Strategy Byte - Week 62 The Journey so Far Part II

Table of Contents

- External Analysis Framework

- Systems Thinking

- P.E.S.T.L.E

- Gross Domestic Product (GDP)

- Balance of Payments (BoP)

We continue our journey to understand strategy by looking back & reviewing our steps which will help us to gain perspective on the subject & also guide us moving forward.

When we try to frame competitive landscape, it doesn't just mean competitors & customers but vendors, suppliers in the same country or different countries where goods or services are exported to or imported from those nations.

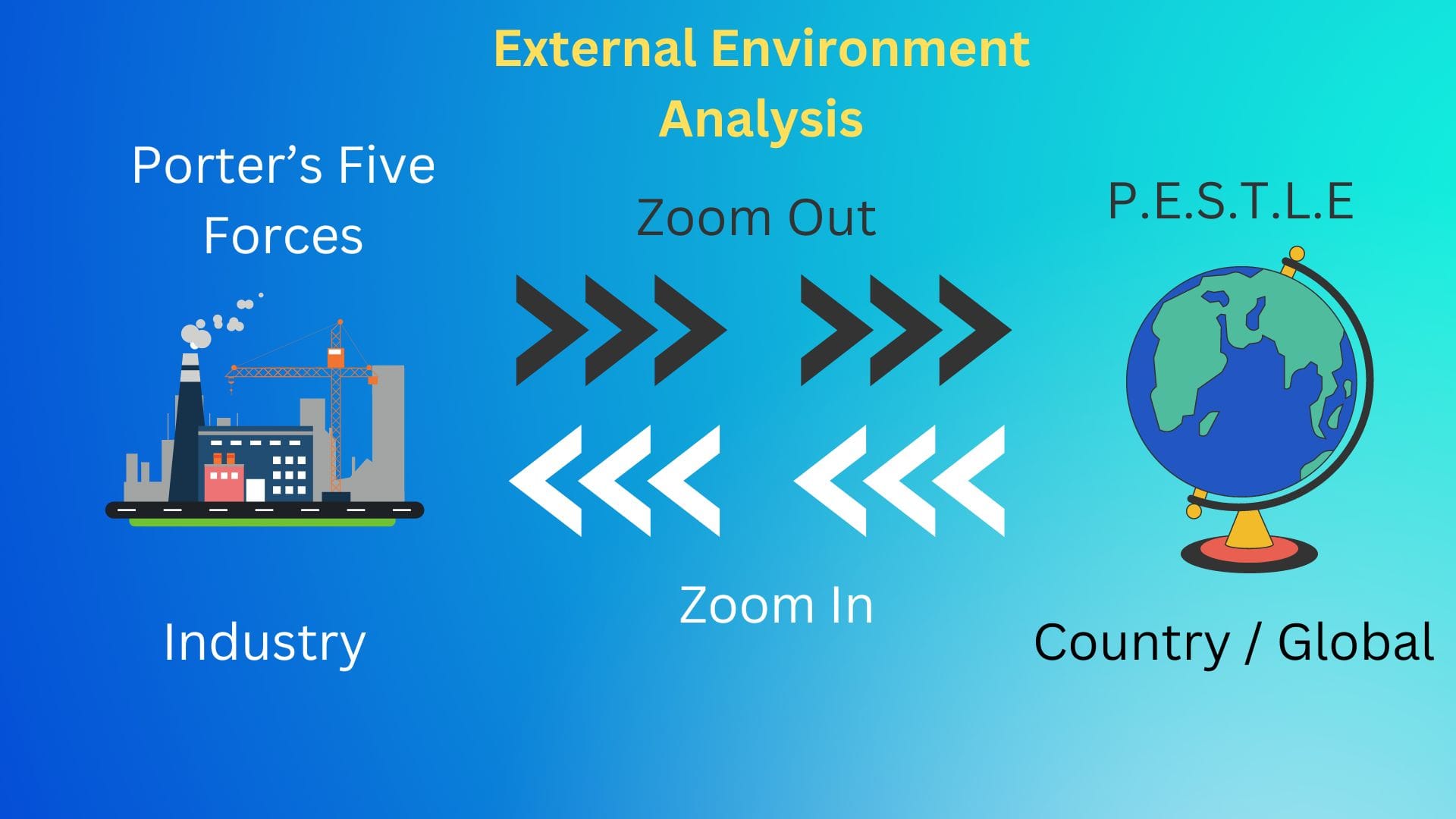

That means the strategy canvas moves from local to national to global which we framed as "External Environment".

External Environment is where a company deploys it's resources & uses it's competitive advantage to earn an economic return over & above it's competitors when serving customers in the best possible way. It is the Where to Play as defined by Roger L Martin in his book Playing to Win.

Why do we analyze the External Environment?

There are industry or market forces within the control of an enterprise & also outside it's control. It is critical to understand these forces & how they affect the environment where the company chooses to play & in turn, the choices it makes, shaping it's strategy.

External Analysis Framework

We started from Country / Global Environment using P.E.S.T.L.E with a focus on Economics, especially certain key macro economic variables :

Before we dived into tools & concepts, we asked "How should we think about all this?". Just diving into tools & concepts without clear thinking is like using a hammer & nail without an idea of what you want to build or in this case, understand how it all works.

To do that, we dove into "Systems Thinking"

Systems Thinking

Understanding the forces that impact the External Environment or competitive landscape is critical. But it does not stop there. It is important that

- We understand the economic variables impacted by these forces &

- We then analyze the impact of the changes in these variables to the global environment, industry or business in which a company operates. What effect can result from these changes & forces? What should a company do in face of such changes.

This calls for a way of thinking called Systems Thinking.

What is Systems Thinking?

Systems Thinking is a vantage point from which you see a whole, a web of relationships, rather than only focusing on the detail of any particular piece, Events are seen in the larger context of a pattern that is unfolding over time.

Systems Thinking is a perspective of seeing & understanding systems as wholes rather than as collection of parts. A Whole is a web of interconnections that creates emerging patterns.

Since systems thinking is an ocean by itself, for our purpose, we focused on two concepts :

- Feedback loops &

- Causality

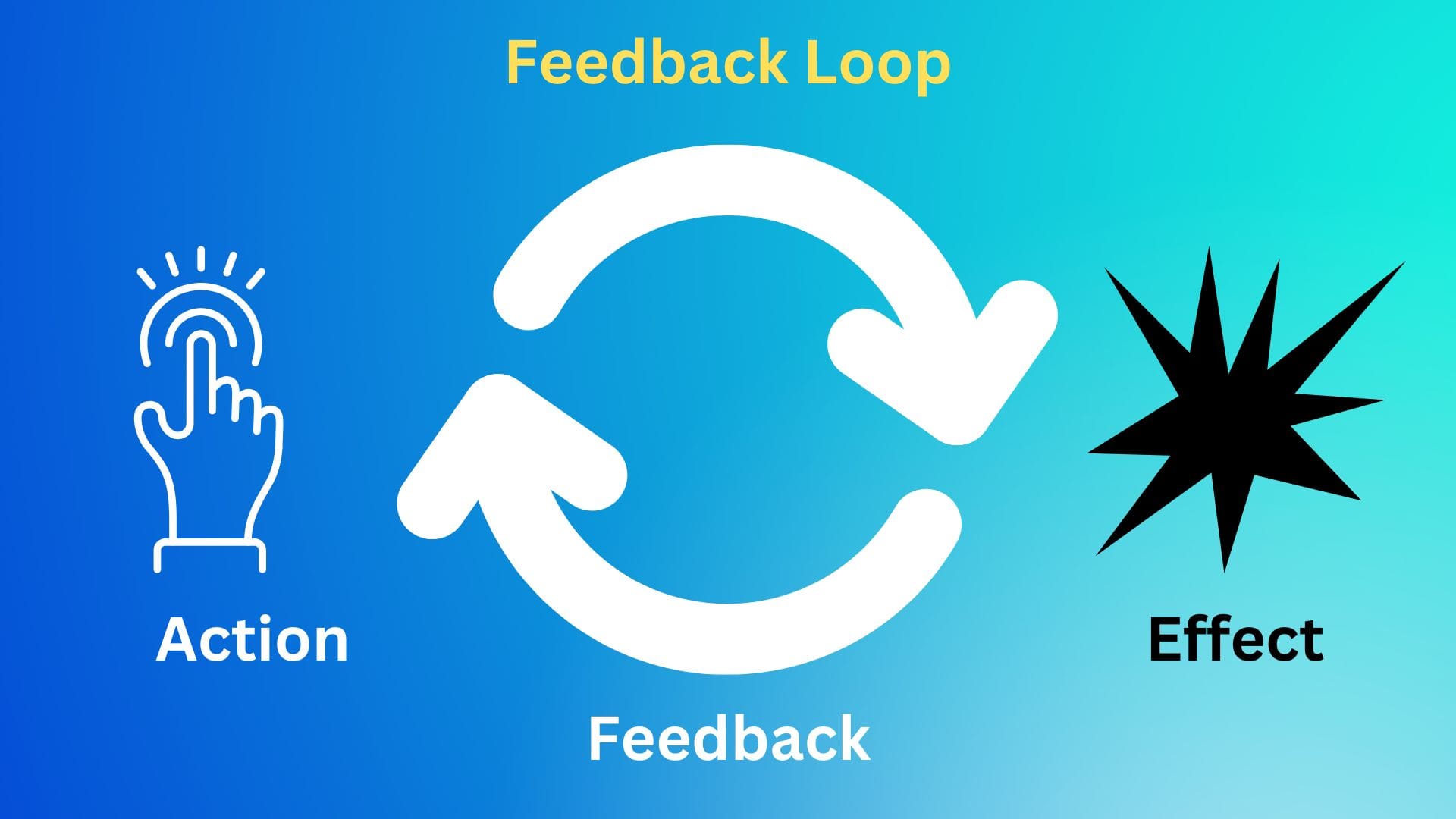

Visualizing feedback loop which is straightforward :

Feedback Loop

As a simple example of feedback loop, Central Banks do certain actions in line with their mandates like :

- When Inflation is high & above Central Bank target rate

- Central Banks raise interest rates

- High Interest rates increases cost of borrowing & reduces economic activity which is a feedback

- Reduced economic activity reduces spending by Individuals & Firms which is another feedback

- This brings down inflation

- Based on this feedback, Central Banks reduce interest rates to increase economic activity & so on.

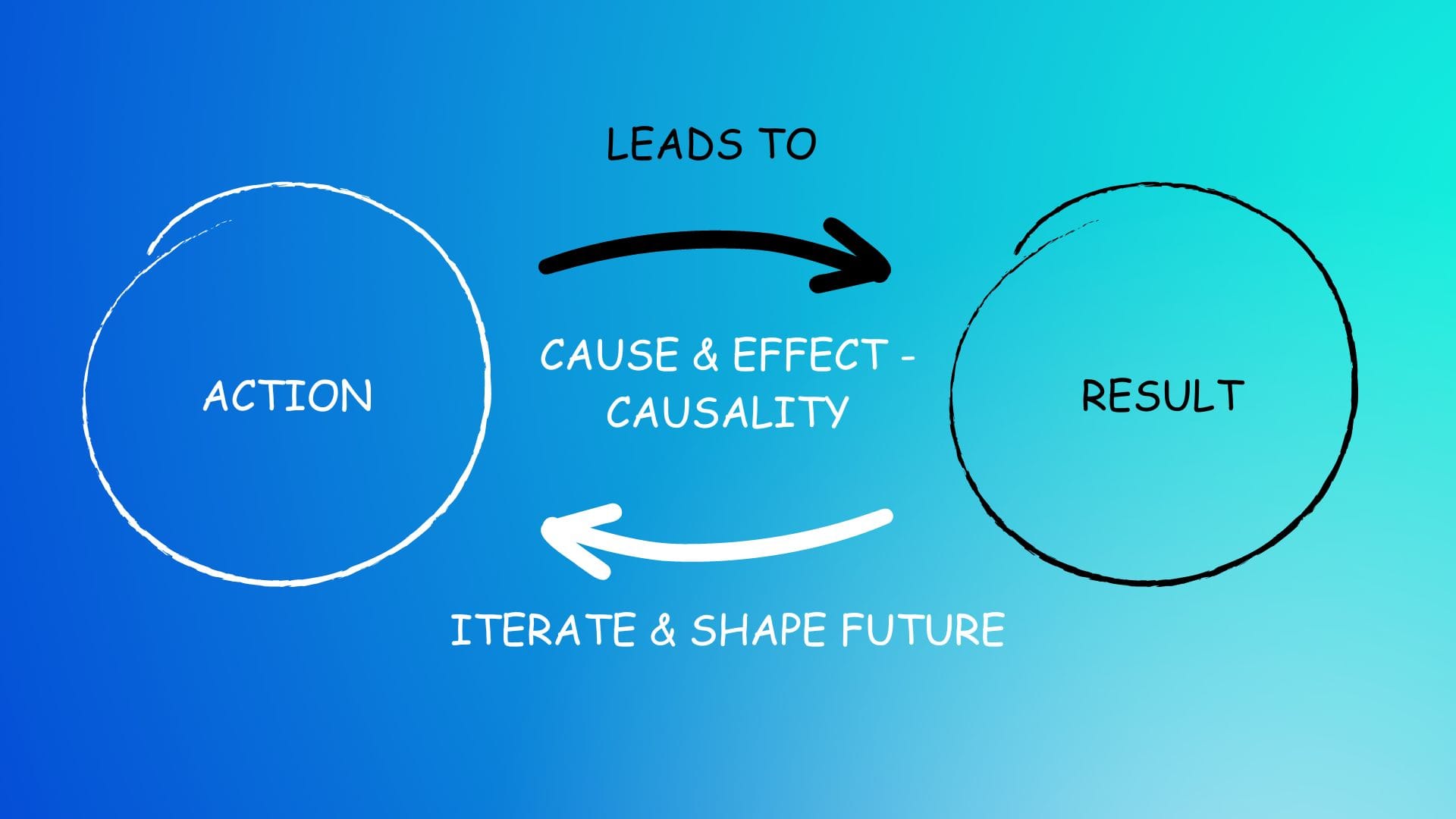

Causality

We are familiar with cause & effect relationships.

Causality as a concept in systems thinking is really about being able to decipher the way things influence each other in a system.

Feedback loops & causality are related in that understanding feedback loops is about gaining perspective on causality - how one thing results in another thing in a dynamic & constantly evolving environment.

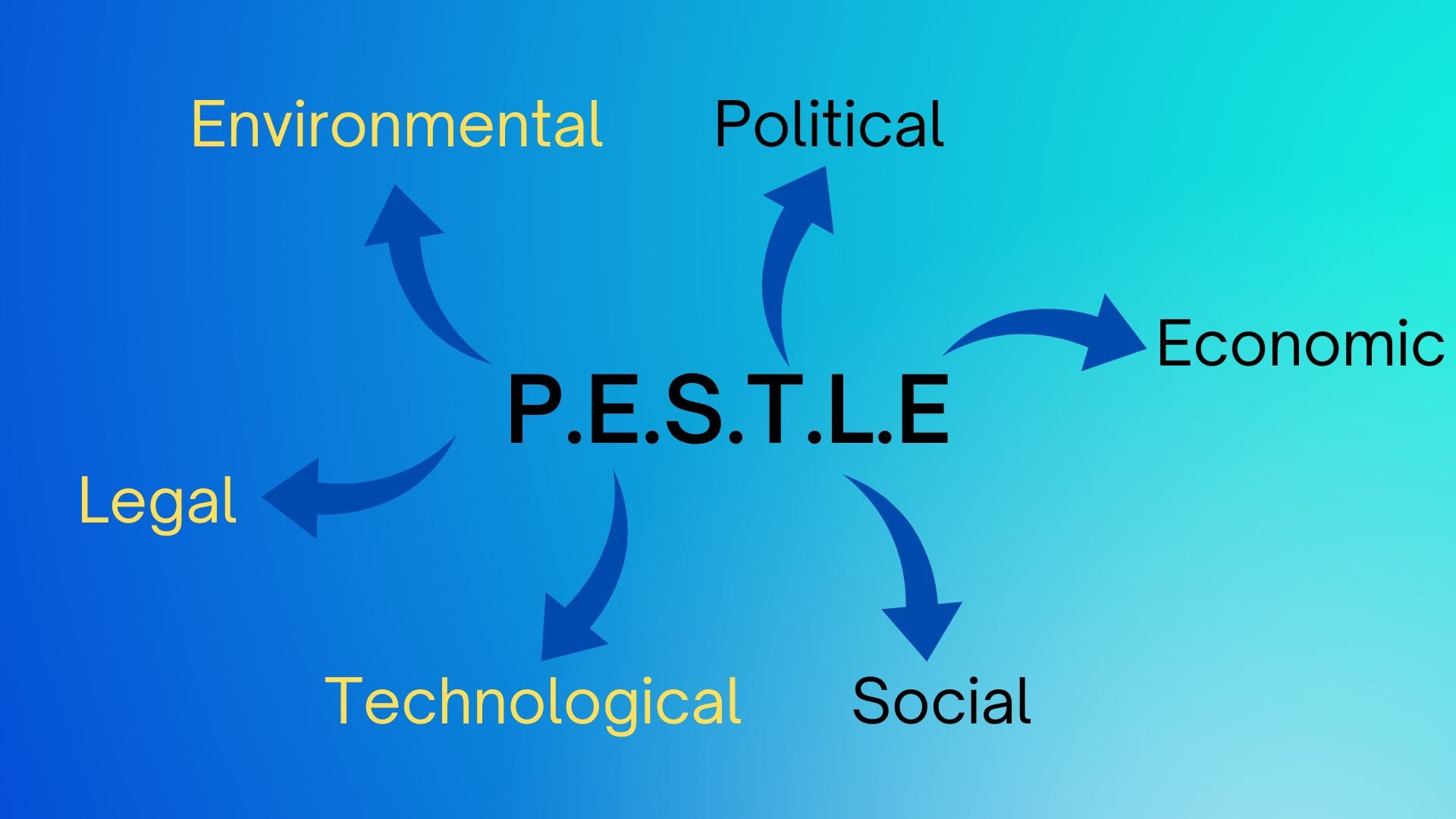

After the thinking part is taken care of, we then moved on to P.E.S.T.L.E

P.E.S.T.L.E

We started with a very common tool called PESTLE used to analyze the below key parameters in external environments :

P - Political

E - Economic

S - Social

T - Technological

L - Legal

E - Environmental

We then explored The "E" as in Economic parameters starting from the Global view.

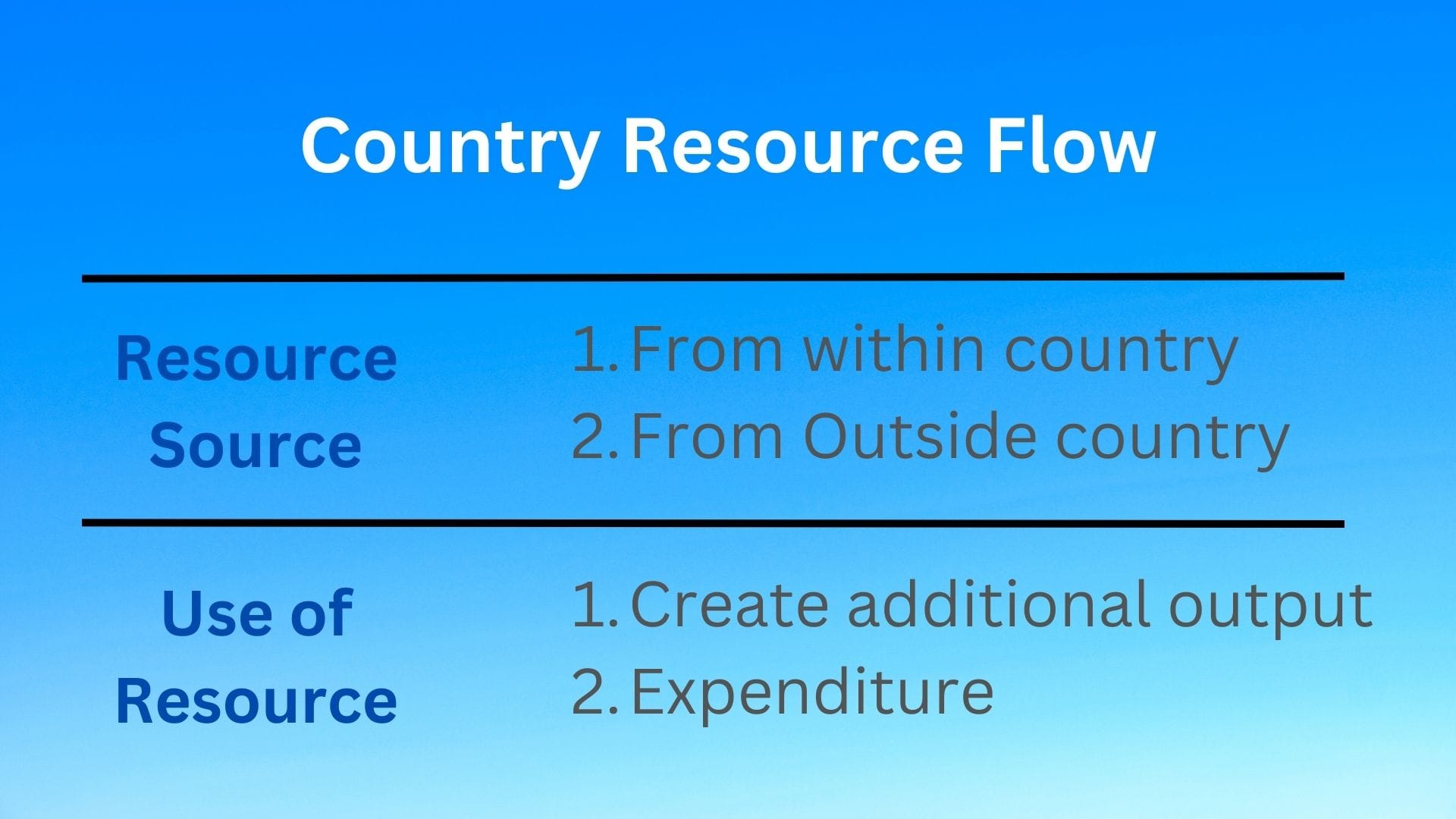

We started with the concept of a Country as a Business with a balance sheet, income statement & "cash" flow. But it is not exactly referred the same way.

For a country, the "cash" part is referred more in terms of "Resources". So, it is more like "Resource Flow" instead of "Cash Flow".

Just like a company generates cash from various sources (internal through profits or external through borrowings, capital etc), a country uses resources from :

- Within the country - What a nation makes itself, within it's borders &/or

- Outside the country - through imports - What a nation buys from other nations

How are these resources utilized in a country? These resources are used mainly for the below:

- Expenditure

- Create additional output

Visualizing the above :

From there, we moved to GDP as a measure of the value of output

Gross Domestic Product (GDP)

GDP or Gross Domestic Product measures

- The monetary value of final goods & services - i.e., those that are bought by the final user

- produced in a country in a given period of time (say, a quarter or year). (Source : IMF)

It counts all of the output generated within the borders of a country. GDP is composed of goods & services produced for sale in the market & also includes some non-market production, such as defense, education services provided by Government.

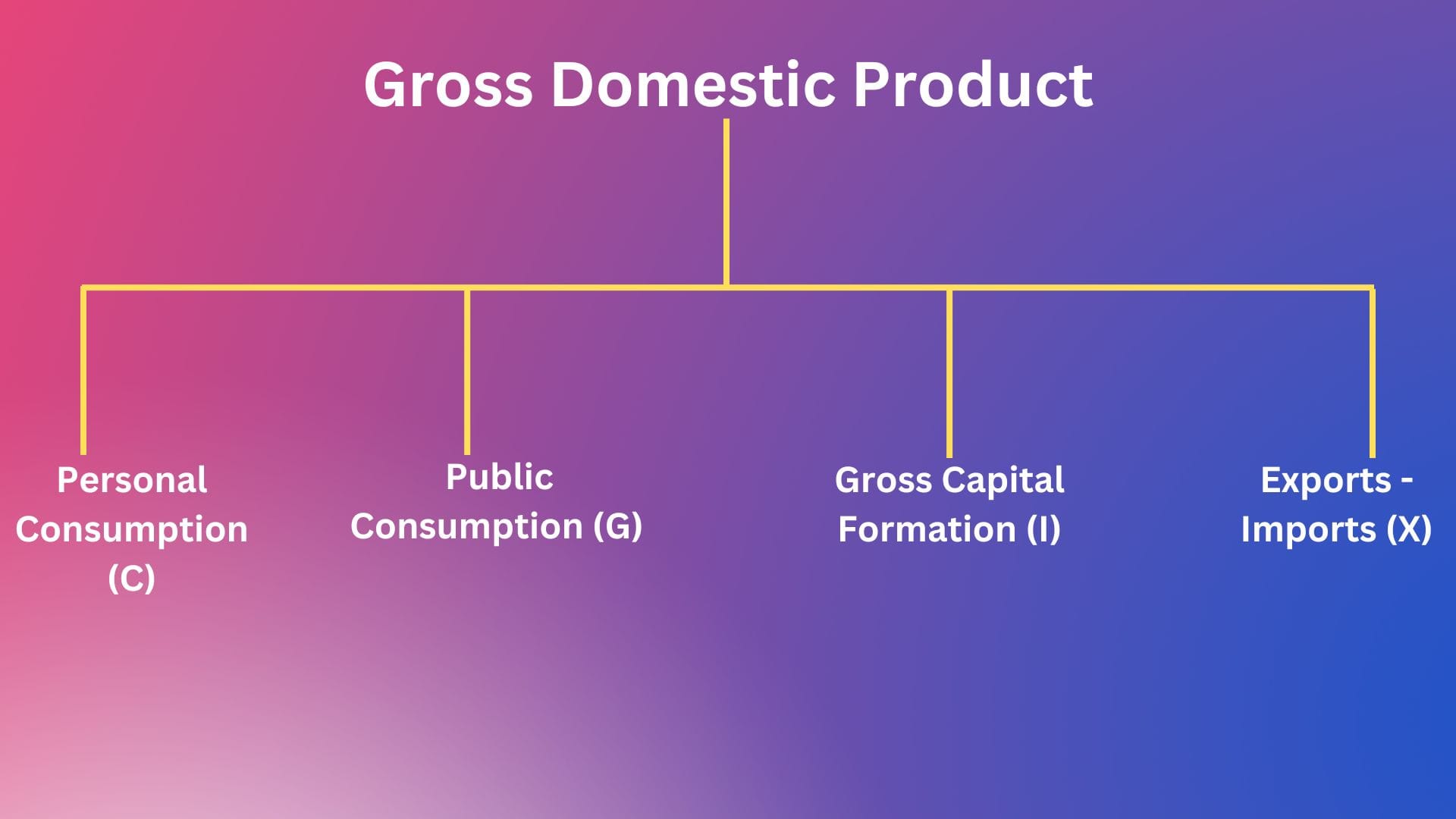

The formula for measuring GDP is :

GDP = Personal Consumption (C) + Public / Government Consumption (G) + Gross Capital Formation (I) + (Exports - Imports)

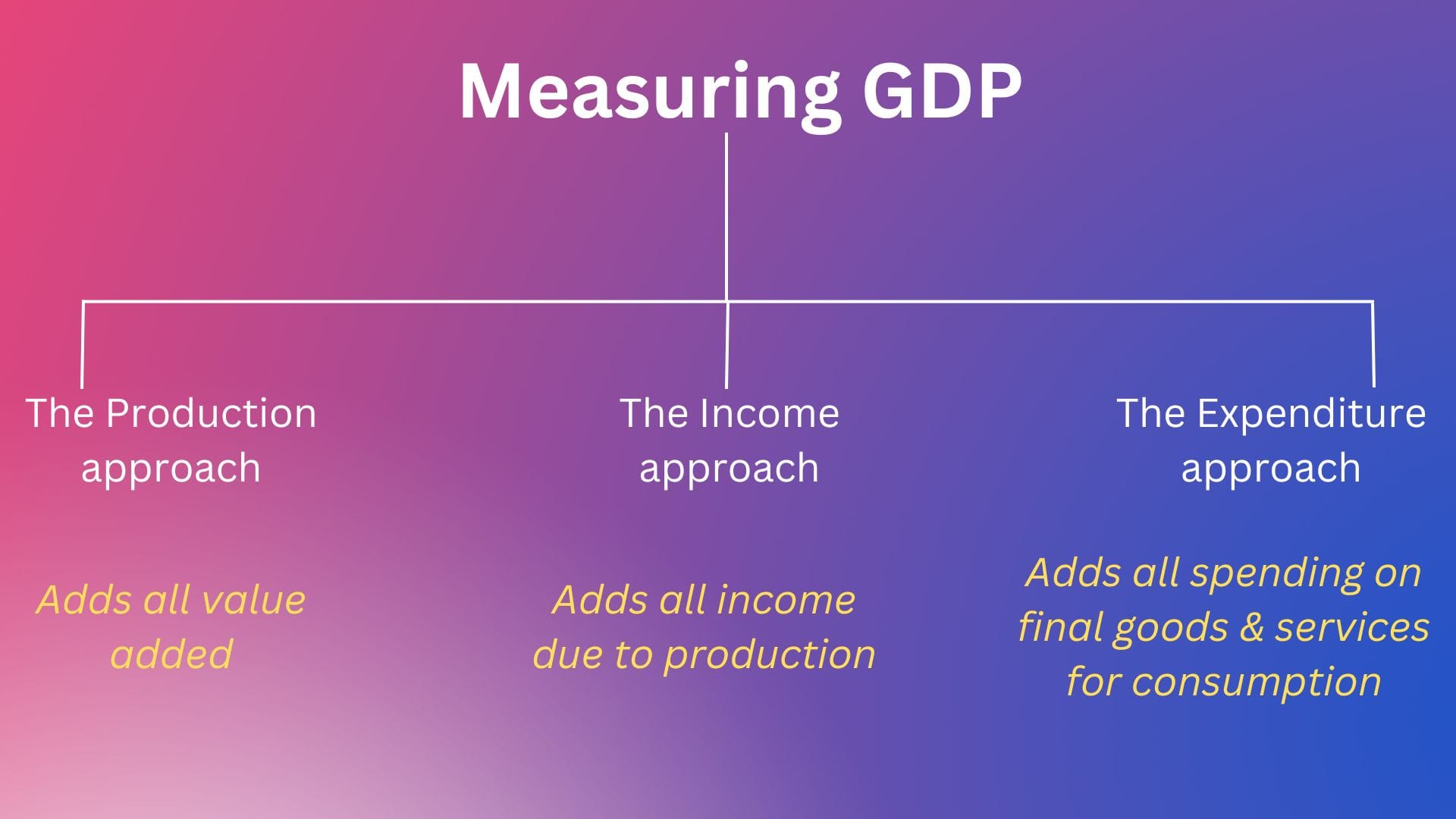

There are three approaches to measuring GDP

GDP is important because it gives information about

- the size of the economy &

- how an economy is performing

What is the relevance of GDP to strategy ?

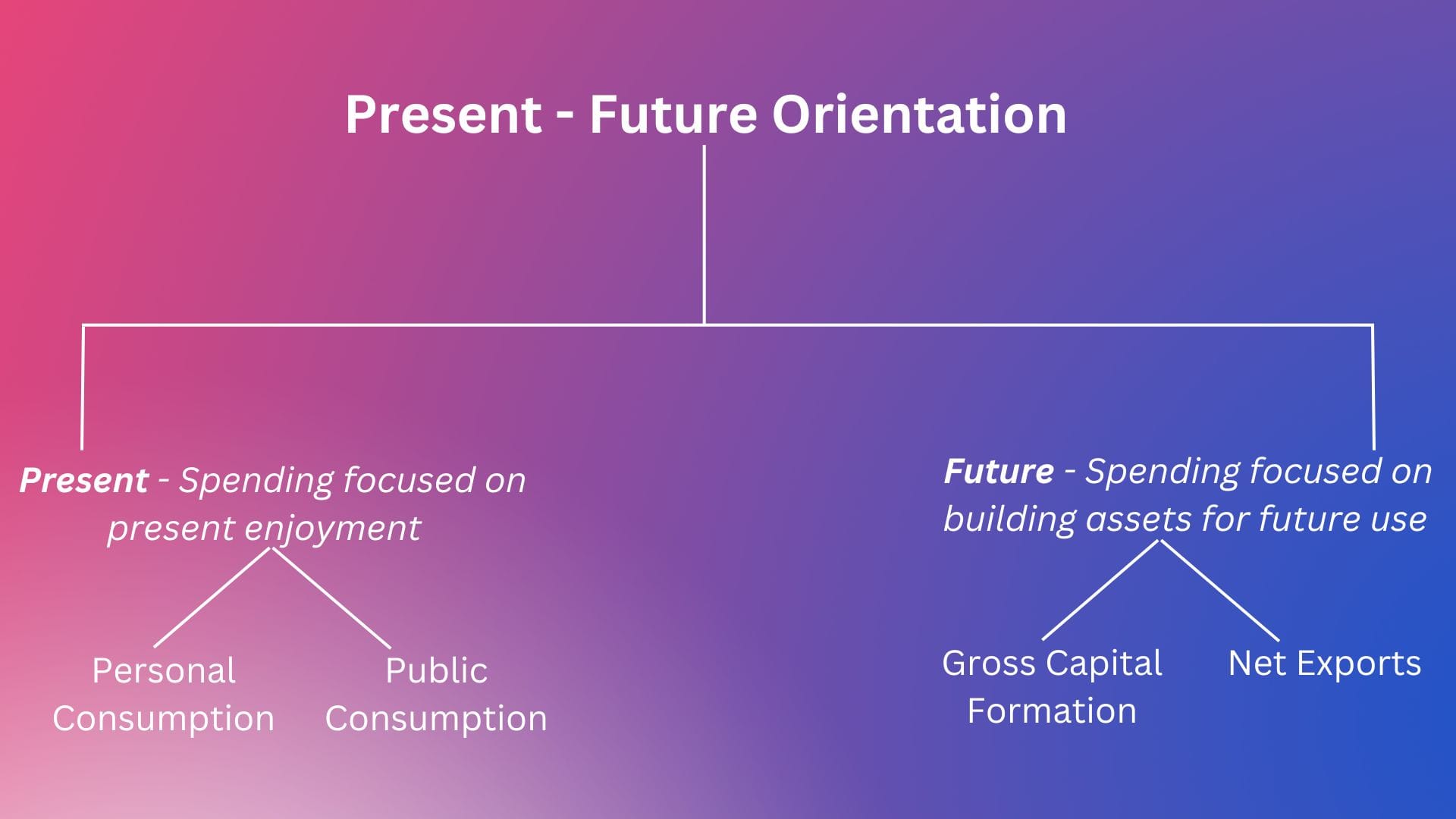

The question to ask when expanding within a country or overseas is - Which GDP component drives a country's growth or decline?

Is the Government spending present-oriented or future-oriented?

After that, we moved on to Balance of Payments.

Balance of Payments (BoP)

When a country imports from or exports to another country, it results in the country using a foreign currency. Just like we use local currency which is acceptable for any local transaction, for international trade, a country has to use a foreign currency which is accepted by majority of nations. This foreign currency or currency most used in international trade is US Dollars.

Such transactions need to be recorded & analyzed to see how it impacts a country's economic position vis-a-vis other nations. This is done through a statement known as Balance of Payments. It is defined as :

The balance of payments (BOP) is

- The method countries use to monitor all international monetary transactions in a specific period &

- Is a record of all international financial transactions made by the residents of a country.

The transactions are summarized as

- Inflows - Transactions that result in cash inflows of US Dollars

- Outflows - Transactions that result in cash outflows of US Dollars

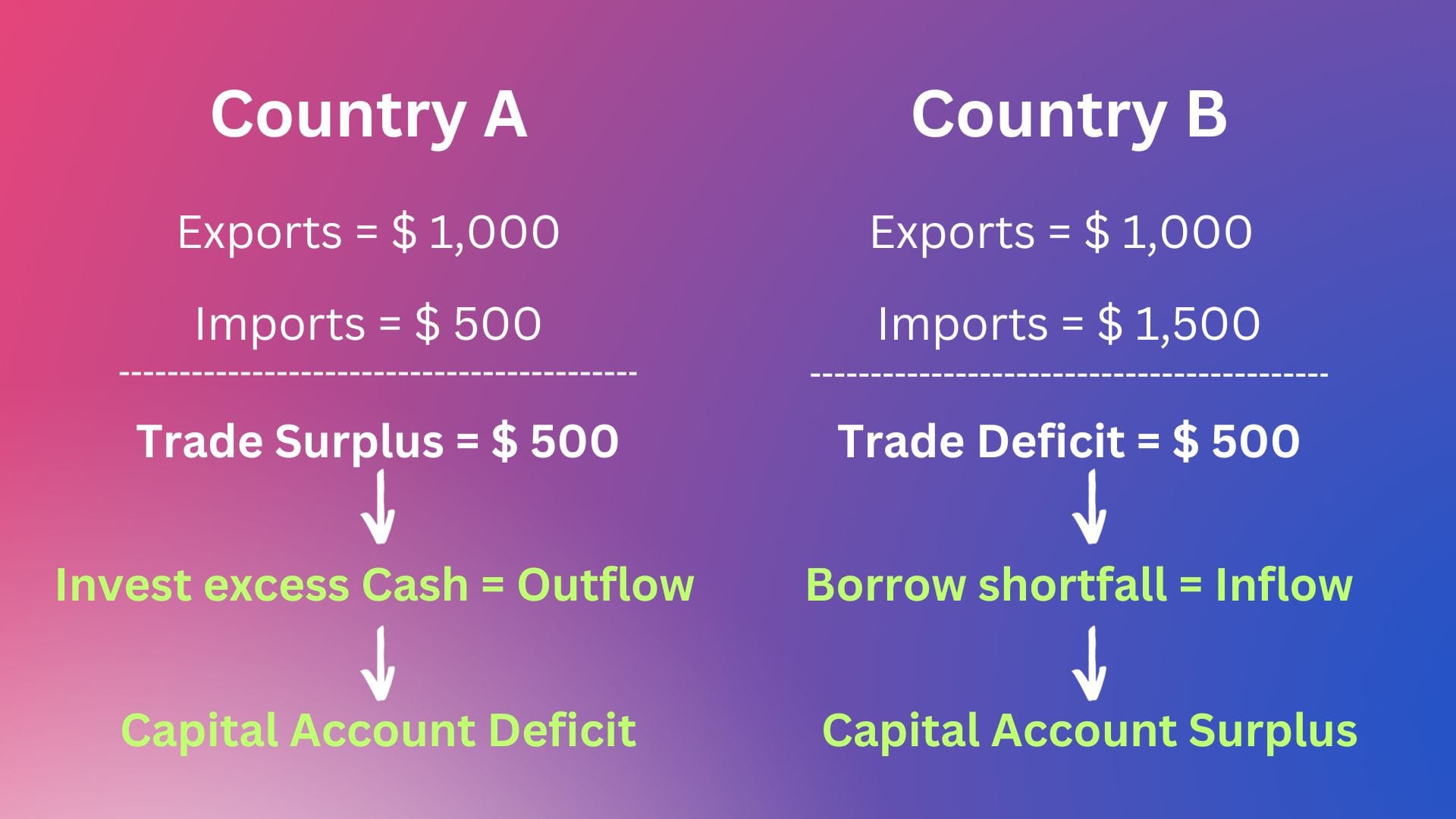

The above transactions can be bifurcated into two types :

- Transactions which are recurring & short term in nature or in other words - Current transactions

- Transactions which are long term in nature & deal in assets / liabilities - Capital transactions

Total Inflow of Dollars must equal Total Outflows of Dollars and hence to balance the transactions, surplus in current account must equal to deficit in capital account & vice - versa.

Why do we care about Balance of Payments ?

Linking foreign exchange transactions with the present-future orientation, a country which invests or saves it's foreign earnings can expect a return on these investments or savings in the future. Thus, this reflects a country's (in effect the aggregate population's) desire to save for the future.

On the other hand, a country which runs a current account deficit to finance consumption is like a family using credit card borrowings to spend on daily expenses.

They will have to find ways to repay that deficit in the future & hence the policies encouraging deficits may be unstable in the long run.

We then moved to the related area of Foreign Exchange which we will tackle next week.