Strategy Byte - Week 50 Strategy & Finance

Table of Contents

- Introduction

- The Fascination

- The Inspiration - Playing to Win

- The Framework

- The Compass - From Strategy to Finance

Introduction

It's been 50 posts on Strategy. Thought I will do a slight detour from Industry Analysis to my reflections on the topic as a finance professional.

It's been a long journey trying to decode the topic of strategy & I'm still learning. As I mentioned in one of my earlier posts, strategy is every problem solver's dream come true. Why? The complexities involved in driving an organization's ( or even one's personal) strategy forward is immense. Why?

An organization needs to move forward & continue adding value to customers in an environment where the variables constantly shift. The shift in variables can be internal or external A good example of shifts in external variables is the current US administration's trade policy & internal variable is change in management. The variables can also be something whose impact can be felt immediately like trade policy, competitor moves, market changes etc or whose impact is not immediate but will substantially impact the near future. For e.g., impact of AI on business models & jobs is being widely debated & can be considered an external variable with capability to significantly influence the way companies function.

An organization (or even an individual for that matter!!) has to be constantly on the vigil to ensure they continue to thrive, prosper & add value to customers in a constantly changing environment.

Without a strategy, it's more like throwing spaghetti to the wall not knowing where it will hit (From Roger Martin).

The Fascination

I was always fascinated with the topic of strategy. I've interacted with strategy consultants on numerous occasions. I saw companies relating Strategy with Vision, Mission statements & thought that was strategy. But was it?

To give context, I've been in corporate finance all my life & a hard core number junkie. I love seeing numbers flow out of excel spreadsheets & whisper what they mean.

Whenever I interacted with strategy consultants & read through their reports, I was always viewing it through the lens of numbers. It was always market share %, growth %, trends in balance sheet, income etc. But is that strategy? No.

Why was I viewing their reports through numbers only? It is because we finance professionals are trained to :

- View numbers from different angles

- Identify issues or anomalies from numbers or trends in numbers

- See why those issues or anomalies arose &

- Identify & rectify or escalate to rectify the problem

In any professional finance course, we are trained through standards, frameworks & rules to report numbers with the intention of

- reporting performance (through income statement)

- reporting long term financial health of the business (through balance sheet) &

- reporting short term financial health of the business (through cash flow)

So, all I could see was numbers, numbers & numbers. We start with compliance & reporting and get stuck in that loop for a long time.

Then I moved to the other side of the table, being part of business & driving numbers through insights which gave me a better perspective on strategy.

Now, don't get me wrong. The compliance & reporting function is the baseline for everything. Without this training, we would be utterly useless if we don't have the qualification & experience to understand numbers & report performance. We will not know whether an organization is performing as required or not.

We have to keep seeing the numbers day in & day out to identify anomalies & report them pro-actively before they escalate to bigger issues.

But then, I knew strategy was much more than numbers yet very closely connected to numbers. But I missed that link & then I read

- "Playing to Win" by Roger L Martin & it changed my entire perspective on Strategy &

- Secret CFO posts on Strategic Finance

The Inspiration - Playing to Win

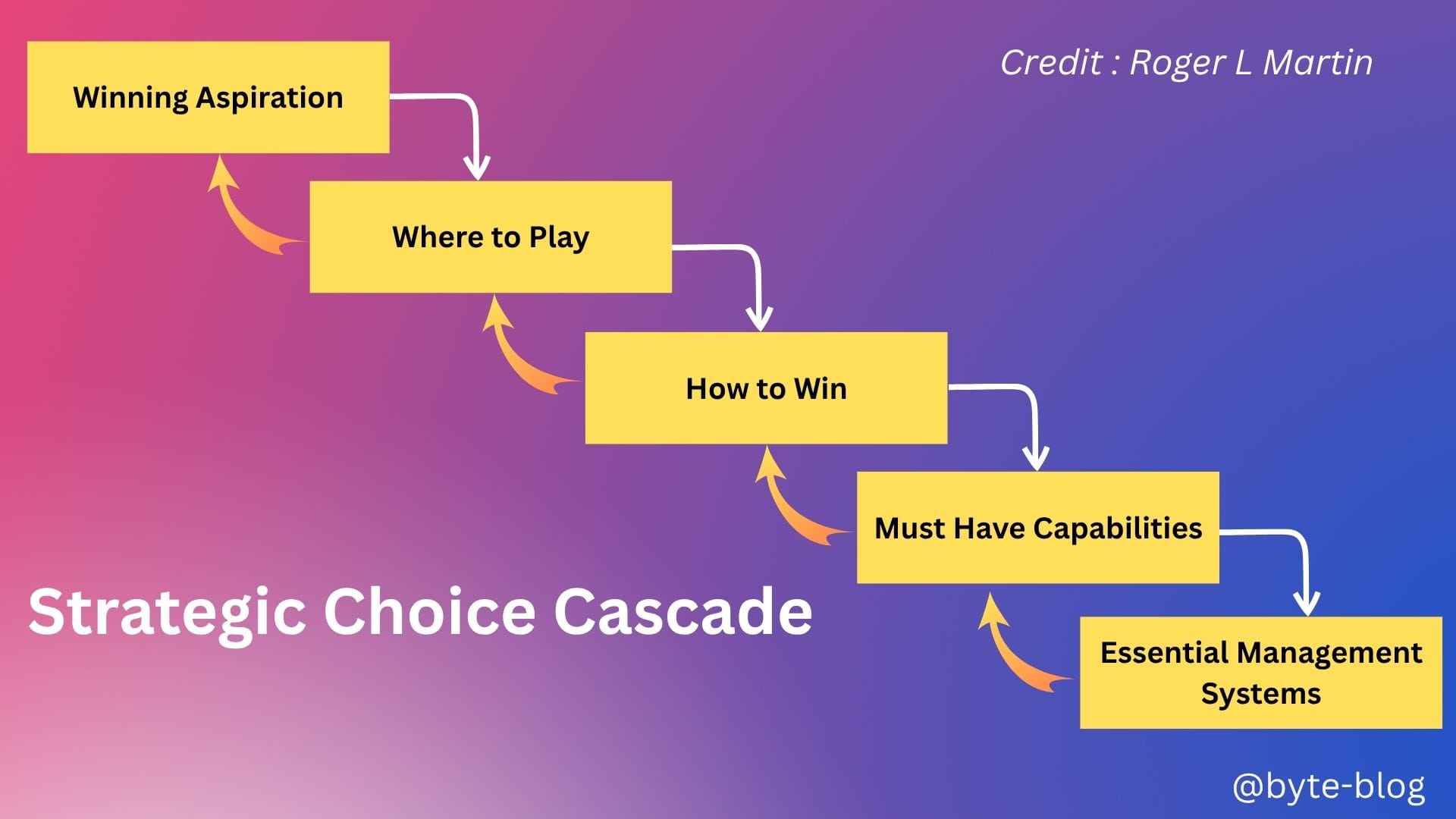

Roger L Martin is a leading management thinker & author of many strategy books including "Playing to Win", a no-nonsense, straightforward book on strategy with a reality check. It was the first book I read on strategy which didn't have esoteric concepts. It was a straightforward series of steps as below :

The book is full of deep-dives & case studies on each step. At a higher level, it means :

- An organization should have a Winning Aspiration - a reason to exist & how it will add value to customers

- Where it will play - Identify market or geographical segment of customers who it will serve

- How to win - What actions it needs to take to serve it's customers in the best possible way & better than competitors & peers.

The first three drive the direction a company takes to achieve it's aspirations.

The next two drive the reality check needed to see if the company has what it takes to move towards it's aspirations & the systems it needs to achieve them.

- Must Have Capabilities - What capabilities does it need to develop to win in the area where they decided to play?

- Essential Management Systems - What systems are required to develop these capabilities?

Then, as an organization goes through each box, it finds something is not right & then toggle back to the previous box or boxes, fix the anomaly & then go back. That is denoted by the orange arrow moving back.

When all the choices fit together, the organization has a strategy with systems to drive it forward. But then, it is not something written in stone. As the environment variables change, each of the boxes need to be reviewed to see if any of the decisions need to change to ensure the organization achieves the aspiration it sets.

The Framework

This gave me a framework to move forward with my study of strategy. I read numerous books with amazing frameworks which gave me better perspective on the practice of strategy & which helped me in my direction to understand strategy but this framework remained.

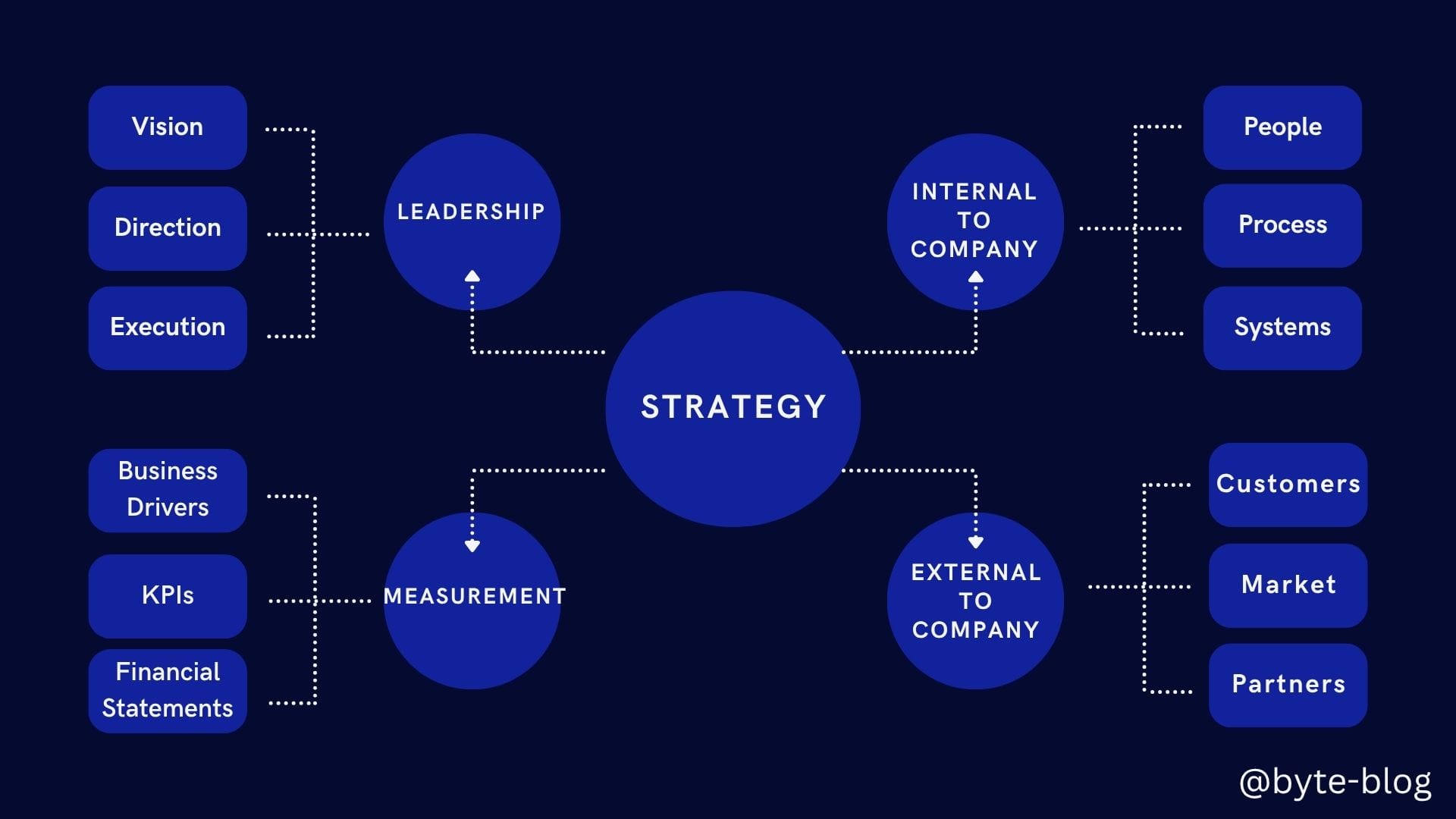

I developed my own framework to study strategy which I shared numerous times to understand the environment variables & it's relationship with an organization's strategy. My framework for understanding the topic of strategy is visualized below:

We started with the "External to Company" part & still exploring it under "Industry Analysis".

Now what does the above have to do with finance? In the framework above, finance comes under the "Measurement" part of the diagram above.

As finance professionals, we are uniquely placed to contribute to an organization's strategy & give it direction like a compass. How?

The Compass - From Strategy to Finance

What does the Finance department do in any organization? Let us start from the base & move upwards :

- Responsible for recording transactions in a proper way.

- Collate these transactions under categories based on accounting principles

- Report these categories on a periodical basis to see

- Whether the organization is making profit or loss

- Whether the organization is in a long term healthy financial position or not

- Whether they have enough cash to carry on their business

- These reports can be

- Internal - to inform management on whether the company is going on the right track to achieve their objectives or

- External - to report to external stakeholders as per regulatory & financial reporting requirements.

- Prepare Budgets with stakeholders to drive towards improved performance

- Forecast how the business will perform with market assumptions

- Fulfill regulatory compliance filings & investor management

There are more, but the above covers more or less at a high level the major responsibilities of a corporate finance unit. But where is strategy?

Nowhere in particular but it's everywhere. How?

All the measurements that we as finance professionals do is to check whether the organization achieved it's budget or not with the reasons for variance. Most of the time goes in extracting numbers, reconciling & checking for errors that the main focus will only be in presenting the budget vs actual comparison without sufficient time for analysis. This is mostly due to staffing or system issues.

We report numbers but do not see or think the context against which these numbers need to be reported.

For e.g., the finance department of a manufacturing entity may report unit costs & breakeven numbers to management. But what is it's context? Where are we placed vis-a-vis the competitors? Are we better than the competitors? What is the industry average? Is the industry having overcapacity or is there scope to grow?

But the irony is that we have to go through the grind of looking at numbers day in & day out and understanding it's flow & nuances to get a "feel" of how the company performs. It's like getting a pulse of how the company is performing.

Then once we get a "feel" for the numbers, think of how these numbers stack up in terms of whether the company is moving in the right direction as per the strategic aspiration or not.

Unless we do the grind of reporting & seeing the numbers day in & day out, we will not understand the nuances behind those numbers. And understanding these nuances help us to correlate these numbers & how they stack up in terms of performance vis-a-vis strategy.

From Secret CFO's posts on Strategic Finance, the relationship between Strategy & Finance was beautifully laid out. It all starts with

- Strategy then moves to

- Long Range Planning Process & then to

- Budget cycle which is then incorporated into the

- FP & A (Financial Planning & Analysis) Cycle.

To be clear, the owner of an organization's strategy is the CEO & the responsibility of delivering the strategy lies with each of the C-suite leaders. Every transaction which drives an organization strategy shows up in the numbers.

Roger Martin wrote in his medium article on "How to Become a Strategic CFO" that the CFO can help in strategy by "being a master of the strategic economics of the company" which means understanding the dynamics of revenue & costs & their interaction in producing profits (or lack thereof).

It's the CFO who like a compass:

- has the capacity to dive deep into numbers & come out with insights based on their deep understanding of the economics of the company & industry

- correlating the numbers to the external & internal variables

- to ensure decisions are taken in time for the organization to deliver on the strategy.

How?

By tracking & monitoring financial performance with lead & lag indicators and relating it to strategic aspiration & industry analysis to see where the organization is placed in the industry & giving the direction needed to improve or change course where required.