Strategy Byte - Week 22 : Interest Rates

Table of Contents

- Recap

- Two Headlines

- Interest Rates

Recap

In Week 21 of Strategy Bytes, we discussed how movements in a country's current account or Balance of Payments (BoP) position impacts the exchange rate.

Higher USD inflows into current account due to strong export performance results in positive BoP position or surplus while higher USD outflows from current account results in negative BoP position or deficit. This in turn is a function of a nation's exports & imports.

Higher exports compared to imports result in BoP surplus while higher imports compared to exports results in BoP deficit (ignoring other current account movements).

Then we moved one step further to analyze the impact of a continuous surplus or deficit on exchange rate & concluded that in the long run, the movement in BoP and exchange rates ultimately leads to the BoP balance moving towards an equilibrium depending on the exchange rate.

For example - continuous surplus in BoP position results in a stronger local currency due to high demand by foreign buyers to exchange for USD. This makes the exported goods more expensive resulting in foreign buyers going elsewhere for lesser cost options. This reduces exports & in turn the demand for it's currency reducing its value & also reducing the BoP surplus & vice versa when there is continuous deficit in BoP position.

There are multiple variables impacting an economy at any point in time. The impact of each variable is different depending on the economic situation.

This week we start with another very important variable - Interest Rate

Two Headlines

Before we start with the definition of interest rate, let us see two recent headlines

The first is the most recent FOMC* statement from the Federal Reserve (Full Statement : here):

Recent indicators suggest that economic activity has been expanding at a solid pace. Job gains have remained strong, & the unemployment rate has remained low. Inflation has eased over the past year but remains elevated.

The Committee seeks to achieve the maximum employment and inflation at the rate of 2% over the longer run. The Committee judges that the risks to achieving it's employment & inflation goals are moving into better balance. The economic outlook is uncertain & the Committee remains highly attentive to inflation risks.

In support of its goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent.

The second is from Bank of Japan (Source- here):

The Bank of Japan (BoJ) has ended an era of negative interest rates, raising borrowing costs for the first time since 2007 in a historic shift as the country puts decades of deflation behind it.

Following a 7-2 majority vote, the BoJ said it would guide the overnight interest rate to remain in the rate of zero to 0.1 percent, making it the last Central Bank to end the use of negative interest rates as a monetary policy tool. It's benchmark rate was previously minus 0.1 %.

The BoJ turned to negative interest rates in 2016 as it tried to encourage banks to lend more in order to generate spending & contain the risks of a global economic slowdown.

Other Central Banks - in the Eurozone, Nordic countries & Switzerland - also cut rates below zero, sometimes angering savers & breaking with hundreds of years of established policy.

So, Federal Reserve maintained the fed fund rates without changing it. BoJ ended negative interest rates. These decisions have significant impact on the economy. We will get into the weeds of the above decisions & it's impact in the coming weeks.

Interest rate is one of the critical economic variables impacting almost everyone as it impacts household cash flows on borrowings (mortgage, auto or personal etc) or investments earning returns & a major cash flow for businesses in the form of interest payments or receipts. What is this interest rate? Let us deep dive..

Interest Rate

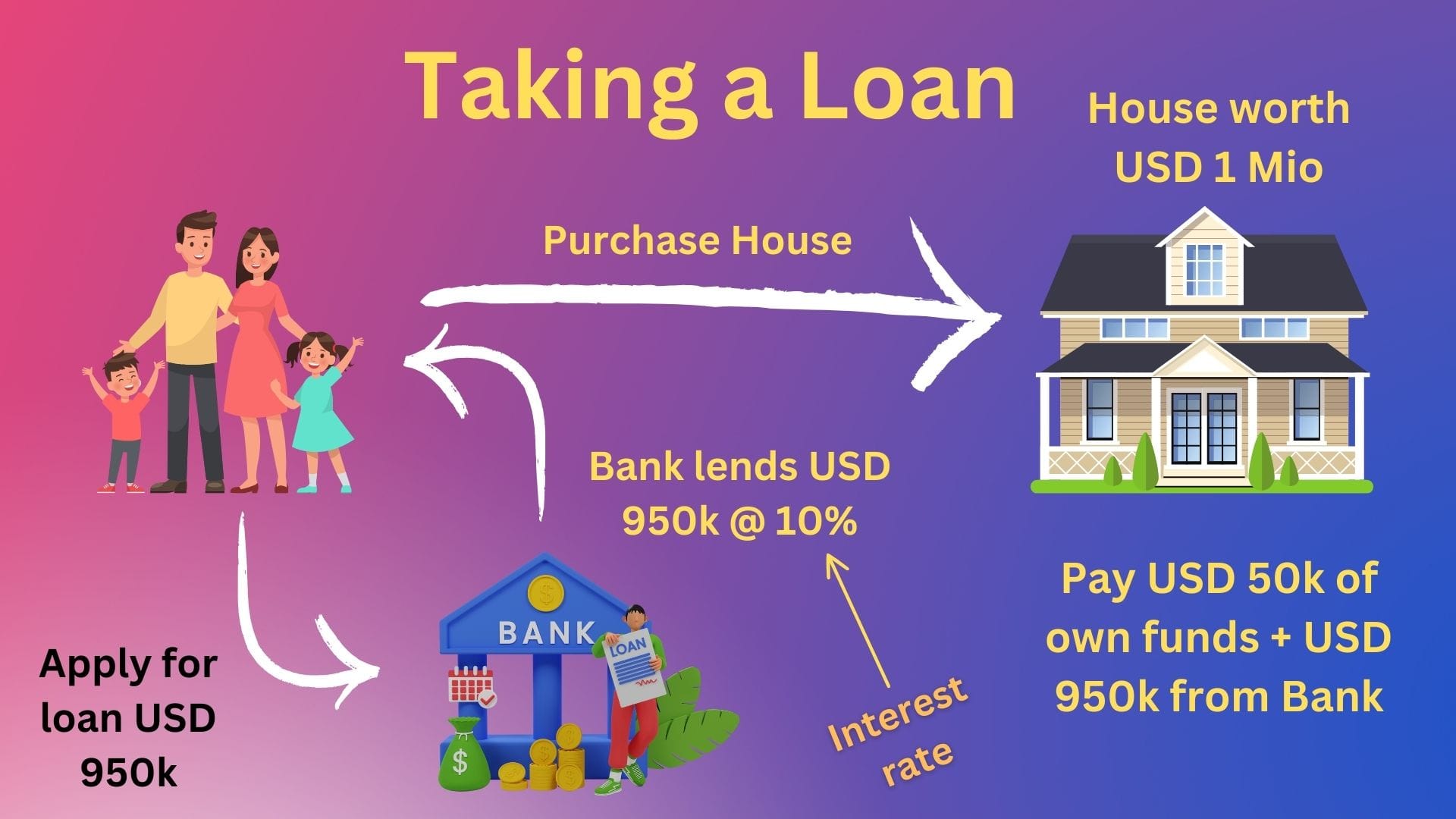

Let us take an example of a family who wants to move into a new house which costs USD 1 Mio.

Assume, they already have USD 50k for initial payment (also called down payment). From where will they get the balance amount? Banks normally lend money for various purposes - buying houses being one among them (Called Mortgage loans). Thus the family approaches a bank for the remaining amount.

Finally a bank agrees to lend USD 950k to the family over 10 years. However, this borrowed money has a cost. Who gives free money to anyone? Nothing comes for free, Everything has a cost.

What is the cost of this borrowed money?

If the bank had not lent this money but invested the money elsewhere, it would have earned some returns on that investment. So, to ensure it doesn't lose by lending, the bank charges the family something extra for lending them USD 950k for 10 years.

So, the bank tells the family that they have to pay up some extra cash on the borrowed money (USD 950k) over 10 years. This is normally expressed as a percentage (%) on the money lent. Let us assume this amount to be 10%. So it means they have to pay 10% extra on USD 950k which comes to USD 95k. So, the total repayment to the bank at the end of 10 years is

USD 950k + USD 95k = USD 1,045k

This 10% extra amount the family has to pay to the bank for the borrowed amount is called interest rate. To define it:

Interest rates are the cost of borrowing money. They are normally expressed as a % of the total amount borrowed.

Visualizing the above:

On the flip side, assume the family has idle money lying around. What do they do with this money? They have to put it somewhere so it can grow or increase in value otherwise money kept simply & not invested loses it's value due to inflation as time moves on (We will touch upon inflation in the next couple of weeks).

One option is to save the money in a bank which will pay an extra amount for keeping money with that bank . This extra amount is expressed as a percentage (%) of the money kept with that bank.

Interest rates are also the return earned on saving money in a bank or an instrument which gives return based on a percentage basis (%).

Visualizing the above two definitions:

There is another way of looking at interest rates. If we look at both definitions & the examples discussed, what is the item being transacted?

A bank lends money to customers or borrows deposits from customers. The item being transacted here is MONEY.

So, basically we can also say interest rate is the price of money. The rate depends on supply of money, the tenor of the transaction etc.

Let us explore deeper into this rabbit hole of interest rates, types of interest rates & the factors driving it.

*Federal Open Market Committee - a committee within the Federal reserve system that makes key decisions about interest rates & the growth of the United States money supply