Strategy Byte - Week 34 Fiscal Policy Impact

Table of Contents

- Recap

- Top 15 Countries Ranked by Budget Deficit

- Reasons for Government Deficit

- Types of Fiscal Policy

- National Debt

Recap

During Week 33, we discussed non-tax revenue which is government revenue not generated from taxes & they are generally classified under :

- Dividends / Profits

- Levies / Fines

- Fees

- Grants

Then we explored the other side of fiscal policy - Government expenditure which refers to all expenditures made by a Government used to fund

- Public services

- Social services &

- Investments in capital

We then classified Government expenditure into :

- Government current expenditure

- Government gross investment / capital expenditure

Then we defined Fiscal Deficit & Surplus as

If Government Expenditure > Revenue, the net position is called Fiscal Deficit &

If Government Revenue > Expenditure, the net position is called Fiscal Surplus.

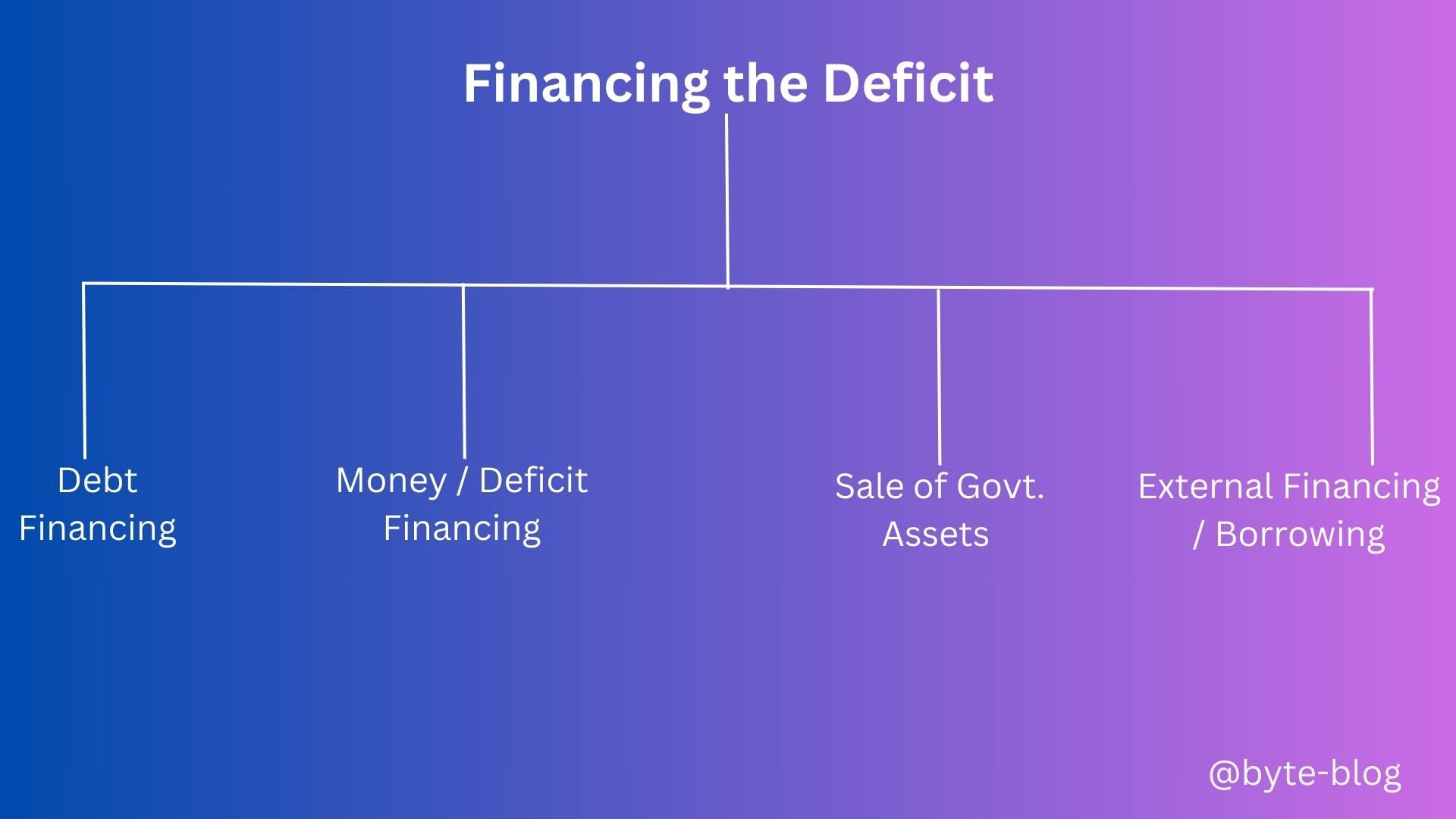

Then we explored ways governments finance their deficits through

- Debt Financing

- Money / Deficit Financing

- Sale of Government Assets

- External Financing / Borrowing

This week let us explore some numbers & then see what drives Government deficits or surplus.

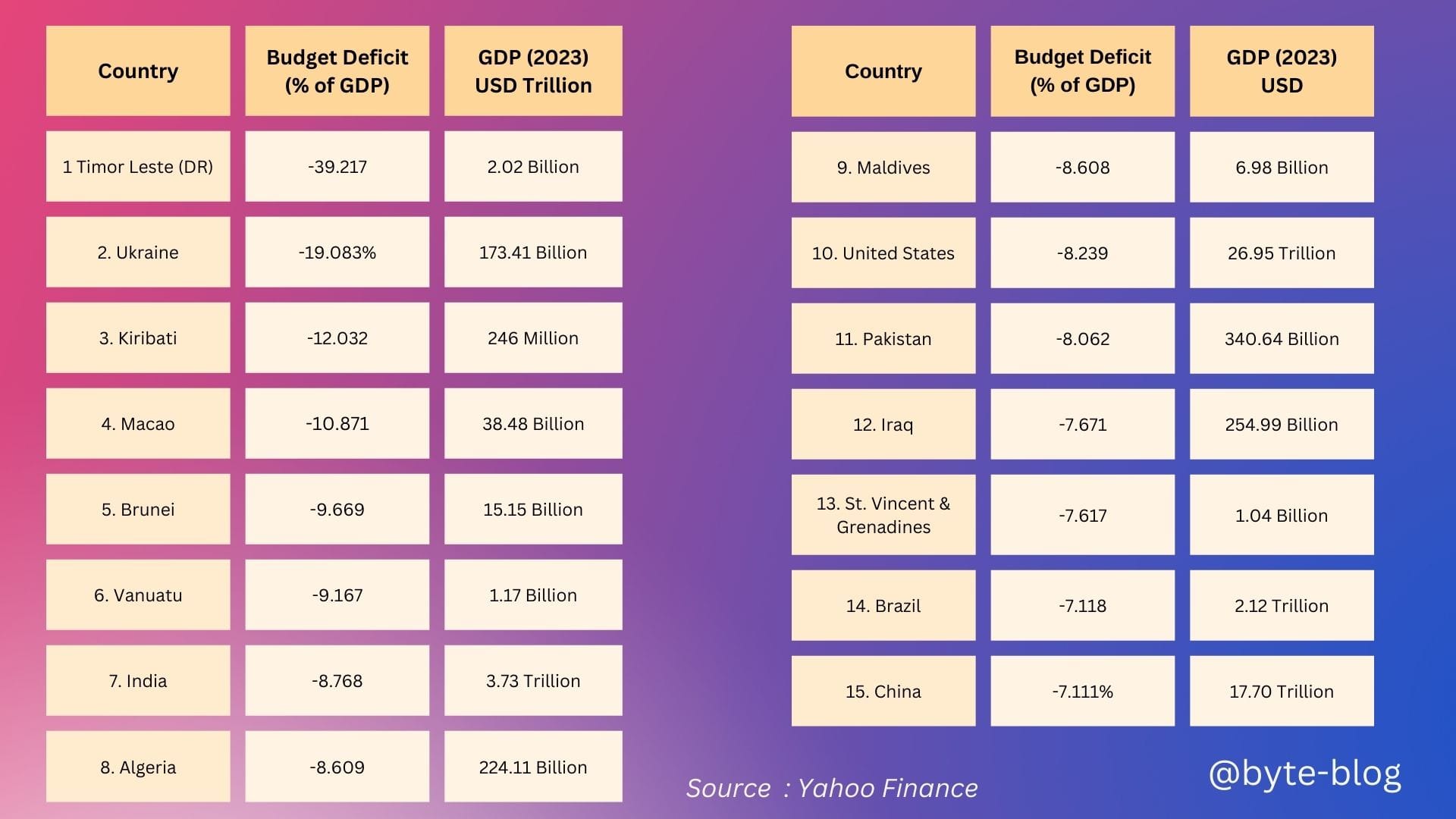

Top 15 Countries Ranked by Budget Deficit

Below are the top 15 countries with the largest budget Deficit as % of GDP (Gross Domestic Product). (Source : here)

Instead of seeing deficits as absolute numbers which would give an incomplete picture, to get a proper perspective in line with the size of the economy, it is important that we analyze the numbers as a % of GDP. (minus denotes deficit)

Reasons for Government Deficit

There are four reasons why a Government budget would run into deficit :

- State of the Economy -

- When an economy is in decline or in other words in a recession, the aggregate demand for goods & services is less than the supply of those goods & hence individuals or businesses are unable to pay for these goods & services resulting in higher inventories, job losses & business closures. Thus, overall income levels in the economy decline and tax collection suffers. To mitigate this, government expenses related to uplifting the economy increases (infrastructure spending, unemployment insurance, other social benefits etc). This causes deficits to increase.

- Conversely when the economy is going strong or in other words in a boom, the income levels increase & the aggregate demand increases & businesses have to increase supply to meet demand. Tax revenues increase & spending does not have to increase as the economy generates enough revenue to cover those costs. This causes deficits to shrink.

- Tax Policies - Inefficient tax policies & governance mechanisms can result in lesser collections than what the tax base can provide. To mitigate this, Governments enact tax policies in line with their objective of increasing their tax base & boosting collection efforts to shrink deficits. For e.g., The recent efforts by GCC economies to implement various tax laws (VAT, DMTT, CIT etc) to boost revenue collection are notable examples.

- Subsidies, Military & Social Programs Spending - Increased spending on public services, military & social services causes expenses to increase causing deficits to rise depending on the security situation of a country.

- Unexpected Events - Unexpected events like war or natural disasters can cause budget deficits to skyrocket due to expenses required to repair the damage done to the economy. The Ukraine - Russia war is a good example of this which caused Ukraine's budget deficit to be 19% of GDP. For perspective, the budget deficit of Ukraine averaged from 3.75% of GDP from 1997 until 2023 reaching an all time high of 5.10% of GDP in 1999. (Source : here)

Types of Fiscal Policy

From the above we can conclude that through Fiscal policy, Governments seek to smooth the economic cycle. How?

- When an economy is performing well but has a risk of overheating, cooling measures are initiated like increasing taxation, reducing spending etc. This policy is called Contractionary Fiscal Policy. This is because increased taxation & reduced spending will leave less money in consumer pockets which will cool down demand for goods & services which in turn will cool business activity resulting in lower employment etc.

- When an economy is not performing well, measures are initiated to stimulate the economy through tax cuts, increased spending etc. This is called Expansionary Fiscal Policy. This will result in more money in consumer pockets for them to spend, increasing demand for goods & services which in turn increases business activity, higher employment etc.

National Debt

What happens when a government accumulates fiscal deficit over several years? They try to finance this deficit by borrowing as discussed last week or in other words - Deficit Financing.

The below visual shared last week shows the various ways through which a Government can finance it's deficit:

The above borrowings results in what we know as National Debt.

In simple terms, National Debt is the amount of money owed by a National Government. (Source : here)

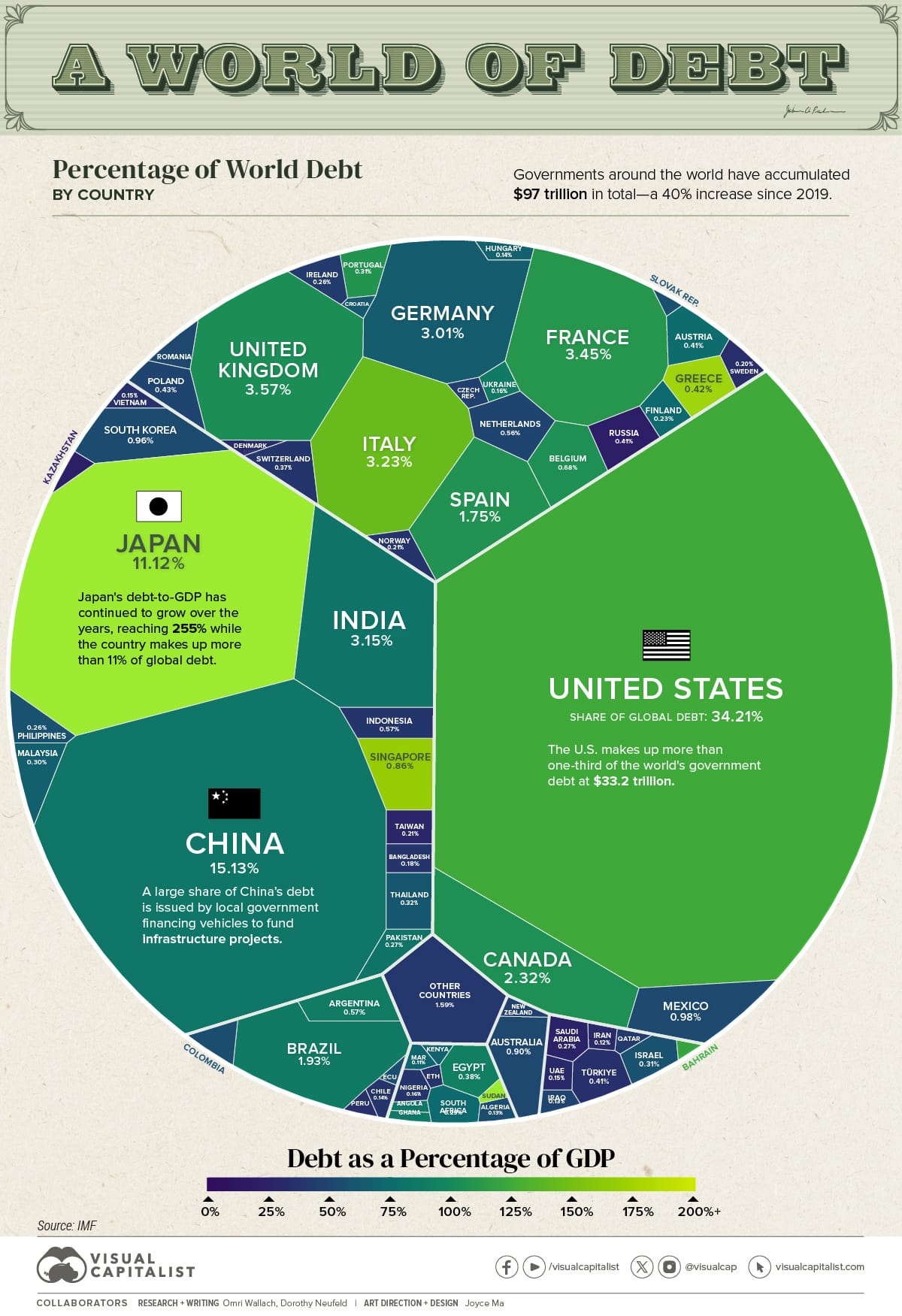

Let us see below how Governments across the world stack in terms of National Debt. As we discussed deficit, National debt is tracked as % of GDP to get a proper perspective on the size of debt in proportion to a country's total economy.

The below visual from VisualCapitalist says it all. Countries around the world have accumulated USD 97 Trillion of Debt in total - a 40% increase since 2019. (As of Dec 2023).

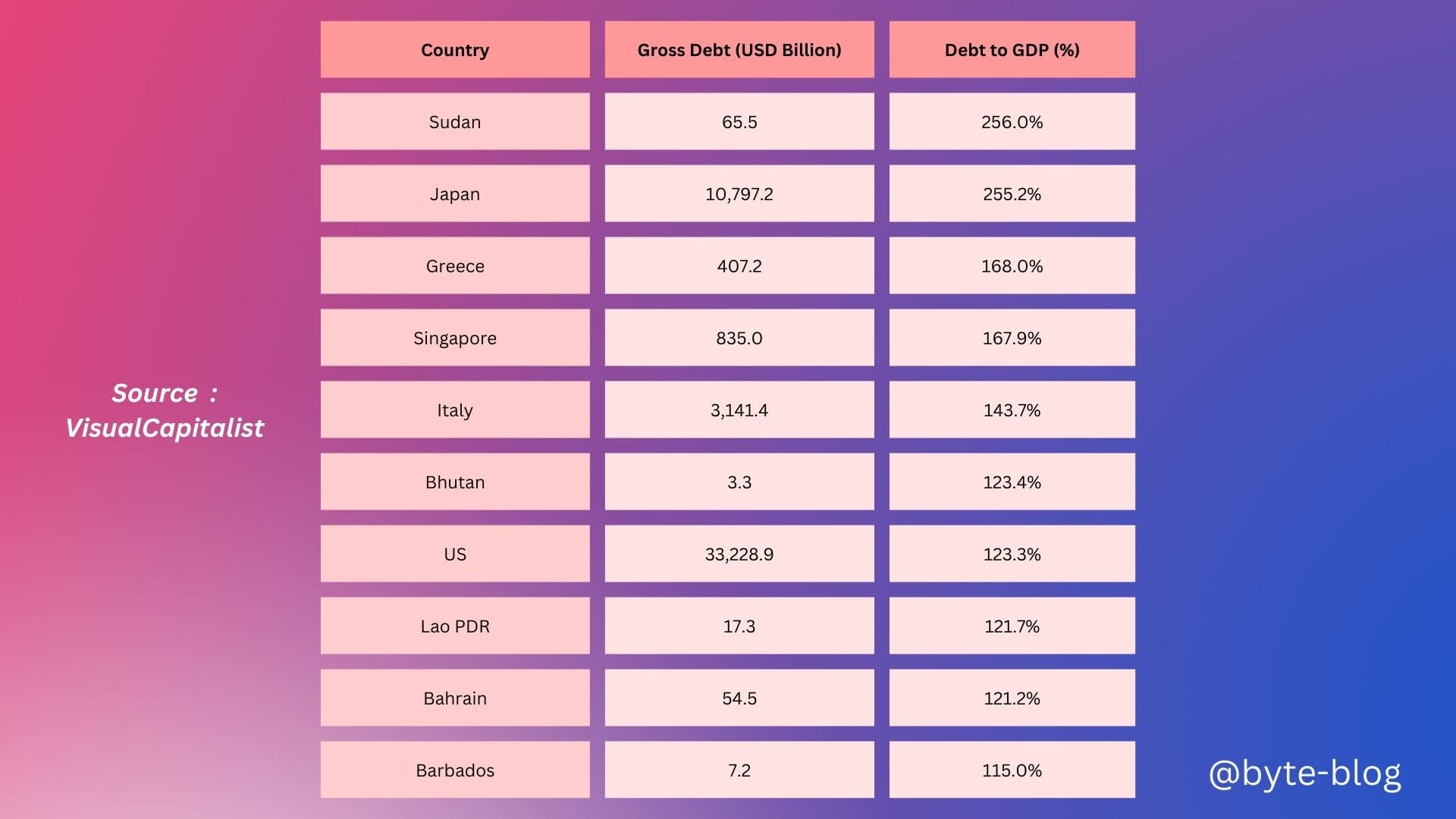

Let us now see the top 10 countries with the highest debt to GDP %. (Source : here)

So, is the above good news? No. Let us see why,

- Higher Interest Payments - Budget deficits are caused due to higher Government spending than revenue generated. When these deficits are financed by borrowing, another cost gets added which is the interest cost of servicing the debt. This can divert a significant portion of government revenue from it's priority programs to interest payments. E.g,

- For US, with total debt at USD 33 trillion & given the increasing debt, the interest cost on this accounts for almost 20% of government spending. It is projected to reach USD 1 trillion by 2028, surpassing the total spent on defense.

- For Egypt, it's borrowing costs are expected to be higher with almost 40% of revenues going towards debt repayment. (Source : here)

- Changing Demographics - The aging demographics in Japan & the West will only exacerbate the debt situation as it results in higher social security expenses with lesser revenue generated as the retiring workforce does not get replaced with the next generation workforce who were supposed to contribute to the economy & the increasing social security costs.

We have discussed most of the macro-economic variables over the last 34 weeks related to the external environment. Why do we care about these variables when doing strategy?

That is because these external macro-economic environmental variables impact economic performance & affects something known as SUPPLY & DEMAND.

What is Supply & Demand?

Let us dive deep into this from next week.