Self Reflection Byte - The Flywheel we need

Today's topic has it's origins in strategy but I couldn't stop thinking about it's link & implementation in our own personal & professional lives & thought I'll write about a strategy topic in self reflection.

The Experience Curve

During my research, I came across something known as "Experience Curve", also known as the "Henderson Curve" after Bruce Henderson of BCG.

It was introduced by Boston Consulting Group (BCG) in the 1960's & was a key concept for understanding efficiency & cost reduction. The theory originated during a cost analysis that BCG performed for a major semi conductor manufacturer in 1966 & held that

A Company's unit production cost would fall by a predictable amount - typically 20 to 30% in real terms - for each doubling of "experience" or accumulated production volume. (Source : here)

When the business environment was more stable during the 1960s & 1970s, this would've been sufficient to analyze competitive advantage & dynamics. However, as the business environment became comparatively more volatile & industry dynamics started changing at a faster pace with new product innovations & disruptions happening at a more regular pace, this theory does not fully hold for competitive advantage.

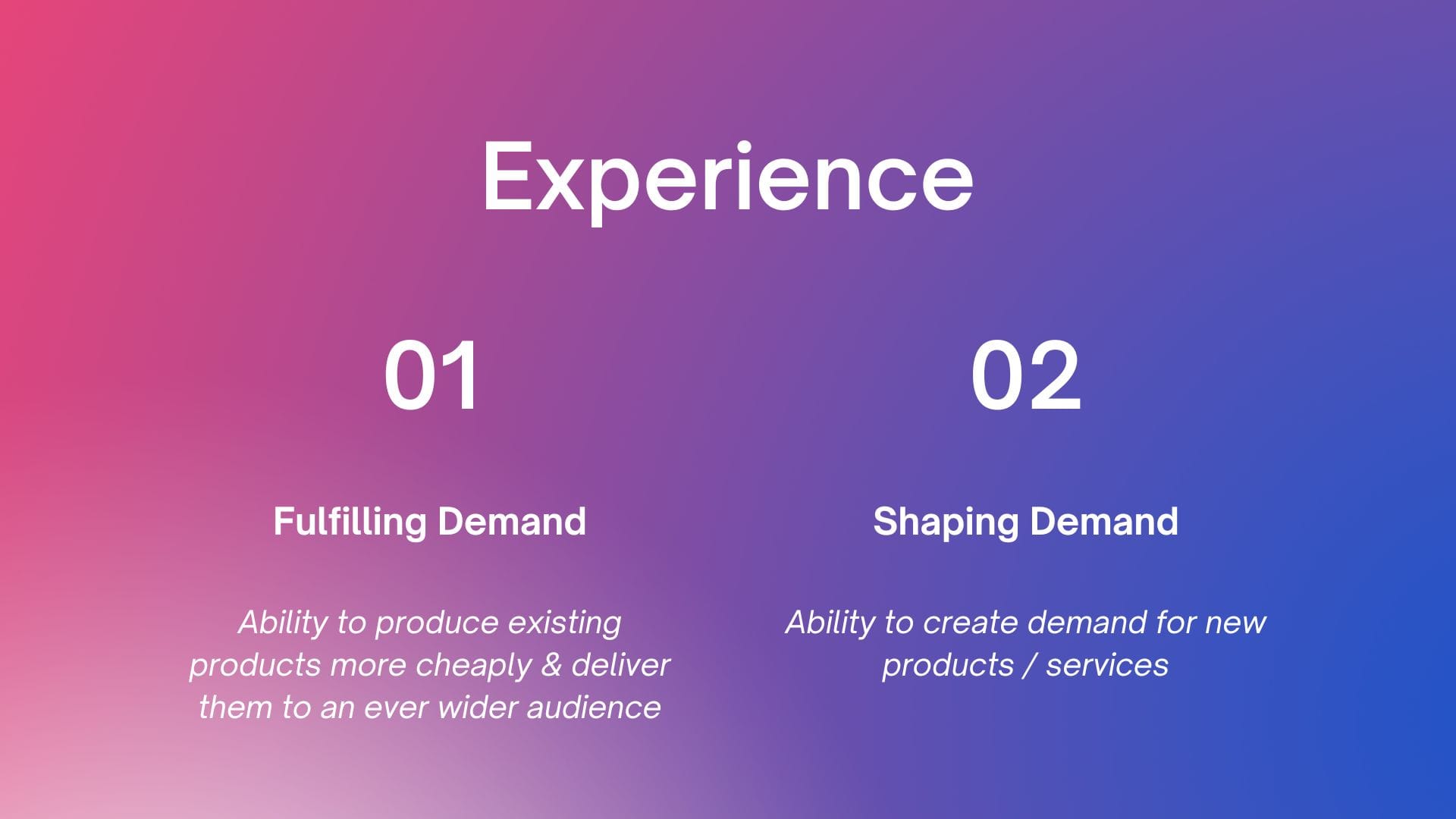

As per BCG, under this theory, there are now two types of "experiences" to maintain competitive advantage :

- Fulfilling Demand

- Shaping Demand

Let us see what the above means

Fulfilling Demand

The definition of Fulfilling Demand is :

The ability to produce existing goods / products more cheaply & deliver them to an ever wider audience.

And how do we develop this experience? - through Logical Deductive process

- Capture cost data

- Analyze cost data

- Determine opportunity improvement

- Implement Changes

- Iterate

There is a learning process - Repetition & Incremental Improvement

Shaping Demand

The definition of Shaping Demand is:

The ability to create demand for new products or services.

And how do we develop this experience? - through Inductive process

- Sample consumer behavior

- Formulate a hypothesis for unmet needs or imagine possibilities permitted by new technologies

- Test the hypothesis with a new product / offering

- Shut down or expand hypothesis based on empirical results

- Formulate new hypothesis based on the latest empirical results

- Repeat

Visualizing the above

So, when the first type of experience (Fulfilling Demand) held more during the stable industry dynamics of 1960s & 1970s, during the current times, the second type of experience (Shaping Demand) has become more prominent & the balance of the two or the mode of how to switch from one to another determines how competitive a company is in comparison with it's peers & competitors.

So, that's the theory from BCG. This is part of strategy & applicable only to companies. Or is it?

Experience by Doing

As finance professionals, we first start as interns, learn stuff - mostly by repeating what our seniors tell us & then learn on the way. We learn on the job & then become better at it.

The most visible area where a finance professional shines is in the use of Microsoft Excel. We start with simple models & then go on to use formulas which then improves to complex models using VBA or Python. We become more experienced in Excel & get better at it.

It takes less time to create a complex model with experience than in the beginning with less or no experience. We can do it better without the need to consult guides (except in certain specific situations where we need further clarifications or guidance).

This reflects with one of the points in my earlier blog where I mentioned that we actually learn by doing rather than by just reading books. Once we close a book we finished, we have two choices :

- Be happy that we finished the book & be done with it

- Apply at least one concept from the book & internalize the learning from that book.

The second point leads us to develop action points & thought process to implement a new thing in our life. We are like interns first & may need to go back to the book or do more research to improve on our understanding of the relevant point or points.

Once we gain experience, we become better at something & add more value either by

- Taking less time or

- Give more output

Can you see the link between learning by doing & the experience curve? It is fascinating.

Experience by Reading More

Tyler Cowen (Holbert L. Harris Professor of Economics at George Mason University and also Director of the Mercatus Center, He was named in an Economist poll as one of the most influential economists of the last decade and several years ago Bloomberg BusinessWeek dubbed him "America's Hottest Economist." Foreign Policy magazine named him as one of its "Top 100 Global Thinkers" of 2011) said of reading fast -

The best way to read quickly is to read lots. And lots. And to have started a long time ago. Then maybe you know what is coming in the current book. Reading quickly is often, in a margin-relevant way, close to not reading much at all. (Source : here)

When we read multiple books of the same topic - say economics or strategy, the ideas flow out of the books faster as we move from book to book. Why ? Because we know what we are reading about. We already have ideas from previous books & so we get more familiar with those from new books than would have been if we were reading them for the first time.

The marginal cost of reading (time spent) decreases as we read more on the same or related topics. The experience curve from reading increases the value that we get from reading.

This means we get more experience from reading more books. But reading itself is not enough. Understanding & then trying to see how concepts can be applied & where it impacts our lives.

Improving Ourselves

We normally go through our lives trying to be better than what we were the day before through iteration & learning in the environment around us (Fulfilling Demand). Letting go of what we think pulls us back & embracing what takes us forward. This is important. If we don't aim to improve ourselves, we get stuck in a rut & results in degradation & rotting of our capabilities, which is something we don't want. We have to constantly reinvent ourselves.

But there is a bigger world out there with oceans of knowledge floating around if we are willing to look. This knowledge can truly change us for the better. For me, I am an experienced finance professional who generated insights from numbers every day, month, quarter or year.

But after leaving that part of finance & then getting into business, I saw things differently in what drives numbers & how that can be influenced by various decisions & external factors. Seeing that linkage between external factors, decisions & it's impact on numbers was fascinating. It's constant learning. It is more challenging to drive those numbers upwards. This is where finance professionals can contribute or add value using their experience of analyzing numbers.

This can only be done by leaving our comfort zone & doing, thinking different from what we are used to (Shaping Demand). This is where innovation comes in to identify what new value can be added through our experience & from this improved experience, how can we improve further & add more value.

This is the flywheel that we need to get into.