Strategy Byte - Week 20 : Forex Drivers

Table of Contents

- Recap

- Interest Rates

- Relative Inflation Rates

Recap

During Week 19, we explored how fluctuations in foreign exchange (forex) rates can impact a company's balance sheet &/or income statement. The impact can be on account of:

- Single or multiple transactions - where currency fluctuations can result in a company paying more or less in local currency resulting in loss or gain on those transactions &/or

- Investment decisions - where the value of foreign investment changes in local currency due to exchange rate fluctuation

We also highlighted it's linkage to strategy where a company's strategy involves outsourcing operations or investing overseas or opening new production facilities overseas, this is a very important external environment variable to consider.

We ended with the below major drivers of foreign exchange :

- Interest Rates

- Relative Inflation Rates

- Current Account Balance in BoP (Balance of Payments)

- Economic Growth Rates

- Competitiveness

Let us explore at a high level how each of the above factors impact foreign exchange rates

Interest Rates

We all know what interest rate is - it is the cost of borrowing or return earned on saving money in a bank or from a financial product which pays a % return.

We will explore it in detail later in the next couple of weeks. But for now, imagine you have some extra cash & there are two banks where you can put your money to earn some return - Bank A & Bank B.

Bank A offers 5% interest while Bank B offers 4%. Which bank would you put your money in?

It's obvious - Bank A which offers 5% interest. Who in their right frame of mind would put money in a bank which offers lesser interest rate, right?

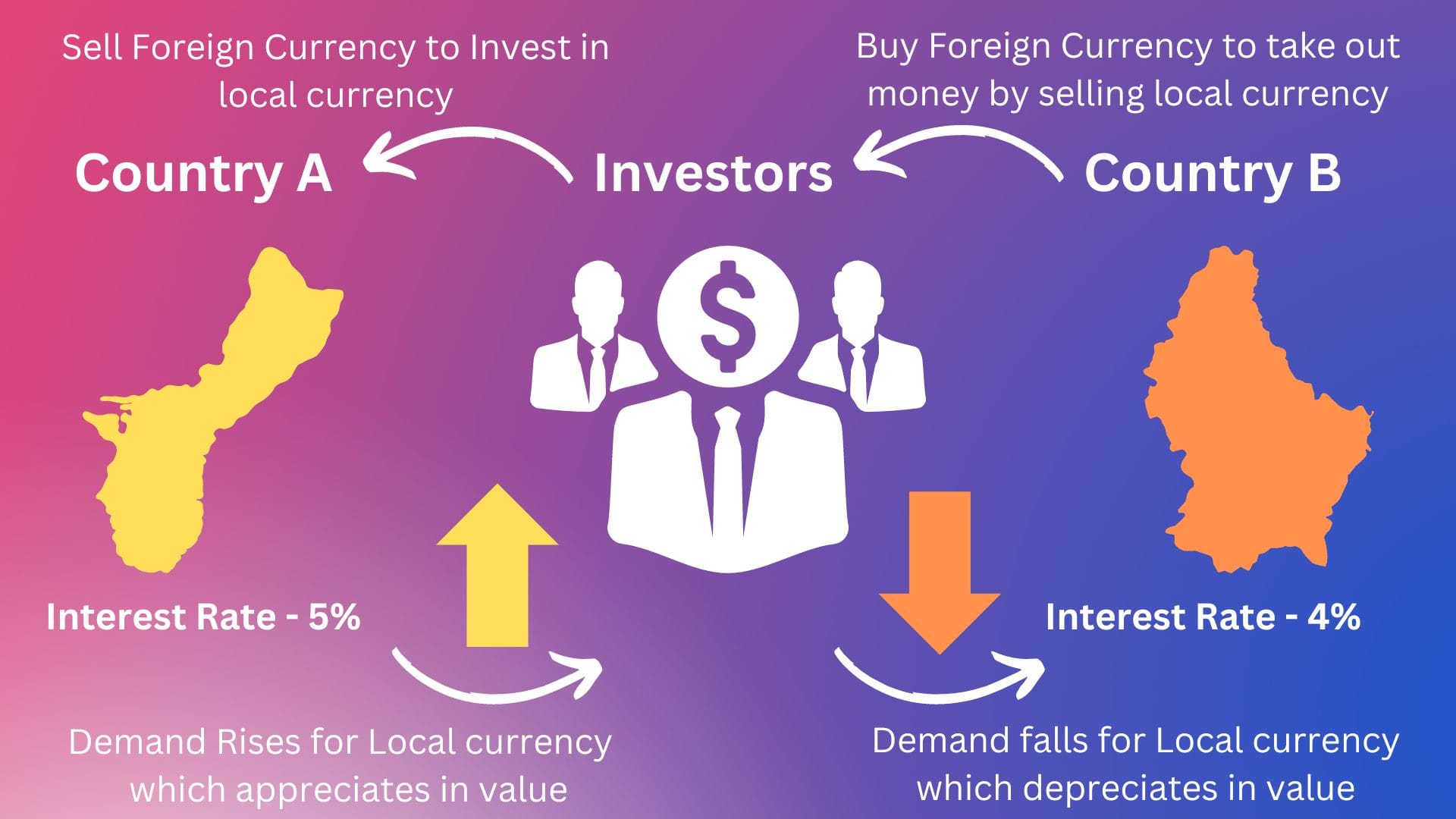

Similarly, if there are two countries A & B with interest rates of 5% & 4% respectively, where would the money flow to? It would obviously flow to country A with 5% interest rate (ignoring inflation). What would be the impact of this money flow into country A?

High amounts of foreign currency would flow into country A due to higher rates which means foreigners with cash will invest in Country A by exchanging their foreign currency with local currency.

This increases the demand for local currency of Country A which in turn increase it's value or in other words the currency of Country A would appreciate due to high demand.

What about country B? Investors would pull out their money from Country B to invest in Country A and so demand for foreign currency rises as it needs to be taken out.

This causes the value of foreign currency to increase and the value of local currency to decrease or in other words, the currency of Country B would depreciate due to low demand.

The below visual makes it more clear:

But then the question is, who moves money between countries when interest rate is high and pulls it out when interest rates are low? We discussed in Week 17 that in BoP, there are two categories of transactions :

- Current Account Transactions &

- Capital Account Transactions

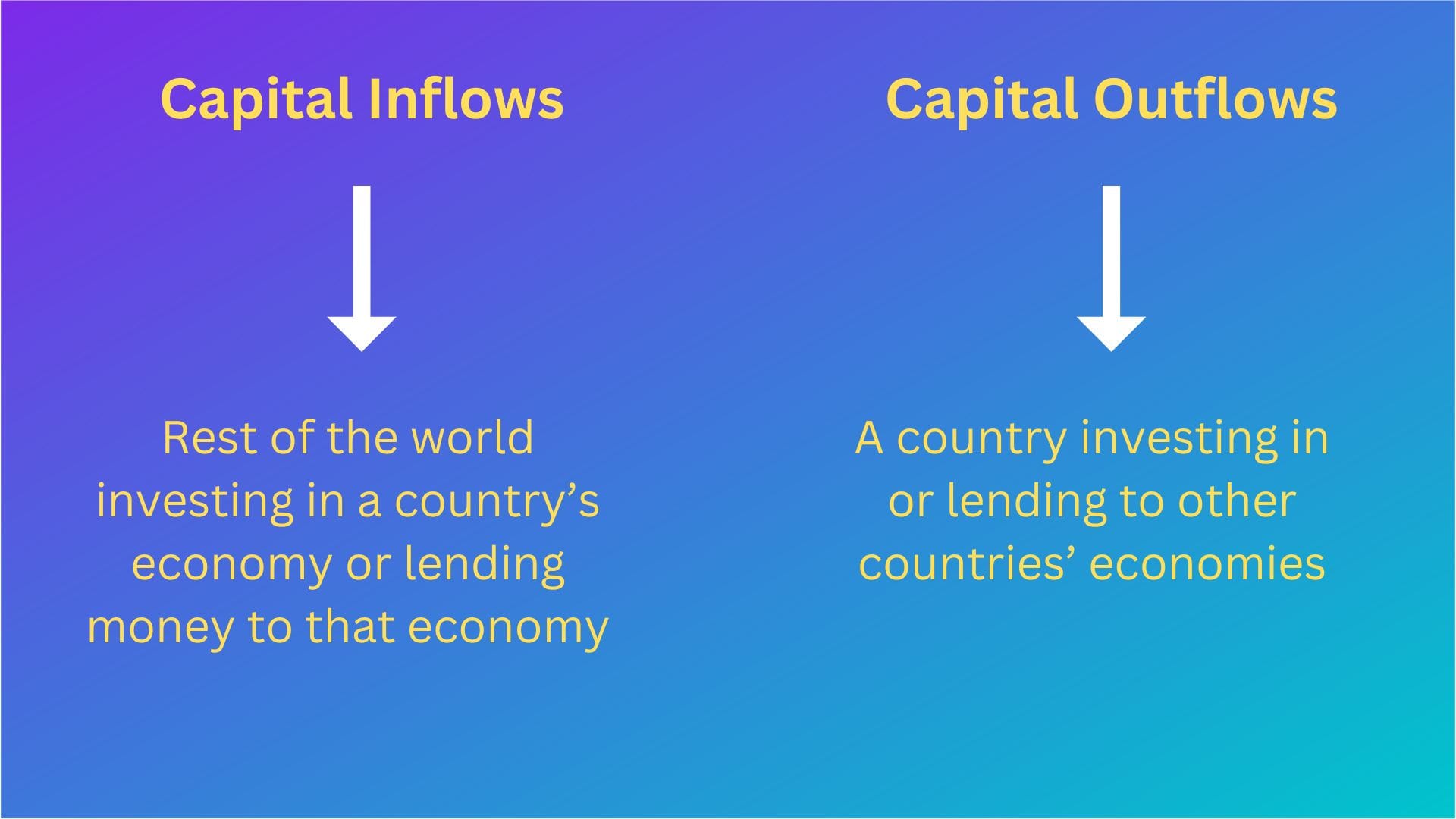

Capital account transactions in BoP (Balance of Payments) capture the net flows of capital between a country & the rest of the world. These are called Capital Flows.

Capital Flows are transactions involving financial assets between international entities. Financial Assets can be bank deposits, loans, equity securities, debt securities etc.

Capital outflows generally result from an uncertain economy in a country whereas large amount of capital inflows indicate a growing economy. (Source : here)

This is akin to investing in shares of companies which have future potential to generate profits or cash flows. These companies' share values increase because investors expect future profits from these companies.

To visualize it in simple terms :

Normally, a country which is competitive in terms of products or services has good export market which causes it's BoP to be positive. This should cause their currency to appreciate. However, if their domestic interest rates are low or other parts of their economy are not managed well, this can result in capital outflows which can cause it's currency to depreciate negatively impact their exchange rate as above.

One of the major reasons of the Asian Financial Crisis of 1997 is capital outflows as elaborated in the below extract from IMF (Source : here)

The Asian Financial Crisis of 1997 revealed the region's vulnerability to cross-border capital flows. Banks & Corporations had borrowed massively and cheaply in US dollars, often on very short terms.

A sudden outflow of foreign capital pushed the region's currencies into a downward spiral, leaving many borrowers insolvent. Government spent billions in vain attempts to support their currencies. Indonesia, South Korea, and Thailand turned to the IMF, which provided almost $120 billion in rescue funds on the condition that the recipients tighten monetary, fiscal, and financial regulatory policies—steps that proved unpopular in the region

Let us now move to another related measure - Inflation Rate

Relative Inflation Rates

Before we get into how inflation affects foreign exchange rates, let us define the term Inflation (We will discuss inflation in detail in the next couple of weeks).

When we see our grocery prices increasing, we know there is inflation. Right? That is exactly how we know that there is inflation in an economy.

There is inflation when the prices of many of the things we buy rise at the same time and then continue to rise. Explained another way, inflation is ongoing increases in the general price level for goods and services in an economy over time. (Source : here)

Now, how does inflation impact exchange rates?

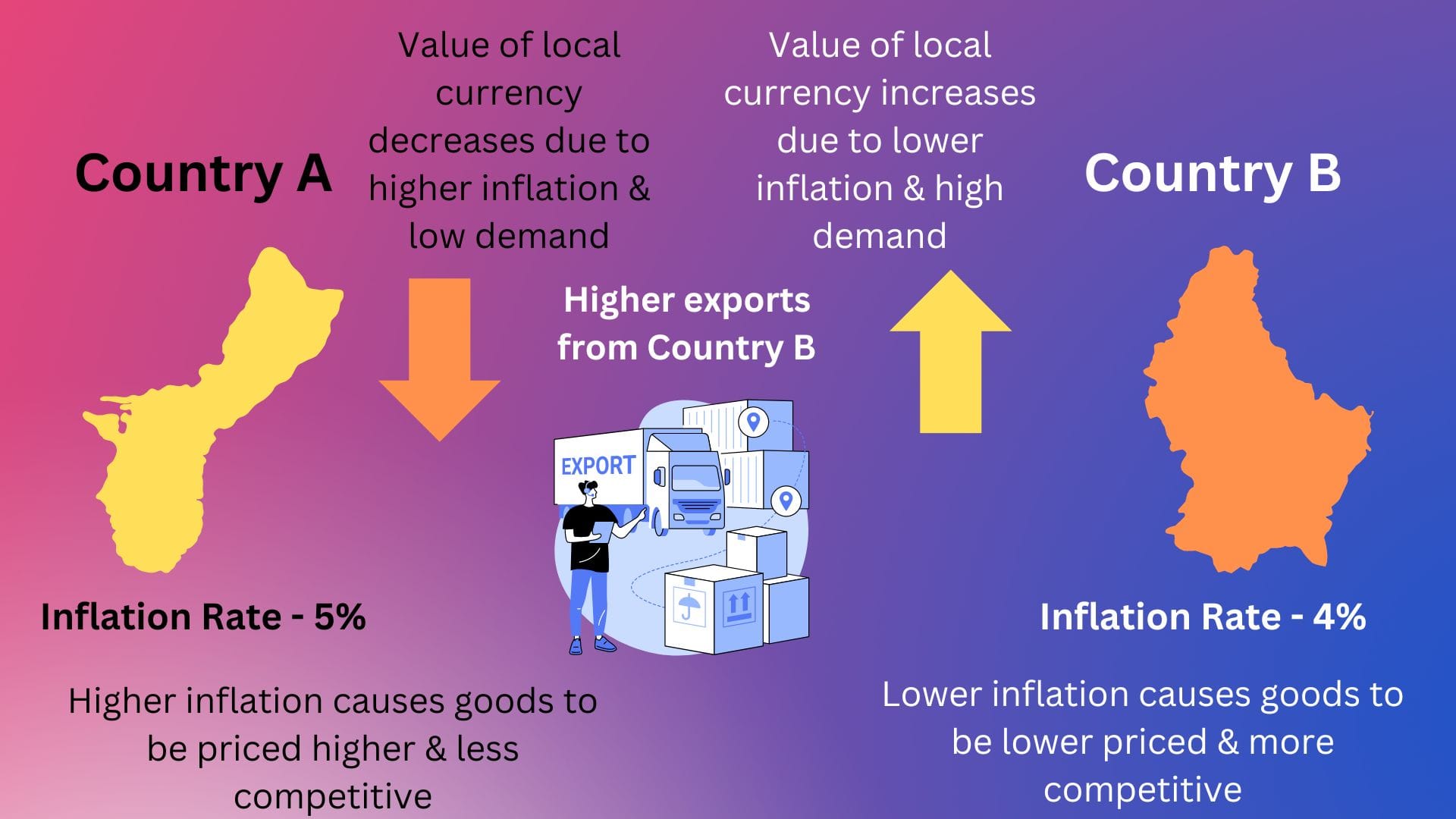

A country with higher inflation incurs higher cost to product goods or services & hence has higher priced goods or services for export which makes it less competitive compared to countries with lower inflation which can produce the same goods or provide the same services at lesser price. Moreover, inflation weakens the currency of that country decreasing it's value.

In that scenario, foreigners finds goods from lower inflation countries more competitive compared to higher inflation countries resulting in higher demand for currencies from lower inflation countries.

This causes the value of lower inflation currencies to increase or appreciate & that of higher inflation currencies to decrease or depreciate.

The below visualization makes it more clear:

But there is one important question to ponder on - Shouldn't interest rates be higher for countries with higher inflation? Will foreign countries invest or trade in such a scenario?

We will deep dive on interest rates & inflation in the coming weeks. Next week, we explore other factors affecting exchange rate.