Strategy Byte - Week 21 : Forex Drivers..Cont'd

Recap

In Week 20, we started our journey to explore the key economic drivers of foreign exchange rates. We started with

- Interest Rates &

- Relative Inflation Rates

We defined interest rates as the cost of borrowing or return earned on saving money in a bank or from a financial product which pays a % return.

A country with higher interest rates (ignoring inflation) would experience higher inflow of foreign currency compared to that with lower interest rates mainly due to higher return. This increases the demand for currency with higher rate compared to that with lower rate causing it to appreciate.

The value of currency with lesser demand due to lower interest rate will decrease causing it to depreciate.

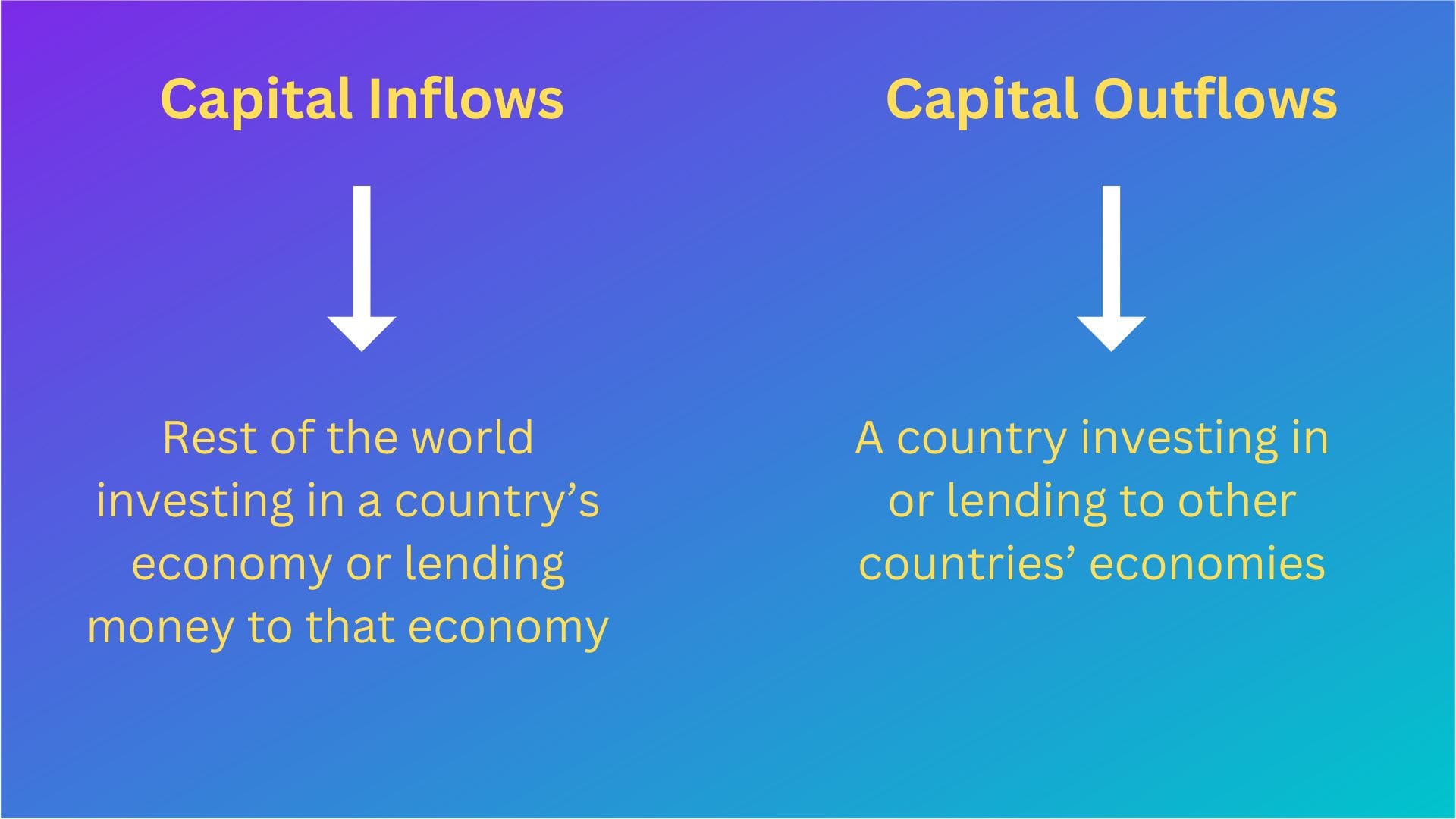

We then defined capital flows as transactions involving financial assets between international entities. Financial assets can be Bank Deposits, Loans, Equity securities, debt securities etc.

The below visual summarized the concept :

We then explored relative inflation rates as :

There is inflation when the prices of many of the things we buy rise at the same time and then continue to rise. Explained another way, inflation is ongoing increases in the general price level for goods and services in an economy over time.

Goods produced in a country with higher inflation cost more to produce & hence is less competitive compared to goods produced in countries with lower inflation which are produced at lower cost.

This increases the demand of goods & services from lower inflation countries which in turn increases the demand for it's currency compared to that of higher inflation countries.

Let us now move on to the next key driver - Current / Capital Account in BoP

Current / Capital Account in BoP

We briefly mentioned last week that if a country's products or services have a good export market, it's trade partners will buy more from it resulting in higher inflow of foreign exchange into it's current account resulting in positive BoP position.

Also, if there are any transactions resulting in investment from one country to another, the resulting movement in capital account causes BoP position to change which can be positive (higher inflows) or negative (higher outflows).

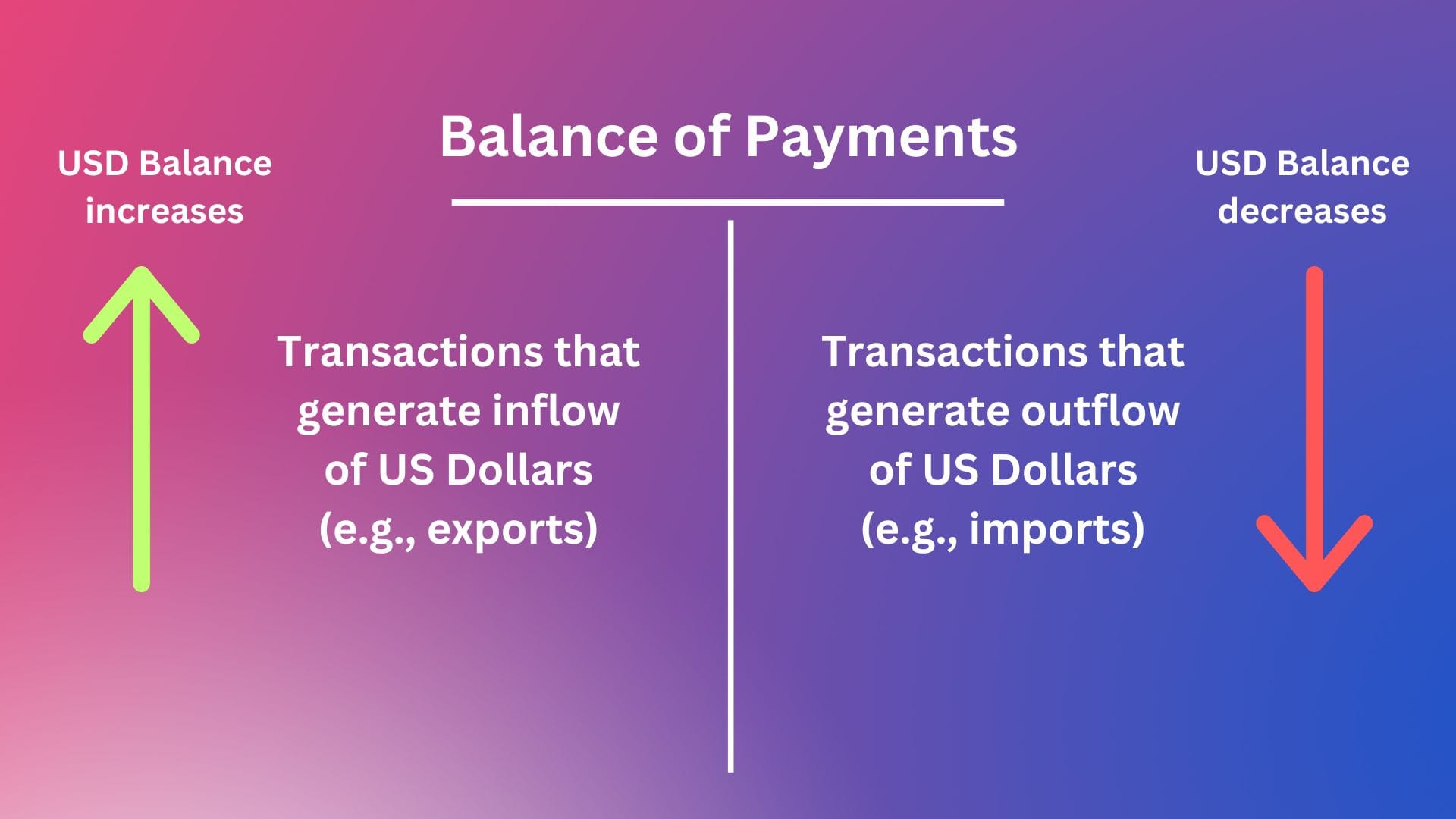

We explained in Week 16 through the below visual on the impact of USD flows (inflows & outflows) on Balance of Payments.

Higher USD inflows as part of current account or capital account transactions results in BoP surplus & higher outflows results in BoP deficit. Changes in any component of BoP affects the supply & demand for foreign currency.

The BoP statement highlights the demand & supply of foreign currency & gives us insights into trends which determine exchange rate movements & also a peek into the future. For example, if exports are trending higher vis-a-vis imports & expected to continue into the near future, it is fair to assume that the current account balances are expected to improve resulting in higher demand for local currency hence resulting it in it's appreciation.

On the other side, if exports are trending lower than imports which causes outflow of foreign currency than inflows & is expected to continue into the near future, it is fair to assume further deterioration of current account balances resulting in lower demand for local currency resulting in it's depreciation.

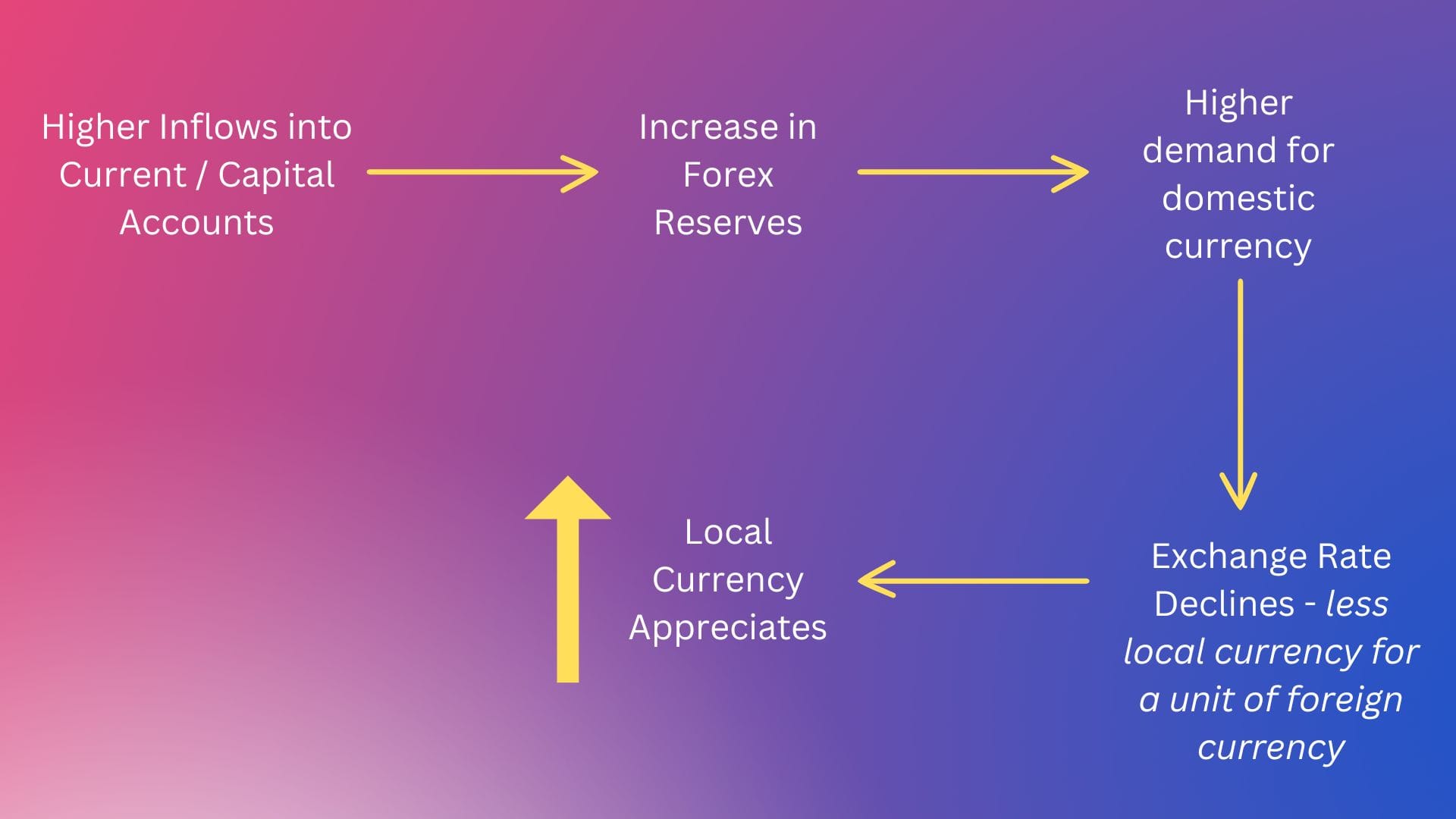

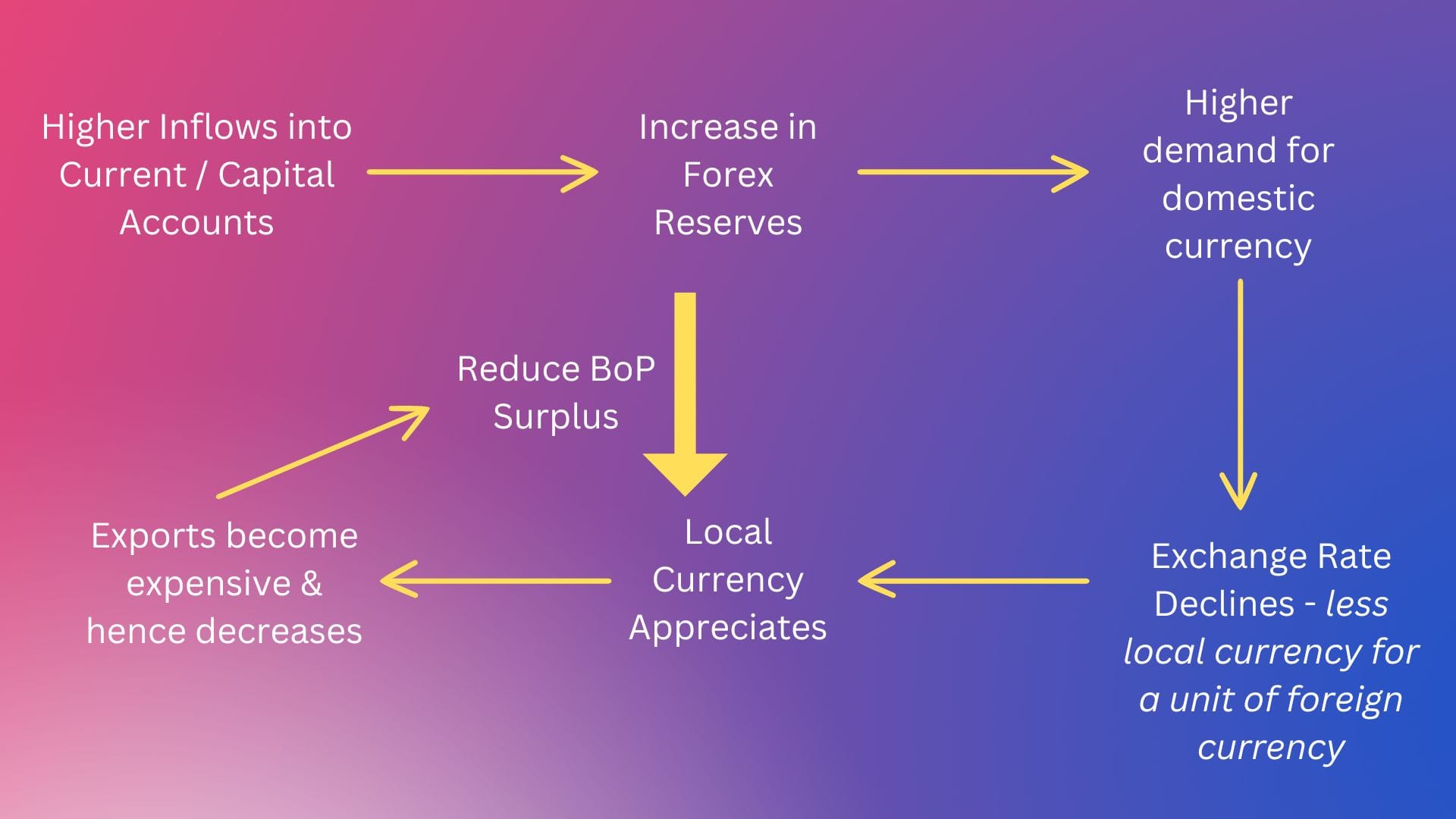

The below visuals makes it clear:

Now, a question to ask is will the trend of higher exports / lower imports or higher imports / lower exports continue forever? What will be the impact?

If there is consistent inflow of foreign currency,

- It results in constant BoP Surplus

- Which in turn results in higher demand for local currency

- This results in appreciation of local currency

- Due to this appreciation, exports become more expensive as foreigners have to pay higher amounts in foreign currency.

- This causes exports to reduce

- Lower exports causes BoP surplus to reduce

- This also causes imports to become more cheaper due to appreciation of local currency.

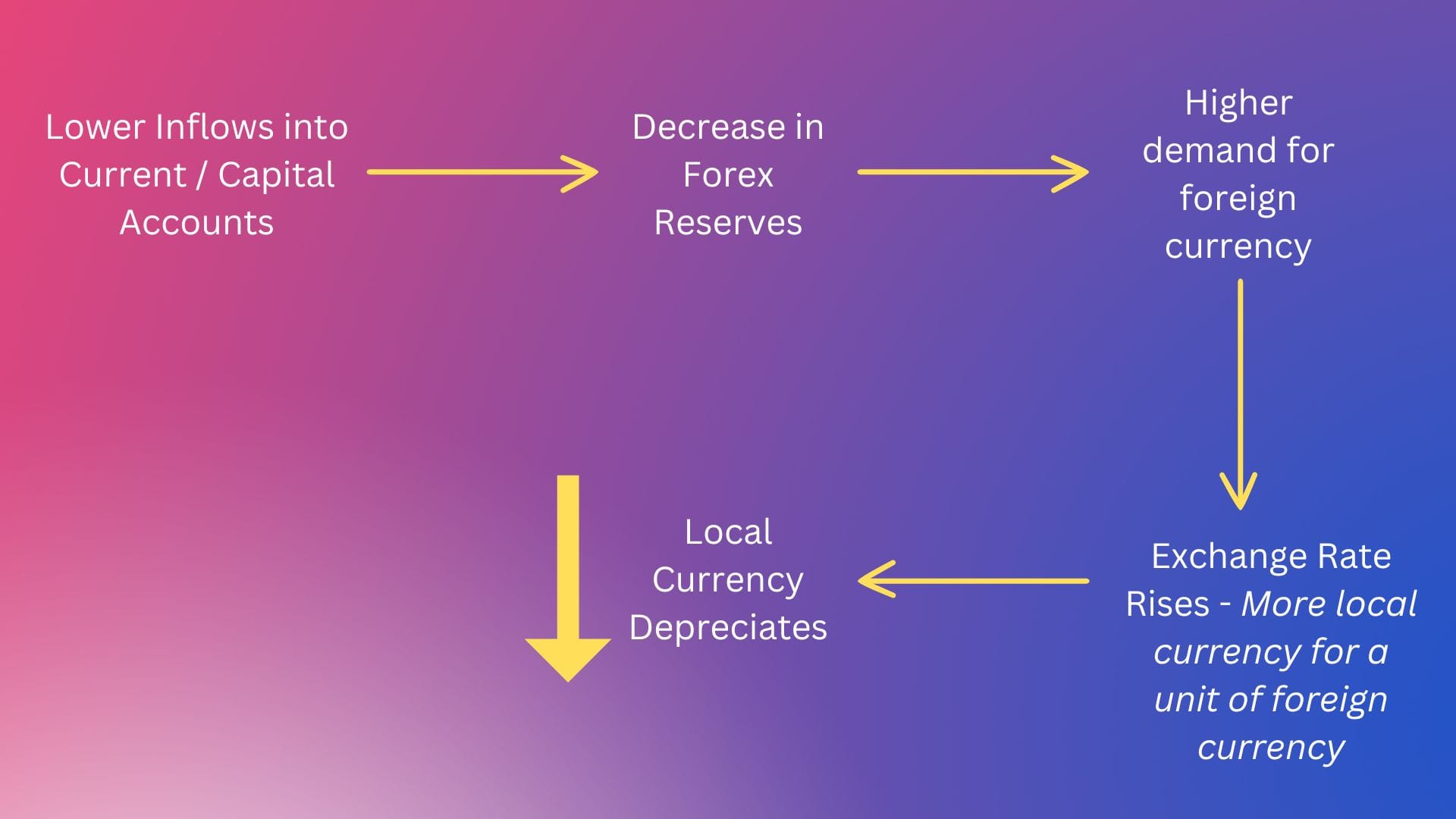

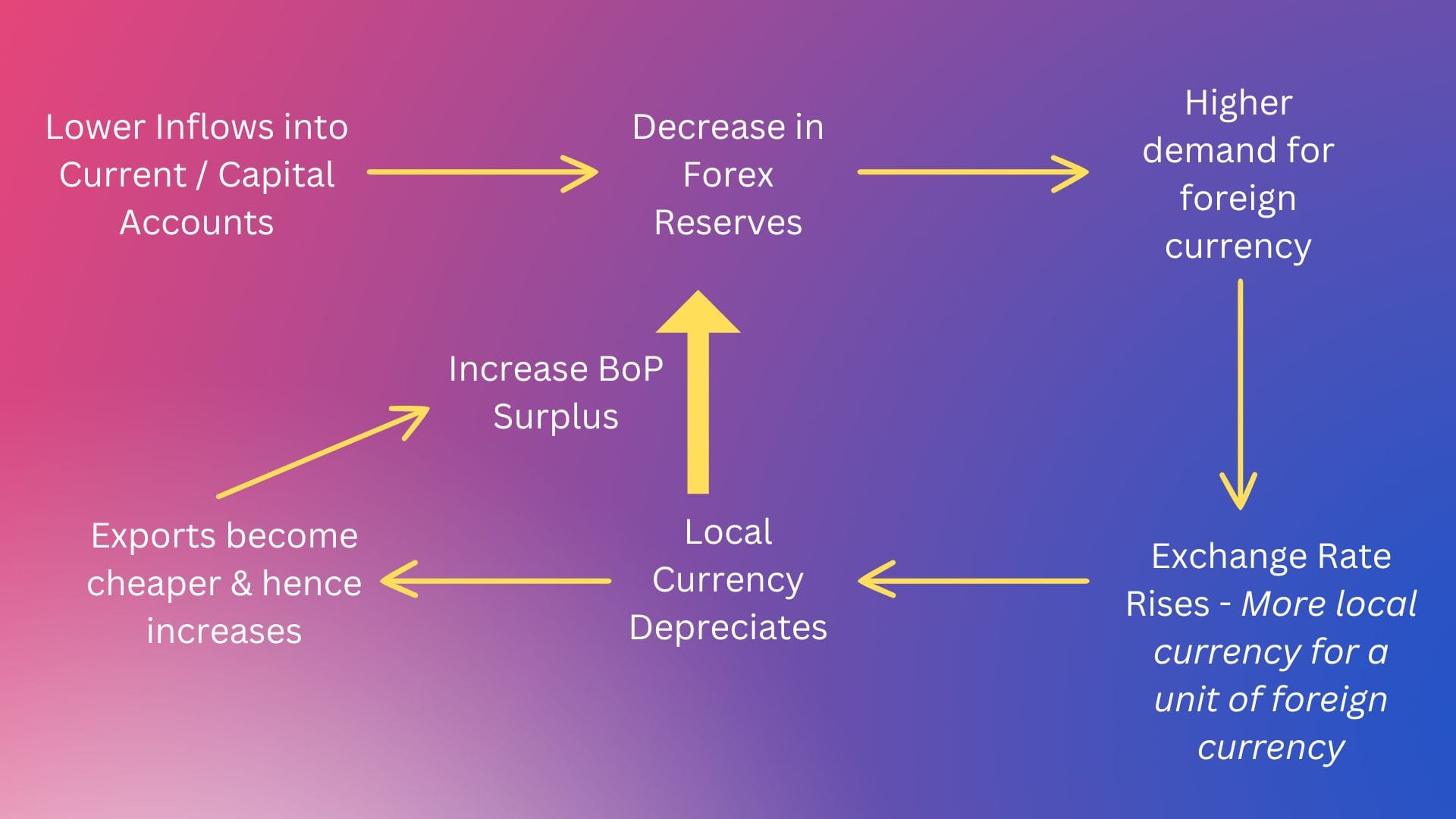

What about the other side where there is consistent outflow of foreign currency?

- It results in constant BoP Deficit

- Which in turn results in lower demand for local currency

- This results in depreciation of local currency

- Due to this depreciation, exports become more cheaper as foreigners have to pay lower amounts in foreign currency

- This causes exports to increase

- Higher exports causes BoP surplus to increase

- This also causes imports to become more expensive due to depreciation of local currency

Continuing the above visuals :

The movement from surplus to deficit & vice-versa depends on the trade structure of a country which means how much a country imports vis-a-vis it's exports.

In the long run, the movement in BoP & exchange rates ultimately leads to an adjustment in the BoP balance towards an equilibrium state through this increase or decrease in it's surplus depending on the exchange rate movement..

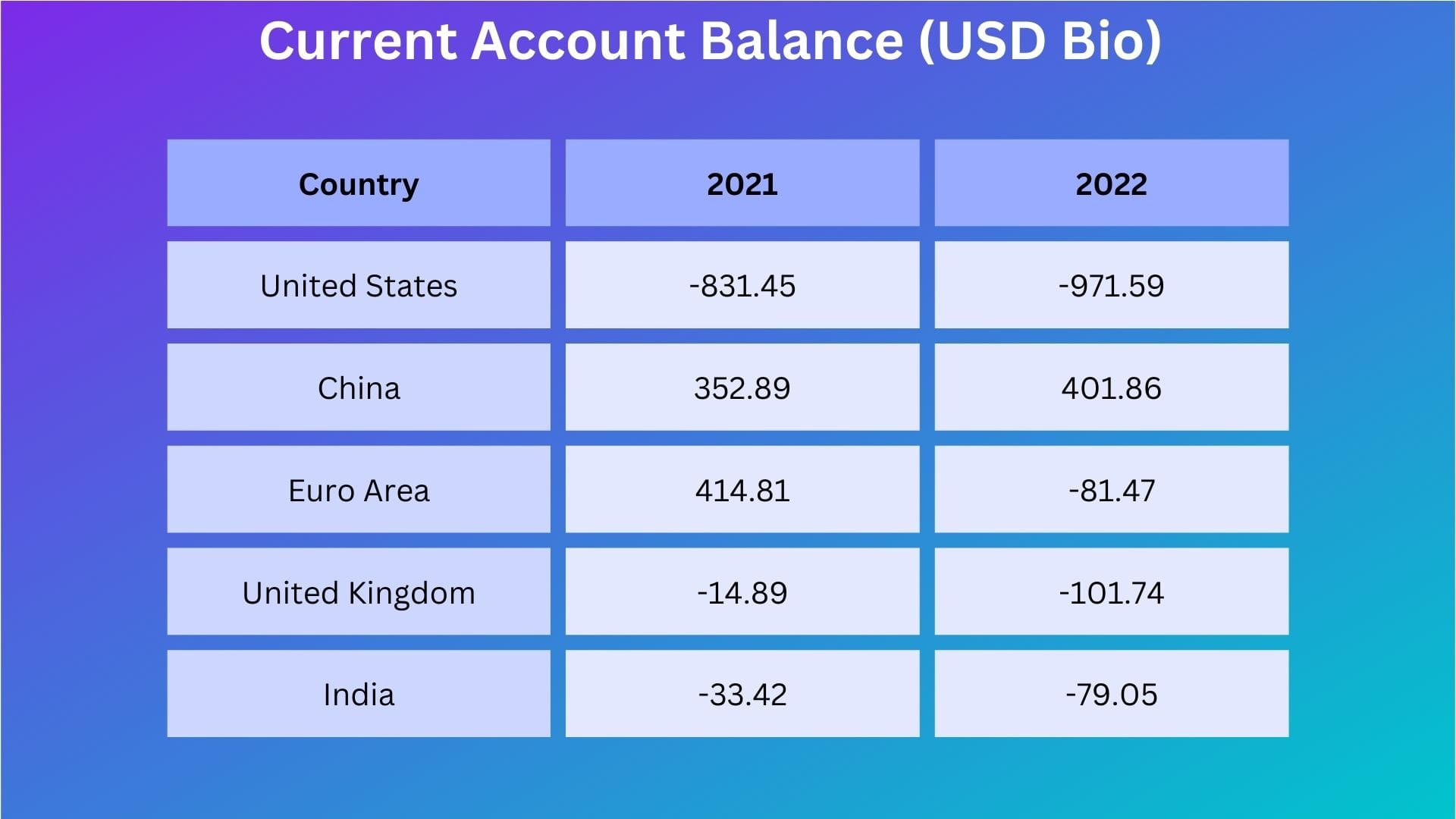

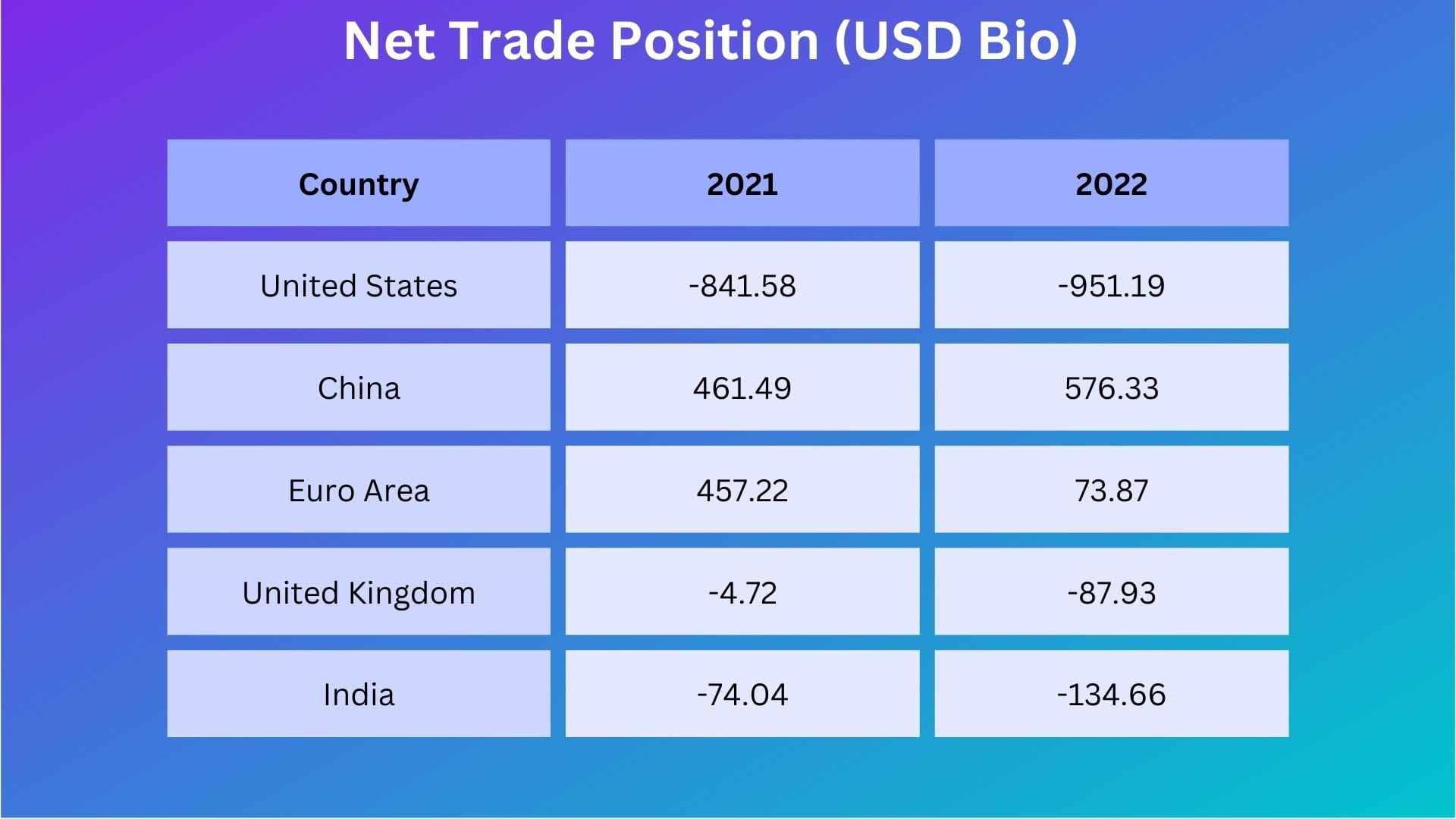

Let us look at some data from major economies. (Source : here)

We can see from the above that the net trade position (exports - imports) mostly corresponds to either positive or negative current account in BoP. If there is any negative correlation, it could be because of other flows forming part of BoP not related to exports or imports like net income from abroad or other transfers etc.

BoP is a critical statement of accounts which helps assess :

- How well a country is doing

- How competitive it is &

- How attractive it is for investment purpose

With the above in mind, let us understand the last two major variables to impact exchange rates.

Economic Growth Rate & Competitiveness

A country with high productivity & better managed economy (more competitive) will produce goods at a competitive price. Such goods will be in higher demand by foreign buyers resulting in appreciation of it's currency & higher foreign currency inflows.

Also, higher growth rates generates higher interest rates which increases capital inflows resulting in currency appreciation.

There are multiple variables & situations in any economy which can impact exchange rates. The impact of each variable is different depending on the economic situation a country is in.

To get a full picture on exchange rate impact, we have to discuss the below too:

- Real Exchange Rate & Nominal Exchange Rate

- Purchasing Power Parity &

- Interest Rate Parity

But for that, we have to first understand the other two important external environment variables - Interest Rate & Inflation which we will discuss in the next couple of weeks.

Let us now move on to the next critical external environment variable - Interest Rate.