Strategy Byte - Week 33 Fiscal Policy.. Cont'd

Table of Contents

- Recap

- Non-Tax Revenue

- Government Expenditure

- Fiscal Surplus / Fiscal Deficit

- Factors affecting Government Expenditure

- Factors affecting Government Revenue

- Financing the Deficit

Recap

During Week 32, we discussed Fiscal Policy which is :

The means by which Government adjusts it's budget balance through spending & revenue changes to influence broader economic decisions.

According to mainstream economics, the government can affect the level of economic activity - generally measured by Gross Domestic Product (GDP) - in the short term by changing it's level of spending & tax revenue.

We started with sources of Government revenue under :

- Tax Revenue

- Non-Tax Revenue

Tax Revenue is defined as a mandatory payment or charge collected by local, state or national governments from individuals or businesses to cover the costs of general government services, goods & activities.

Tax Revenue is classified as :

- Direct Taxes &

- Indirect Taxes

Direct Taxes are levied on individuals or entities based on the amount of income or profit earned by these individuals or entities over a period of time, normally one year, usually referred to as a financial year.

Indirect Taxes are taxes levied on transactions in goods &/or services & not on individuals or business entities.

Let us now understand Non-tax Revenue.

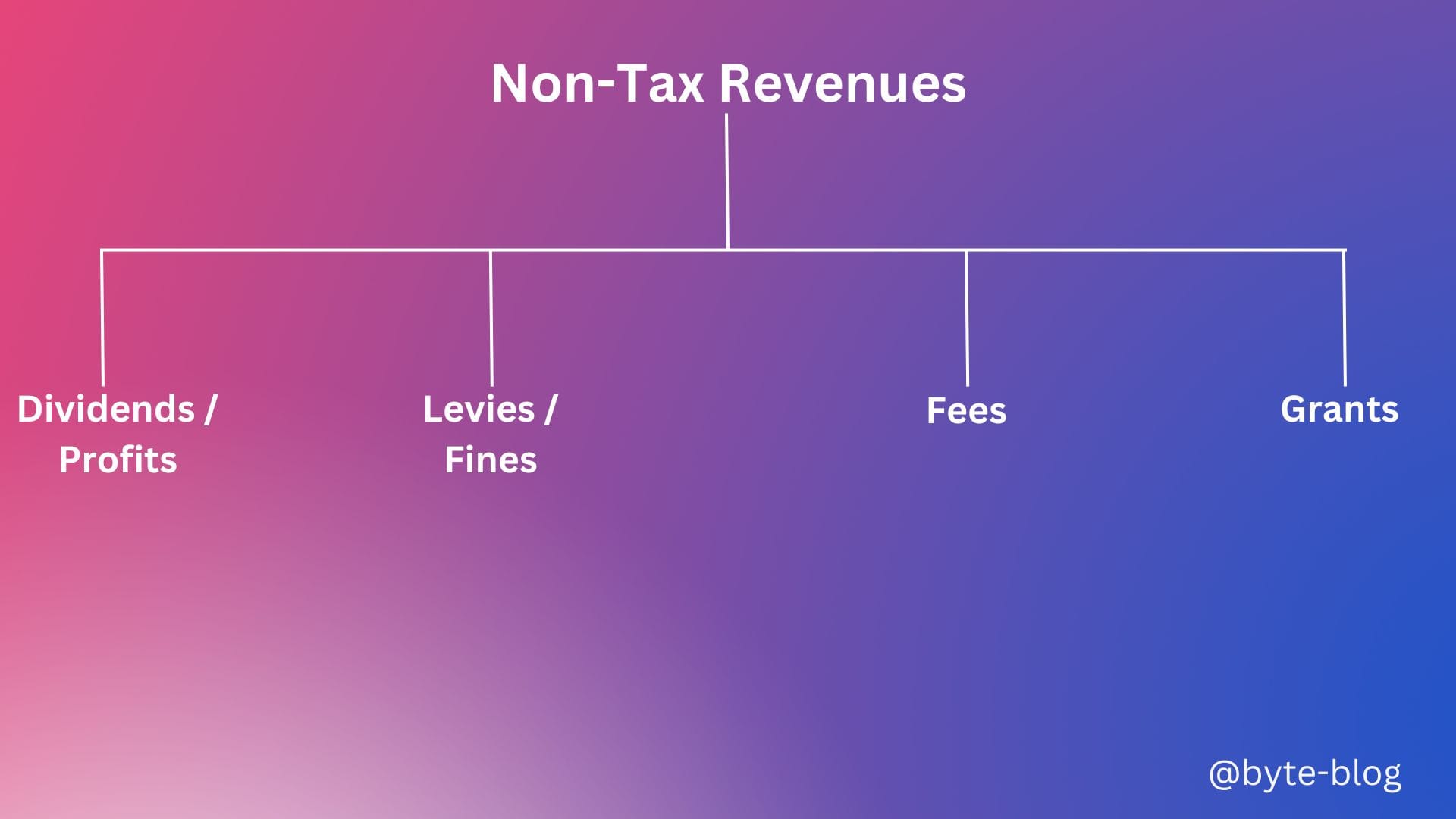

Non-Tax Revenue

What is Non-tax revenue?

Non-tax revenue is government revenue not generated from taxes. For e.g., toll charges for using toll roads, fines etc. They can be classified as below:

- Dividends / Profits - Includes dividends &/or profits from Public Sector Enterprises & Government entities

- Levies / Fines - Amounts collected on account of non-compliance with a regulation or rule. E.g., parking fines, traffic fines etc.

- Fees - Amounts collected for usage of rights or facilities provided by the Government. E.g., electricity charges, road & bridge toll charges, licence renewal fees, etc.

- Grants - Any donations or voluntary contributions to the Government

Now that we have understood sources of Government Revenue, let us now explore the other side of Fiscal Policy - Government Expenditure

Government Expenditure

Government Expenditure refers to all expenditures made by a government which are used to fund public services, social benefits & investments in capital.

There are two types of government spending :

- Government Current Expenditure - Ongoing recurring expenditure to produce & provide public services, current transfer payments (spending on social benefits & other transfers), interest payments & subsidies

- Government Gross Investment / Capital Expenditure - includes outlays on long term structural & development projects. It affects the asset / liability position of the Government.

(Source : here)

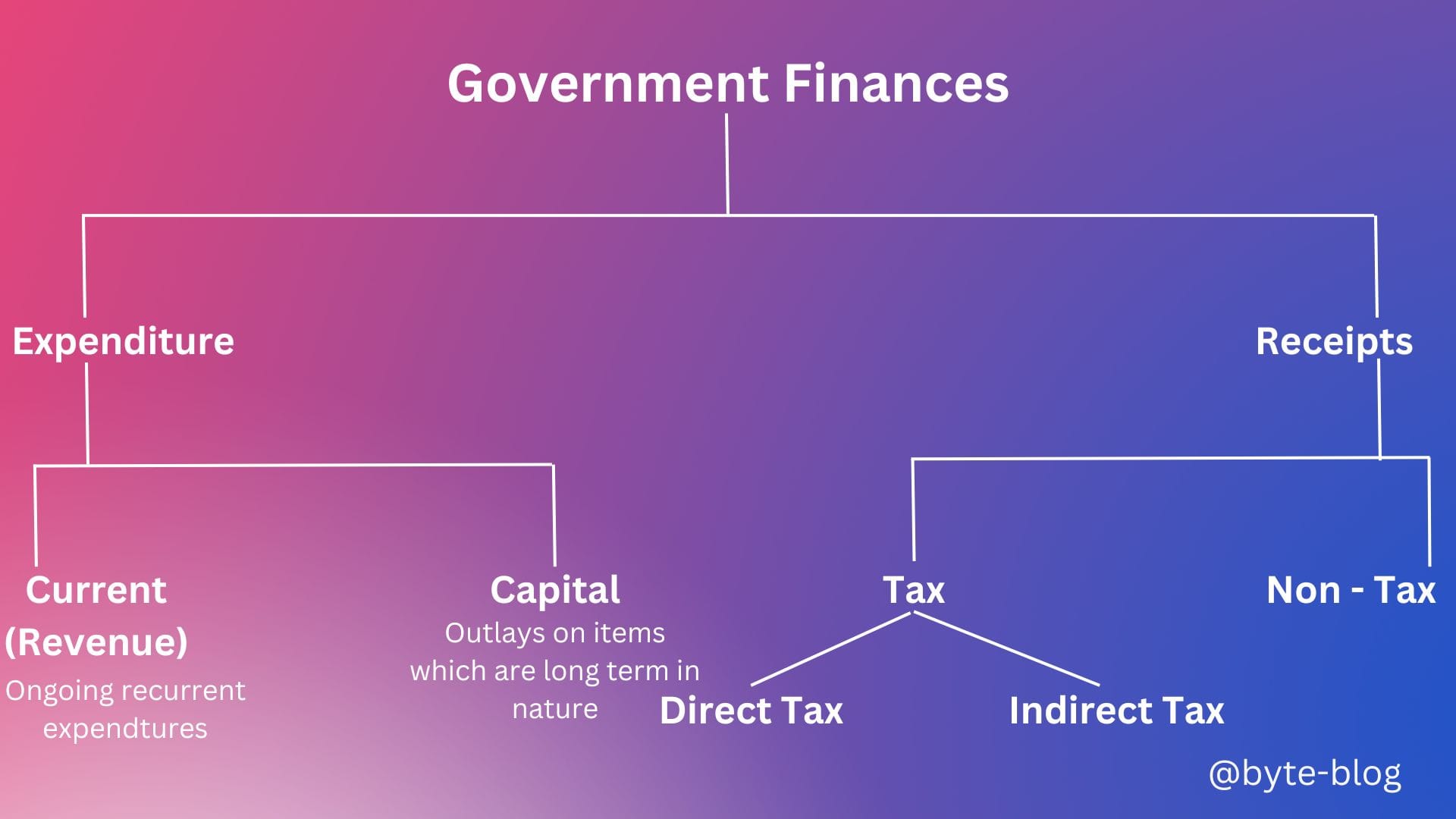

Let us now visualize the full structure of Government Finances as below :

Now that we have an understanding of the structure of government finances, what happens if either revenue or expenses exceed the other? This leads us to our next topic - Fiscal Surplus & Fiscal Deficit.

Fiscal Surplus / Fiscal Deficit

The definition of Fiscal deficit / Surplus is pretty straightforward.

If Government Expenditure > Revenue, the net position is called Fiscal Deficit &

If Government Revenue > Expenditure, the net position is called Fiscal Surplus.

When a country runs a fiscal deficit, it means the government is spending beyond it's means or the revenue it generates.

The concept is the same for companies, only the terminology differs. If a company spends more than it earns, it runs into a loss while a company earning more than it spends earns a profit.

Let us understand some major factors or issues affecting Government expenditure & revenues

Factors affecting Government expenditure

- Loss making public sector enterprises causing higher expenditure to maintain the enterprise

- Difficult to reduce expenditures (infrastructure, social security, health care etc)

- Subsidized credit, loan guarantees

- Low returns on public services which may not be commercially viable but scores high on social & community requirements.

- Other budgetary support & hidden subsidies

Factors affecting Government Revenue

- Narrow tax base

- Poor tax administration

- Low compliance with tax or revenue laws

- Inefficiencies & leakages in tax structure

What happens when a government runs fiscal deficits across multiple years? What does an individual or corporate entity do when they spend more than their earnings or revenue? They end up having to finance that deficit by taking debt or in other words - Borrowing.

How does a Government finance this deficit? Through the below means

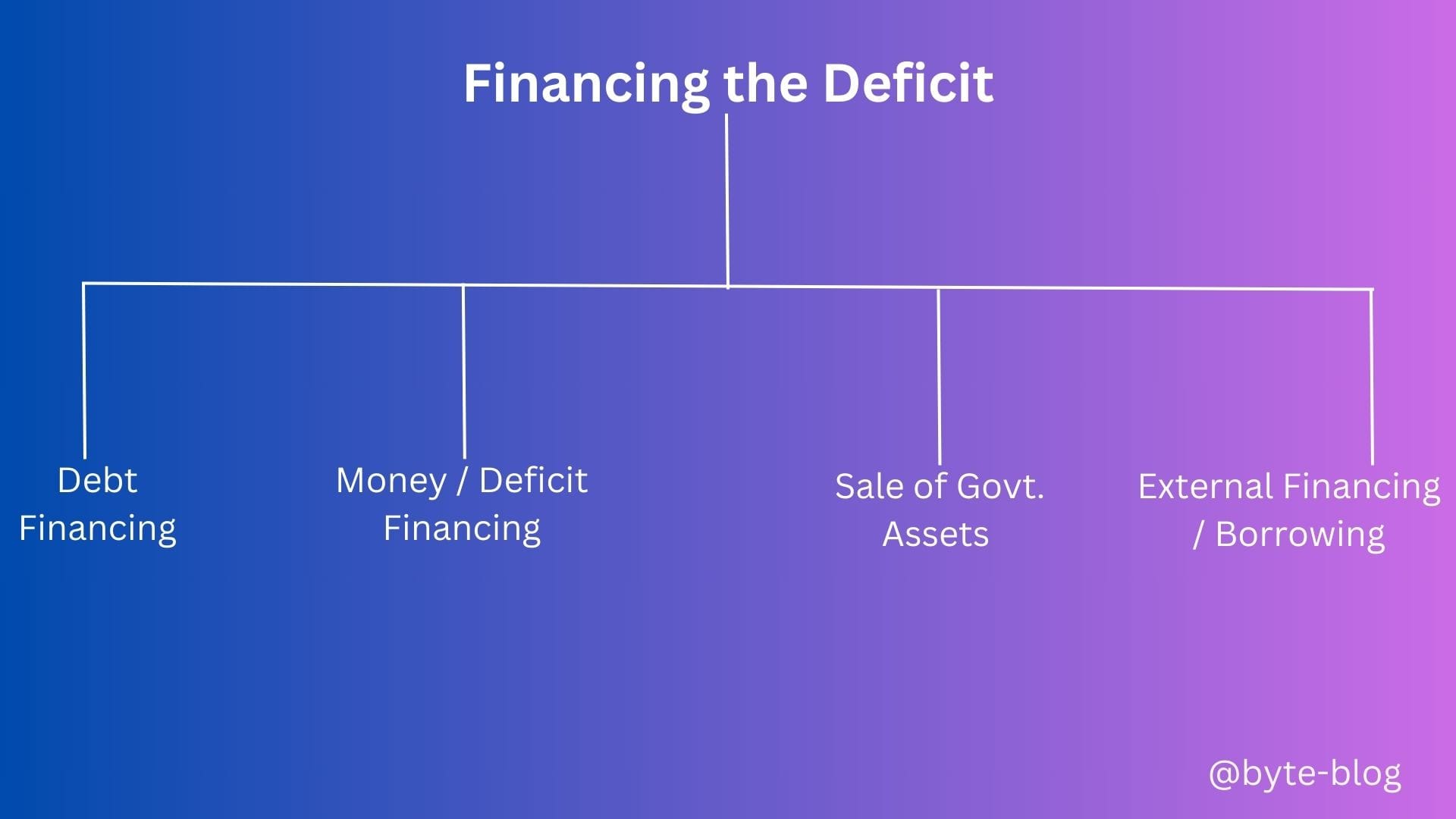

Financing the Deficit

Deficit Financing refers to the practice where a government covers it's budgetary deficits by borrowing money, issuing bonds, creating new money through the Central Bank or by selling or privatizing government or public sector entities.

There are four ways through which a Government can finance it's deficit :

Let us understand what each of the above means :

Debt Financing

Where the Government issues bonds &/or other types of debt instruments to finance expenditure

Money / Deficit Financing

Where the Government draws down the cash balances with Cenral Bank or sells Government securities to Central Banks.

Sale of Govt. Assets

Where the Government sells it's stake in Public Sector or Government entities through disinvestment or privatization

External Financing / Borrowings

Where the Government borrows from other nations or Multilateral Agencies.

Next week, let us understand why Governments run into deficits, whether it is good or bad for the economy & what is the impact of each method of financing deficits & more.