Strategy Byte - Week 16 : Balance of Payments

Recap

Last week, we explored Net Exports which in simple terms is Exports - Imports.

Exports are what a country sells to other nations & imports are what a country buys from other nations.

We then discussed GDP as resources produced & consumed within a country either for current consumption or for future outlays. We concluded that GDP is like a cash flow statement in local currency.

We expanded beyond the local context & moved to interactions between nations through export & imports.

We then explored Trade Surplus & Trade Deficit where a country which exports more than it imports has a Trade Surplus & a country which imports more than it exports has a Trade Deficit.

We then discussed relevance of Net Exports to strategy & ended with the below question :

Do we have anything to record the US dollar cash flows & balances resulting from a country's trade policies with other countries?

Balance of Payments

When a country imports from or exports to another country, it results in the country using a foreign currency. Just like we use local currency which is acceptable for any local transaction, for international trade, a country has to use a foreign currency which is accepted by majority of nations. This foreign currency or currency most used in international trade is US Dollars.

Such transactions need to be recorded & analyzed to see how it impacts a country's economic position vis-a-vis other nations. This is done through a statement known as Balance of Payments. It is defined as (Source - here):

The balance of payments (BOP) is

- The method countries use to monitor all international monetary transactions in a specific period &

- Is a record of all international financial transactions made by the residents of a country.

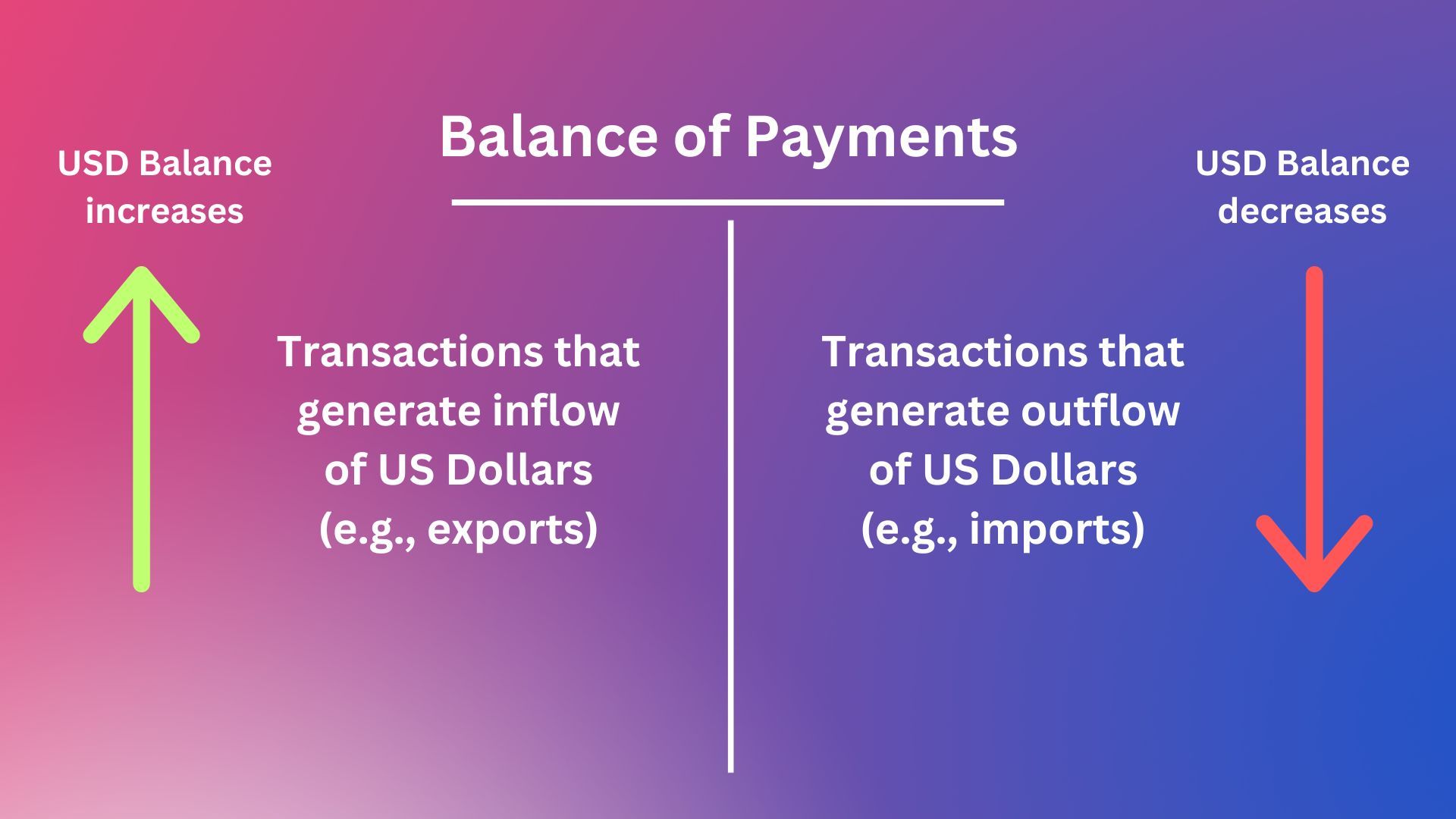

In simple terms, it summarizes the transactions between citizens & residents of a country & foreign citizens. The transactions are summarized as

- Inflows - Transactions that result in cash inflows of US Dollars

- Outflows - Transactions that result in cash outflows of US Dollars

The below visualization in ledger form makes it more clear :

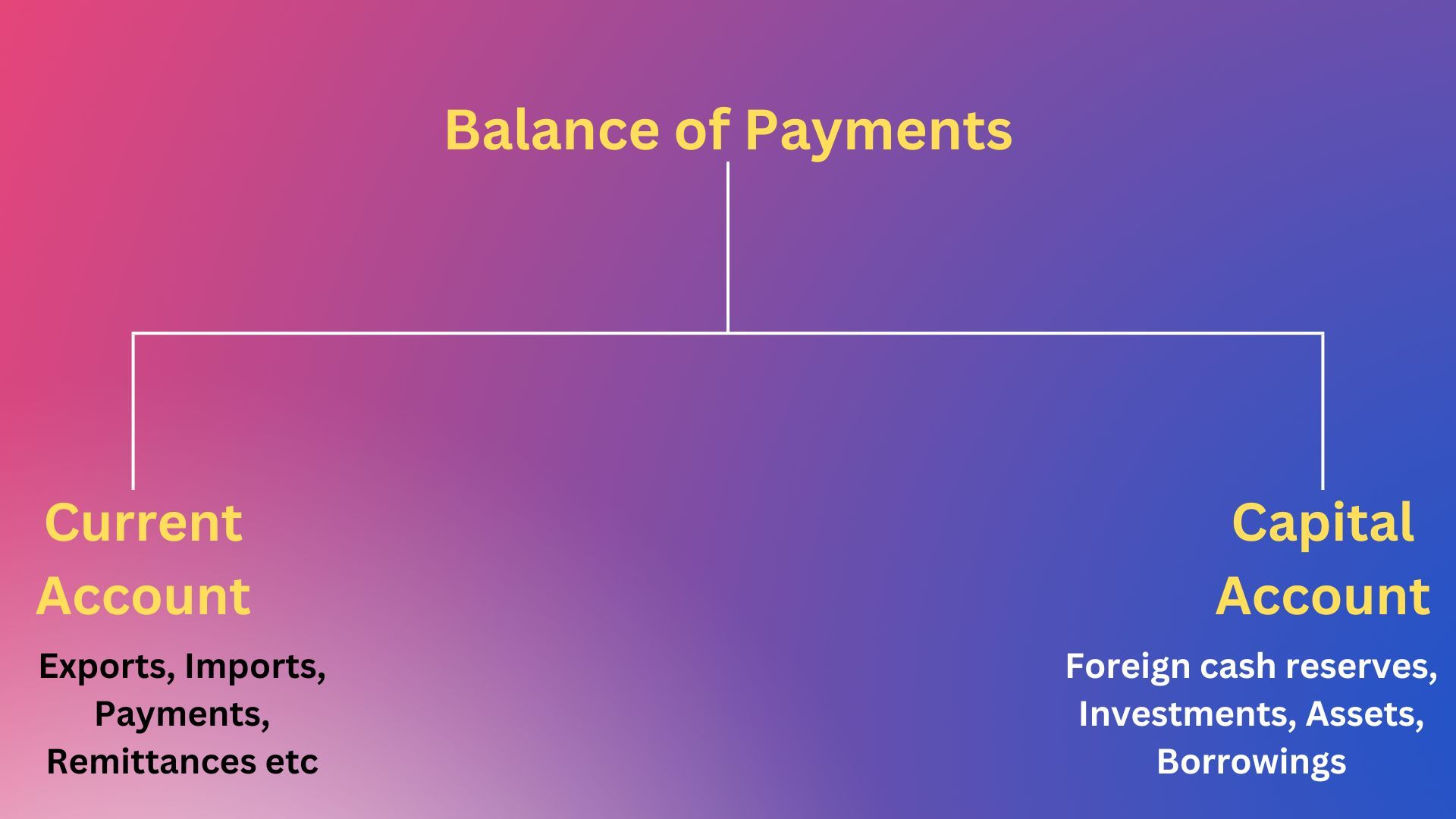

The above transactions can be bifurcated into two types :

- Transactions which are recurring & short term in nature or in other words - Current transactions

- Transactions which are long term in nature & deal in assets / liabilities - Capital transactions

What does the above bifurcation signify? Let us take an example of a family (again!)

Assume this family has two accounts -

- One account which they use for their running expenses like groceries, other consumables etc. They credit the account depending on any credits received (incoming funds due to income received) & debit it (withdraw funds) as and when they spend on their requirements. Any income earned on investments or interest paid on loans also go through this account. This type of account is called Current Account.

- Another account which they use for their long term savings, long term assets / investments (car, house etc) or long term liabilities (like mortgage loans etc). This type of account is called Capital Account.

Let us now extrapolate the above to a country or nation.

Balance of Payments - Current Account

The running expenses account maintained by the family above is what is called Current Account of a nation.

It mainly contains a listing of transactions involving purchase & sale of goods & services with other countries or in other words - Exports & Imports.

The current account of a nation measures the value of a country's net exchange of goods & services with the rest of the world. It also includes any income earned on capital invested abroad & net transfers of cash to other countries (e.g., foreign aid, remittances etc). (Source : here)

Balance of Payments - Capital Account

The second account maintained by the family above to account for their long term investments or liabilities is what is called Capital Account of a nation.

The capital account contains a record of international transactions involving foreign cash reserves, purchase & sale of assets or investments or incurring long term liabilities.

The below visual makes it more clear:

Now that we have bifurcated international transactions into current or capital depending on their type, there is a very important point to note which is

In Week 15, we explored Trade Surplus & Trade Deficit where a country which exports more than it imports has a Trade Surplus & a country which imports more than it exports has a Trade Deficit. Hence this surplus or deficit will be reflected in the current account as current account surplus or current account deficit.

Since the total inflows of dollars must equal total outflows, surplus in current account must equal to deficit in capital account & vice versa.

We defined current account surplus or deficit. What does capital account deficit or surplus mean?