 - To buy or rent a store

Step 2 - To furnish the store

Step 3 - To purchase coffee machines

Step 4 - To buy raw materials to make coffee (coffee beans, milk, cups etc)

Step 5 - To pay operating expenses (rent, suppliers, store maintenance, system upkeep etc)

Visualizing the above :

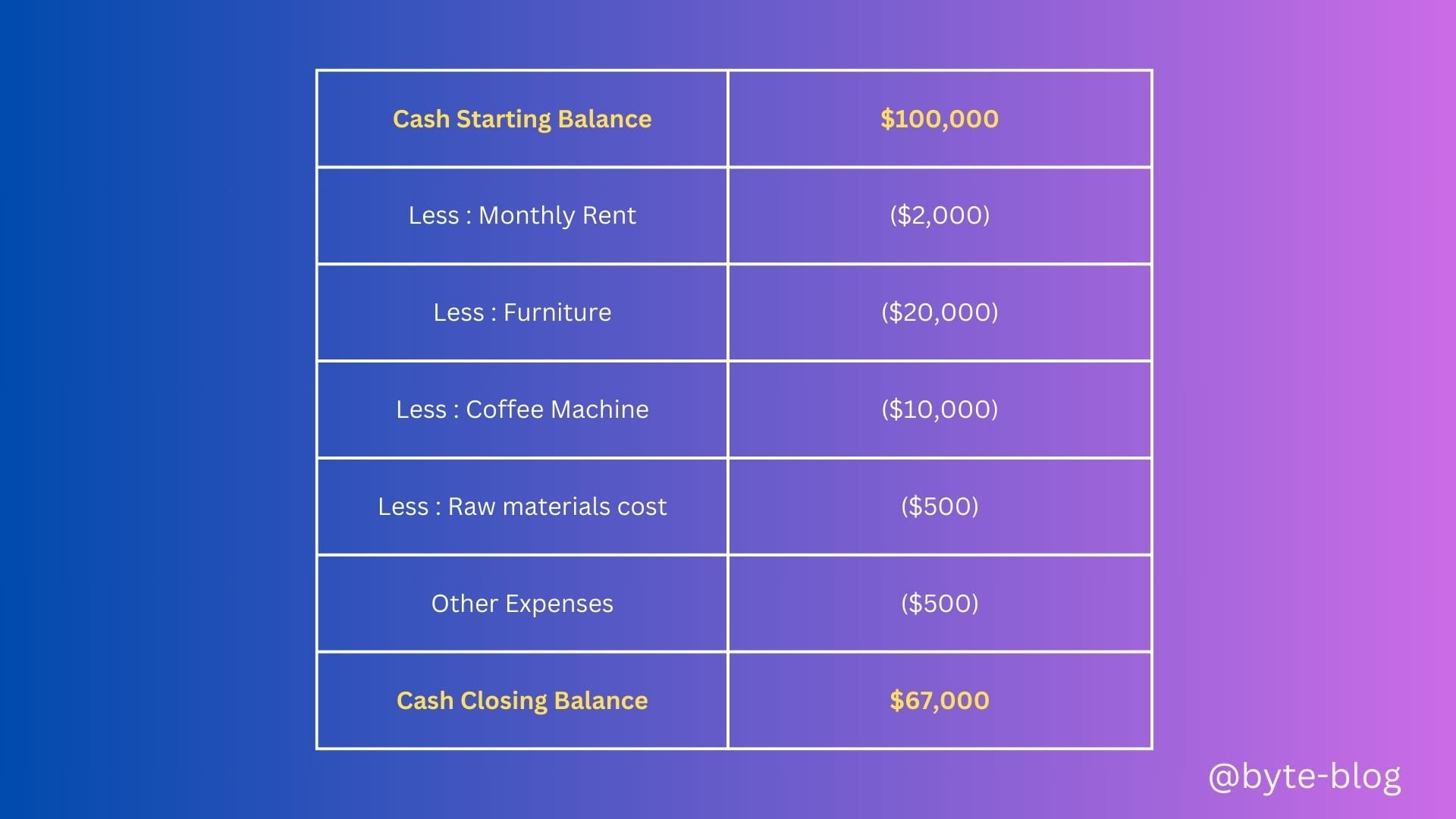

Let us assume he rents the store. Let us break down the transactions on cash spend as below :

- Rent per month - $ 2,000/-

- Furniture cost - $ 20,000/-

- Coffee machines - $ 10,000/-

- Raw materials for coffee - $ 500 per month

- Other expenses - $ 500/- per month

Why is he doing all this? So that he can sell coffee to customers & earn revenue from the sale. This can be done in two ways:

- Spend on items that he can use over & over again (normally more than a year) to make coffee. E.g., The furniture & coffee machines he purchases one-time but utilizes over longer period in his business to earn revenue in the future. Such items are known as assets.

In economics, An asset is a resource with economic value that an individual, a company, or a country owns or controls with the expectation that it will provide a future benefit.

- Spend it on items which he utilizes immediately. E.g., raw materials for making coffee & other expenses to keep the business running (rent, salary etc). These are called expenses.

Let us see how the cash looks at the end of the month :

So he has got $ 67,000 cash balance at the end of the month.

Next week, let us understand

- How these transactions are classified &

- Which statements are impacted &

- Why?