Strategy Byte - Week 63 The Journey so Far Part III

Table of Contents

- Foreign Exchange

- Interest Rates - Forex Driver

- Relative Inflation Rates

- Current Account Balances in BoP

- Economic Growth Rate & Competitiveness

- Interest Rates

We continue our journey to understand strategy by looking back & reviewing our steps which will help us to gain perspective on the subject & also guide us moving forward.

Foreign Exchange

Last week, we started from systems thinking, moved to GDP (Gross Domestic Product) & then explored BoP (Balance of Payments) & it's relevance to strategy. A key driver of Balance of Payments & world trade is Foreign Exchange Rate.

When goods are imported or exported between countries as part of international trade, a critical component is foreign exchange. Foreign exchange or Forex in short is nothing but exchanging one currency for another. Why is it important?

Because it determines the exchange value of goods &/or services between countries. However, foreign exchange is not restricted only to international trade but also to financial assets called Capital flows.

What is Foreign Exchange Rate?

The rate of exchange used for exchanging currencies is called Exchange Rate. In a free economy, currency values are normally dictated by supply & demand.

Certain countries peg their currency to another currency like USD or a basket of currencies in line with their broad economic policies. Hence such currency's value remains the same vis-a-vis USD or the relevant basket of currencies over the time frame the peg is maintained.

The marketplace where currencies are exchanged is called "Forex Market".

The foreign exchange market (FX, forex or currency market) is a global, decentralized or over-the-counter (OTC) market for the trading of currencies.

This market determines the foreign exchange rate of every currency.

It includes all aspects of buying, selling & exchanging currencies at current & determined prices.

Why is foreign exchange rate an important external environment variable for strategy purpose? If a company is a global company or a multinational company, it will have operations in multiple countries or jurisdictions. Even local companies may have transactions to import raw materials or export their finished goods. That means dealing & transacting in different currencies which can impact

- A single transaction or multiple transactions over a period of time or

- Transactions embedded into the balance sheet which can impact a company's performance over a financial period or multiple financial periods (e.g., investments).

Even if a company has excellent products with good demand, where these products are manufactured, exported, imported etc makes a lot of difference to the ultimate financial impact - the bottom-line or net profit. The result of a good strategy ultimately shows up in net profits due to better performance or better market share than peers or competitors.

The macro economic variables of a country are all correlated & any fluctuation or change in one variable impacts the other either positively or negatively. However, just as a company's share price is driven by it's performance as well as expectations of it's future performance, a country's economic outlook is a key driver of that country's currency value & exchange rate. The other major (the Forex market is complicated & hence not all factors influence currency values equally) drivers are :

- Interest Rates

- Relative Inflation Rates

- Current Account Balance in BoP (Balance of Payments)

- Economic Growth Rates

- Competitiveness

Interest Rates - Forex Driver

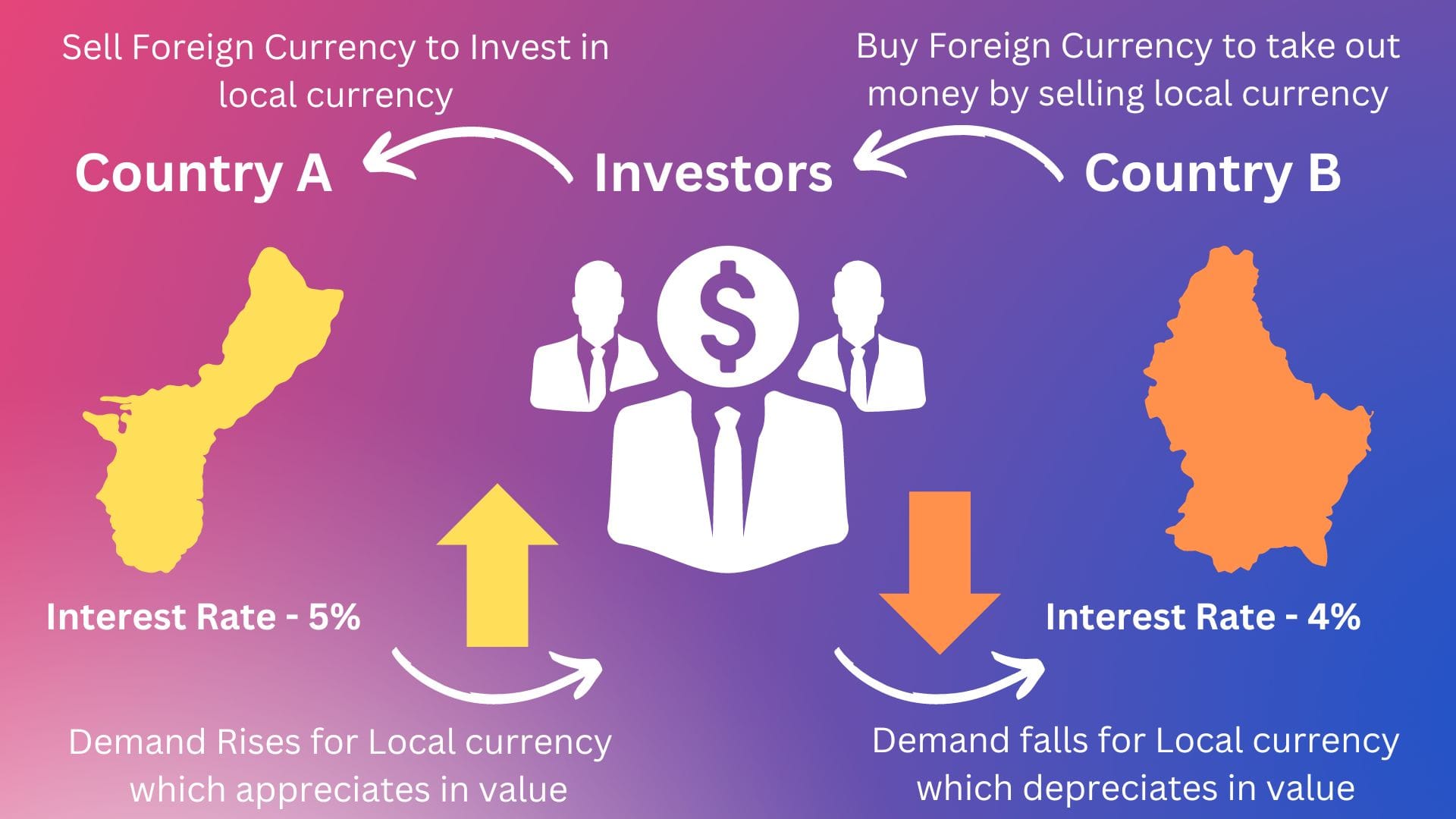

A country with higher interest rates (ignoring inflation) would experience higher inflow of foreign currency compared to that with lower interest rates mainly due to higher return. This increases the demand for currency with higher rate compared to that with lower rate causing it to appreciate.

The value of currency with lesser demand due to lower interest rate will decrease causing it to depreciate.

Visualizing the above :

We will discuss interest rates again below.

Relative Inflation Rates

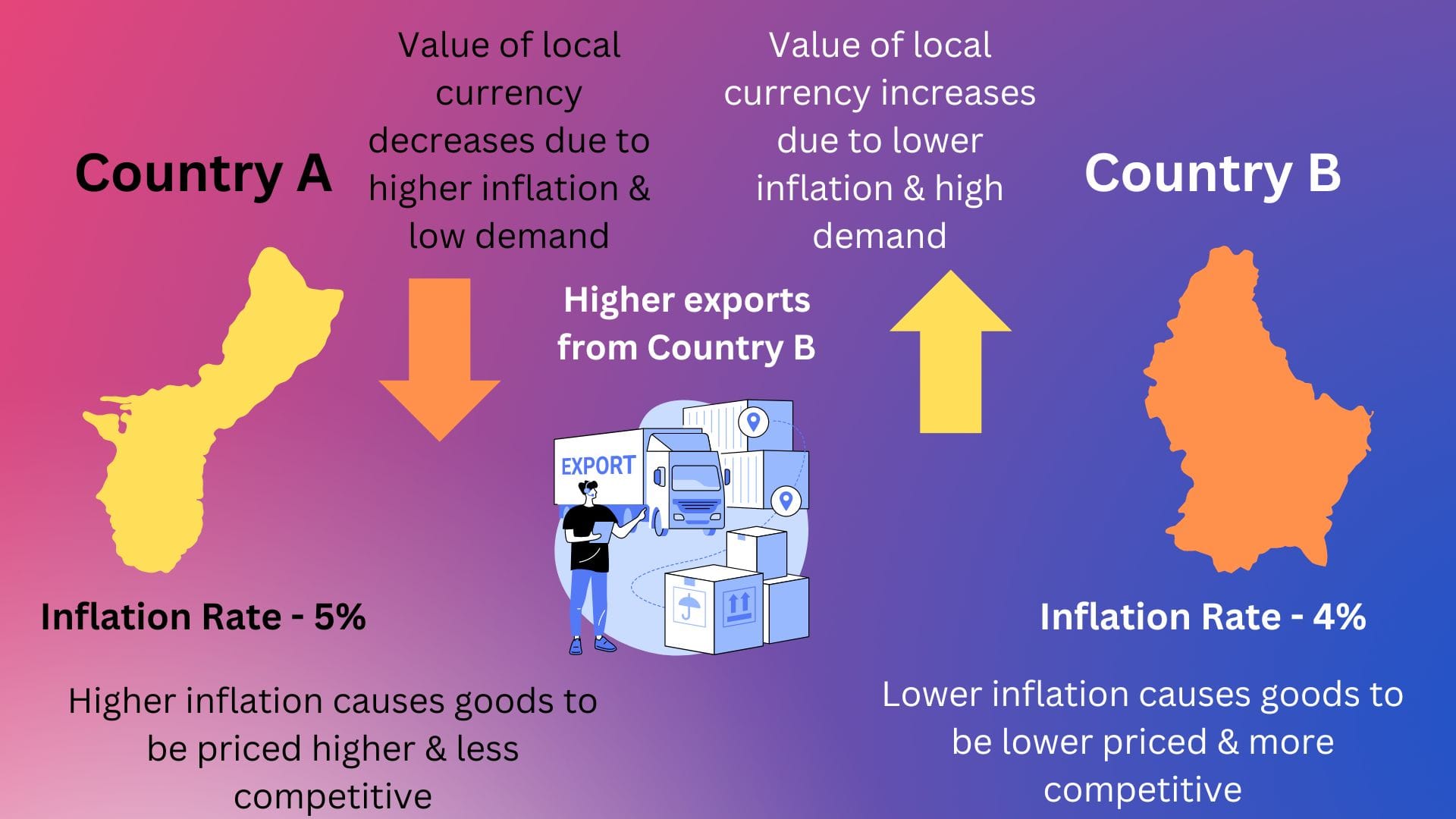

We then explored relative inflation rates as :

There is inflation when the prices of many of the things we buy rise at the same time and then continue to rise. Explained another way, inflation is ongoing increases in the general price level for goods and services in an economy over time.

Goods produced in a country with higher inflation cost more to produce & hence is less competitive compared to goods produced in countries with lower inflation which are produced at lower cost.

This increases the demand of goods & services from lower inflation countries which in turn increases the demand for it's currency compared to that of higher inflation countries. This in turn impacts the Balance of Payment (BoP) position.

Current Account Balances in BoP

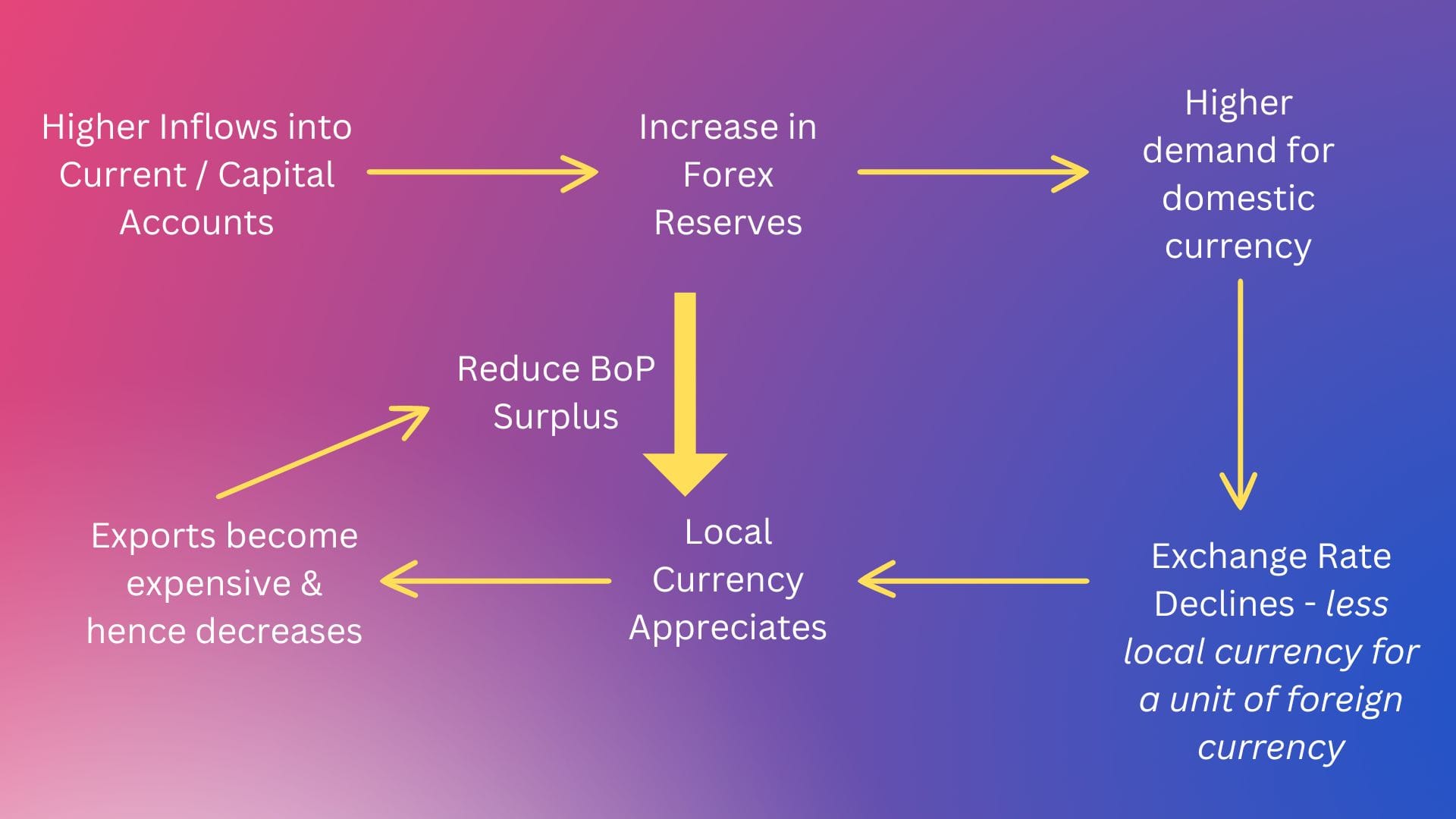

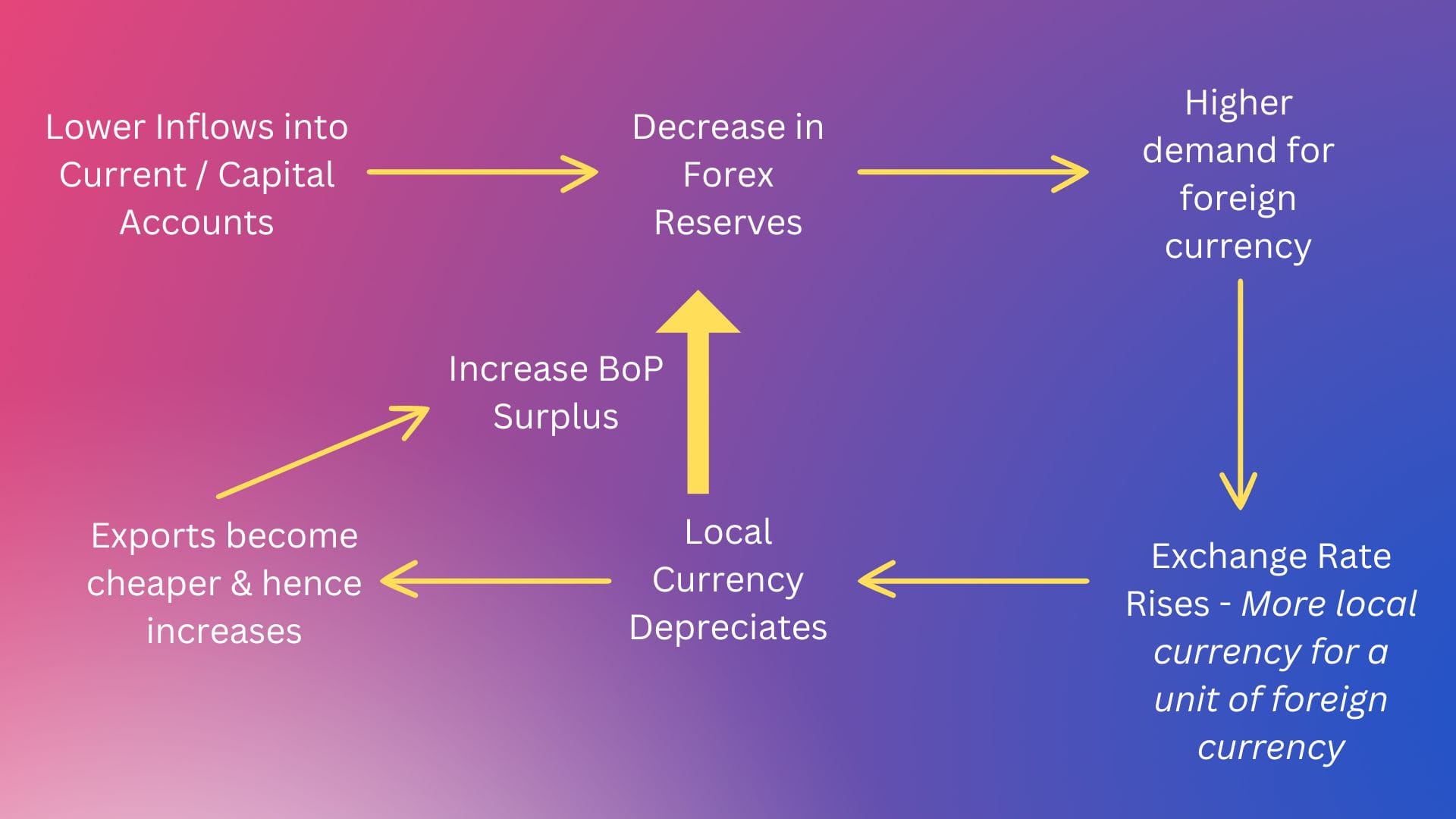

If a country's products or services have a good export market, it's trade partners will buy more from it resulting in higher inflow of foreign exchange into it's current account resulting in positive BoP position.

Also, if there are any transactions resulting in investment from one country to another, the resulting movement in capital account causes BoP position to change which can be positive (higher inflows) or negative (higher outflows).

Impact of Exchange Rate changes & BoP is visualized below :

BoP is a critical statement of accounts which helps assess :

- How well a country is doing

- How competitive it is &

- How attractive it is for investment purpose

Economic Growth Rate & Competitiveness

A country with high productivity & better managed economy (more competitive) will produce goods at a competitive price. Such goods will be in higher demand by foreign buyers resulting in appreciation of it's currency & higher foreign currency inflows.

Also, higher growth rates generates higher interest rates which increases capital inflows resulting in currency appreciation.

There are multiple variables & situations in any economy which can impact exchange rates. The impact of each variable is different depending on the economic situation a country is in.

We then tackled Interest Rates next.

Interest Rates

What is Interest Rate?

Interest rates are the cost of borrowing money. They are normally expressed as a % of the total amount borrowed.

Interest rates are also the return earned on saving money in a bank or an instrument which gives return based on a percentage basis (%).

Visualizing the above :

If we look at both definitions & the examples discussed, what is the item being transacted?

A bank lends money to customers or borrows deposits from customers. The item being transacted here is MONEY.

So, basically we can also say interest rate is the price of money. The rate depends on supply of money, the tenor of the transaction etc.

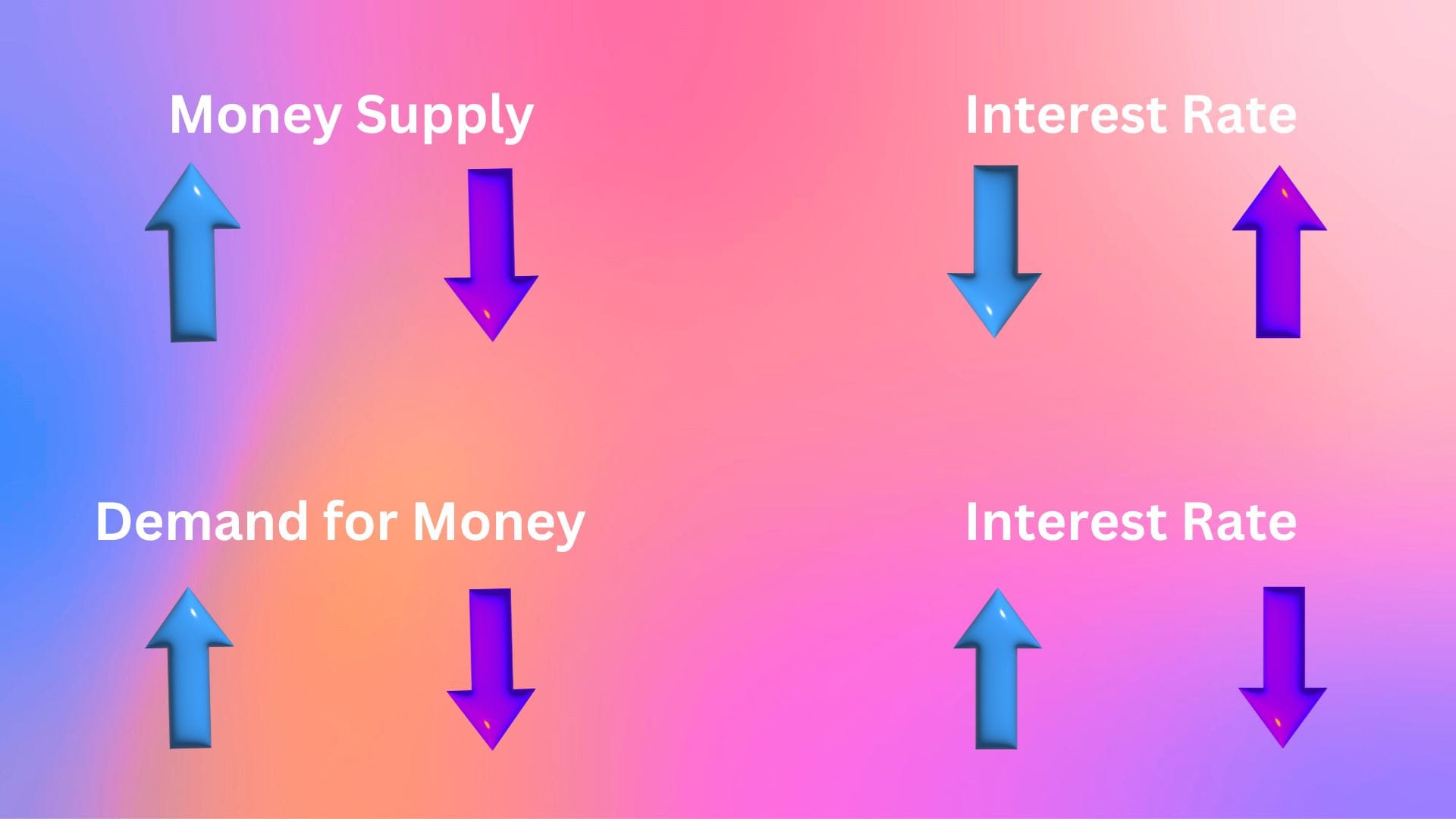

Supply Side Impact

- An increase in the supply of money lowers the interest rate

- A decrease in the supply of money raises the interest rate

Demand Side Impact

- An increase in the demand for money raises the interest rate

- A decrease in the demand for money lowers the interest rate

Visualizing the above :

In a country, the Central Bank or Monetary Authority sets a base rate which serves as a Benchmark for other interest rates in the economy.

The starting point for Commercial banks is the Prime rate defined as :

The Prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers.

It serves as a benchmark for many other loans, meaning that when the prime rate rises or falls, the interest rates on various types of loans, like mortgages, small business loans, and personal loans, are likely to move in the same direction.

Now, not all customers of a bank are the most credit worthy. The credit worthiness depends on the economic circumstances of a customer & those circumstances differ from that of the most credit worthy customer.

So, this difference in credit worthiness is quantified as a spread & added to the prime rate & so the rates on loans lent to these customers are higher than the prime rate taking into consideration

- The customer & their economic circumstances &

- The type of loan offered to the customer

We then moved to term structure or yield curve which we will explore next week along with what drives interest rates in an economy.