Finance Byte - Week 9 Net Profit

Recap

During week 8 of Finance Bytes, we explored Gross Performance. It's not enough just to know & report numbers. The key is to identify the drivers behind those numbers & that understanding comes from identifying the key activities underlying any business.

We divided activities into :

- Direct &

- Indirect activities

Direct Activities are those which are directly related to producing & selling the goods / services.

Indirect Activities are those related to running the business but not directly related to producing & selling the goods / services.

Once we know the above, we can analyze business performance at the direct as well as indirect level. This means we analyze costs & revenue based on activities.

Gross Performance

Direct Level means activities resulting in Revenue & Costs related to the core business activities required to run the business.

The net result from direct level activities is called "Gross Profit" or

Net Sales - Cost of Sales = Gross Profit

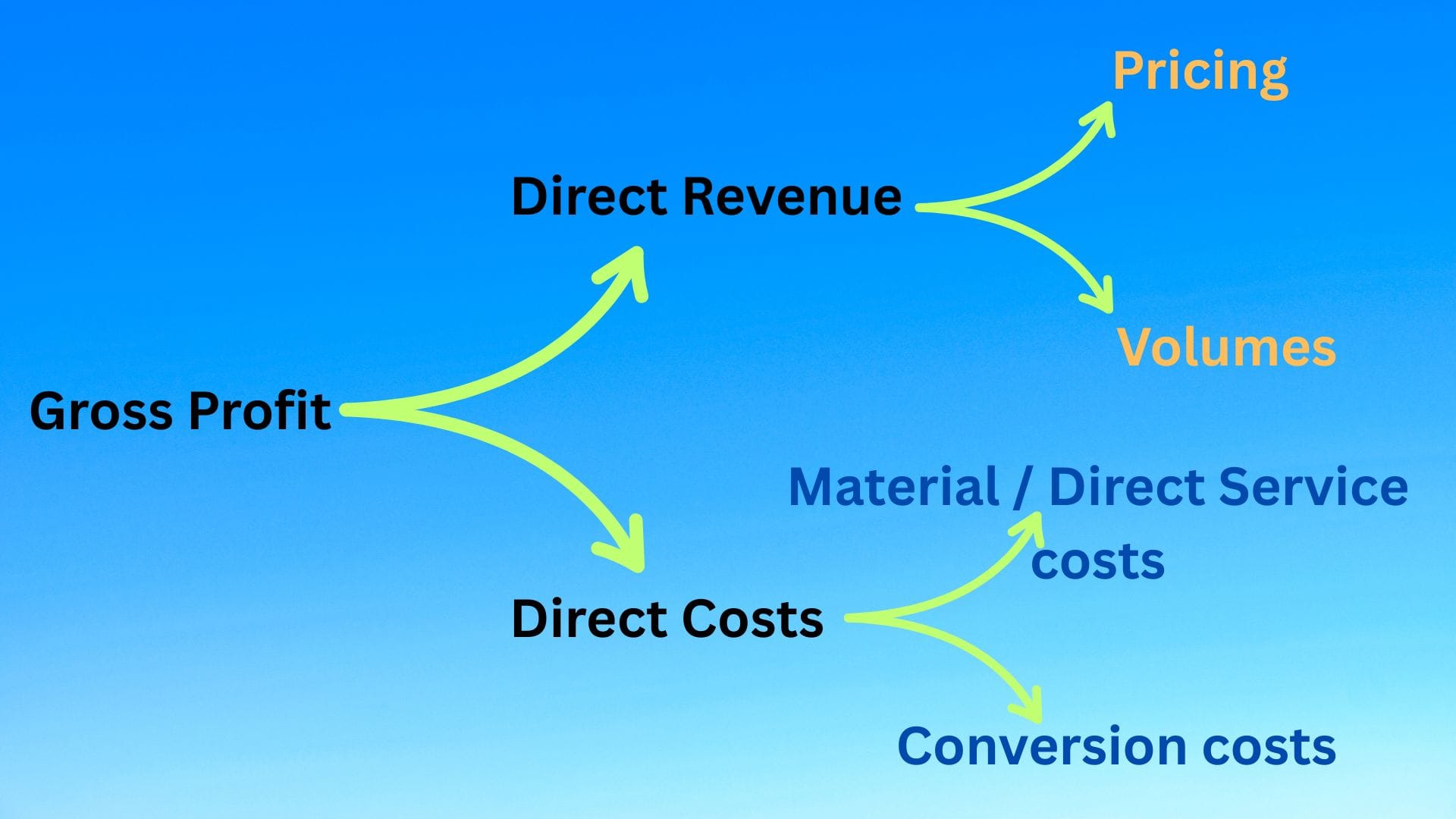

This number shows how efficiently a company manages it's production or direct activities, , meaning pricing, volume, direct costs (raw material, inventory, shipping etc) in a way that results in positive gross profit.

Higher gross profit levels convey optimal pricing combined with optimal processes for material / labor sourcing & conversion costs.

We ended with the below visual which summarized the above points :

Why is the above analysis important?

It is because first, the sales revenue has to cover direct costs under level 1 before we even consider indirect costs under level 2. If revenue doesn't even cover direct costs, then there is a problem in the economics of running the core business itself.

Before we get into Contribution, let us continue our journey.

Level 2A - Operating Income

Let us revisit our visual from last week for direct & indirect activities in Jack's coffee shop:

Any activity which are not directly related to producing &/or selling but is required to facilitate & run the business is called Indirect Activity.

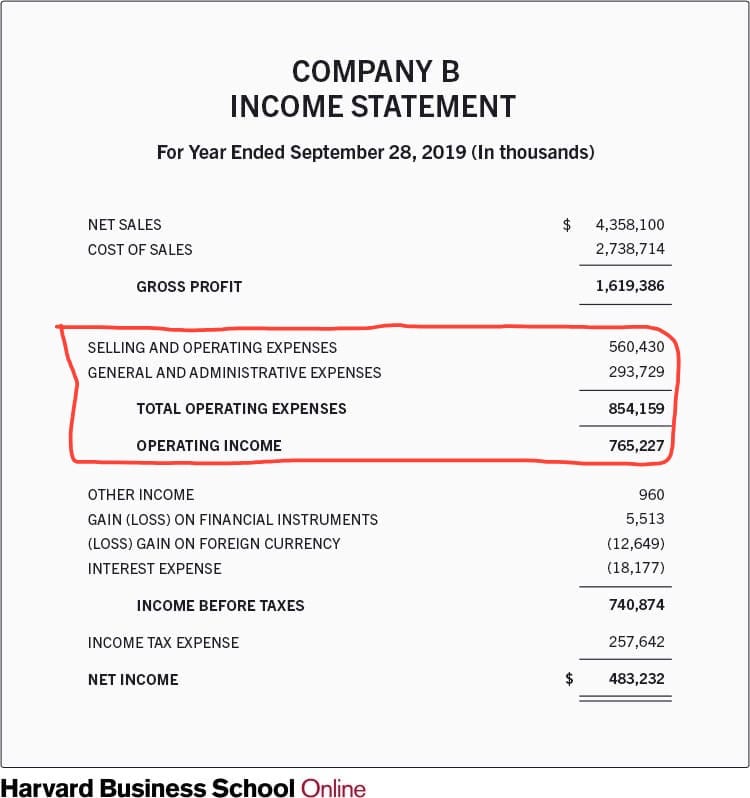

Let us look at the general income statement shown last week:

The net result of reducing indirect expenses (or Selling / Operating Expenses & General / Administrative Expenses) from Gross Profit is called Operating Income.

If we take Jack's coffee shop, he might have

- Advertising & marketing expenses to ensure more customers know about his business & visit his cafe.

- Employee related costs like cost of his accountant who manages his finances, HR costs like employee training & development

- Cafe rent

- Depreciation on furnitures & coffee machines (we will explain depreciation later!!)

They are not required for producing or selling coffee per se but is required to keep the business running smoothly & developing it. It shows how Jack manages his cafe efficiently in managing expenses to be profitable.

Let us now define Operating Income.

Operating income, also referred to as operating profit or Earnings Before Interest & Taxes (EBIT), is the amount of revenue left after deducting the operational direct and indirect costs from sales revenue. (Source : here)

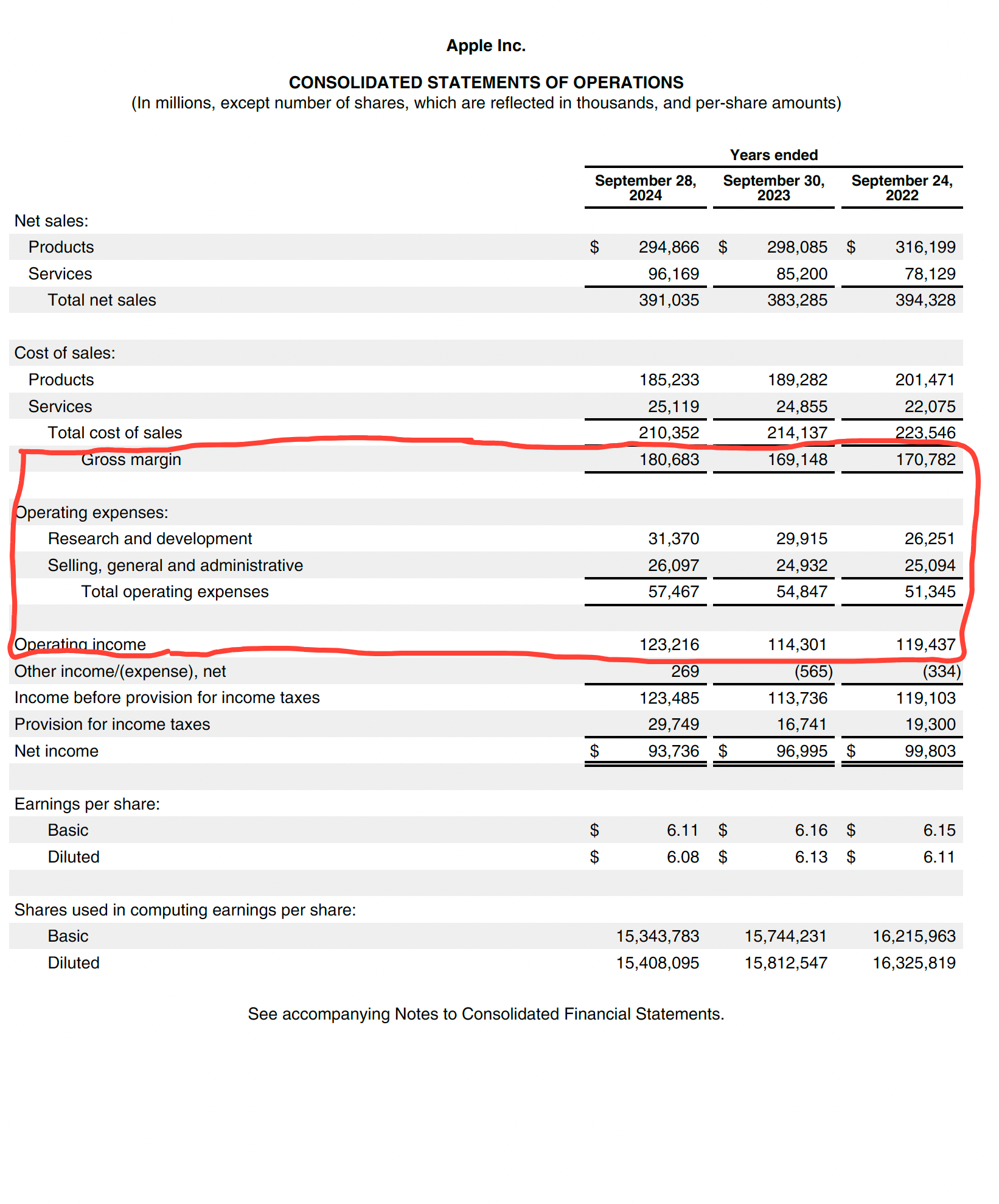

Let us look at Apple's income statement again:

We can see that

- Direct expenses incurred in generating revenue is classified under "Cost of Sales" for both Products & Services while

- Indirect expenses are classified under "Operating Expenses" which includes Research & Development and other expenses incurred for smoothly running Apple.

Level 2B - Net Income

Now, Jack has arrived at operating income after reducing operating expenses from his revenue. But there are certain expenses which is incurred & calculated based on factors outside his control like taxes, borrowing costs etc. These are expenses incurred but not directly related to his operations of making & selling coffee.

The tax rate for corporate tax depends on the rate as specified by the Government from time to time. Interest rates depend on macro economic conditions & even though is required for running his business, has nothing to do with operational activities. So, if Jack borrows from a bank for his working capital or capital expenditure, he has to pay the interest rate as specified from time to time as long as the borrowing is outstanding.

If Jack has excess cash from sales, he can deposit or invest it to earn additional returns till he uses it to buy additional coffee machines or Jack can sell used plastic cups for recycling & earn some income from that too. These are all classified under "Other Income" or sub-classified under "Other Income" as "Interest Income" & "Miscellaneous Income" respectively.

Let us now define "Net Income" :

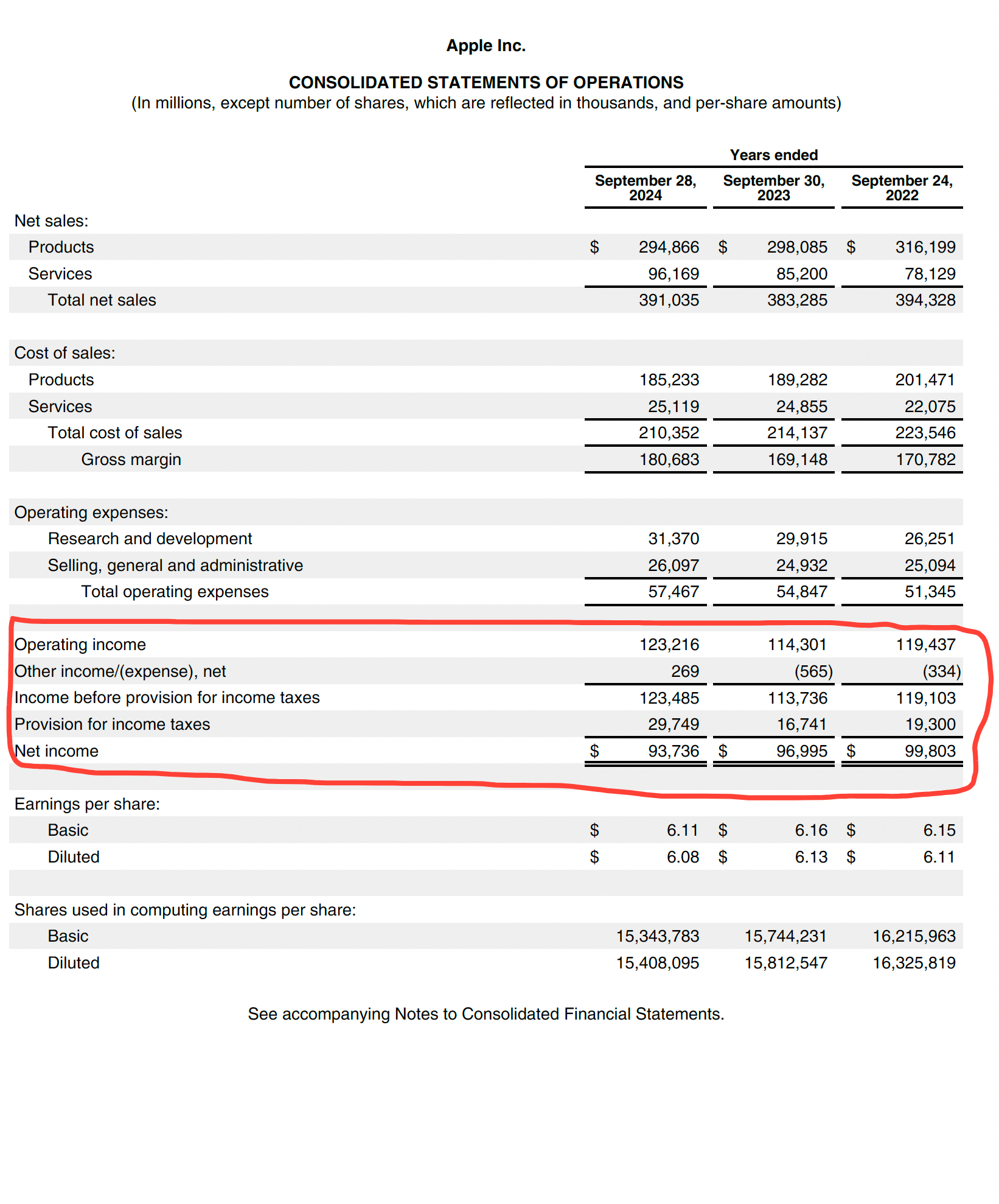

Net income is a company’s profits or earnings. Net income is referred to as the bottom line since it sits at the bottom of the income statement and is the income remaining after factoring in all expenses, debts, additional income streams, and operating costs. The bottom line is also referred to as net income on the income statement.

Net income is calculated by netting out items from operating income that include depreciation, interest, taxes, and other expenses. Sometimes, additional income streams add to earnings like interest on investments or proceeds from the sale of assets. (Source : here)

Let us look at Apple's Income statement again :

We know whether a company is profitable by checking the Net Income as it is the balance left after all the expenses are reduced from the revenue earned for that particular period (could be a month, quarter, half year or year).

If Jack's revenues does not cover his costs, his business ends up in a Net Loss or is loss making.

Now that we analyzed the income statement from top ( Level 1 - Gross Profit) to the bottom (Level 2B - Net Income or Net Profit), Jack would know whether his business is earning positive returns if he has a net profit.

Now, how will Jack work towards making his business profitable or increasing the profitability levels of his business? All businesses start with a loss because expenses start kicking in first before any business starts earning their first dollar of revenue. Depending on the business, it can be years also. Is that bad? No.

That is because some businesses might focus on cash flow (which we will get into!!) to ensure the cash flows come in for reinvesting or running the core business. See the below write up on Amazon which took almost 10 years to be profitable. (Source : here)

Amazon was founded in 1994 with a focus on selling books online. At the time, the internet was still relatively new, and the concept of e-commerce was far from mainstream. From the outset, Bezos had a vision for Amazon's future that extended well beyond books. However, that vision wasn't immediately profitable.

For years, Amazon posted losses, and it wasn't until 2003 – almost a full decade later – that Amazon finally turned a full-year profit. That year, the company reported a net income of $35 million, a significant turnaround from the $149 million loss it had posted just the year before.

But normal business owners like Jack cannot wait years for their business to turn profitable. So, how will Jack know when will his business turn from loss to profit, what is the turning point? What analysis will help him in his decision making?

We will discuss Contribution Analysis next week.