Strategy Byte - Week 46 Porter's Five Forces

Table of Contents

- Recap

- Mindset for Five Forces

- Rivalry Among Existing Competitors

- Supplier Power

- Buyer Power

Recap

During Week 45, we introduced Porter's Five Forces using the analogy of a gourmet burger stall at a food festival. But first, the definition

The Five Forces is a framework for understanding the competitive forces at work in an industry & which drive the way economic value is divided among industry actors

There are two parts to this definition :

- Understanding the competitive forces at work in an industry &

- How it drives the way economic value is divided among industry actors

Without understanding the industry landscape (competitors, suppliers & customers) & how they interact with each other, a company cannot develop a strategy to survive & thrive in that environment.

Knowing who are the other players in the industry & what actions can they do to impact a company's market share / profitability & vice versa is critical to develop a strategy to navigate around such actions.

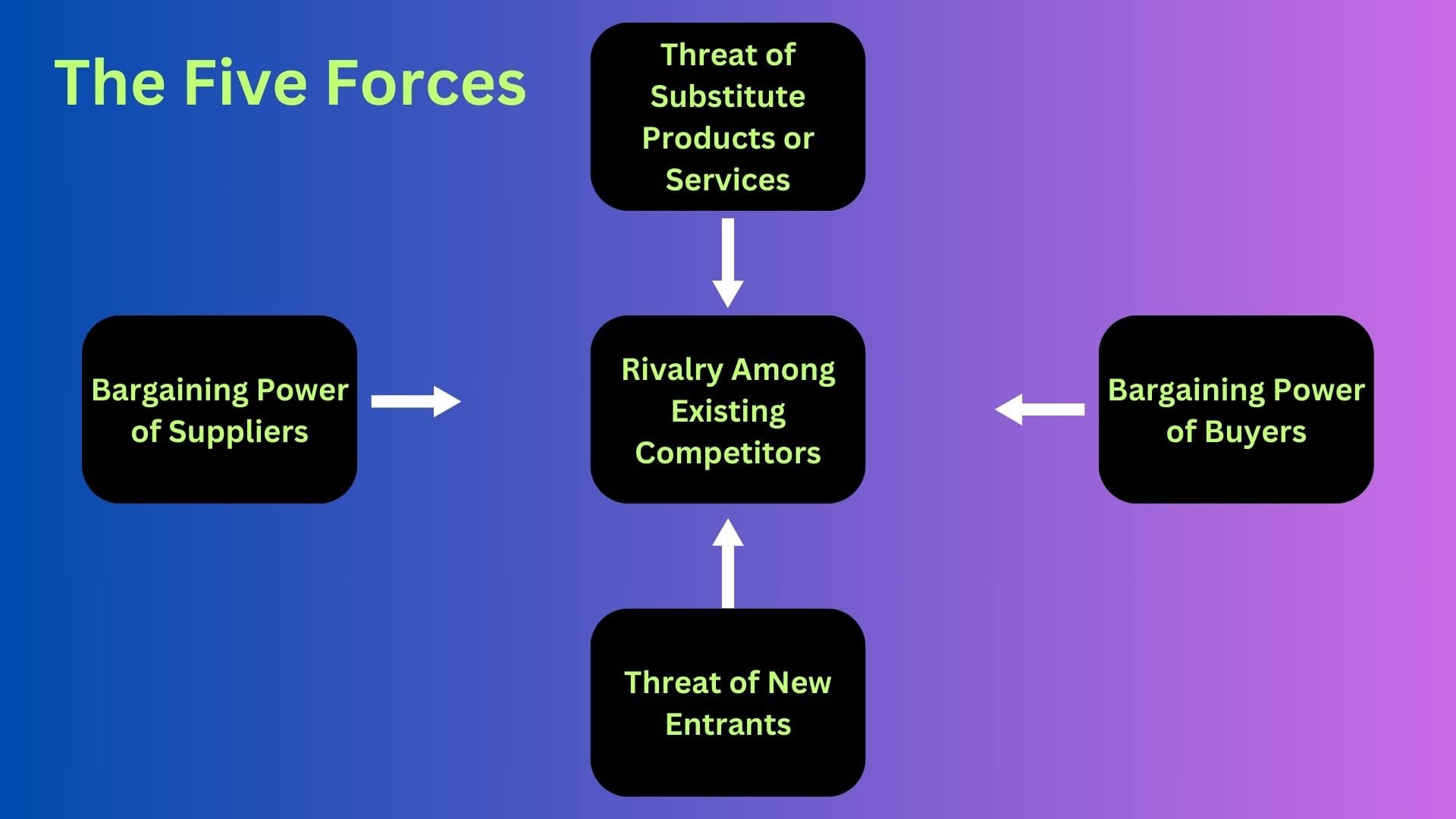

Let us visualize Porter's Five Forces :

Mindset for Five Forces

Before we get into understanding Porter's Five Forces, we have to understand that companies can be disrupted by their external environment in two ways:

- By Competitors themselves - If competitors release better products & do it more efficiently (at lower cost)

- By Disruption - If the entire industry itself is subject to disruption.

1 & 2 are not mutually exclusive in that disruption can be brought about by a competitor. But mostly industry disruption happens due to external forces disrupting a product or service in a way existing incumbents may not be able to replicate unless they fundamentally change their business model &/or systems & processes.

Fintech companies disrupting legacy banking is a good example of disruption happening right in front of our eyes. Legacy banks are saddled with old systems and related processes which they will find hard or almost impossible to change. This is the threat of new entrants. For e.g., Monzo & Nubank taking on legacy banking in UK & South America and thriving by increasing market share by focusing on customer service

AI disrupting / in the process of disrupting several industries is another example why companies should keep an eye out on the external environment & the direction in which industry forces are blowing

Mindset 1 - Environment

There are tons of literature online on Porter's Five Forces. So, we will not go too much into the theory but to have a foundational mindset of how to think about Five Forces, I would like to highlight the below excerpt from James Clear - author of the best selling classic Atomic Habits. (Source : here)

We underestimate the impact the environment has on our personality & the way we navigate through each twist & turn in our lives. But how we react to situations depends on the imprints from the environments that we were in the past & are framed from those experiences.

This is exactly what Michael Porter Five Forces alludes to when he explains about companies & how their strategies & actions need to be in tune with the external environment or industry forces.

When a company understands it's external environment or the forces affecting it's industry,

- It can fine tune it's strategy &

- Increase market share & boost profitability

- Which helps it stay ahead of competition

A company can take action to leverage it's competitive advantages & work on it's weak points to ensure it takes the right steps to maximize it's odds of success based on how the five forces interact with the company & with each other.

Mindset 2 - Tension

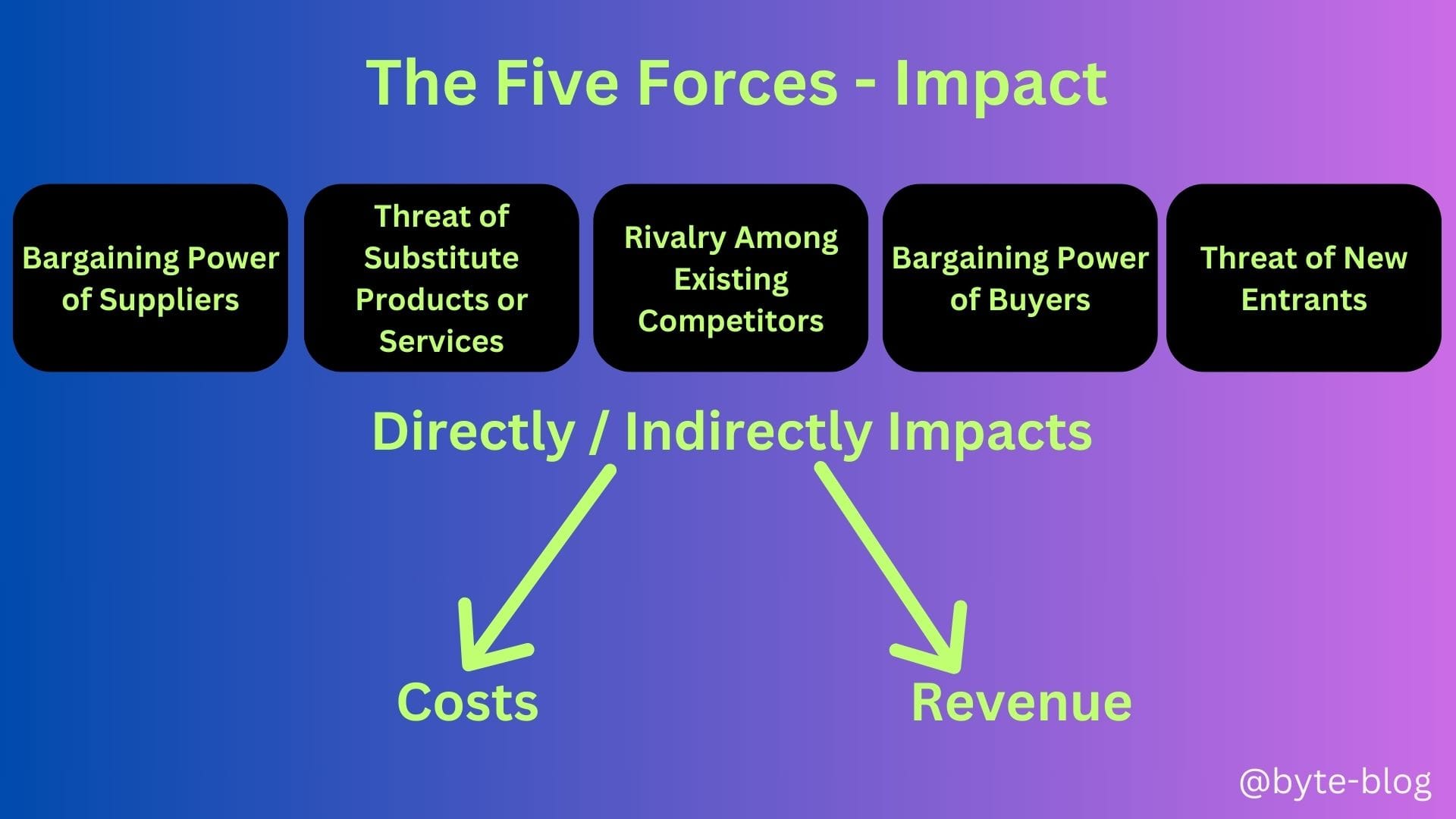

Once we understand all the five forces, we can see a common thread between them all - It is that any or all of these five forces impact one or both of the below critical performance indicator of any company-

- Revenue

- Costs

There is always a tension between these two & trying to extract maximum revenue with minimal cost is any CFO's holy grail.

Strategy is Identifying the impact of these Five Forces on Revenue & /or Costs and how to maintain or increase profits (By increasing revenue & / or reducing costs) by navigating these forces to our advantage.

Also, within costs, the type of costs (fixed or variable) impacts decision making in term of the direction to take. For example, if the proportion of fixed costs is higher than variable costs due to high capacity (e.g., a large production facility), it can work both ways -

- In case of increasing demand, higher capacity helps the company to scale faster in line with demand. If more goods are sold, the fixed costs get divided over larger goods sold effective decreasing cost per unit

- However, if demand falls or does not pick up, the company is stuck with higher fixed costs which will drag down its profitability.

Visualizing the above :

Let us scan through each of these forces with real life examples.

Rivalry Among Existing Competitors

Every industry has companies which compete with each other for customers & market share. Now, how intense is the competition defines pricing & profitability of the companies within that industry.

This force refers to how companies compete with one another in a particular industry & how this competition impacts profitability

Companies in intensely competitive industries compete with each other through cut throat pricing, more advertising, increased offers & discounts & better customer service.

The issue here is that such intense competition especially price cuts leave everyone worse off. This means companies in this industry will earn nil or minimum extra returns over their cost of capital which means the industry average profitability % will be very low.

Value capture happens through the pricing of the company's product or service. This pricing is dependent on the industry structure meaning if the industry is highly competitive with low barriers to entry, then the competition is cut throat & the pricing will be so low that margins will be minimal or zero. So, the value added by the company to the product or service is not captured by the company through pricing..

For instance, industries like airlines, textiles, and steel face intense competitive forces, resulting in lower average profitability, while sectors such as medical supplies, soft drinks, and toiletries experience milder competitive pressures and consequently enjoy higher returns. (Source : here)

Supplier Power

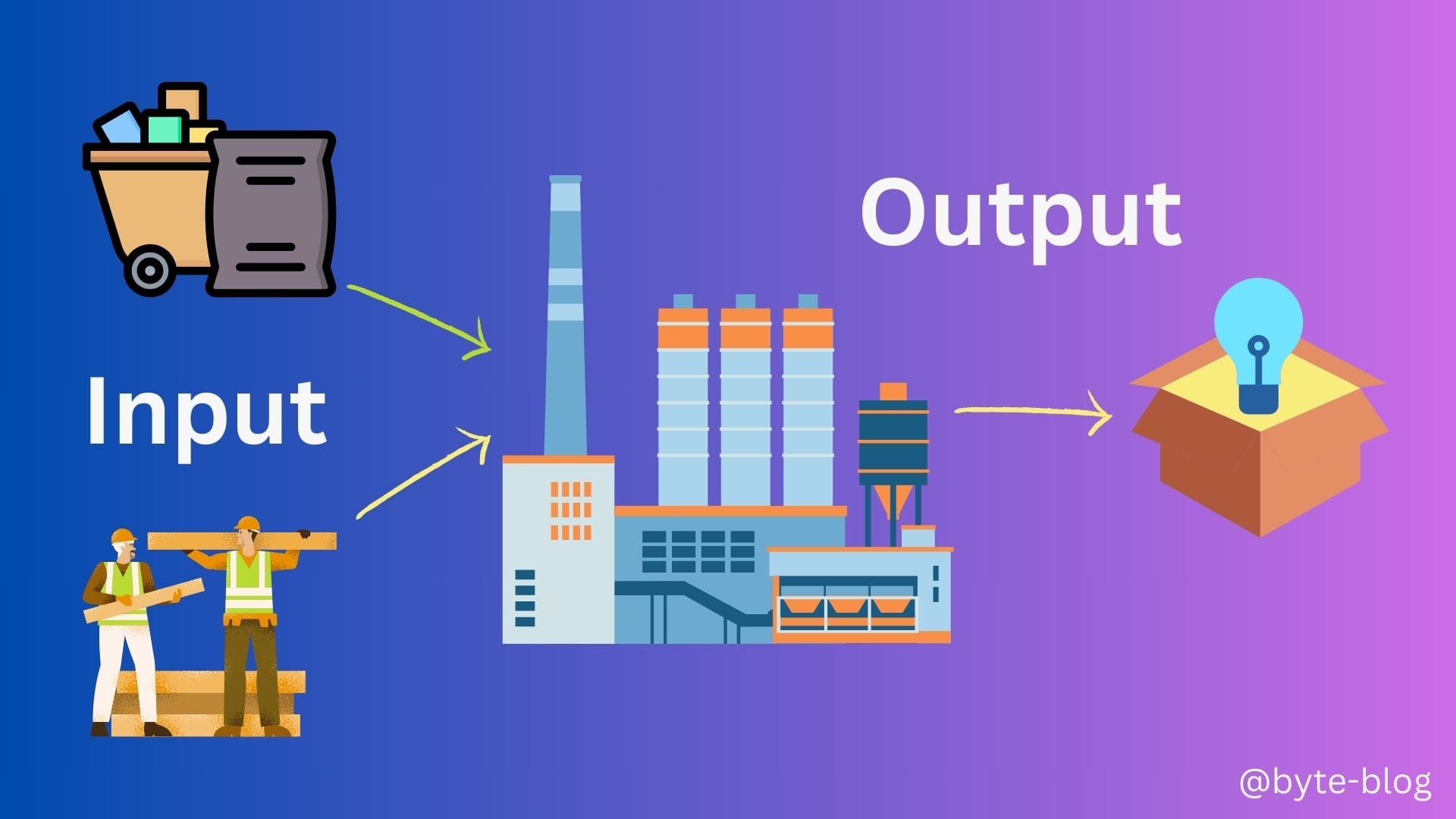

What does a company actually do? In very simple terms, it takes a bunch of inputs & produces outputs using :

- Capital - Resources used to produce goods & services

- Labor - Time & Effort people contribute to produce goods & services

In the process, raw materials or intermediate goods are used by the company as inputs to produce the required outputs. Where do these raw materials or intermediate goods come from? - Suppliers.

Visualizing the above,

Supplier Power refers to the influence suppliers have over businesses in an industry, particularly on pricing, quality & supply of inputs.

Suppliers can exert bargaining power over companies in an industry by

- threatening to raise prices or

- reduce the quality of purchased goods or services

thus increasing costs for the company purchasing from such suppliers.

Some questions to consider :

- How powerful are these suppliers in relation to the company on the terms & conditions on which these materials are sold to the company?

- Is the company able to negotiate suitable discounts from suppliers? Are they treated in line with other companies?

- Is the supplier the only one which provides the required material or are there other suppliers which the company can substitute in case something goes wrong?

- Are they capturing disproportionate value by charging high prices for their materials?

If the suppliers hold an advantage or strong position relative to the company, then the impact of suppliers on the company's strategic positioning & value capture is strong.

A good example of supplier power is AI Companies like Open AI, Anthropic etc.

The bargaining power of suppliers for OpenAI is high, driven by its reliance on a few cloud providers, specialized AI chips, scarce AI talent, and proprietary datasets.

Such companies rely heavily on Microsoft Azure for cloud infrastructure and computing power. Training and deploying large AI models, such as GPT-4, require massive amounts of GPUs (Graphics Processing Units) and TPUs (Tensor Processing Units), which are primarily supplied by a few key players like NVIDIA, AMD, and Google (for TPUs). (Source : here)

Buyer Power

The other end of the spectrum is the company's customers. A company exists or creates products & services for it's customers.

Buyer power refers to the influence customers have over a business's products & services mainly pricing & quality.

Buyers compete with the industry by

- forcing down prices through bargaining,

- asking for higher quality or services &

- playing competitors against each other.

These actions impact profitability negatively by increasing costs or reducing revenue.

Buyers hold an advantage or strong position relative to the company if among other reasons,

- they can easily find the same value from competitors &/or other like products (substitutes) & move to those products

- if customers are concentrated and buy in bulk.

For e.g., The bargaining power of buyers in OpenAI’s industry is moderate to high, depending on the customer segment. OpenAI serves a diverse range of buyers, including individual users, businesses, developers, and enterprises, each with different levels of influence. Factors such as alternative AI solutions, pricing sensitivity, switching costs, and regulatory concerns all impact buyers’ power over Open AI.(Source : here)

Next week, we look at the remaining two forces -

- Threat of Substitute Products

- Threat of New Entrants

And we will also dissect the cost & revenue impact when considering each of the five forces.