Strategy Byte Week 23 - Interest Rates Origin

Table of Contents

- Recap

- Starting Point

- Monetary Policy & OMO

- Central Bank Base Rate

- Natural Rate of Interest

- Impact of Fed Funds Rate

Recap

During Week 22, we introduced interest rates as

The cost of borrowing money which are normally expressed as a % of the amount borrowed. The rate at which money is borrowed is called borrowing rate.

We also defined it as :

Return earned on saving money in a bank or an instrument which gives a return on a percentage basis (%). This rate is the savings rate.

Thus, when a bank lends money to or borrows money from customers, the commodity being transacted here is MONEY. Interest rate is the price of money.

This price depends on demand - supply dynamics of money as is with any commodity & also the tenor. The longer we deposit money with the bank or if we take a longer term loan, the higher will be the interest rate. Why? we will explore this at a later stage.

Interest rate can be considered as an opportunity cost of holding money. If we kept money under the mattress, it is the money we would've earned had we invested it elsewhere.

We will explore this topic under two headings :

- Starting Point - What is the starting point of interest rates in any economy &

- Interest Rate Drivers - What drives them at any point in time or in other words, reasons for fluctuation

Starting Point

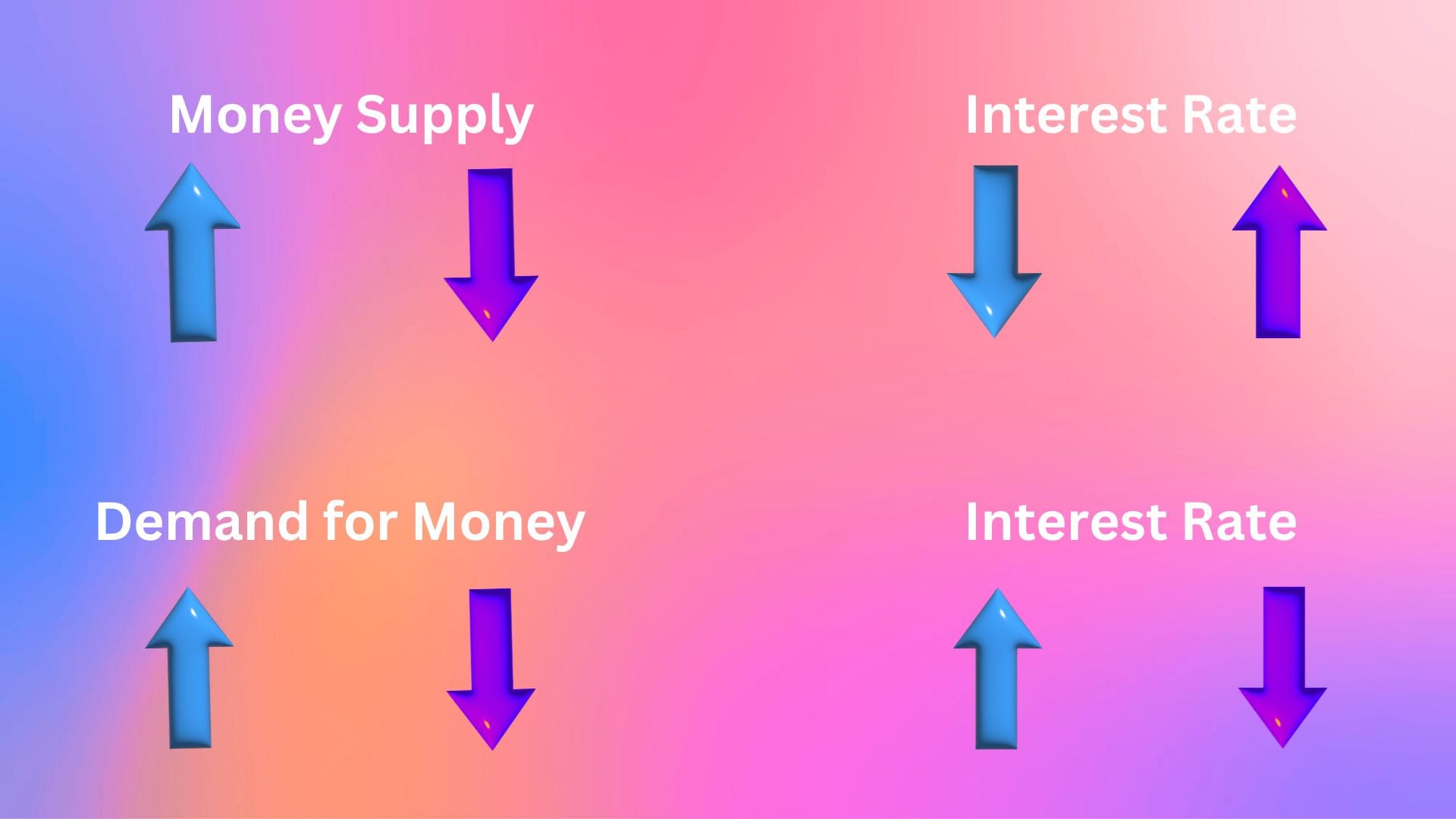

We said above that interest rate is the price of money & thus subject to the supply & demand of money just like the value of any commodity which is subject to supply & demand.

Supply Side Impact

- An increase in the supply of money lowers the interest rate

- A decrease in the supply of money raises the interest rate

Demand Side Impact

- An increase in the demand for money raises the interest rate

- A decrease in the demand for money lowers the interest rate

Visualizing the above

Let's consider supply side first. Who or what determines the supply of money in an economy? It is the Central Bank or Monetary Authority. This is done through a set of tools known as "Monetary Policy".

Monetary Policy & Open Market Operations (OMO)

What is Monetary Policy? As per IMF,

- Central Banks use monetary policy to manage economic fluctuations & achieve price stability, which means that inflation is low & stable. Central Banks in many advanced economies set explicit inflation target.

- Central Banks conduct monetary policy by adjusting the supply of money, usually through buying & selling securities in the open market.

- Open Market 0perations (OMO) affect short-term interest rates, which in turn influence longer term rates & economic activity.

- When Central Bank lowers interest rates, monetary policy is easing & when they raise interest rates, monetary policy is tightening.

Open Market Operations (OMO) - buying & selling of government securities by Central Banks in the open market influence the supply of money. How? In simple terms,

- An Open Market sale decreases the supply of money & raises interest rate. How? Central bank sells security & the banks and other parties pay for it to the Central bank which leaves less money with the banks for commercial lending & investment purpose. Thus, this pulls out liquidity from the system.

- An Open Market purchase increases the supply of money & lowers interest rate. How? Central Bank buys security & pays the money to the banks who have more liquidity to pursue commercial lending & investments. This injects more liquidity into the system.

Central Bank Base Rate

Let us now go to the demand side. To boost Aggregate Demand (AD) for money, the Central Bank or Monetary Authority can cut interest rates & vice versa. If you refer point 4 above, lower interest rates result in easing of monetary policy while higher interest rates result in tightening monetary policy.

But who sets the rates & what is the starting point for this rate which goes up & down based on the monetary policy applicable at that point in time?

This rate is set by the Central Bank or Monetary Authority of a country. How? By setting a base rate.

In general, the Central bank or Monetary Authority of a country sets the Base Interest Rate (also called benchmark rate), which serves as the Benchmark for other interest rates in the economy.

For e.g., In the US, The Federal Reserve sets the Federal Funds Rate, which is the key interest rate that influences other borrowing & savings rates throughout the economy. This rate is set by the Federal Open Market Committee (FOMC) & serves as a reference point for various types of loans, mortgages & savings accounts.

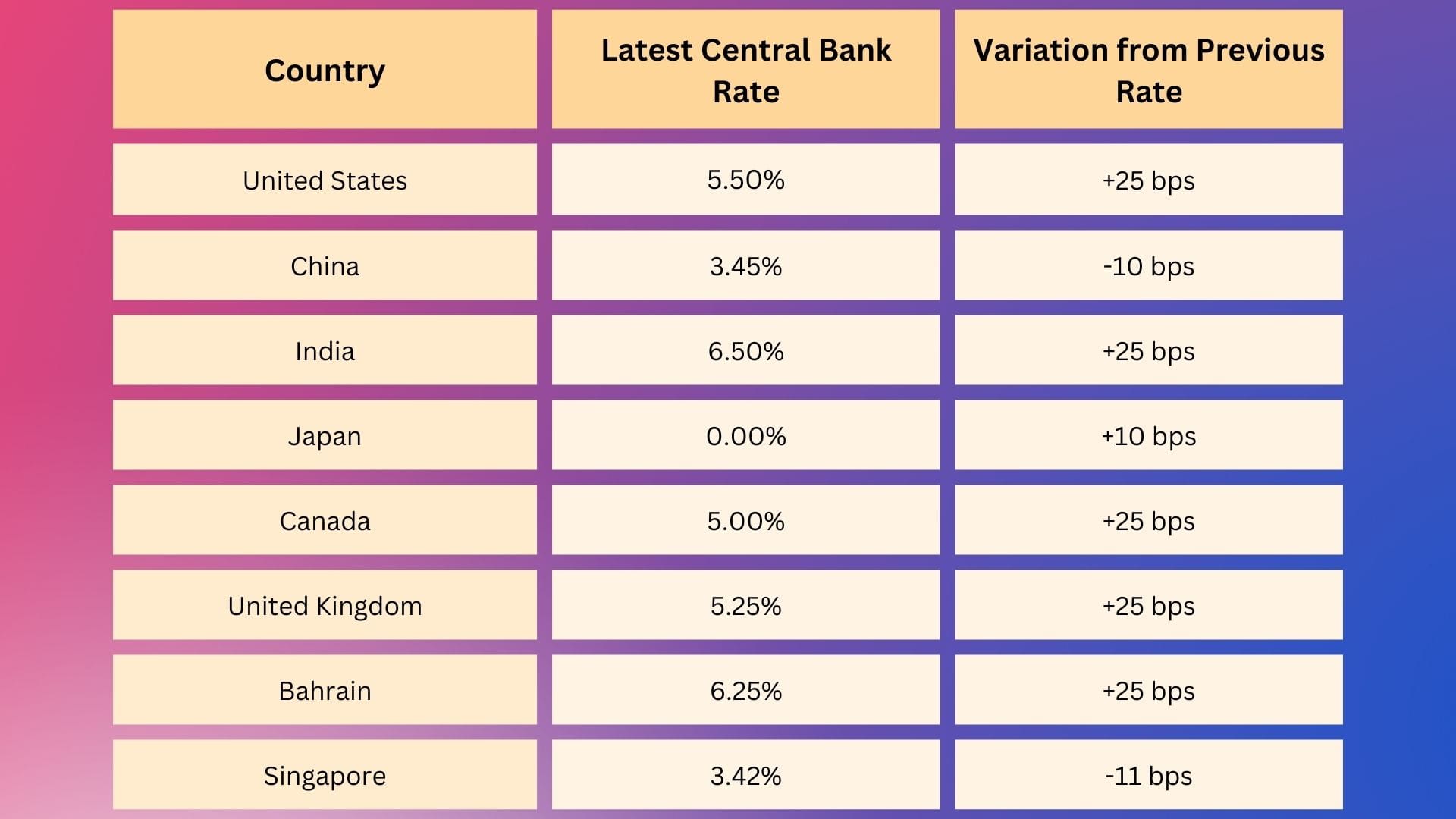

Let us look at some sample base rates of certain economies around the world: (Source : here)

To be clear, there are multiple factors that go into determining a base rate like level of economic activity, inflation expectations & monetary policy goals. But we will not get into those now as our focus is on a broad layman understanding of interest rate & it's impact. However, we will touch upon one concept called Natural Rate of Interest.

Natural Rate of Interest

The natural rate of interest, also called the long-run equilibrium interest rate or neutral real rate, is the rate that would keep the economy operating at full employment & stable inflation.

It is a function of the economy's underlying characteristics & is not "set" by the Federal Reserve. It is usually discussed in real terms that is after reducing inflation rate (we will get into this later). (Source : here)

This rate matters because it affects how the Fed steers interest rates as part of monetary policy.

Impact of Fed Funds Rate on overall Economy

Now that we understand at a high level the base rate fixed by the Central Bank or Monetary Authority of a country, we need to understand how this rate impacts the overall economy. Let us use the Fed funds rate as an example.

Normally Banks & Financial Institutions are supposed to maintain balances with the Central Bank or Monetary Authority to fulfill regulatory requirements to ensure they are financially sound & customer deposits are safe. These balances maintained by banks with Central Banks is called Reserves.

In the US, banks can borrow & lend reserves to each other depending on their liquidity needs & market conditions. The Fed funds rate is the interest rate that banks pay to borrow reserve balances overnight.

Now, if this is the rate banks get from the Fed, will they lend to others at a rate lower than this rate? No. This is the minimum rate that the banks must pay to borrow from other banks or earn return on their reserve balances.

Thus, any changes in Fed Funds rate is reflected in the interest rates that banks charge to other banks, Financial Institutions & customers on short term loans. Also, the interest rates on Treasury bills move in alignment with the movement in Fed funds rate.

Any changes to the Fed funds rate is also reflected in floating rate loans, including mortgage & commercial loans.

Changes in interest rates across the spectrum also impact asset prices like bonds, equity, real estate & other financial assets as these changes impact asset allocation decisions.

As we mentioned in week 20, higher interest rates result in higher capital inflows into that country resulting in appreciation of local currency. Thus interest rates changes also impact exchange rates.

Let us now explore

- What drives interest rates?

- What are various classifications of interest rates?

- Whether banks lend at the same rate as the Fed funds rate or Central Bank base rate?

- What is the linkage between interest rate & inflation rate?

- What is the linkage between interest rate & exchange rate?

Lot of rabbit holes to dive into: