Strategy Byte - Week 42 Case Study Monzo

Table of Contents

- Recap

- Case Study 2 - Monzo

- Having a Digital Focus

- Customer Focused Offerings

- Managing Uncertainty

- Summary

Recap

During Week 41, we discussed how the various issues surrounding the Brazilian Banking system from the customer perspective as well as the economic situation influenced Nubank's (Nu Bank is one of the largest digital financial services platforms in the world, serving over 110 million customers across Brazil, Mexico & Colombia) strategy in it's initial period since launch. We divided the discussion into:

- The Problem

- Check the Temperature

- The Strategy

The Problem

The major problems with Banking services in Brazil before Nubank were :

- High interest rates & fees charged by the incumbent banks

- Domination of the banking sector by five major banks

- Frustrating customer experience

- Financial exclusion - only 30 to 50% of the population in Latin America over the age of 15 had an account with a Financial Institution (Source : here)

Check the Temperature

Even though there is an opportunity to add value or solve problems for customers, no one just jumps into the market with a product without checking the state of the economy. It's like checking the pool temperature before getting into the pool.

Below visualization shows the macro-economic variables in Brazil at the time of Nubank's launch in 2013:

The Strategy

In 2013, we began with a small team & in 2014, we introduced our first product in Brazil, the Nu Credit Card, a purple Mastercard-branded credit card. Our new credit card marked Brazil's first foray into annual fee free credit cards, & was coupled with a digital mobile-first customer experience.

Nubank considered the state of Brazilian economy & the market along with the impact it would have on Brazilians before launching their first product. The annual fee-free credit card provided credit to ordinary Brazilians who were financially excluded from the banking system & was an attractive proposition for them to access credit. The digital only model helped both the bank & the ordinary Brazilians as below :

- For Nubank, the digital only approach helped by minimizing operational costs in an inflationary environment & allowed them to offer lower fees & charges to customers compared to traditional banks stuck with high operating costs due to physical branches & legacy systems/ processes. For customers, it made their lives easier as everything from applying to delivery of the card was handled through the app.

- It also meant financial inclusion, access to banking services & credit at fees affordable by ordinary Brazilians facing high inflation.

During 2013 to 2017 at the initial phase of the launch, Nubank reached over 3 million customers which showcases the huge success of their strategy. (Source : here)

This week we explore another challenger bank - Monzo. Monzo is a digital challenger bank based in the UK, founded in 2015.

Case Study 2 - Monzo

Let us understand the history of Monzo along with the macro-economic conditions prevalent in the UK then : (Source : here)

- Monzo was founded in 2015. It began as a mobile app with prepaid credit card

- In 2016, the company raised GBP 1 million in just 96 seconds via Crowdcube setting a record for the fastest crowdfunding campaign in history.

- In 2017, Monzo obtained it's full UK banking license from the Prudential Regulatory Authority & the Financial Conduct Authority. This allowed it to open full current accounts, with almost 94% of active prepaid card users migrating to the new offering.

- In 2019-20, Monzo introduced new products such as Business Accounts, Personal loans & premium tiers like Monzo Plus

- In 2021, Monzo entered the US market through a partnership with Sutton Bank.

- As of June 2024, Monzo had over 9.3 million customers & reported an annual net profit of GBP 15.3 million.

During the early days of Monzo, the macro-economic environment in UK was characterized by the below conditions : (Source : here & here)

- Economic Growth - The UK GDP growth was at 2.3% in 2015 & 1.9% in 2016 which slowed to 1.7% in 2017. This growth was largely driven by private domestic demand.

- Inflation - Inflation was low, averaging at around 0.3% in 2015, but rising sharply after the Brexit referendum in 2016 reaching 2.7% by 2017, driven by weaker pound & higher import costs

- Interest Rates & Monetary Policy - The Bank of England maintained low interest rates during this period to support economic recovery. Rates were reduced further following the Brexit vote in 2016 to stimulate economic growth amidst uncertainty

- Consumer Spending - Consumer spending initially supported growth but began slowing by 2017 as inflation exceeded growth, reducing real household incomes. The household savings ratio also fell to record lows during this time.

We can see during that period, the UK economy was slowing down with higher inflation & significant uncertainty surrounding Brexit. Bank of England adopted an expansionary monetary policy through lowering of interest rates to stimulate economic growth.

Monzo responded to the slow growth in UK amidst the uncertainty of Brexit, low interest rates, increasing inflation & slowing consumer spending by : (Source : here & annual reports)

- Having a Digital Focus

- Customer Focused offerings

- Managing Uncertainty

Having a Digital Focus

Having a digital focus allowed Monzo to navigate the low interest rate environment by creating new digital products which gained traction among customers & wide acceptability. This helped Monzo in two ways :

- By adapting to changing consumer preferences due to economic conditions where customers were spending less. It's focus on data-driven credit models & products like Monzo Flex (a credit card with flexible payment options) helped it identify credit quality of customers & stay competitive in a challenging economic environment.

- Subscription revenue for products like Monzo Plus or Monzo Premium helped diversify income streams in a low interest rate environment providing it with much needed revenue

Customer Focused Offerings

In tough economic conditions, focusing on customer experience helps in enhancing customer loyalty which in turn drives growth. Monzo tailored it's support to individual customer needs using customer-centric approaches as below:

- Content Recommendation - Monzo uses content recommendation systems to analyze user behavior, transaction history & preferences. Based on this data, it provides tailored financial advice, such as budgeting tools, savings options & educational resources on improving credit scores & managing debt.

- Flexibility - Products like Monzo Plus & Monzo Premium are designed keeping different customer personas in mind. Customers who travel frequently can benefit from features like travel insurance & those focused on personal finance management can access advanced budgeting tools that categorized spending & credit score monitoring.

- Monzo introduced features like "Pots" which allowed users to set aside money for specific goals (e.g., holidays or emergencies) while keeping it separate from their main account.

- Proactive Vulnerability Support - Monzo allows customers to self-report vulnerabilities (e.g., mental health challenges, gambling issues etc) directly through the app. Based on this information, Monzo tailors it's services such as activating Gambling Block or limiting borrowing options to prevent customers from over borrowing

Managing Uncertainty

The business model followed by Monzo by having a digital focus & prioritizing customer needs helped in building customer trust to navigate the uncertainty created by Brexit.

Summary

In summary, Monzo launched during a period of moderate economic recovery but faced challenges from Brexit-related uncertainty, rising inflation, and slowing consumer spending. These factors shaped its focus on digital offerings & customer centricity.

With this we complete the impact of Macro-economic factors on a company's strategy & how decisions around products & customers are taken after considering these factors along with other environmental variables.

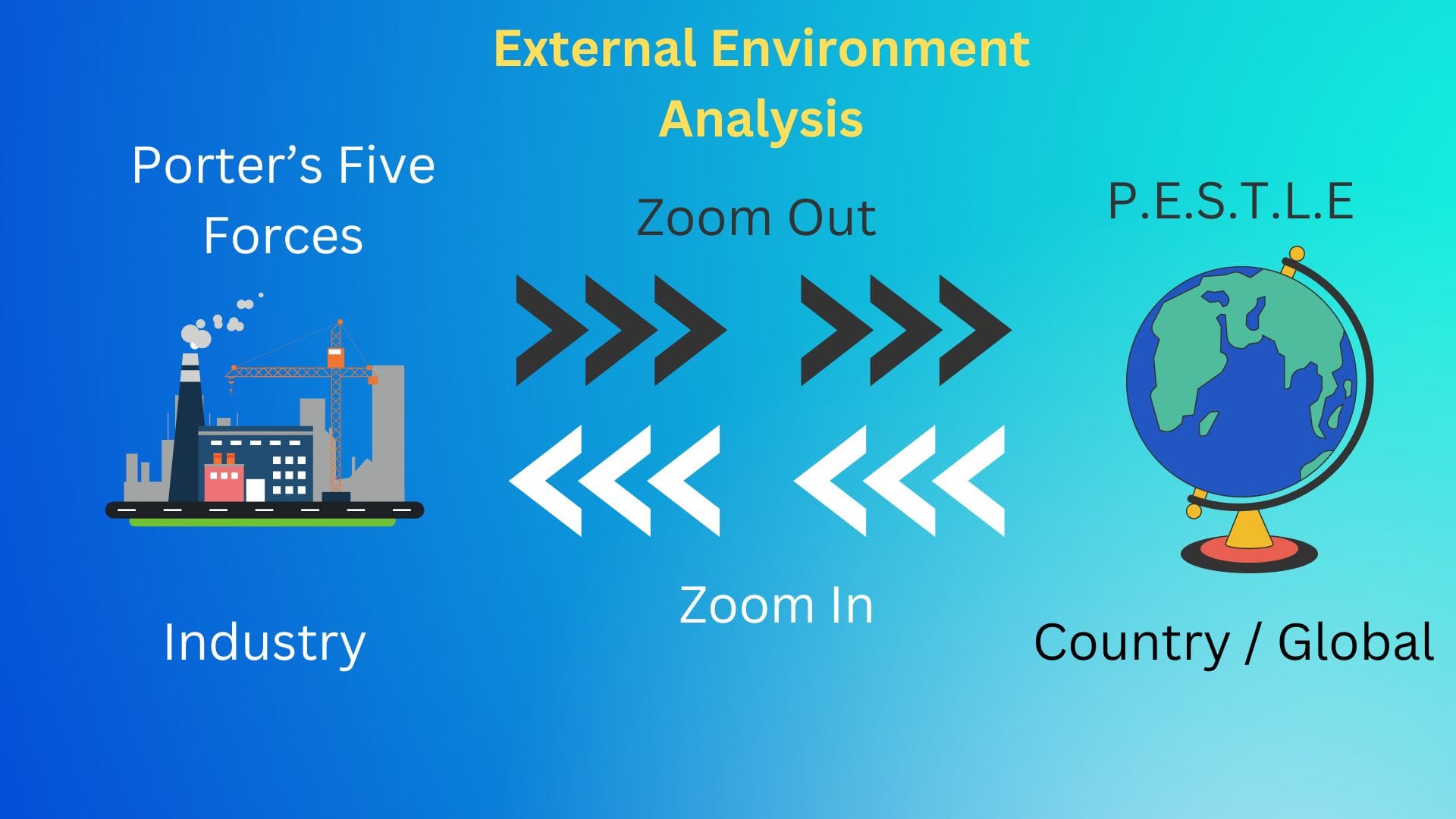

From next week, we zoom in from "E" of PESTLE Analysis for macro Economic variables to Industry Analysis.