Strategy Byte - Week 41 Case Study - Nubank

Table of Contents

- Recap

- Systems Perspective

- Case Study 1 - Nubank

- The Problem

- Check the temperature

- The Strategy

Recap

Over the last 40 weeks, we discussed several variables in macro-economic environment affecting from high level to low:

- Single or multiple countries

- Multiple industry sectors or a certain sector

- All consumers or certain set of consumers

There are two stages at which macro-economic variables are considered during strategy :

- The assumptions that go behind the strategy at the time of it's creation. E.g.,

- What would be the interest rates over the next xxx period?

- Where would inflation be over the next xxx period & how would it impact customers?

Both the above would form part of the financial model.

- When executing strategy to assess whether the macro-economic variables are trending in the right direction in comparison with the assumptions made & to take action in case of any significant variance .

Roger Martin coined the term "WWHTBT" which stands for What would have to be true? We ask the question - What would have to be true in the economy for our strategy to work?

Before we get into the above, let us recap the macro economic variables discussed over the last 40 weeks with the below visual :

It is important that we see the economy of a country as a huge system impacted by variables within the system & outside it. How? Let us explore that next.

Systems Perspective

All the above variables or sub-systems are part of the larger economic system impacting each other & the whole system. Any change in one or more of them changes the whole economy of one or more countries depending on the feedback loop provided by the change.

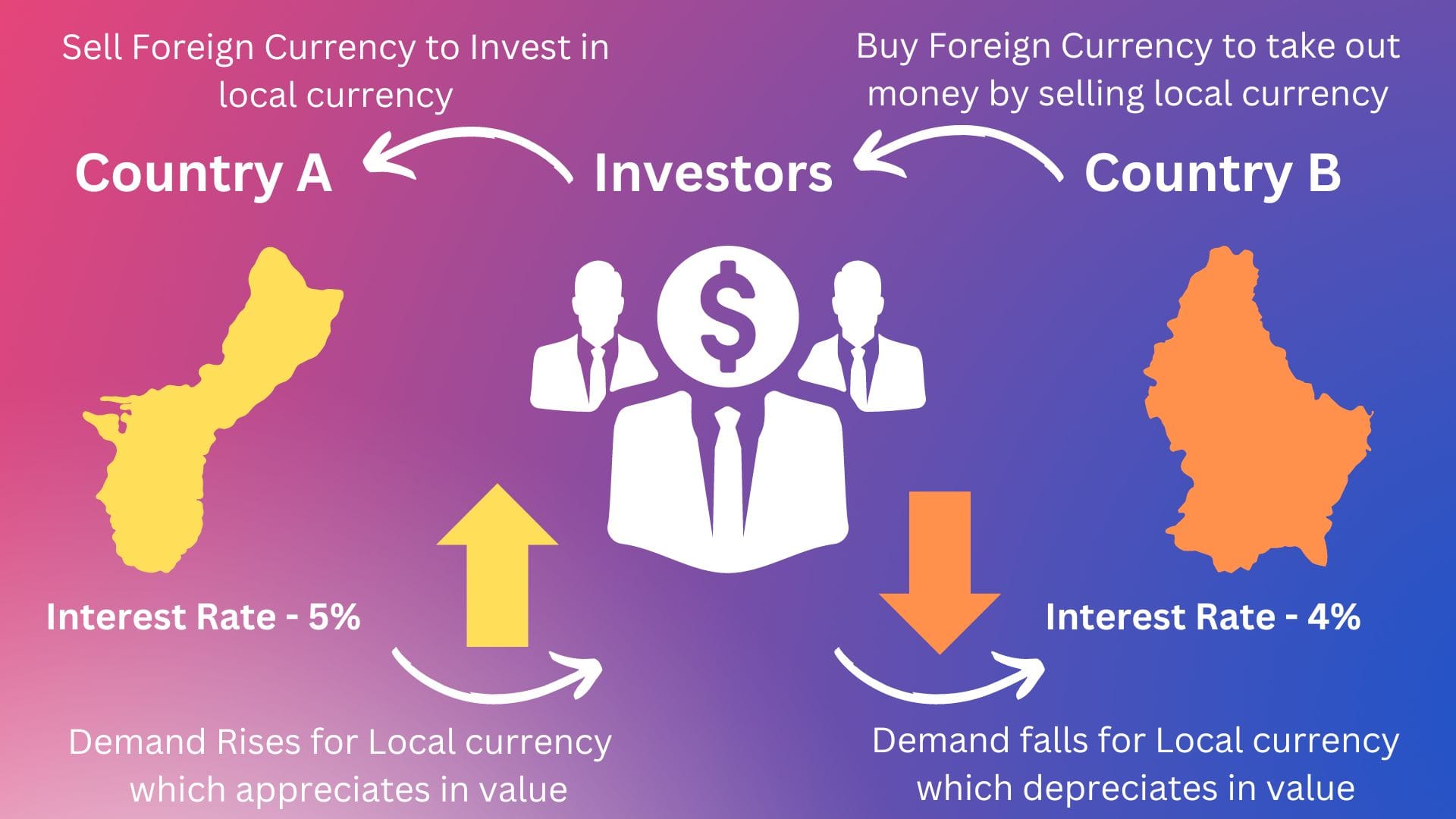

For e.g.,- Increase in interest rates in a country (say, A) can cause inflow of capital into that country causing increase in demand for it's currency causing it to appreciate & outflow of capital from another country (say, B) which has not increased it's interest rate. Hence, the demand for it's currency falls causing it to depreciate.

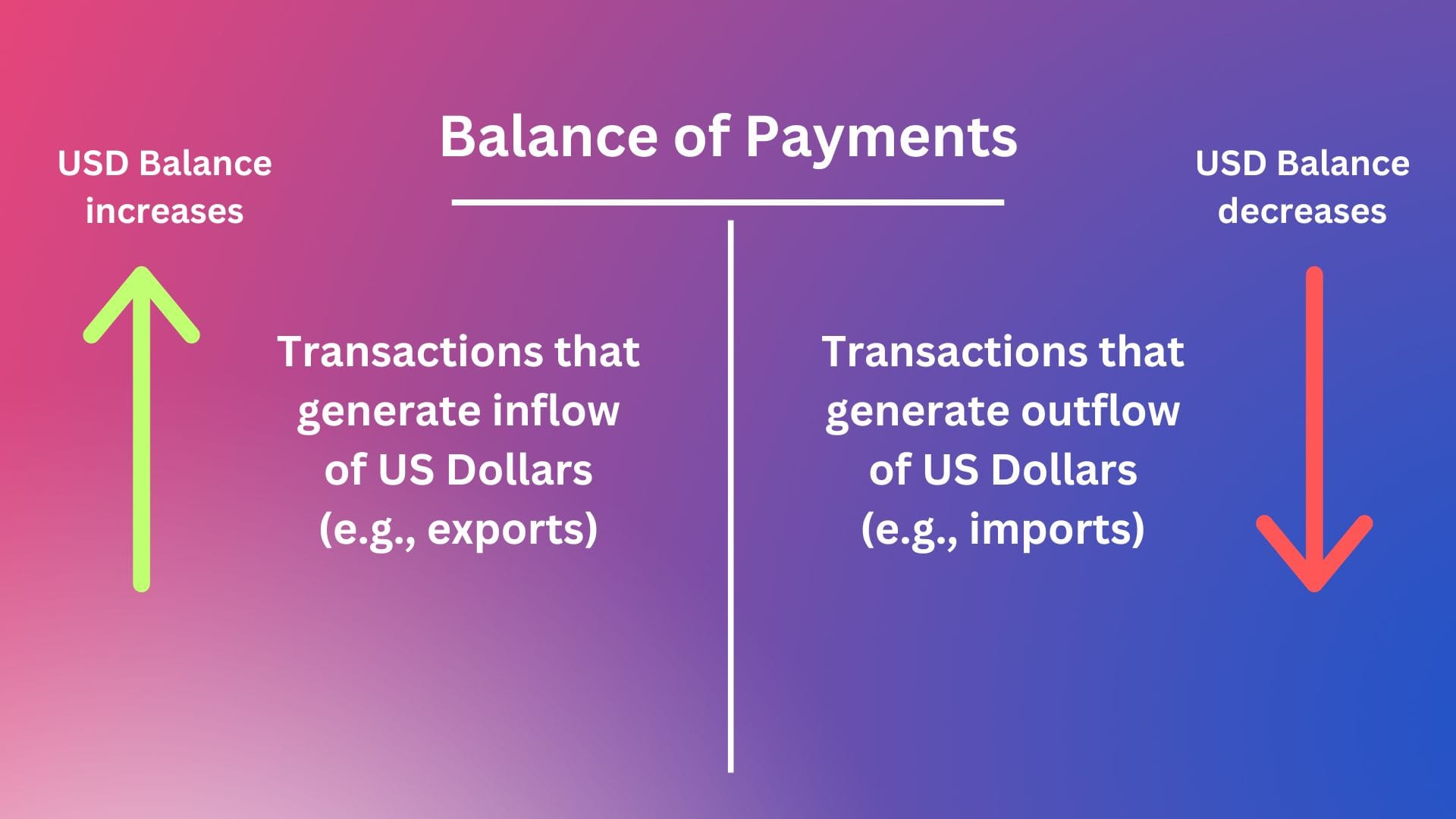

This causes imports in Country B to be more expensive (due to cheaper currency) & country A to be more cheaper (due to expensive currency) affecting Balance of Payments position of both Countries A & B in opposite direction.

Since Country B's currency is cheaper, it's exports becomes more competitive causing it to increase causing it's currency to appreciate & it's Balance of Payments position to improve.

The above impacts prices of goods & services which can increase causing inflation to rise in country B. The Central Bank, after reviewing inflation data can decide to increase or decrease interest rates through the Monetary Policy to control inflation & bring it to the target level as mandated.

Ultimately the interaction of above variables impact the price of goods & services causing changes in demand &/or supply of those goods & services. So, any impact of economic changes on customer demand & it's subsequent impact on supply of those goods or services is what is key when designing strategy.

The Government adjusts the fiscal policy in line with it's objective of achieving a target budget deficit or surplus.

The banking industry is one of the most affected by changes in macro economic variables. Why? Because it deals with money & the main function of banking is transfer of money from those who have it (savers) to those who want it (borrowers - corporate or individual) providing incentives to the savers through interest & borrowers the flexibility to repay loans (on interest) & earning fees & charges on these services along with the net interest margin (difference between interest earned on loans & interest paid on deposits).

Let us take two examples of very successful challenger banks - NuBank & Monzo.

Case Study 1 - Nubank

The Problem

Strategy is created from

- A customer problem to be solved or

- A concept which changes the current paradigm of a good or service to create an improved value to the customer or

- An entirely new value or service which doesn't currently exist.

The vision for Nubank was created from a customer problem with existing banking services as per the below extract from their annual report

We launched Nu to revolutionize financial services for Latin America consumers & small businesses, challenging the status quo of incumbent banks. These banks historically applied homogeneous underwriting methodologies & lacked customer obsession, often resulting in high fees & interest costs for customers

This approach not only ignored their needs but also excluded a significant portion of the population from the banking system. Brazil, a country with some of the highest banking fees in the world, presented an ideal backdrop to introduce new customer-centric financial solutions.

We saw an opportunity to create a set of fully digital, tailored financial services focusing initially on credit cards. Through our obsession with customer experience, we sought to help our customers make payments more conveniently, organize their finances better, & improve their use & control of credit.

So, there was a problem with existing banking services in Brazil as below :

- High interest rates & fees charged by the incumbent banks

- Domination of the banking sector by five major banks

- Frustrating customer experience

- Financial exclusion - only 30 to 50% of the population in Latin America over the age of 15 have an account with a Financial Institution (Source : here)

Check the Temperature

From the starting point of the problem or opportunity to add value to customers, no one just jumps into the market with a product without checking the state of the economy. It's like checking the pool temperature before getting into the pool.

We start by asking the below questions (From Week 12):

- What is the current state of a country's economy & it's inherent risk?

- Based on the above analysis, what is the most likely short term or long term scenario?

Let us analyze the macro economic variables in Brazil at the time of Nubank launch in 2013. (Source : here)

- GDP Growth - The Brazilian economy grew by 2.5% in 2013 which was an improvement from the 1% growth recorded in 2012. This growth was driven by domestic consumption, though affected by global uncertainties & government policies

- Inflation - Inflation in Brazil was at 5.9% throughout 2013, similar to 2012 rate of 5.8%.

- Monetary Policy - The Central Bank raised the base interest rate from 7.25% in January to 10% in December 2013 to counter inflationary pressures

- Fiscal Policy - The fiscal policy was expansionary, with a primary surplus of 1.8% of GDP, down from 2.3% in 2012 due to slower revenue growth compared to spending

- Current Account Deficit - The current account deficit widened to $81.075 billion, up from $54.249 billion in 2012.

- Exchange Rate Volatility - The exchange rate fluctuated significantly, influenced by changes in US monetary policy & domestic political events.

Visualizing the above :

So, let's break the above in simple terms :

- Brazil was recovering from a slowdown (shown by 1% growth in 2012), but it still was not out of the woods yet. But the recovery was not driven by increase in investments for the future but domestic consumption. The economy was dependent on consumption driven growth while investments & net exports had fallen (denoted by increase in current account deficit).

- Inflation was high throughout the year which caused Brazilians to pay more for goods & services impacting their lives negatively. This caused the Brazilian Central Bank to raise interest rates from 7.25% to 10% causing borrowing costs to increase & it became more difficult for Brazilian companies or individuals to borrow. This resulted in shrinkage of business activities impacting economic growth & causing further hardship to Brazilians.

- The currency fluctuation was further complicating the government's effort to stabilize & grow the economy. The fiscal policy adopted was expansionary meaning Government spending increased compared to revenue generated through taxation & other means.

So, could Nubank ignore these macro economic variables & create new banking products & services to Brazilians already frustrated with high fees & charges along with the big pinch of inflation making their lives more difficult?

No, what did they do then? (Source : here)

The Strategy

In 2013, we began with a small team & in 2014, we introduced our first product in Brazil, the Nu Credit Card, a purple Mastercard-branded credit card. Our new credit card marked Brazil's first foray into annual fee free credit cards, & was coupled with a digital mobile-first customer experience.

We can see Nubank considered the state of Brazilian economy & the market along with the impact it would have on Brazilians before launching their first product. Let us focus on the points in bold :

- Annual fee-free credit cards

- Digital mobile-first customer experience

So, ordinary Brazilians already hit by high inflation, used to the high non-transparent fees & poor services provided by existing banks had a taste of convenient mobile banking at low fees & charges from Nubank.

Brazilian credit cards had very high interest rates running then at around 200% to 400% a year. The other bank also charged annual fees on basic cards along with monthly fees for everything from fraud protection to text alerts. (Source : here)

The annual fee-free credit card provided credit to ordinary Brazilians who were financially excluded from the banking system & was an attractive proposition for them to access credit. The digital only model helped both the bank & the ordinary Brazilians as below :

- For Nubank, the digital only approach helped by minimizing operational costs in an inflationary environment & allowed them to offer lower fees & charges to customers compared to traditional banks saddled with high operating costs due to physical branches & legacy systems/ processes. For customers, everything from applying to delivery of the card was handled through the app.

- For the customers, it meant financial inclusion, access to banking services & credit at fees affordable by ordinary Brazilians facing high inflation.

But one question comes to mind, how would they ensure that customers wouldn't default on their card dues in an uncertain economic environment? For any bank, the nightmare scenario is high proportion of non-paying customers (also called non-performing loans or NPLs). They mitigated this risk through :

- Data Analytics - which helped refine their data models in line with customer transactions, repayments & financial position. This helped in better credit scoring their customers.

- Risk Management - Nubank had a cautious approach to approving credit. They approved only 20% of applicants & approved ultralow spending limit of $14, raising it only if payments were timely. (Source : here)

Both data analytics & risk management reinforce each other. Data analytics provides data on customer payments & financial history which fed into their credit models improving the credit risk management process.

So, what is the key takeaway from Nubank strategy?

Even though strategy is all about creating value for customers & identifying opportunities how it can be done better than competitors, it has to be done keeping in mind the economic conditions along with the market & competition.

During 2013 to 2017 at the initial phase of the launch, they reached over 3 million customers which showcases the huge success of their strategy. (Source : here)

Let us explore our second case study - Monzo next.