Strategy Byte - Week 28 Inflation - Impacting lives

Table of Contents

- Recap

- Inflation - Deep Dive

- Zimbabwe

- Argentina

- Key Takeaways

- Causes / Sources of Inflation

Recap

During Week 27, we introduced inflation as one of the critical variables in analyzing external environment. It is a macro-economic variable closely tied to our daily lives. It also increases the uncertainty in any financial or investment analysis.

There is inflation when the prices of many of the goods that we buy rise at the same time & then continue to rise. Explained another way, inflation is ongoing increases in the general price level for goods & services in an economy over time. (Source :here)

Then we analyzed the process by which inflation is computed as below :

- Select a Basket of goods & services

- Collection of Price data

- Assign weights

- Calculate the cost of the basket of goods & services

- Calculate inflation

We defined Consumer Price Index, also known as CPI which is a measure of the aggregate price level in an economy. The CPI consists of a bundle of commonly purchased goods & services.

Let us dive deeper into the concept of inflation.

Inflation - Deep Dive

We know that inflation is increase in prices of goods & services over a period of time. Now the question that comes to mind is, why are prices increasing? Let us take two cases of hyperinflation to understand their root cause.

Hyperinflation is defined as when inflation rate exceeds 50% each month over time.

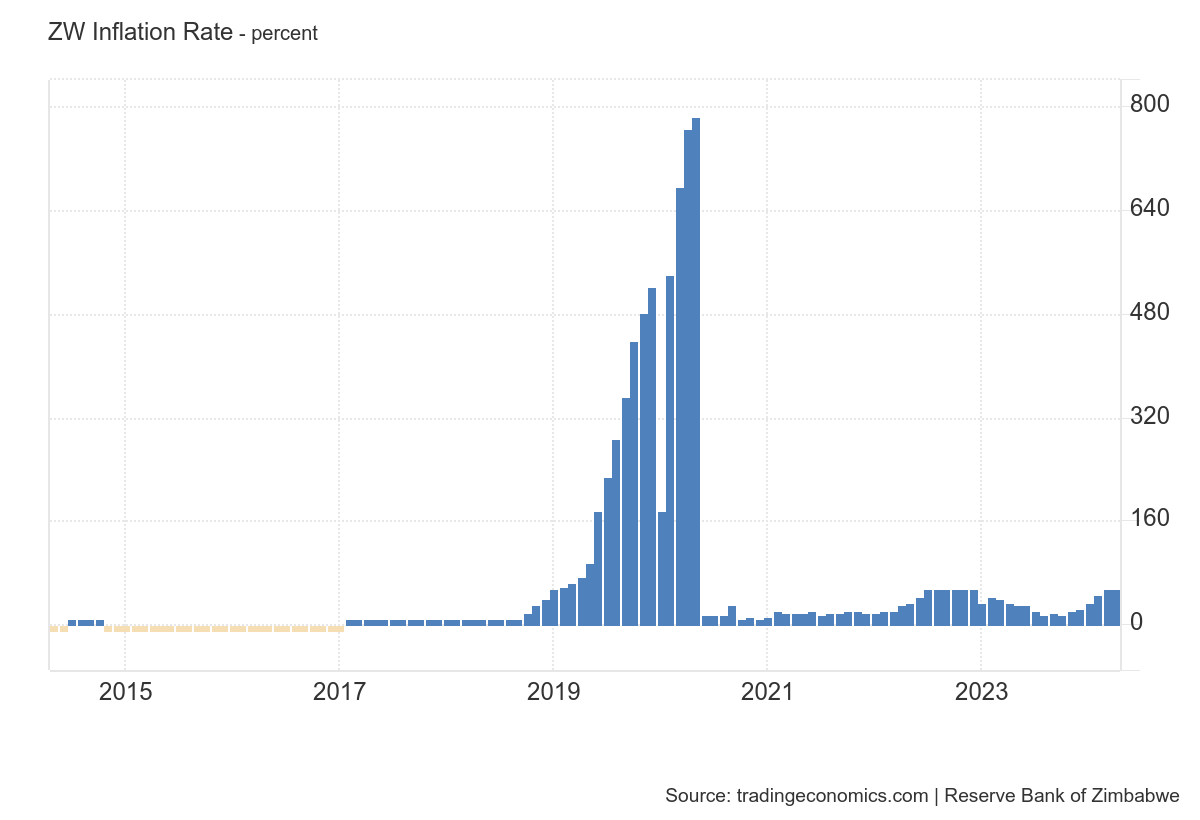

Zimbabwe

The inflation rate for consumer prices in Zimbabwe moved over the past 42 years between -2.4% & 24,411.0%. For 2022, an inflation rate of 104.7% was calculated (Source : here)

Hyperinflation Causes

Hyperinflation results from an interconnected set of policies & circumstances. In Zimbabwe's case, the main reasons were:

- Poor Economic policies of the Government which resulted in

- Decline in economic output causing shortage of goods

- Excessive printing of money

- Price controls

- Expectations of hyperinflation

Poor Economic Policies - Shortage of goods

- In the late 1990s, the Zimbabwe government introduced a series of land reforms. The faulty implementation of these reforms reduced agricultural output & most notably tobacco farming which was a significant source of foreign exchange. The effects also impacted the overall agriculture output negatively resulting in a large fall in food production.

- The sharp fall in output (both agricultural & manufacturing) experienced by the economy caused a collapse in bank lending which reduced investments in businesses - both ongoing support as well as new.

- The decline in output caused shortages of goods, which pushed prices up.

Poor Economic Policies - Excessive Money Printing

- The Government began increasing the rate at which they were printing money. This started with printing money to finance a war in Congo & also to increase the salaries of officials & soldiers. This caused a significant increase in money supply.

- But, as the economic crisis worsened, printing money became a very short term solution to try & placate people relying on government pay.

- With the economy in decline, government debt increased. To finance the higher debt, the government responded by printing more money, increasing inflation further.

- Combining this shortage of goods with more paper money resulted in higher demand for those goods causing prices to rise rapidly. It was a case of too much money chasing too few goods

- The prices were so high that they started printing notes worth billions & trillions in local currency.

Price Controls

- To combat rapid price rises, the Government imposed price controls ( with the good intention to keep prices affordable & stop inflation).

- However, the cost of producing goods increased while the output prices were controlled which affected the producers negatively by way of higher costs & lesser income hence impacting production. This exacerbated the shortage & increased inflation further.

Expectations of Hyperinflation

Once a country enters hyperinflation, the people expect it to be ongoing & hence demand higher wages & push up prices in anticipation of higher inflation in future. This is a self fulfilling dangerous loop which further contributes to higher inflation.

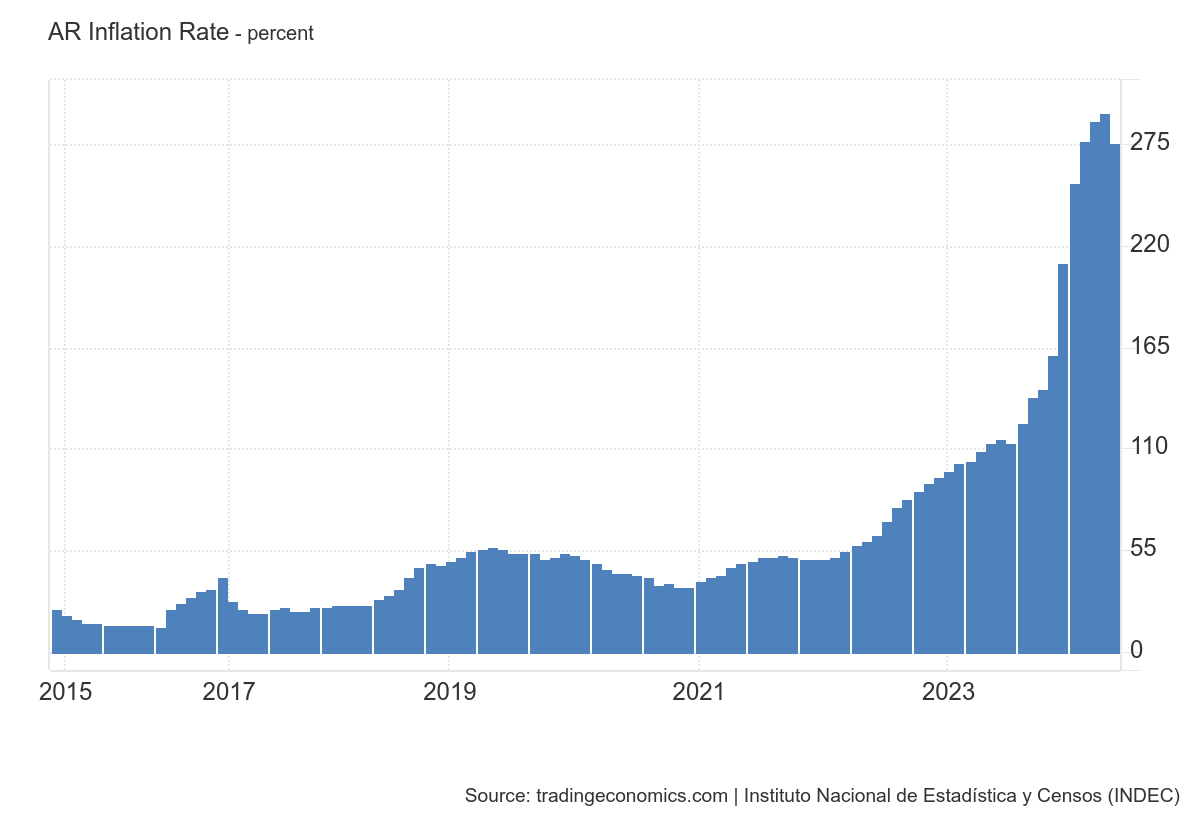

Argentina

Argentina's inflation has been extremely high and volatile in recent decades. The hyperinflation of the 1980s peaked in 1989 with an inflation rate of over 3,000 percent. In the years that followed, the rate fell relatively quickly back to almost normal levels of less than 5% per year. There was even slight deflation in 1999 and 2001.

Poor Economic Policies - Political Uncertainty

Due to political uncertainty & resulting economic policies, price increases of often over 10% were not uncommon until 2013.

In recent years, however, rates have risen dramatically & consumer prices are even expected to rise by over 200% again in 2024. This means that Argentina once again has one of the highest inflation rates in the world. (Source : here)

Inadequate economic & monetary policy are the main reasons for the decades old inflation. Political instability & corruption in government are often cited as root causes. The high level of political uncertainty also prevented consistency in economic policies & long term economic planning.

An expansive monetary policy to finance budget deficits & uncoordinated economic planning contributed significantly to inflation. Currency fluctuations & debt crisis further exacerbated the effects of inflation.

Key Takeaways

We can see from the above that the impact of poor economic policies combined with short term actions which cause long term damage are the most likely causes of inflation.

We can classify the above under :

- Falling economic output resulting from mismanaged economic policies & resultant demand for those goods

- High Government spending

With the above in mind, we can now answer the question - What causes inflation?

Causes / Sources of Inflation

From the above, we can see that Monetary policy is a critical driver of inflation. The major reasons for inflation can be

- Increased money supply

- High cost of production (materials, labor etc)

- Supply chain disruptions

- The above can be exacerbated by local as well as geopolitical events (COVID, Wars etc)

There are two primary causes of inflation. They are

- Demand Pull Inflation

- Cost - Push Inflation

Let us deep dive further next week