Finance Byte - Week 3 The System Mindset

Table of Contents

- Recap

- The System Mindset

- What is a System?

- First Order Effect

- Second or Nth Order Effect

- System Beat

- Summary

Recap

During Week 2, we discussed how

- Finance nerds have a sixth sense for numbers &

- The importance of being commercially savvy &

- Having a control on the flow of information leading to final reporting numbers.

By sixth sense, it means through experience, we can identify whether the numbers reported are in line with our understanding of the company's activities & the external environment.

Then we laid out the causes of why some of us never get this sixth sense. It is mostly due to :

- Data issues

- System issues or

- Staffing Issues

Also, the onerous work of churning out periodical reports just to meet deadlines results in the mentality of only focusing on doing the reports without looking beyond the numbers.

We should be able to help the leadership team drive strategy since finance is the only department which has a vantage point to analyze whether the company is on the right track to achieve it's strategy or not.

If not, analyze & advise the executive team on whether the corrective action being considered makes sense in the current market & economic conditions.

This means understanding

- What is the story behind the numbers?

- What do the end users of these reports look for?

- What decisions are being taken using these reports?

- Any additional information that can be provided to improve the decision maker's perspective to take better decisions?

How do we get there? It all starts with "The System Mindset"

The System Mindset

Before defining system mindset, let us understand as finance professionals, why is system mindset important? It is not only important but the very essence of what we do everyday. We utilize systems thinking most of the time without even realizing it. How? Let us divide our discussion into the following :

- What is a System?

- First order effect

- Second or nth order effect

- System Beat

What is a System?

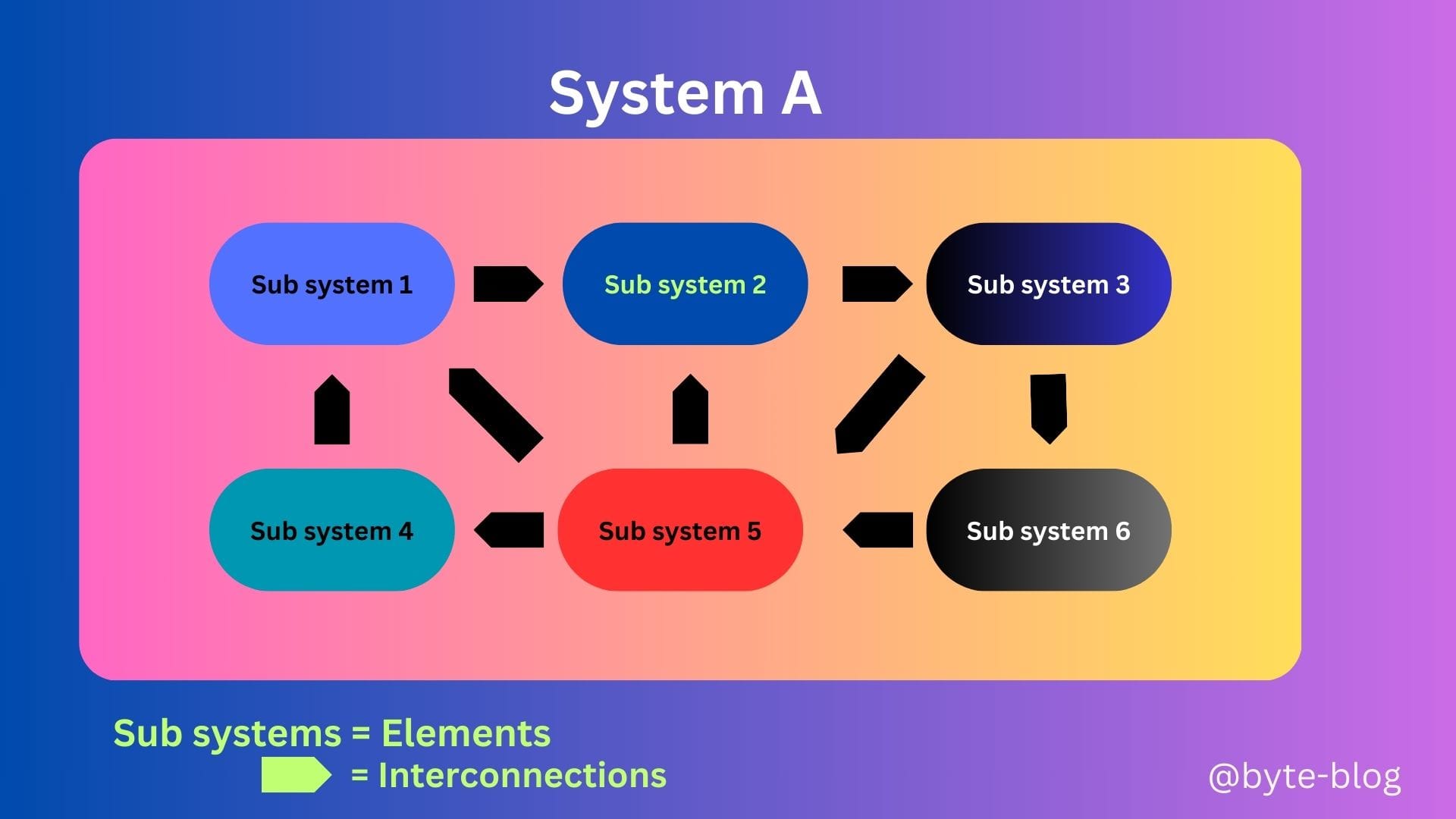

System is defined as "an interconnected set of elements that is coherently organized in a way that achieves something". (Source : Thinking in Systems).

So, a system consists of :

- Elements

- Interconnections &

- A Purpose

To put it simply, different units or sub-systems (Elements) interact with each other through connections between them (Interconnections) to achieve a goal or objective (Purpose).

Below visualization of a system makes it more clear:

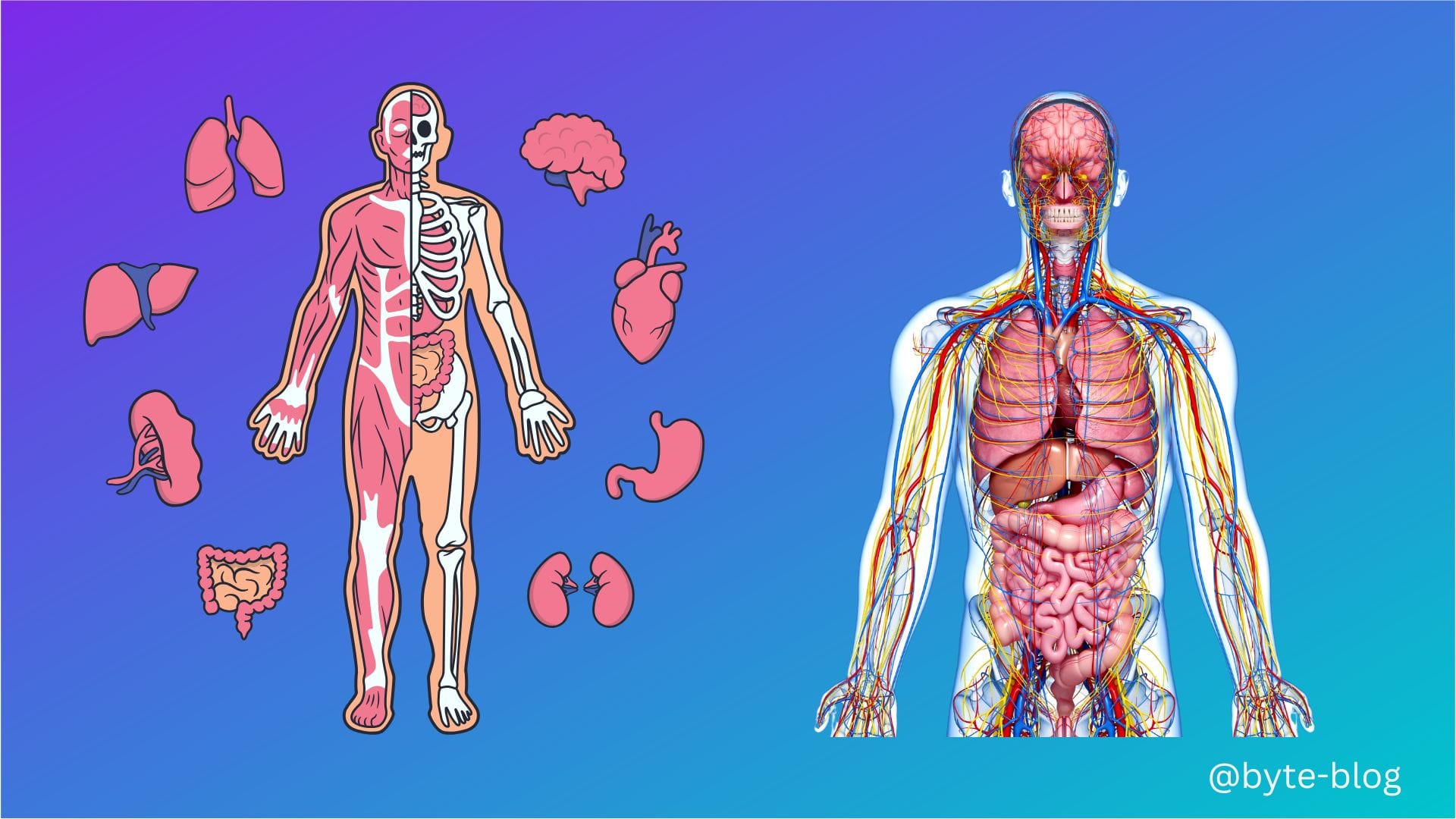

The best example of a perfect system that comes to mind is the human body which consists of various elements (organs, blood, skin etc) connected together with bones, tissues and muscles & functioning with the sole purpose to keep the whole body alive.

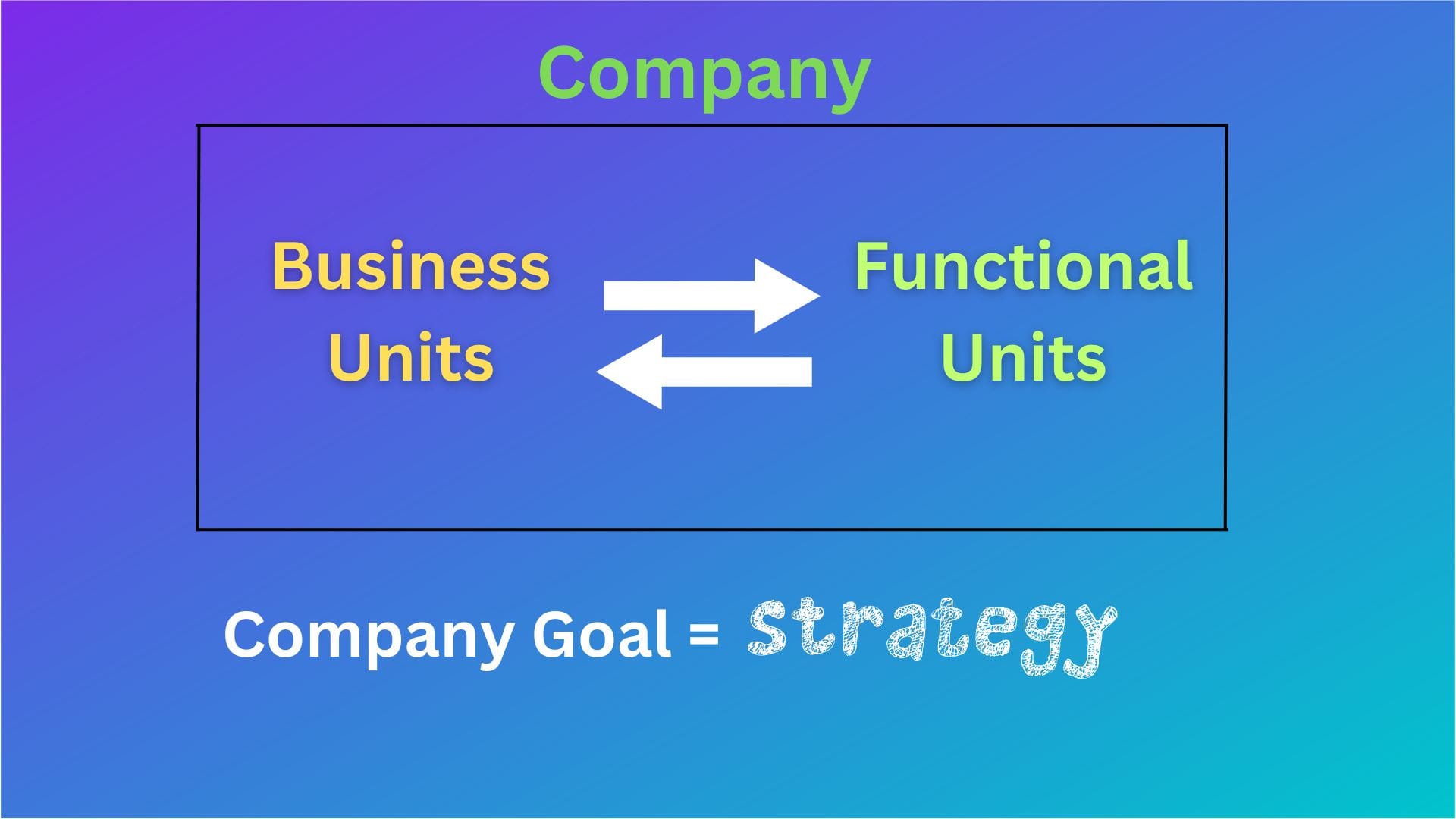

What does the above have to do with finance? Let us visualize a company or a business entity as a whole system with various sub-systems or departments working together to achieve a common goal based on it's strategy.

These departments or units can be divided into :

- Business Units - One or more units responsible for satisfying customer needs & bringing in revenue

- Functional Units - One or more units responsible for supporting business & running the functions necessary to keep the company moving (Finance, HR, operations etc)

These units have to interact within themselves & with each other to achieve the company's strategic goals. How do we measure the results of these interactions to see whether the company is achieving it's strategy or not? Through the holy trinity of

- Balance Sheet

- Income Statement &

- Cash Flow

Any resources that goes into the company (Capital, labor etc) goes through a process which generates an output. This output generates surplus (revenue minus costs).

- The resources used to generate the output as well as run the company is reflected in the Balance Sheet

- Amount spent to generate the output as well as revenue earned from the output is reflected in the income statement

- The difference in cash balances from the start of the year to the year end is reflected in the cash flow statement

As finance professionals, it is our job to ensure resources are being put to efficient use to generate revenue, ensure costs are in control, working capital is optimal etc.

This will happen only if all the business & functional units interact in the most efficient way possible to ensure that the strategic objectives as laid out is met. Analyzing this requires a system mindset. For example -

- HR interacts with business to develop incentive structures to improve sales along with maintaining organizational level people policies.

- Maintenance & Operations interact with each other to schedule manufacturing & ensure the machines are maintained to ensure continuity of operations

- IT should ensure the entire organization IT hardware & software is up to date & ensure seamless operations along with maintaining organization wide IT policies

We can see from the above the departments represented as sub-systems working together to achieve the company wide strategy.

Any decision or action for achieving an objective has an impact. This takes us to our next systems thinking topic - First Order Effect

First Order Effect

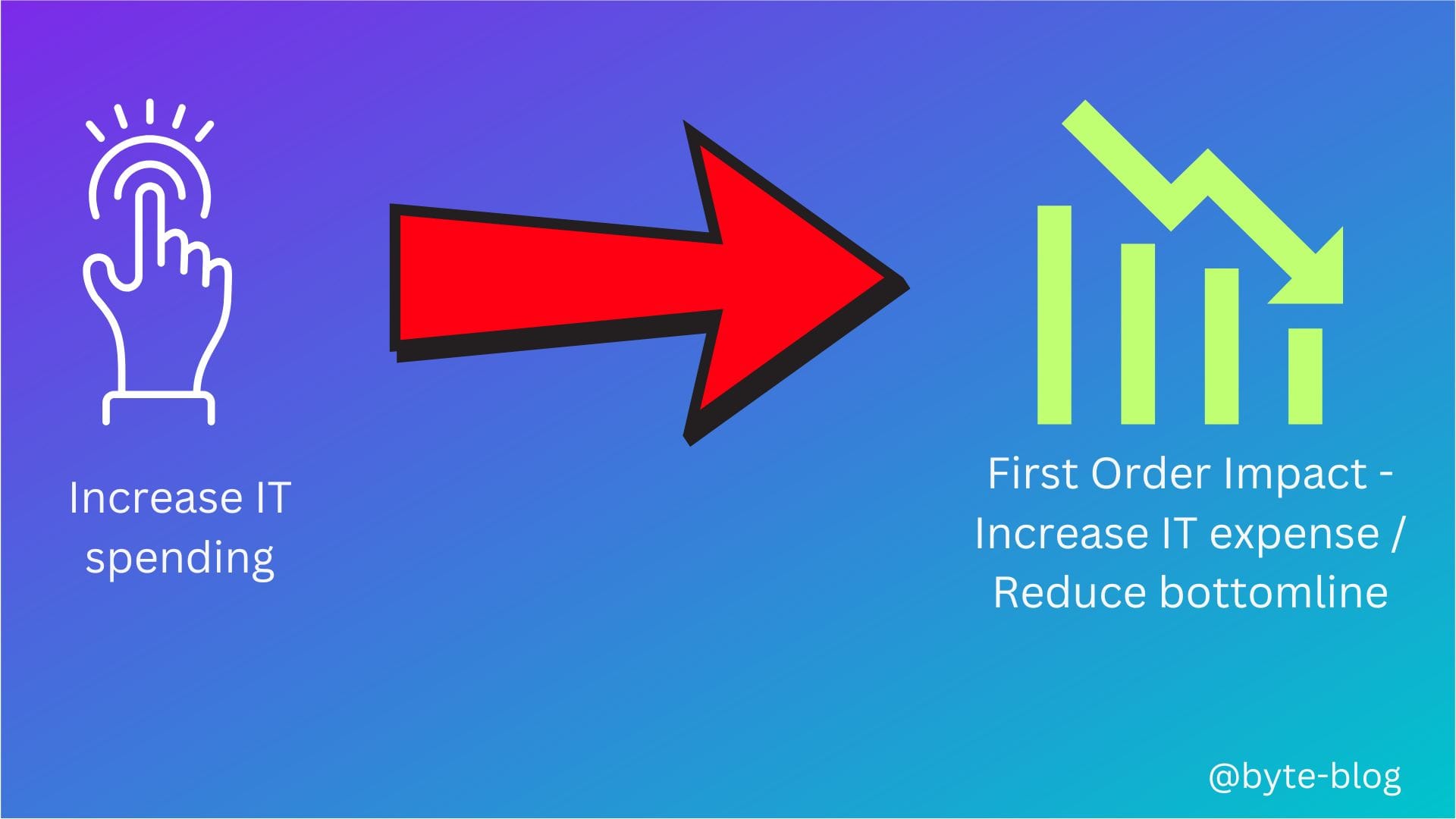

A First order effect is an immediate consequence of an action & direct impact of a change or action within a system. It is the primary consequence that occurs as a result of an action or decision, without considering any subsequent or indirect effects that may follow. (Source : here)

Let us take some examples of first order effect only:

- Increased spending on IT security will reduce the bottom line

- Introducing minimum balance charges will ensure customers maintain the required balance throughout resulting in higher deposit balance for the bank

- Increasing pricing on loans ensures higher income from loans & advances for the bank

If we change the element or variable impacting the system, it has a direct impact on the result or output either within the same unit or elsewhere. This is what we put in our models showing the impact of a particular action or decision on certain or all variables related to the system E.g., in a valuation model, what would be the impact of an interest rate change by 5 bps.

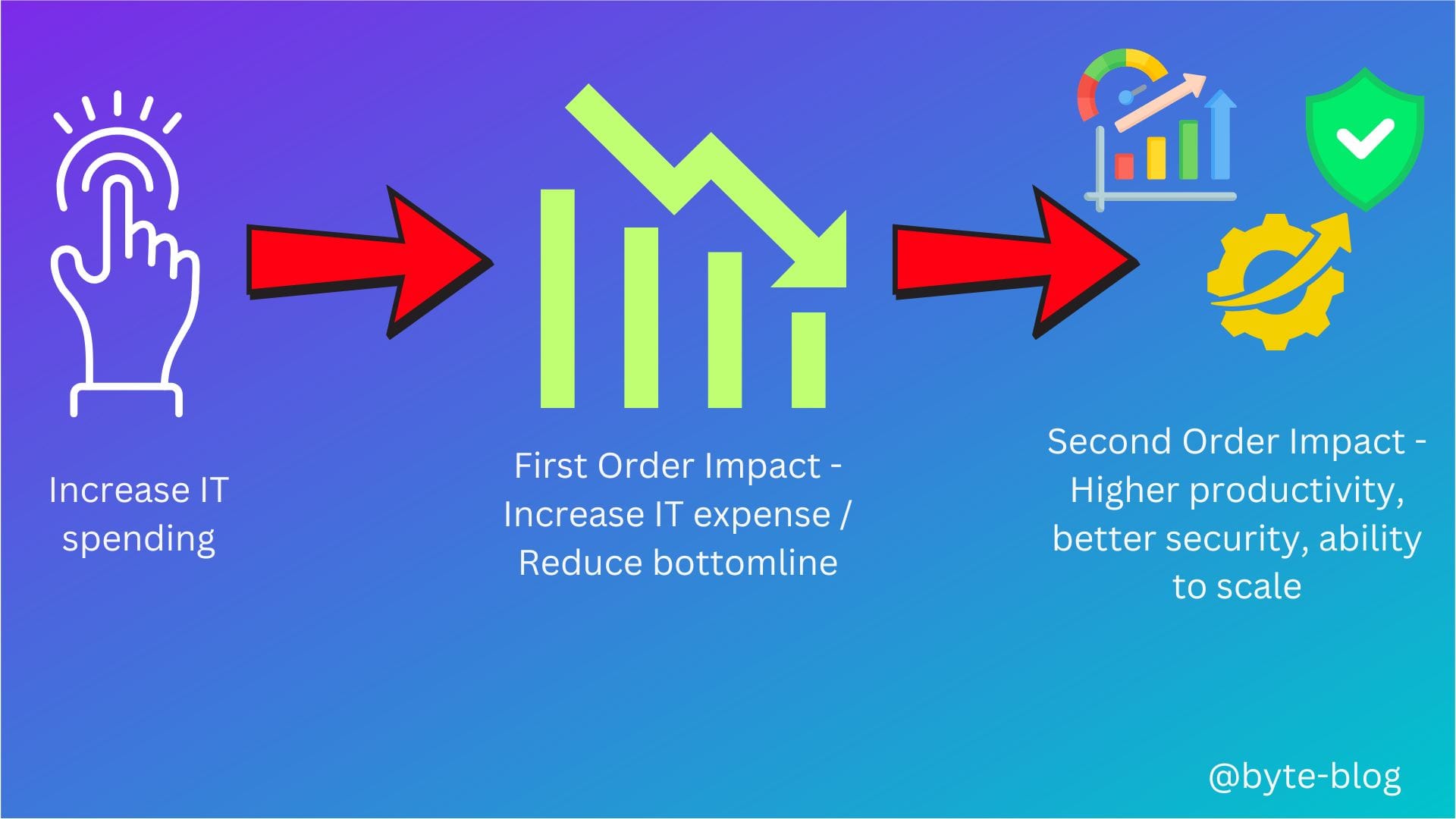

Visualizing our first example on increased IT expense,

But is it enough to see only the first order impact? No and this is where we need to hone our skills to identify the second or nth order impact of any action or decision.

Second or Nth Order Effect

Second order effect is defined as :

Every action has a consequence, & each consequence has another consequence. These are called Second Order Effects. (Source : here)

So, if we we take action on one variable, it may impact some other variable which we may not be aware of. Hence it is important to lay out all the assumptions when preparing a model to ensure that even second order or nth order impacts have been considered..

Let us continue with our example of increased IT spending. The increased spending causes increase in operating expenses reducing net profit. That is the primary consequence as shown above. But then, what is it's secondary consequence?

Increased IT spending could result in :

- Improved efficiency due to automation

- Better cybersecurity reducing risk of cyber attacks

- Better infrastructure to help scale operations

All the above are positive & could result in better performance due to increased productivity or ability to scale operations. This is the second order consequence of higher IT spending.

Visualizing the above:

A finance professional must think second, third or even nth order consequence of any action or decision to ensure any negative or positive impact is considered in any investment or strategy related assumptions. For e.g., an increased marketing spend could result in short term negative impact but will increase the product awareness to a wider market resulting in higher customer awareness & higher revenue.

To understand a system behavior better, in addition to understanding its internal subsystems & interactions, it is also important to understand the history or behavior of the system.

System Beat

Below extract from "Thinking in Systems" is worth noting :

Before you disturb the system in any way, watch how it behaves. Study it's beat. If it's a social system, watch it work. Learn it's history. If possible, find & make a time graph of actual data from the system.

- Starting with behavior of the system forces you to focus on facts, not theories.

- Starting with the behavior of the system directs one's thought to dynamic, not static analysis meaning not only to "what's wrong?"but also to "how did we get here?" & "where are we going to end up if we don't change direction?"

Does the above sound familiar? Trend analysis is a significant part of reporting & analysis that we do. Trend analysis shows during a particular period whether relevant KPIs moving in the right direction or not over a period of time & if not, what can be done to remediate the situation to move it in the right direction?

Summary

To summarize the long nerdy post above,

- As finance professionals, having a system mindset is critical to understand relationships between different variables interacting within the company & between the company & it's external environment.

- We have to understand the elements of the system, their interconnections and the purpose of it all. The impact of these interconnections on the whole system also needs to be understood.

- These relationships can help us understand the impact of any change in the balance sheet in the income statement & cash flow. For e.g., if a bank increases the pricing on it's loan book in the balance sheet, it causes increase in interest income in the income statement & the new disbursements & repayment schedules impacts it's cash flow.

- Then we have to understand not only the first order consequences to any action or decision but also the second or nth order consequence to ensure all aspects related to that action or decision is considered positively in light of it's second or nth order even though the first order impact may result in negative short term consequences

- Understanding system history & behavior is critical to understanding whether the variables underlying the company's KPIs are moving in the right direction or not. It will help us to understand

- How we got here?

- What needs to be corrected?

- Where will we end up if we don't correct our course of action?