Strategy Byte - Week 60 Horizon of Uncertainty

Table of Contents

- Recap

- The Horizon of Uncertainty

- Exploit vs Explore

- Turn to the Future

- Customer Impact

- References

Recap

During Week 59, we discussed the third point in our framework (in bold) :

- What are the current trends in the industry & it's challenges?

- What trends or underlying currents are expected to change or disrupt the status quo?

- How are companies looking at these trends & what are they doing about it?

- What do these disruptive trends mean for the customer?

We saw that disruption has been a constant factor throughout history. From Ford introducing the assembly lines for automobiles which disrupted the horse carriage industry to automation in the 1970s & internet in the 1990s, disruption has changed not only our way of life but our perceptions & social conditioning.

We discussed how companies look at these disruptive situations through two lenses :

- Profit Pools &

- Exploration vs exploitation

We explored Profit Pools last week as :

A profit pool is defined as the total profits earned across all points of any industry's value chain.

Understanding profit pools provides insights into sources of profits or which activities of the value chain contributes to the profits & companies can take action accordingly to increase it's profitability.

Then we explored profit pool shifts where understanding profit pool trends over time shows how the industry evolved over that period of time.

- What were the sources of profitability previously or legacy profit pools?

- What changed in the industry - disruption or externally imposed changes like regulation?

- What are the new drivers of profitability or emerging profit pools?

In an industry undergoing transformation, the source of profits or profit pools will change. The activities which are a source of profit or margin today will dry up & new sources of profit or margin will arise as a result of disruption / transformation.

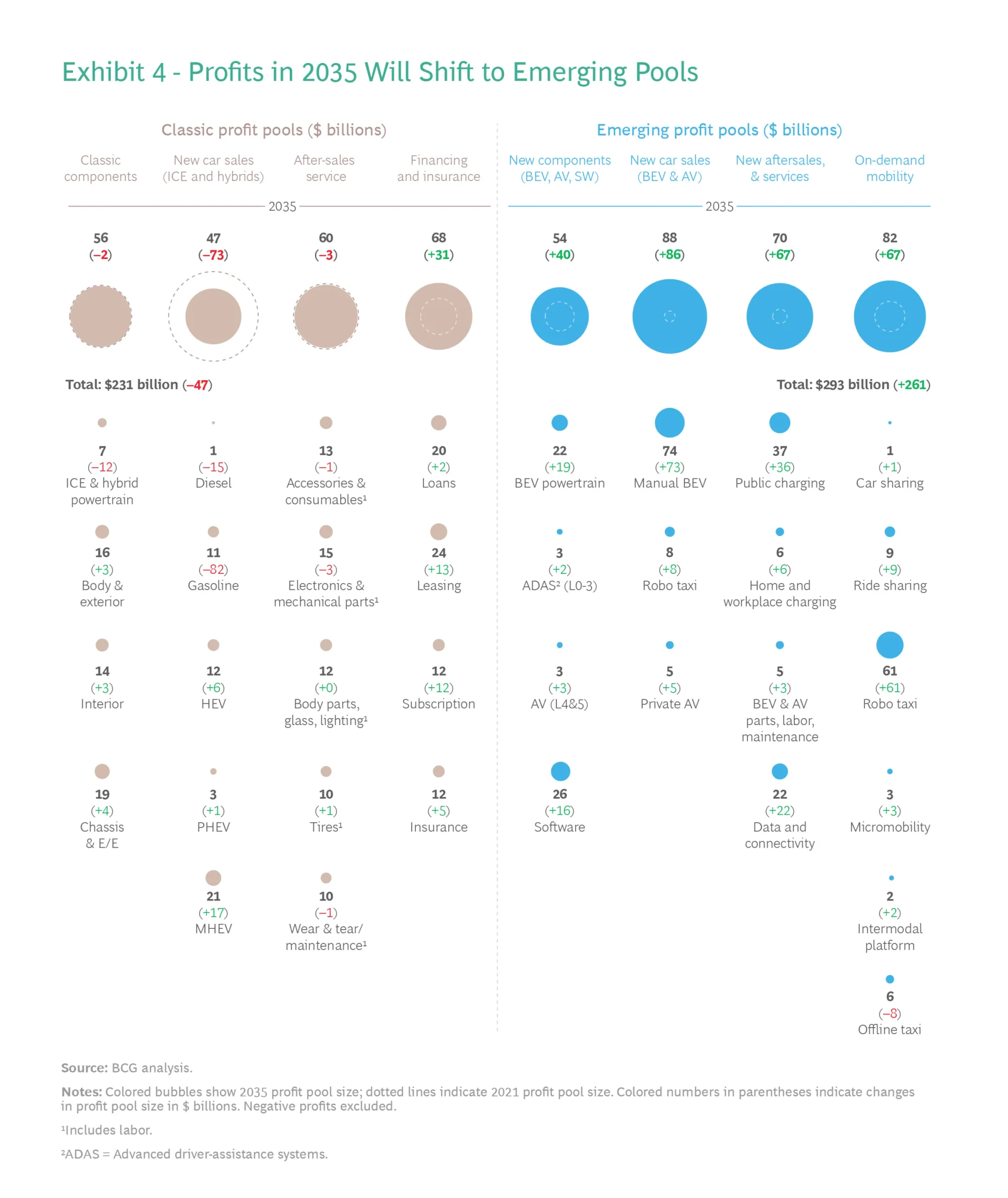

We then explored the current & emerging profit pools of the automotive industry (see visual from BCG below).

Now that we saw the disruptive trends & how the profit pools are shifting, how will companies navigate a volatile & disruptive external environment?

What we all see in an atmosphere of change is the horizon of uncertainty.

The Horizon of Uncertainty

This is the literally where the use of tools, analysis (markets & competitors) & strategy frameworks ends and the horizon of uncertainty opens in front of us. Questions arise such as :

- What do the underlying disruptive trends mean?

- In which direction are the trends moving?

- Are the trends sustainable or temporary fad?

- What does it mean for companies with existing businesses which are profitable & generating cash?

- How do companies move ahead of the wave of disruption?

How do we tackle these questions? How do we prepare ourselves to be relevant in the changed environment & also ensure we are prepared for the next wave of change. Change is inevitable & is the only constant (other than death & taxes!!) which affects one & all.

No one knows which changes are going to last & which changes are temporary. To answer these questions & many more, it is not enough just to have frameworks & tools in place in the name of strategy.

The mindset required to carry on an existing business profitably with environmental variables which are known & predictable is different from the mindset needed to navigate a new environment where the environmental variables are changing & new paradigms are being created. This is the the exploit vs explore mindset. Let us dig deeper

Exploit vs Explore

The objective of any business enterprise is to serve customers & do it profitably. It may have one or more business models to carry on it's activities.

In an environment where the variables are not significantly volatile, an enterprise can carry on it's activities for a long time without changing itself. E.g., utility companies.

But what about companies where change is a constant factor & their existing business models are under constant threat of becoming obsolete? In some cases, the environments move too fast that they will not be aware that their business models have already become obsolete.

In such cases, there needs to be a mindset to explore in addition to exploit. What does this mean?

Companies making profits from their existing business models by "exploiting" their resources. Now, exploit in this case means use the resources efficiently & not in a negative sense. Companies allocate a good percentage of their capital to existing profitable operations. If we take the automotive sector, companies like Toyota utilizing their resources to carry out their manufacturing or logistics operations in an efficient manner & doing so profitably is "exploiting" their current business model.

The "explore" mentality is where companies go beyond their existing profitable operations & divert some capital to activities which are beyond their existing area of competence or adjacent to their existing operations. There is no guarantee when those investments can generate returns or if it will generate returns at all. But then not going beyond their area of competence will render them irrelevant sooner than later.

I came across this concept first when reading one of Roger's blog & I was fascinated by it. It reflects the mindset required of a strategic thinker to ensure they are ready to make the choices & trade-offs in the face of uncertainty.

Some key points from his blog are :

- All organizations operate in two contrasting modes :

- Exploitation - which is about doing things which the entity is proficient in more intensely & incrementally better than previously

- Exploration - which is about doing new things or things at which a company is currently not good at

- The exploration path :

- fraught with twists & turns

- is harder to predict &

- there is often a gap between effort & results

- Exploitation is more straightforward, faster acting & rewards come sooner.

But the problem with exploitation is that it works as long as the competitive environment is stable. Once the stable environment is subject to disruption by an existing competitor or a new entrant, exploitation stops working.

But do we know what lies beyond the turn or what the future looks like to know where to explore?

Turn to the future

We don't know what lies beyond the turn or what the future will look like.

Over the past couple of weeks, we explored the automotive industry from

- It's current business model,

- Analyzed the numbers (market share, EBIT etc)

- Identified trends disrupting the industry &

- Explored the new expected areas of profitability or profit pools.

But are those profit pools certain? If yes, when would companies see return on investments against such exploratory investments?

We saw the below chart from BCG last week:

Nothing can be predicted for certain but the direction is becoming clear. Automotive companies are allocating huge amounts of capital to new areas. They are accelerating investments in electrification, software, digital platforms & new mobility models.

Massive Electrification & Battery Investments

OEMs like Volkswagen, BMW, BYD, and Tesla are investing billions in EV platforms, batteries, and charging infrastructure to compete with Chinese EV makers and new entrants. E.g., Volkswagen is investing €180 billion (2023–2026) in electrification, digital, and battery R&D, with a focus on launching new EV models annually & BMW plans to spend around €30 billion in 2025 alone on EVs, charging tech, and digitalization, with a new R&D center dedicated to EVs and software

Enhanced R & D

Traditional and Chinese OEMs are increasing R&D spend year-on-year, with a focus on software, autonomy, and platform development. For example, Tesla invested $4.5 billion in R&D in 2024, BMW about €9 billion, and BYD over $7.5 billion.

These investments are directed at AI, software-defined vehicles, and advanced mobility services to avoid falling behind tech-centric competitors.

Diversification into Mobility Services

Most OEMs are expanding into new mobility services (ride-hailing, car-sharing, robo-taxis), partnering with tech firms or launching new ventures to capture future profit pools. For e.g., Volkswagen (MOIA), and Daimler (Mercedes-Benz Mobility).

Partnerships & Acquisitions

To accelerate capability, OEMs are partnering with tech firms and startups: BMW with AWS, VW with Microsoft, etc. Several OEMs are acquiring AI and autonomy startups to fast-track exploration projects.

What does this all mean for us, the customer?

Customer Impact

Some major areas where customers are impacted by all these changes are :

- Customers now have access to a wider range of EVs, capable of going longer ranges, faster charging & lower maintenance costs

- Mobility services (like ride hailing, car-sharing & subscription models) changes the paradigm of vehicle ownership to pay-per-use access to vehicles & subscription services.

- Connected car technologies allow for remote diagnostics & predictive maintenance, saving customers time & ensure better maintenance

- Better safety through new features such as collision avoidance & real-time connectivity

- Last but not the least, the shift to digital platforms lets customers receive new upgrades & features without having to purchase a new car.

With this we end the detailed analysis of the automobile industry which we started in Week 49