Strategy Byte - Week 32 Fiscal Policy

Recap

During Week 31, we took a small deviation from discussing macro-economic variables to understand strategy from a problem solving perspective.

First, we analyze a situation to understand whether we are in a problem or a situation. What does it mean?

Problems, by definition, have solutions, irrespective of costs or trade offs while situations, on the other hand, don't have any solutions. We have to live with them. (Source : Seth Godin)

We then explained mental models, which is a framework used to solve problems by understanding how something works.

It is more like a tool or framework used to solve problems using certain mental maps created from our experience or knowledge of how things work.

Then we explored systems thinking which is a vantage point from where you see a whole, a web of relationships, rather than only focusing on the detail of any particular piece. Events are seen in the larger context of a pattern that is unfolding over time.

We then defined variables in the context of strategy as :

- Relevant macro economic variables - GDP, interest rates, inflation etc

- Industry dynamics - industry segment, profitability, competition, barriers to entry etc

- Customer dynamics - customer profile, segment etc

- Supply chain dynamics - import or local etc

- Internal / Corporate dynamics - Corporate Structure, investments, Funding, stakeholders etc

We then linked problem solving with Strategy through the below steps:

- Identify the problem - Have a problem statement. This can be a friction in customer interaction or something entirely new which can make a customer's life easier or an objective (like increase market share)

- Develop a hypothesis - What is required to make it your strategy successful? Or as Roger L Martin put it - "What would have to be True?"

- Test the hypothesis using data - Talk to customers directly or through surveys to understand what the customer truly values & is the strategy delivering the same

- Accept / Reject - Based on the results, accept or reject the hypothesis

Now, let us get back to our macro economic discussion. We are going to discuss a key government policy which, along with Monetary Policy results in positive or negative impact on the other macro-economic variables. This is the Fiscal Policy.

Fiscal Policy

What is Fiscal Policy? Before we get into the weeds, let us understand it using a simple example.

We either work for salary or earn income through services or business. We also spend some money, called expenses to maintain ourselves, our families & our business. So, there are two sides to this equation :

- Income - Amounts earned from our work / services / business

- Expenses - Amounts paid to maintain ourselves / families / business

There is also a third side called Investments which is amounts allocated to assets to earn returns on them either through dividends or capital appreciation.

We spend considerable time thinking how much of the amount earned should be spent as expenses or invested to earn returns / asset accretion. In other words, we manage our revenue, expenses & investments to achieve our goals related to lifestyle choices.

The question is whether we want to maintain a simple lifestyle or a luxurious one & adjust our expenses & investments accordingly in line with those choices.

Photo by Li Yang on Unsplash, Photo by Matt Atherton on Unsplash, Photo by Alex Block on Unsplash, Photo by Laura Chouette on Unsplash

With the above in mind, let us now understand Fiscal Policy.

Fiscal Policy is the means by which the Government adjusts it's budget balance through spending & revenue changes to influence broader economic decisions.

According to mainstream economics, the government can affect the level of economic activity - generally measured by Gross Domestic Product (GDP) - in the short term by changing it's level of spending & tax revenue. (Source : here)

Just like our decision on allocation of revenue against investments & expenses has impact on our lifestyle, similarly, the government, through managing it's spending & revenue can impact the level of economic activity. How does it do that & how are the macro economic variables connected to the level of government spending & revenue?

For that, we need to first understand where does Government gets it's revenue from & what does it spend on?

Government Revenue & Expenditure

We will start with Revenue. Government revenue can be classified under

- Tax Revenue

- Non-Tax Revenue

Tax Revenue

A tax is a mandatory payment or charge collected by local, state or national governments from individuals or businesses to cover the costs of general government services, goods & activities. (Source : here)

So, governments provide various public services like maintaining infrastructure, police, emergency services, defense etc & to fund those services, it mandates us to pay taxes to enable the government to continue & maintain those services. So, how does the government actually collect these taxes? There are two methods of imposing tax revenues by the Government. These are :

- Direct Taxes &

- Indirect Taxes

Direct Taxes

Direct taxes are levied on individuals or entities based on the amount of income or profit earned by these individuals or entities over a period of time, normally one year, usually referred to as a financial year.

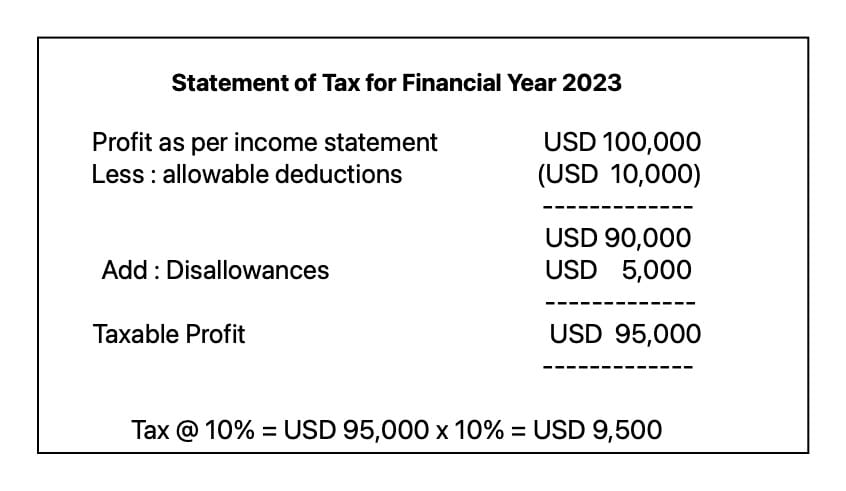

The rules may specify some deduction or adjustments from the income or profit to arrive at the net taxable income or profit. It is on this net taxable income or profit that tax is computed & paid. An example of a simple tax computation is shown below (though the actual computation is more complex with the number of deductions & disallowances prescribed by the tax code):

Taxes are levied directly on the individuals or entities & have to be paid by them only. The tax liability cannot be transferred to another person or entity.

Also, tax rates increase as the tax payer's income or profit increase resulting in higher tax revenues for businesses or individuals with higher profitability or income.

Indirect Taxes

Indirect taxes are taxes levied on transactions in goods &/or services & not on individuals or business entities. They are imposed on entities or individuals providing goods or services but collected from a different person or entity, usually those consuming the goods or services. Sales tax or VAT (Value Added Tax) are examples of indirect tax. For example, when a consumer purchases milk, the purchase price of milk includes sales tax or VAT which is paid by the consumer.

Next week, we will explore non-tax revenue