Strategy Byte - Week 43 Industry Analysis

Table of Contents

- Introduction

- Industry

- Sector

- Industry Analysis

- Operator

- Investor

- Layers of Industry Analysis

- Summary

Introduction

From this week, we begin the next stage of our journey to understand strategy & use these insights to build a better business or do our jobs better.

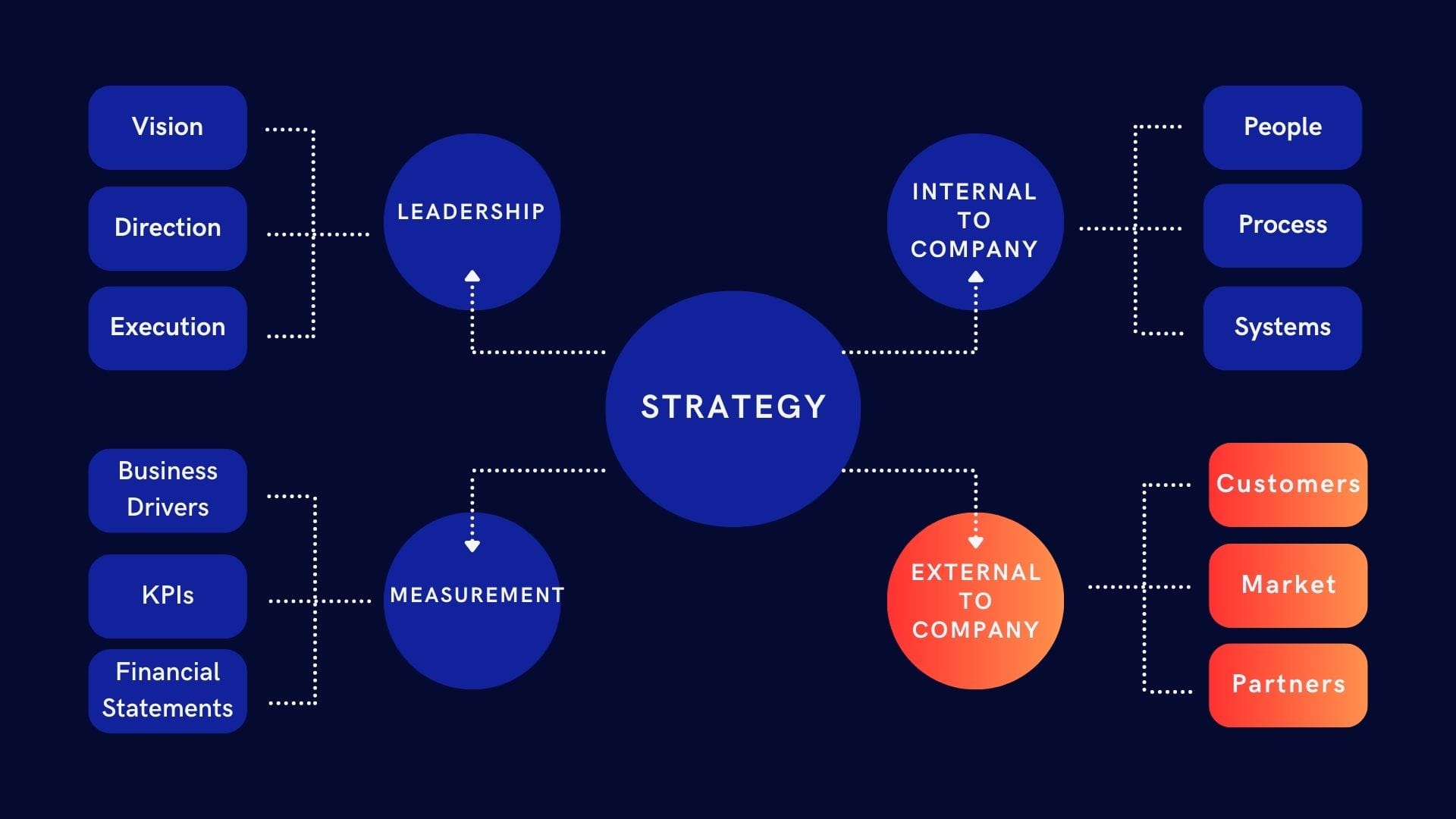

As I mentioned during week 7, we structured our discussion on strategy around the below key pillars :

- Leadership

- Internal to Company

- External to Company &

- Measurement

We started with variables "External to company" (highlighted in orange)

The variables underlying "External to Company" are

- Market

- Customers &

- Partners

We started with "Market" & the outermost layer - Macroeconomics.

Macro economics affects the whole industry or sector in a country or across countries. A company within any industry or sector should have risk management and mitigation measures in place like scenario planning, stress testing & contingency planning to navigate the complexities around macro economic policies. Why?

Because macro economic trends significantly impact market dynamics, customer behavior, investor sentiments which in turn are important variables around strategic decisions. Micro decisions on managing macro economic conditions is also strategy.

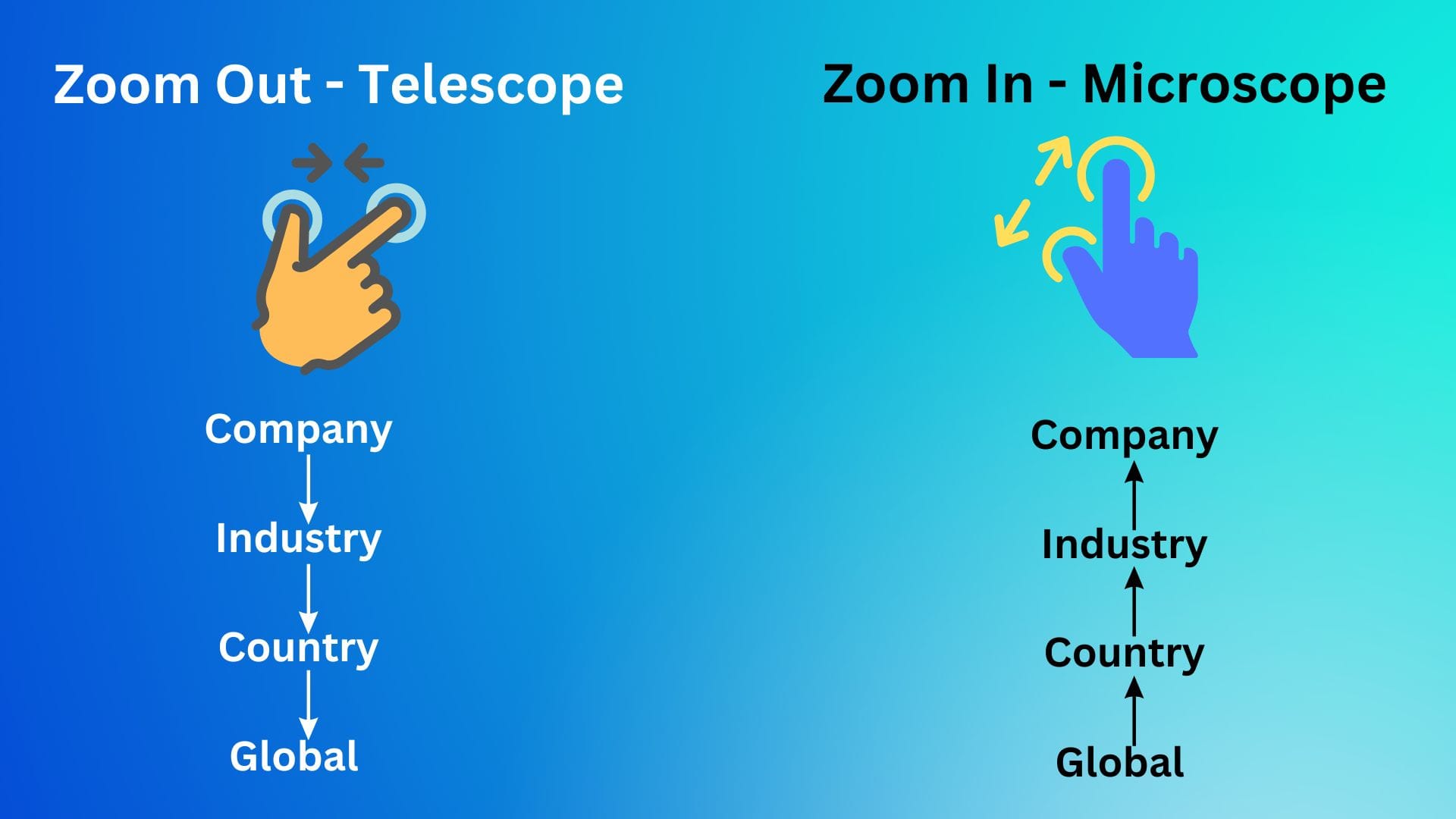

From this week, we zoom in one level below from macro economics (Global -> Country) to Industry analysis. (Refer "Zoom in - Microscope" visual below)

Before we move forward, let us first understand what is an industry.

Industry

Industry refers to a specific group of companies that operate in a similar business sphere & have similar business activities. (Source : here)

So, an industry basically means a cluster of companies doing similar business activities which means they produce similar or comparable goods or services to customers. Examples of industries include Banking, Advertising, Entertainment, Healthcare, Retail, Telecom, Technology etc.

Companies within a particular industry often respond in similar ways to macro economic trends. For e.g., The banking industry responds to interest rate changes by revising their base rates which subsequently impact their lending & deposit rates. Interest rate changes impact other industries in that it impacts their borrowings or investments which causes them to respond to mitigate any negative impact.

Sector

Similar industries are grouped upwards to form a sector.

Sector refers to a part of the economy into which various industries consisting of a greater number of companies can be fit, & is larger in comparison. (Source : here)

For e.g., transportation sector includes automobile, airline, trucking industries etc.

Now that we know what an industry or sector is, let us understand what does analyzing an industry mean.

Industry Analysis

Industry analysis is a market assessment tool used by businesses & analysts to understand the competitive dynamics of an industry. It helps them get a sense of what is happening in an industry, e.g, demand - supply, degree of competition, future prospects etc. (Source : here)

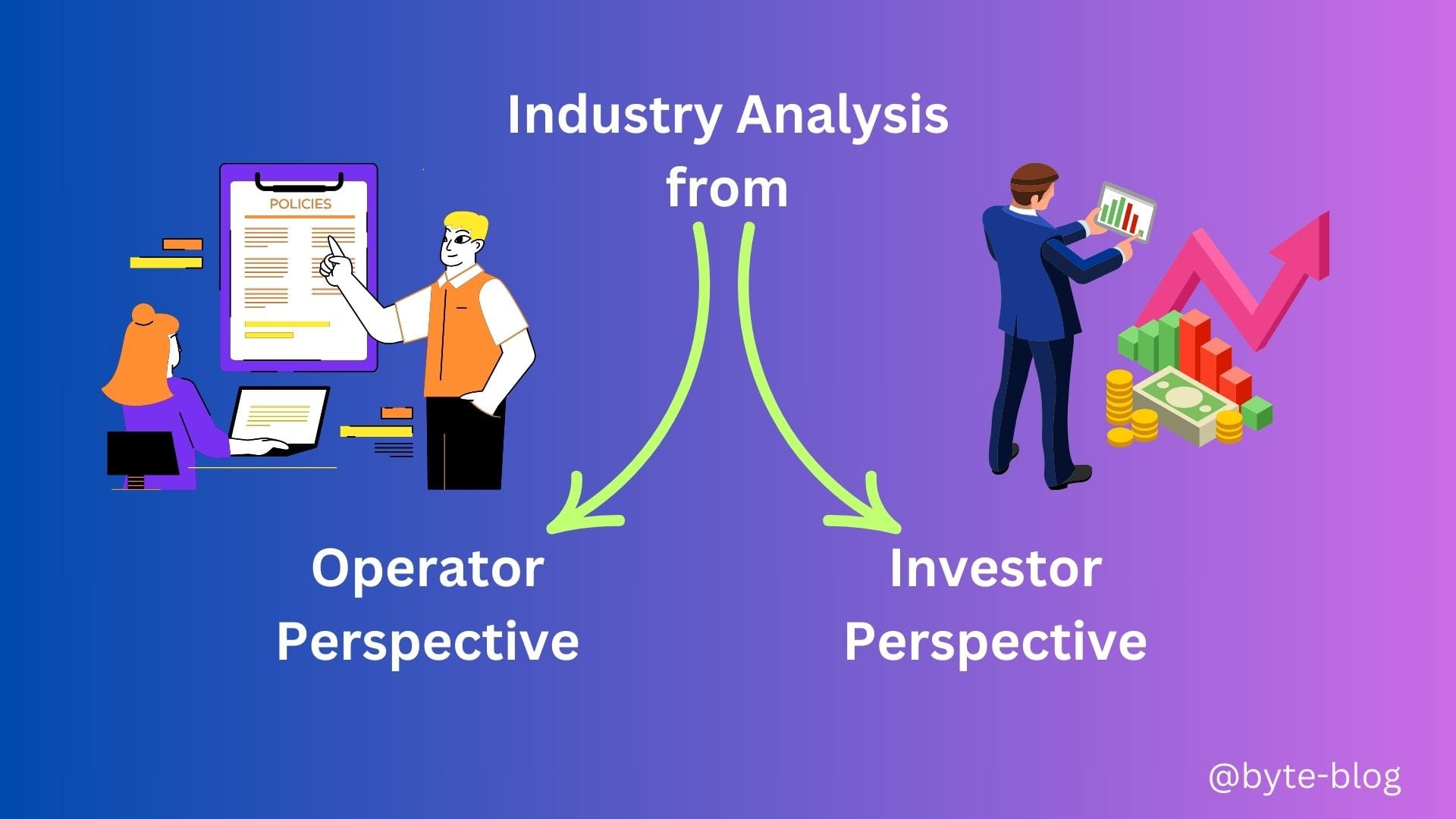

There are multiple factors involved in analyzing an industry. It always starts with WHY? Why do we analyze an industry. I believe we can classify the WHY under two perspectives :

- As an Operator

- As an Investor

What does this mean? Let us first understand what an operator or investor means?

Operator

An operator is a business professional who oversees the general operations of a company on behalf of the business owner. They help the company interview and hire high-quality employees, develop processes and procedures for staff to follow, set strategic business goals and ensure the business operates smoothly.

Operators often analyze the effects of the business decisions they make. Then they make adjustments to the operating model as needed. These professionals often consult with business owners to review the performance of the company and make plans for improvement. (Source : here)

An operator is someone who runs the company in line with it's objectives & strategy. It can be a business owner or CEO, but not necessary to be an operator. For some companies, these responsibilities may lie with the COO (Chief Operating Officer). But it refers to someone who ensures smooth operations of the business & identify improvements in line with opportunities.

As an operator, understanding where the company stands in comparison with it's peers is very important. Some of the questions they have to tackle are :

- Is the company improving it's stand in the market?

- How are customers perceiving their products or services compared to their competitors'?

- What is the financial position of the company vis-a-vis their peers ?

- Are they managing their operations more efficiently compared to their competitors?

Hence, as an operator, being better than competition is what helps them to be in the market and run the operations in a VUCA (Volatile, Uncertain, Complex & Ambiguous) environment.

Investor

Investors are people or entities that risk their money in various financial assets or ventures with the expectation of earning a return, which they may or may not realize. (Source : here)

From the perspective of companies, investors provide them with capital to invest in their operations and depending on how much the company earns, these are either returned to investors through dividends or share buybacks or reinvested back into the company to maximize earnings to investors.

As an investor, understanding whether it is worth it to invest in a company is important. Some of the key questions they have to tackle are :

- Is the company performing at par, below or better than competitors ?

- What is the earning potential of the company & the industry?

- Based on the above, should I invest or not?

- If yes, how much money can I commit for the returns promised?

Now that we understand what an industry is and why industry analysis is a foundation for strategic direction, how do we actually do Industry Analysis?

Let us take this discussion further in two layers. I refer to these as layers because the concepts are inseparable but cannot mix. Its like oil & water which can be together but never mix. The concepts will be discussed separately but actually are interwoven in reality.

Layers of Industry Analysis

We can classify Industry Analysis under two layers :

- Business or Non-Financial Layer

- Financial Layer

Layer 1 - Business / Non-Financial Layer

This layer involves understanding at a minimum

- The industry structure which means how the industry is structured from beginning of the value chain to the end

- Who are the players in the value chain

- Who are the competitors? What are their likely reactions to new developments in the market?

- What are the regulations governing the industry?

- Who are the customer segments & what value add are the products or services providing to those customers?

- And many more

Layer 2 - Financial Layer

This layer involves understanding

- The unit economics of the industry - which means the cost & revenue patterns in that industry

- The margins earned by the players in the value chain & the potential for sustaining or improving these margins

- Where can value be extracted from in the value chain?

As I mentioned before, the above two layers are inseparable but for our discussion, we will tackle them separately in the next couple of weeks to understand the underlying dynamics of each.

We will use multiple tools & concepts available to develop mental frames around our discussion.

Summary

Is Industry analysis same as Competitive Analysis - Yes and No.

Yes - because the strategy of every company is to earn more than their cost of capital & better than competitors. So everyone has to perform better than the other which means we have to check our company performance against our competitors. Who gives more value to customers? Or gives better customer experience and who does it more efficiently.

No - because we can analyze an industry in terms of it's structure & unit economics without considering the competitive aspect to see whether the industry as a whole is able to deliver value to customers efficiently.

Why do industry analysis?

Industry analysis shows whether the companies within than industry are efficient in what they do as a whole & also compared to each other. That’s the financial part.

Efficiency can also be non financial in that how good are their end products or services compared to each other? Which company products have good market potential or not? Do customers love their products?

The final aspect of why industry analysis is necessary is to see whether the industry itself is subject to disruption due to new technology or process which will change the way the industry currently operates. The very survival of the industry as it exists is at stake.

Let's dive in. The next couple of weeks is going to be exciting !!!!