Strategy Byte - Week 29 Inflation Drivers

Recap

During Week 28, we explored two hyper-inflationary economies - Zimbabwe & Argentina to understand what drives hyper-inflation & it's impact on an economy as a worst case scenario case study. Let us again revisit the question - What is Inflation?

There is inflation when the prices of many of the goods that we buy rise at the same time & then continue to rise. Explained another way, inflation is ongoing increase in the general price level for goods & services in an economy over time.

We also explored how inflation is computed in Week 27 using a measure called Consumer Price index or CPI.

It is a measure of the aggregate price level in an economy. The CPI consists of a bundle of commonly purchased goods & services.

The formula for computing inflation is :

Inflation Rate = (CPI Current Year - CPI Base Year) / CPI Base Year * 100

After analyzing the hyper-inflationary environment at a high level for Zimbabwe & Argentina, the main reasons for hyper-inflation were :

- Falling economic output resulting from mismanaged economic policies & resultant rise in demand for those goods

- High Government spending

- Increased money supply

- High cost of production (materials, labor etc)

- Supply chain disruptions

- The above can be exacerbated by local as well as geopolitical events (COVID, Wars etc)

Let us climb down from hyper-inflationary environment to a normal inflationary environment. We saw inflation levels for different countries last week & hence can identify the numbers. But what drives these numbers? Let us dive deeper

Inflation Drivers

We can broadly classify the factors driving inflation as below:

- Demand-Pull Inflation

- Cost-Push Inflation

Demand - Pull Inflation

Demand - Pull Inflation, as the name signifies, occurs when the demand for goods & services exceed their supplies.

We discussed earlier in the context of interest rates, how it fluctuates in line with supply & demand for money. Focussing on the demand part, if the demand for money increases, the price of money or interest rates also increases.

Applying the same analogy to goods & services, if the demand for goods & services increases than is being produced, the supply of those goods & services remain the same or they drop. Due to shortage in supply of these goods & services, suppliers increase their prices on those goods & services.

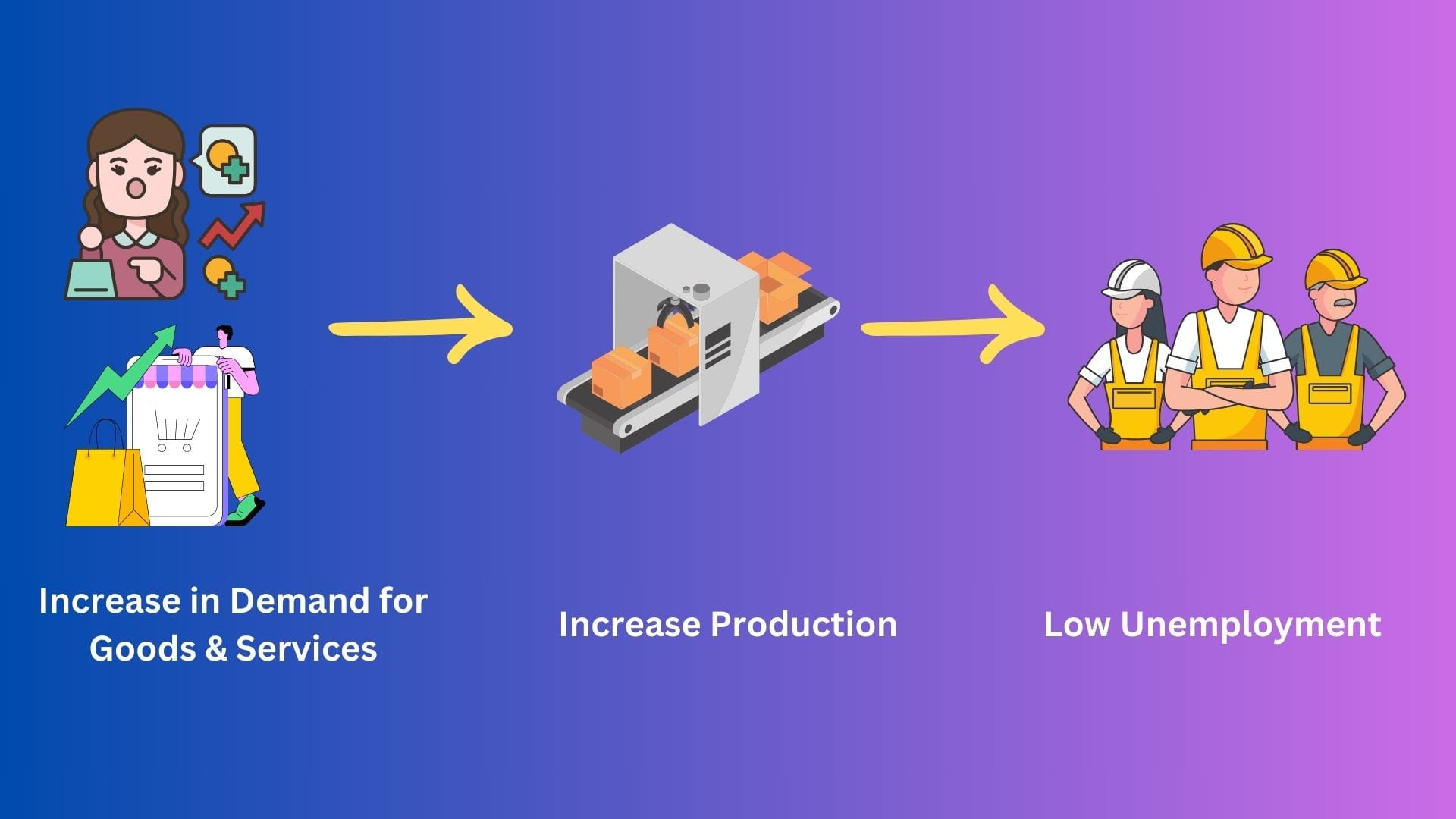

Visualizing the above :

To meet the increased demand, suppliers have to increase production of those goods & services which means more workers to be hired (of course, this scenario excludes fully automated factories!!). This means this type of inflation is accompanied by lower unemployment.

Visualizing the above :

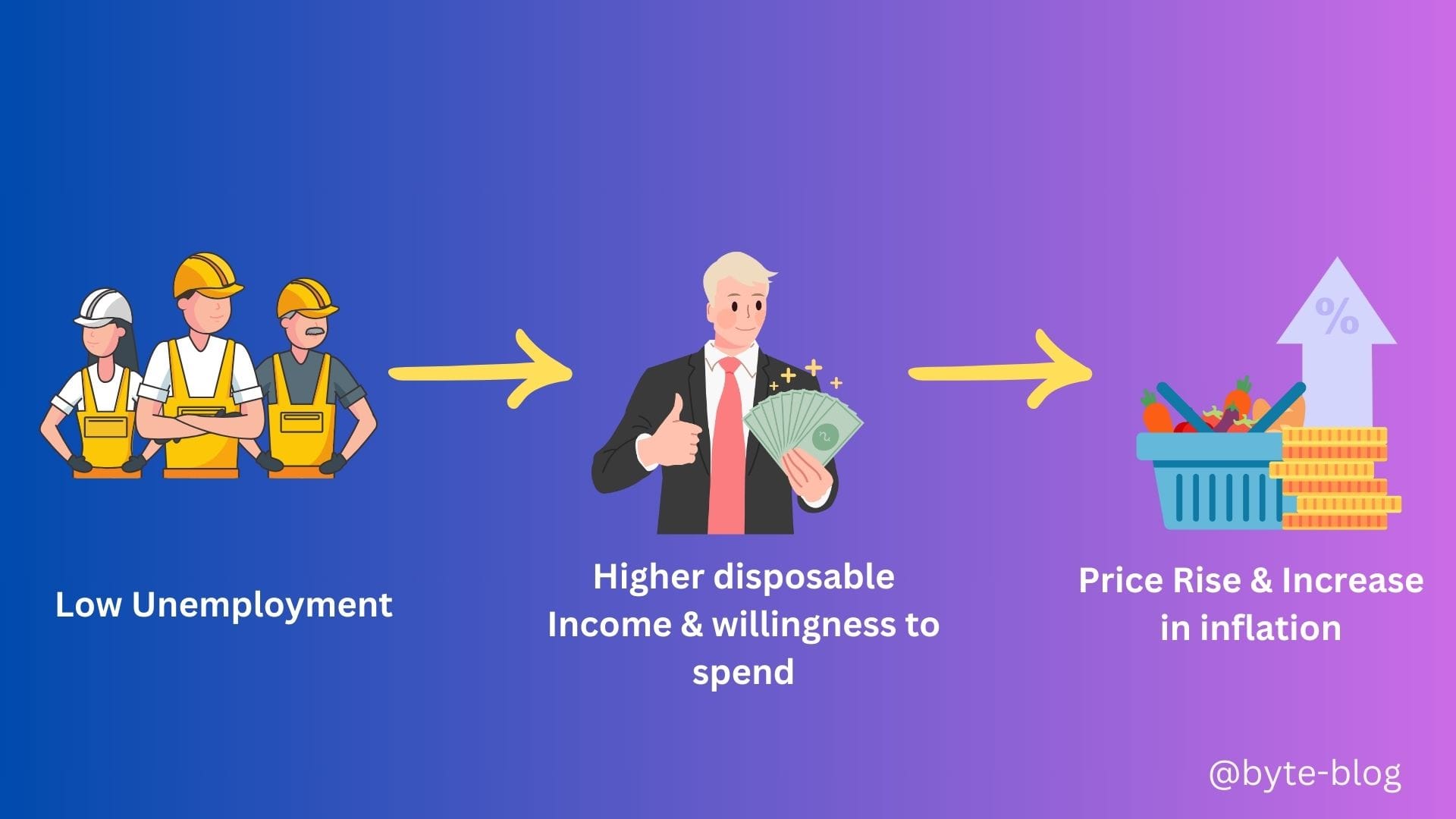

Higher employment or lower unemployment results in higher disposable income for households & higher willingness to spend. This causes more people to have higher disposable income.

This causes demand to increase further & further price increases. This price rise causes higher inflation & as it is accompanied by lower unemployment & higher production & disposable income, it causes GDP to increase.

Visualizing the above:

In a nutshell,

- Excess demand for goods & services causes supply constraints

- This causes businesses to raise prices & increase operations to meet rising demand

- Increasing operations causes higher employment & more disposable income.

- This increases willingness to spend increasing demand & so on..

Now, what are the causes of demand pull inflation or what causes this increase in demand?

Causes of Demand - Pull Inflation

- A Growing Economy - A growing economy causes consumers to have higher disposable income & be more optimistic about the future. This increased optimism results in higher spending pushing up demand further.

- Expansionary Monetary Policy - An expansion of money supply without corresponding increase in supply of goods causes prices to rise. Also reduction in interest rates causes consumers to take on more debt to buy goods or services pushing up demand leading to price increases.

- Expansionary Fiscal Policy - We will discuss fiscal policy in the next couple of weeks but for now, economic policies resulting in higher government spending, lower tax rates etc result in higher disposable income for households pushing up demand leading to price increases.

The economic transformation of US post World War 2 was marked by economic boom attributed to pent-up consumer demand & expansionary policies. Consequently, widespread price increases ensued. This scenario typifies demand-pull inflation post-crisis. (Source : here).

Let us now understand the other type of inflation

Cost - Push Inflation

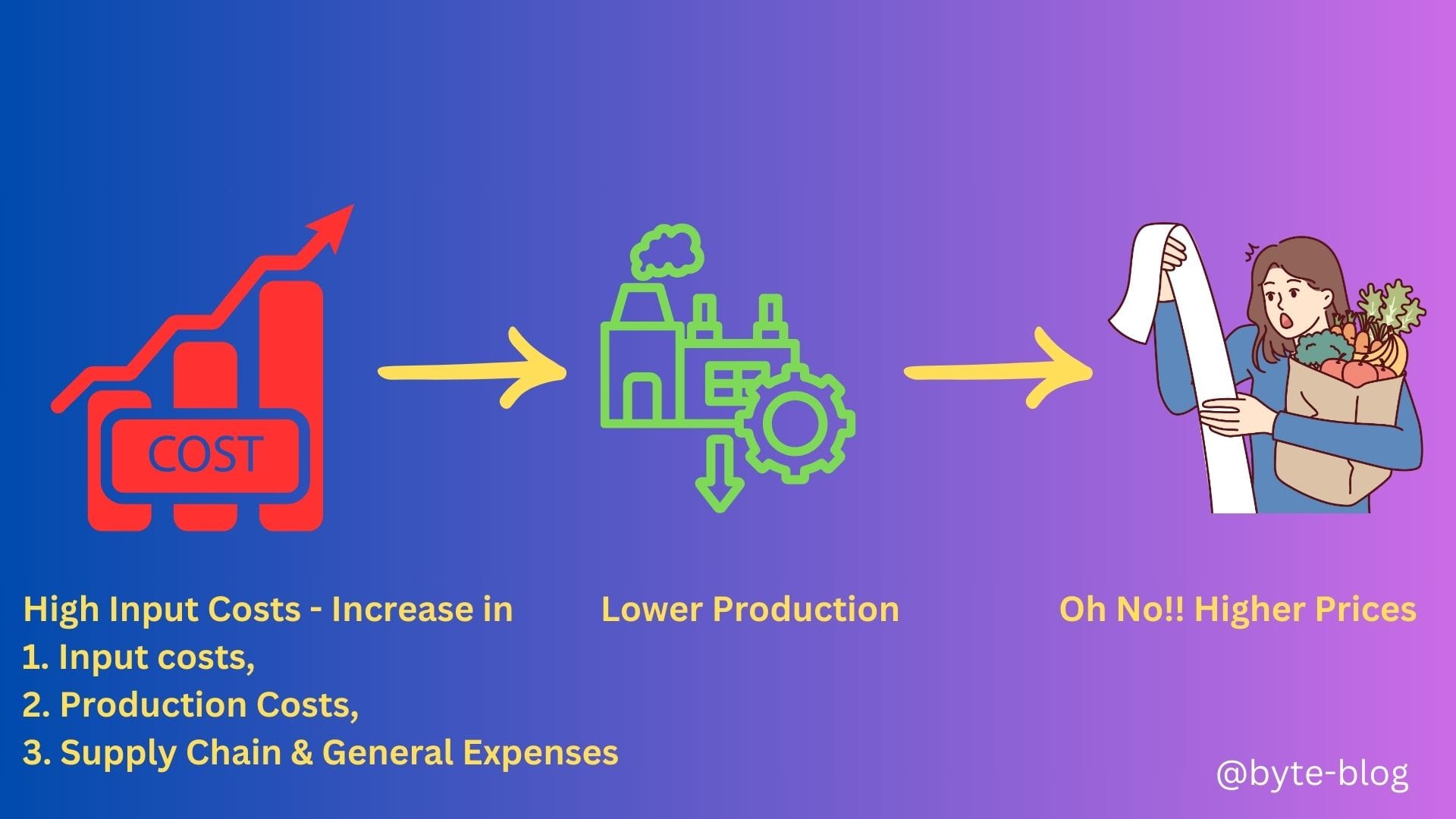

Cost - Push inflation refers to inflation caused by increase in costs of production. In simple terms, when the cost to produce any goods or service increases, the price of the final goods or services increase, & this causes cost-push inflation.

The increase can occur at any stage of production or in general business costs - energy costs, supply shocks, wage increase, interest rate hikes, tax hikes etc

What are the implications of higher production costs ?

- Contracting supply - Suppliers decrease production when it costs more for each unit of output they make

- Increase Price - Suppliers increase price to offset the increasing cost of production.

The main point about cost push inflation is that this is not caused by increased demand. In demand-pull inflation, higher prices was caused by high demand & low supply. Producers can increase production & supply with increased confidence due to high sustained demand. This also causes increase in production costs but this increase would be offset by higher profits due to hike in price & ouput.

In cost-push inflation however, due to high prices, demand actually falls resulting in contraction in economic activity. For the suppliers, this results in lower output & profits. This causes rising unemployment as suppliers embark on cost reduction initiatives.

Visualizing the above :

Causes of Cost - Push Inflation

Anything that causes cost of manufacture, supply, distribution or general expenses to increase results in cost - push inflation. Some of the major reasons are :

- Rising Fuel Costs - affects transport & production costs

- Rising Food Prices - impacts costs where agriculture produce is input to various agri-based & processed food industries.

- Higher Taxes - affects firm profitability & they respond by increasing prices

- Higher Wages - increases cost of production & general expenses

- Supply Chain Shocks & Natural Disasters - affects production due to disruption in supply, infrastructure damage etc & causes shortage or scarcity of resources.

Which Inflation Driver?

From the above, we saw that inflation is driven by two very different forces - one operates on the demand side of the economy & the other on the supply side.

However, at any point in time in any economy, both at are work in varying degrees & it is important to understand which factor is dominant in an economy.

But, how can we tell whether inflation in a particular economy is cost-push or demand-pull?

- Track the numbers for supply & demand. Is the supply increase as a result of underlying demand?

- Track prices & GDP over time periods - Generally when prices rise & GDP falls, it is cost-push inflation & if prices rise & GDP also rises, it is demand pull.

Understanding the inflation type impacting an economy is critical so that Central Banks can use the relevant tools to tackle the root cause of inflation & ensures it stays within the prescribed range.

But, why is inflation bad & what impact does it have on our lives & on the overall economy?