Strategy Byte - Week 27 Inflation

Recap

During Week 26, we discussed interest rate drivers where we started with interest rate as cost of money & hence subject to supply & demand of money. More money means higher liquidity and lower interest rates. Less money means lower liquidity & hence higher interest rates.

Then we discussed the main driver of interest rates is a country's Central Bank through it's policies. There are various tools used by Central Banks to drive interest rates. Some of them are :

- Open Market Operations (OMO) - buying & selling Government securities

- Reserve Requirements - mandate minimum liquid asset holding requirements on commercial banks

- Discount Window

- Base Rate - Modify the base rate (e.g., Fed Funds rate) which impacts other interest rates

- Forward Guidance & Perception

Another macro economic variable which is an important driver of interest rates & a key factor in Central Bank policy making is Inflation. From this week, let us deep dive into inflation.

What is Inflation?

This macro economic variable is closely tied to our daily lives. How?

When we see our grocery prices or cost of services increasing & that trend continues, we know there is inflation & that is exactly how we know there is inflation.

There is inflation when the prices of many of the goods that we buy rise at the same time & then continue to rise. Explained another way, inflation is ongoing increases in the general price level for goods & services in an economy over time. (Source :here)

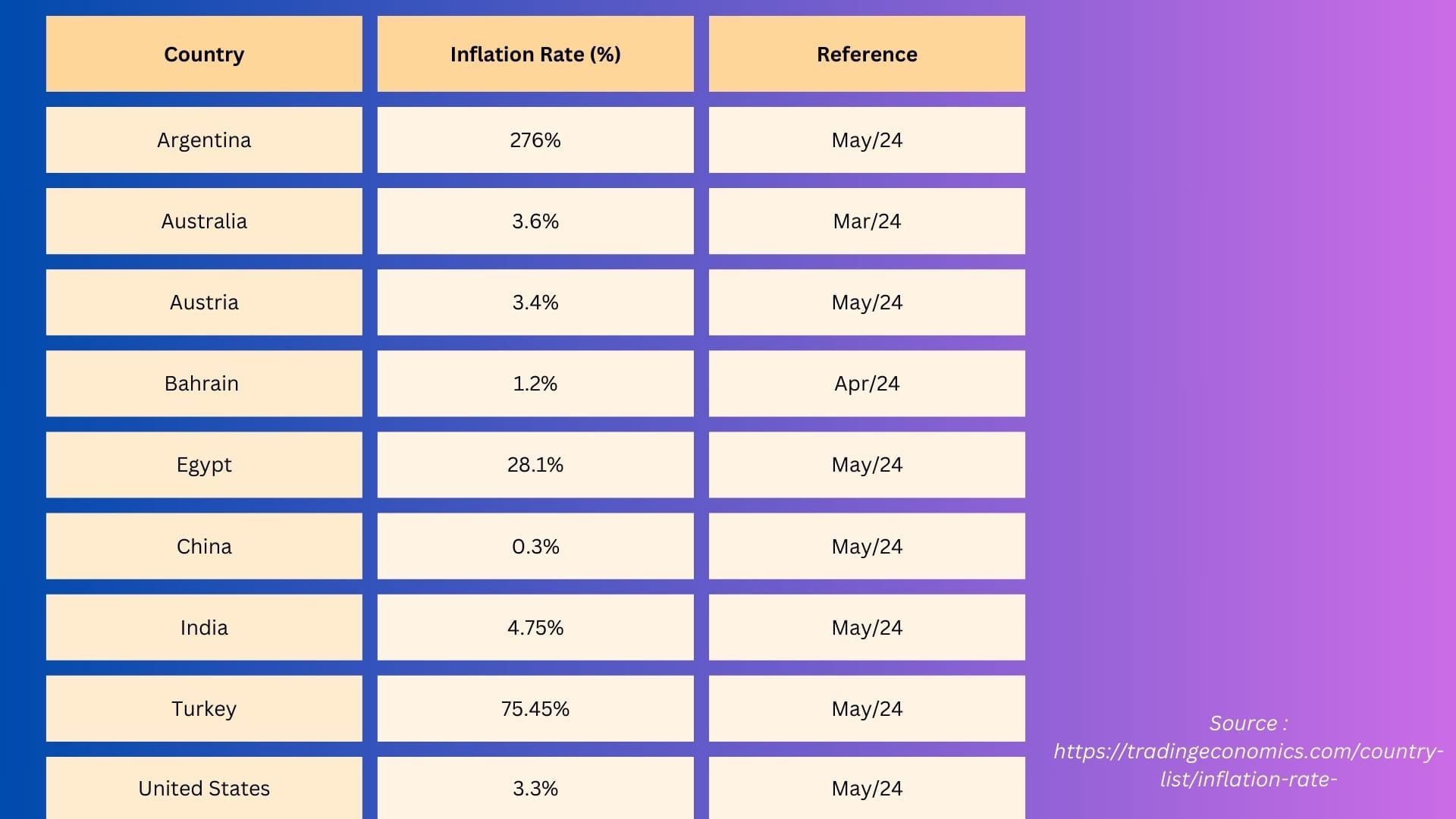

Let us see some sample inflation numbers of some major economies (Source : here)

We see that the inflation numbers vary from 276% in Argentina to 0.3% in China. There are also some countries with double digit inflation - Egypt at 28.1% & Turkey at 75.45% while others are in single digit inflation.

How are these numbers calculated?

Inflation Computation

We defined inflation as ongoing increases in the general price level for goods & services in an economy over time.

So the price level of goods & services is computed over a period of time & the increase over that period is determined. A common measure of the price level is the Consumer Price Index or CPI. What is Consumer Price Index or CPI?

Consumer Price Index (CPI)

The Consumer Price Index (CPI) is a measure of the aggregate price level in an economy. The CPI consists of a bundle of commonly purchased goods & services. (Source : here)

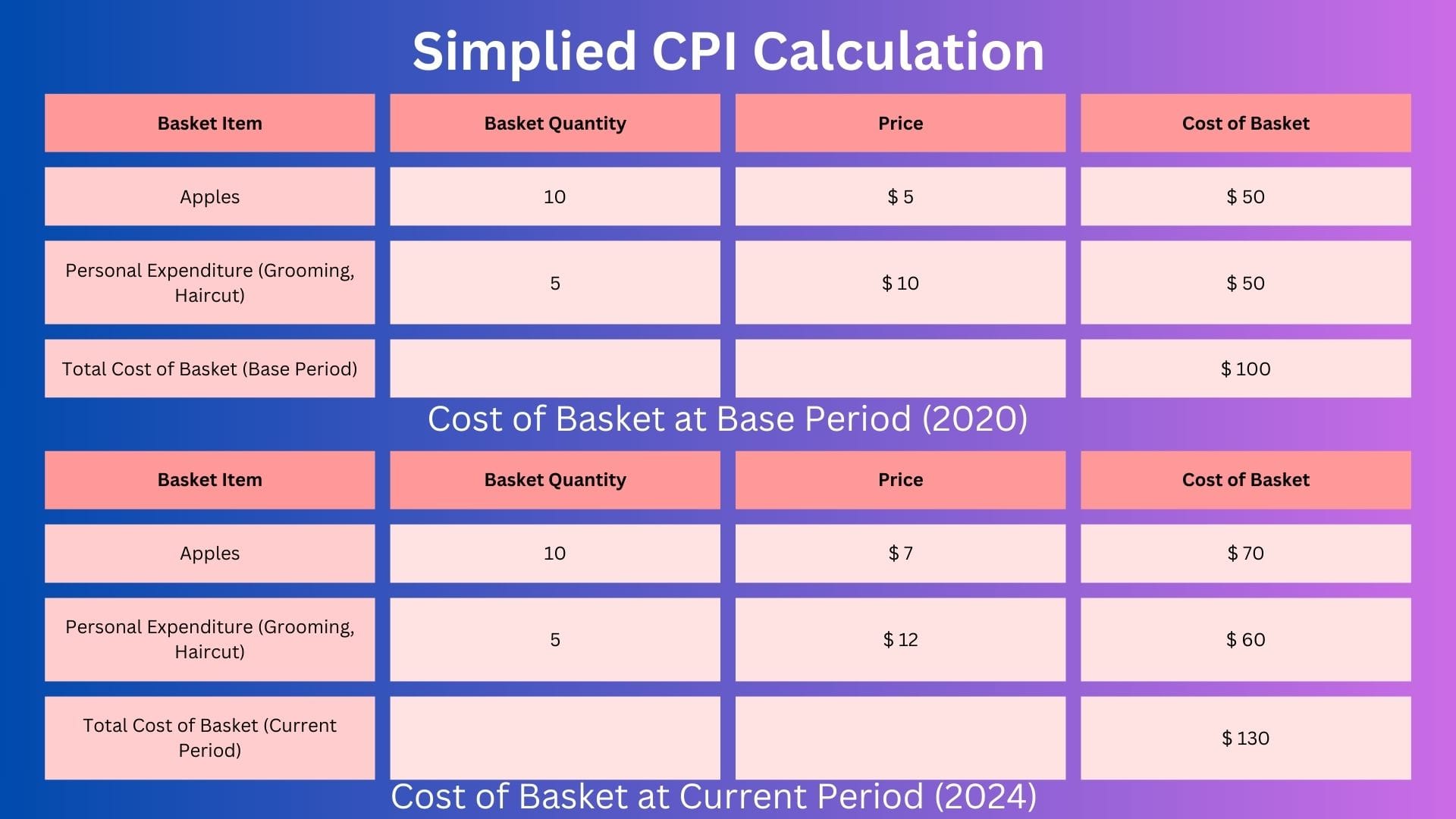

The below steps are used to compute CPI & ultimately inflation rate.

Step 1 - Select a Basket of goods & services

A representative basket of goods & services is selected which reflects the spending habits of households. This basket includes categories like food, housing, clothing, transportation, education & medical care.

Step 2 - Collection of Price Data

Prices for the goods & services in the basket are collected periodically from various sources such as retail establishments, service providers & utility companies

Step 3 - Assign Weights

Items in the basket are assigned weights. This reflects their relative importance or share of total expenditure for a typical household.

Step 4 - Calculate the cost of the Basket of goods & services

- Find the cost of the basket at base-period prices

- Find the cost of the basket at current-period prices

- Calculate the index (CPI) for the base period & the current period

Step 5 - Calculate inflation

Inflation rate is calculated as the % change in the price level from one year to the next.

Let us visualize the above steps with a very simple example:

What are the reasons or drivers of this price increase? Why is there inflation & how does it impact an economy & Central Bank policies?