Finance Byte - Week 12 Cost Structure & Behavior

Table of Contents

- Recap

- Jack's Problem

- Cost Structure

- Cost Behavior

Recap

During Week 11 of Finance Bytes, we discussed Product Mix. Let us recap the salient points discussed :

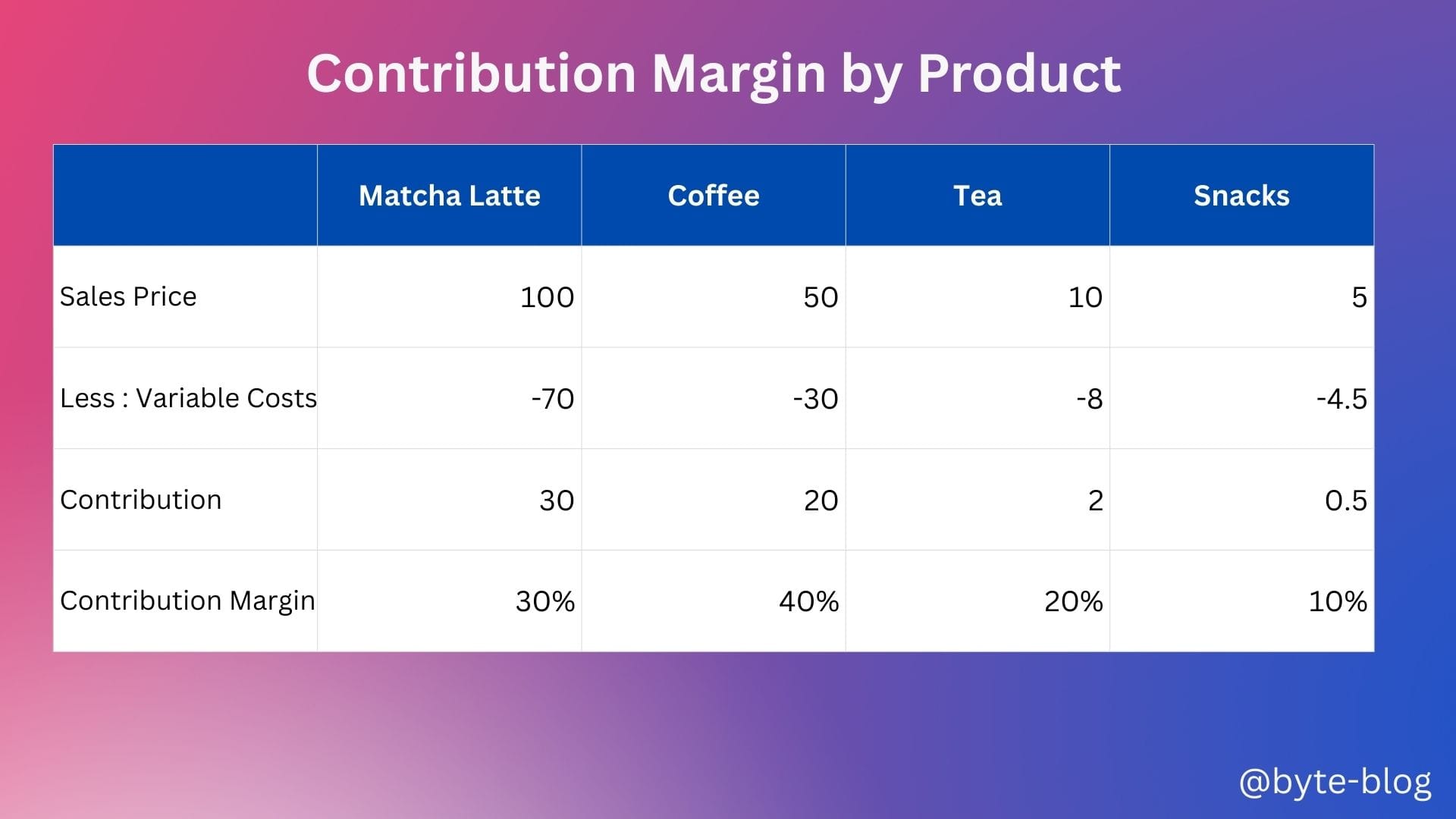

- A company might have one product or multiple products which it sells to customers. Our cafe owner Jack sells Matcha Latte, other latte mixes, hot coffee, tea, snacks etc to customers.

- Understanding the contribution margin of each product is important. Why?

- Because, higher contribution margin means the income from that product covers fixed costs & contributes to higher profits for the entity as a whole in comparison to products with lower contribution margin

But just doing product mix analysis without considering customer sentiments is not right as customers might prefer to buy low contribution margin products also, Hence, companies manage their product mix in a way that their profit potential is maximized in line with customer needs & market requirements.

The strategy of including a product which sells at a loss along with other profitable products is called Loss Leader which is defined as :

A loss leader strategy involves selling a product or service at a price that is not profitable but is sold to attract new customers or to sell additional products & services to those customers.

We then explored the segmental results of Apple to get an idea of the breakup of income by product.

But the efficiency of contribution analysis depends on how robust the system is to capture & allocate costs to individual products. Direct costs can be captured & allocated to individual products like component & labor costs for Iphone, Ipad etc. Allocation of indirect costs can be tricky & involves assumptions which must be robust & revisited periodically depending on circumstances.

Another complication is that costs don't stay the same over a period of time. Variable costs may change reducing the margin for some products & requires constant revision & analysis. Fixed costs change in line with step up in production or sales which we will get into later.

From Contribution & Contribution Margin, we explored how much revenue covers fixed costs to add to enterprise profits. But understanding contribution margin is just the first step for Jack to decide on an action plan to increase profitability. What does Jack need next? Let's dive in to see....

Jack's Problem

Before we get into the weeds of the analysis, let us understand Jack's problem.

- Jack has multiple items in his menu which he sells at different margins.

- He earns higher contributions from Matcha latte & Coffee while earning lower contributions from Tea & Snacks.

- But, as we said last week, he cannot just cut tea & snacks from the menu as his customers might prefer tea & snacks either on their own or with other items in the menu.

But to ensure his cafe business grows with sustained profits, there are two things Jack needs to get a grip on :

- Reducing costs & introducing cost efficiencies into operations

- Optimizing his product mix with pricing to increase revenue & profitability by selling more products with higher contribution margin.

Before initiating cost reductions or introduce efficiencies, Jack first needs to understand his cost structure to see how actually cash flows through his cafe operations.

Now, what exactly is cost structure?

Cost Structure

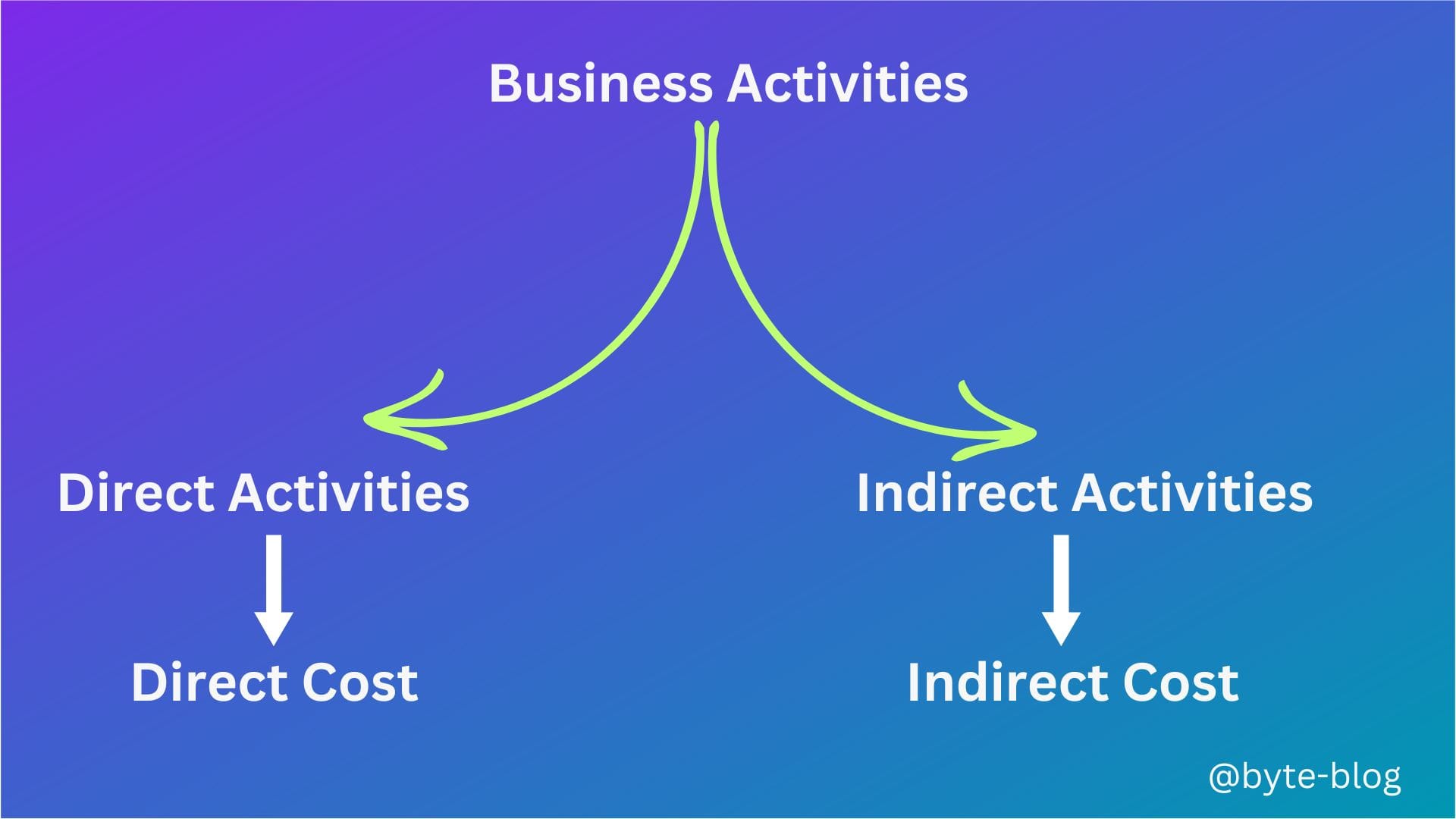

We correlated business or operations activity of a company to cost in Week 5 as visualized below:

So, it means there are activities or operations

- required to make & sell coffee (Direct Activities) &

- required run the coffee shop (Indirect Activities)

Cost Structure is the breakdown of expenses incurred by a business in it's operations. It refers to various costs associated with production & delivery of goods & services.

Understanding the cost structure is critical for a business to understand their profitability & efficiency of operations.

Through understanding cost structure, Jack will know :

- What are the major items of cost influencing his cafe business?

- Which key operating activities drives his cafe costs?

He then will be able to focus from cost perspective to see if he is running his cafe efficiently & allocate resources to increase profitability.

Once Jack has an idea of his cost structure & how they behave, he has to earn revenue to first cover his costs before he can think of making a profit. This is actually the first step in his path to growth when building his cafe.

But for that, he needs to know how his costs behave depending on his business operations. What does that mean?

It means he has to know which costs vary directly with production &/or sales as they need to be covered first to earn a contribution margin.

Then the contribution margin must cover fixed costs.

Cost Behavior

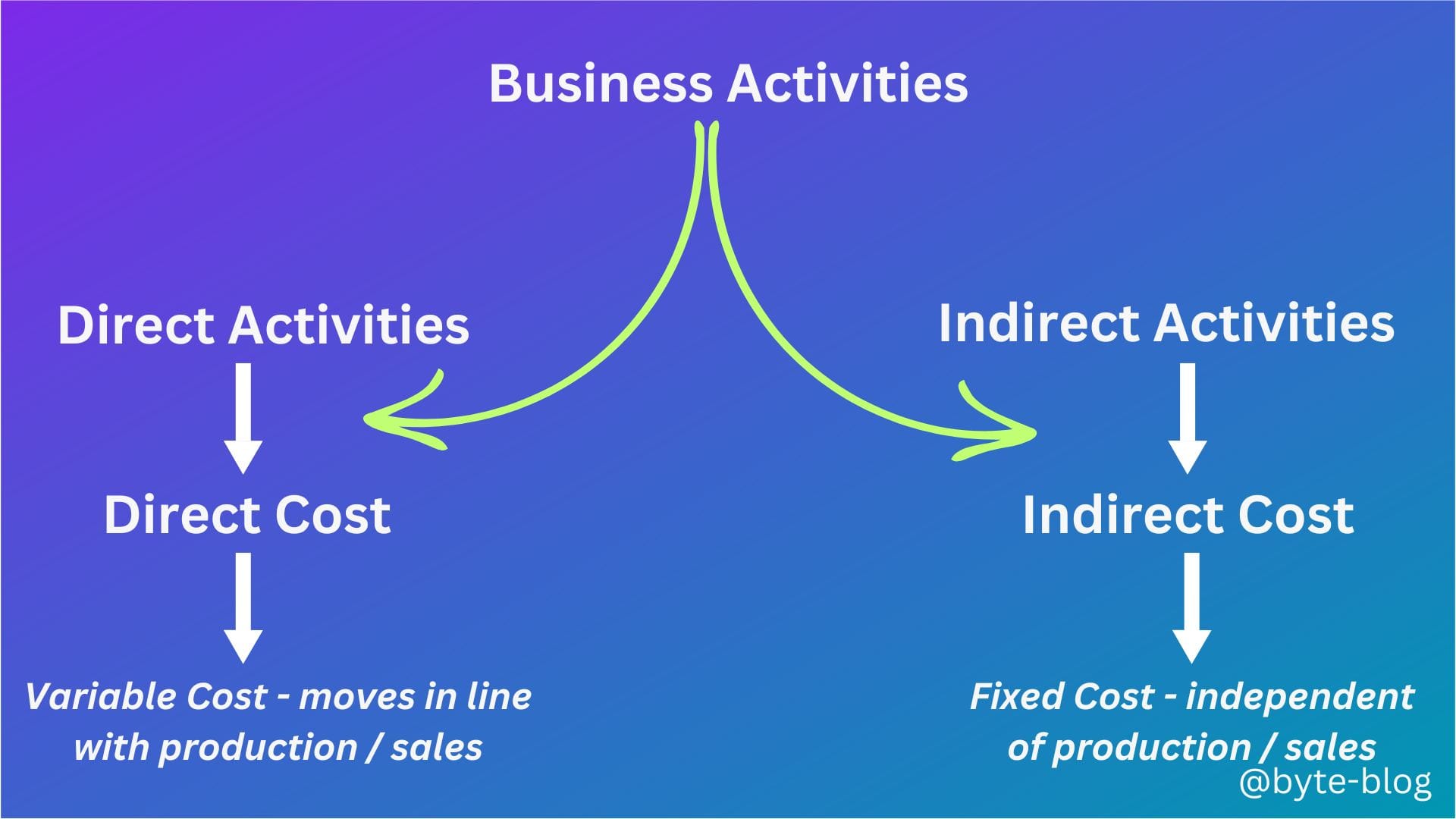

We discussed two ypes of costs in Week 5 - Variable & Fixed Costs. Let us again do a recap with a new classification:

- Variable Costs - which varies with production / sales volume &

- Fixed Costs - which remains fixed irrespective of production / sales volume.

- Mixed / Semi-Variable Costs - which has a mix of both meaning a cost might remain fixed up to a certain level but increases once a threshold is crossed.

This variability in costs in line with activity levels in a business is called cost behavior which means how an item of cost changes with production &/or sales volume. An important thing to understand is that theoretically though costs are either variable or fixed, in real life it's not that straightforward (which we will get into later).

But where will Jack get the information on cost behavior?

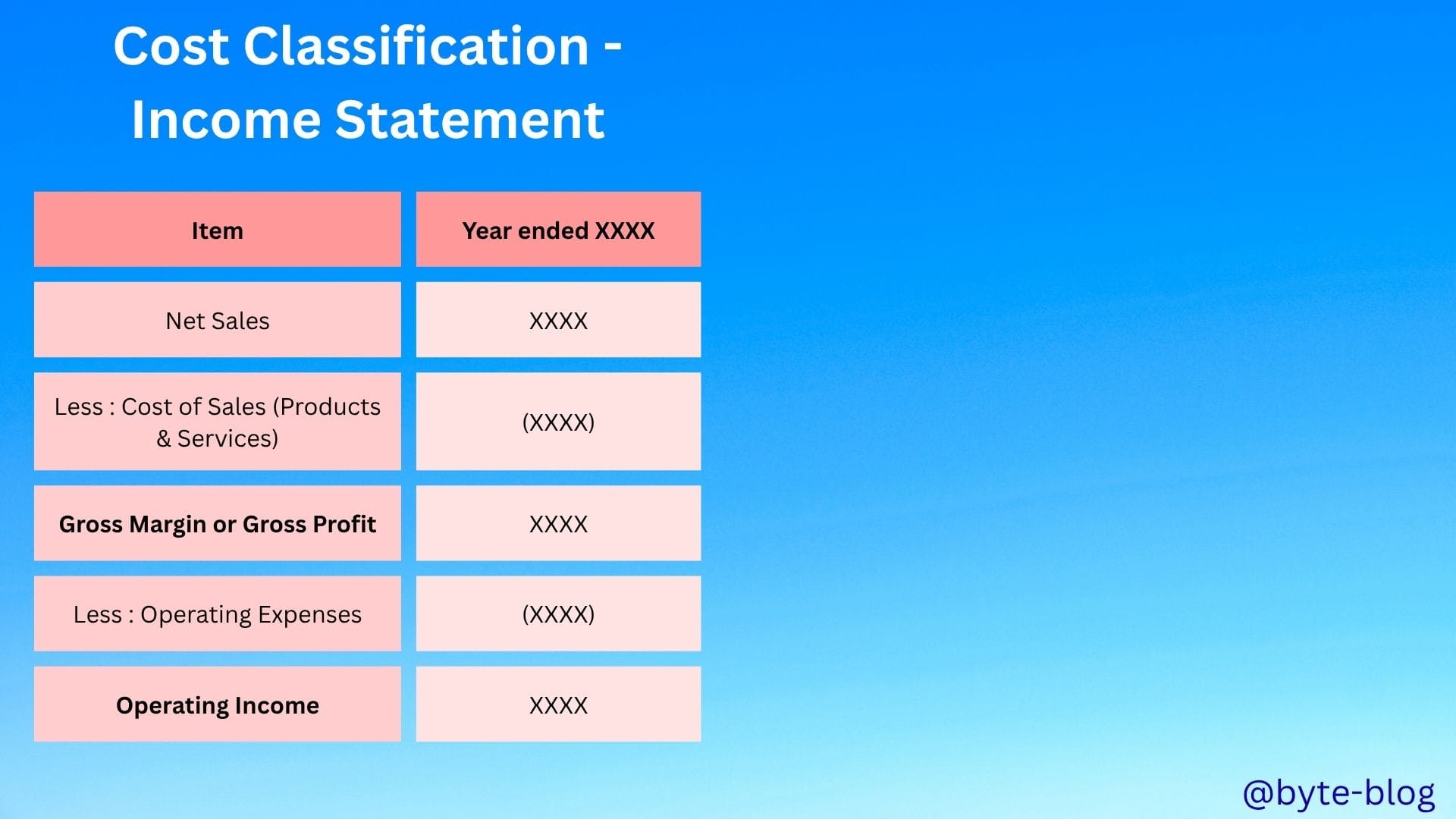

From the income statement, can Jack make out which costs are fixed or which are variable? Let us revisit the income statement from Apple :

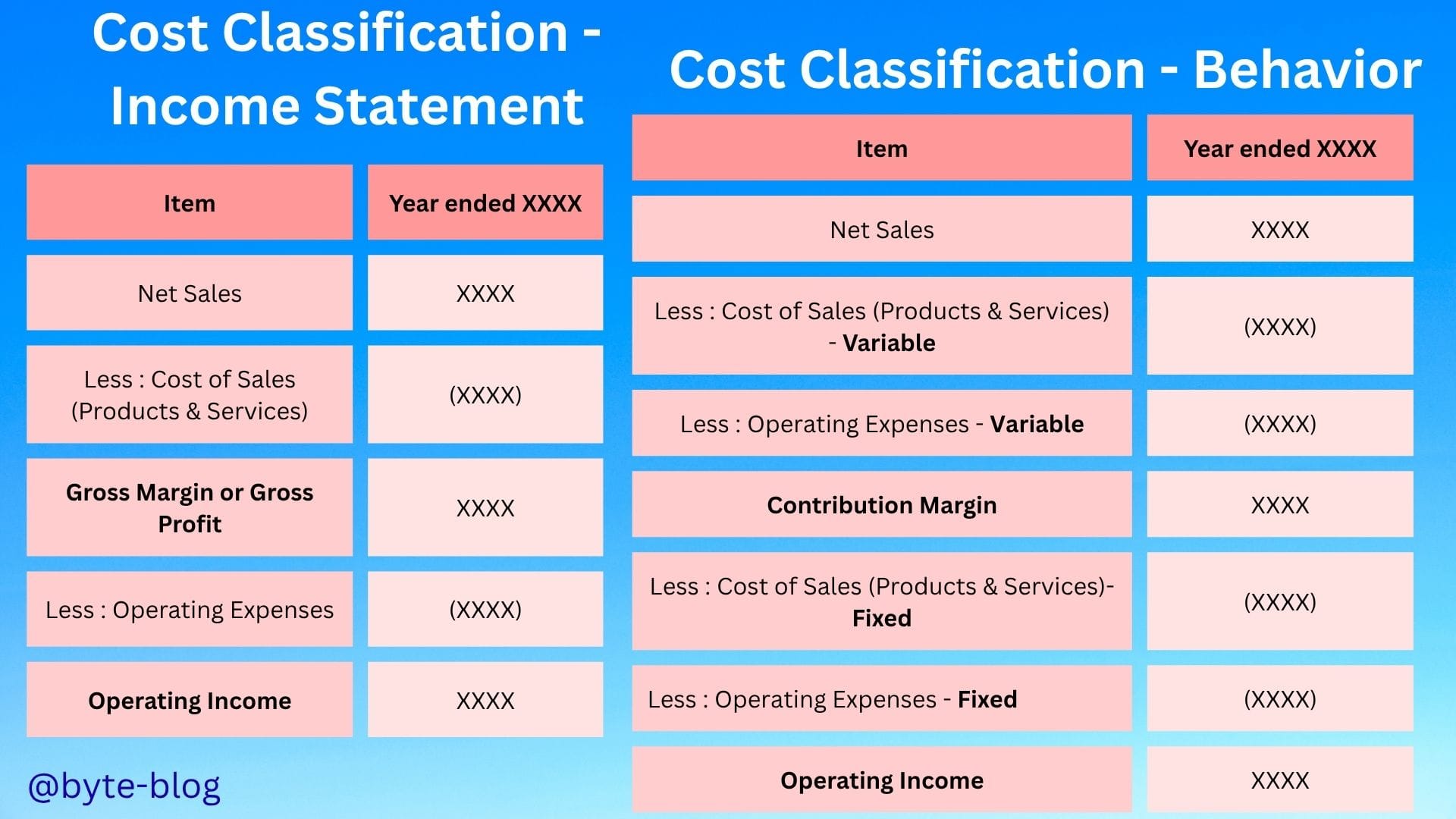

We can see the lines under costs classified as visualized below :

Does it say anything about costs being fixed, variable or semi-variable ? No.

Financial statements reflect classification of costs & does NOT reflect cost behavior. That is the objective of financial statements - to give context behind company performance by

- Classifying income & costs so that the reader can know from where & how much the company earns it's revenue & where does it spend to earn that revenue.

- And providing stakeholders with the final result whether the company is profitable or not.

But what Jack needs is to classify his costs based on behavior as in the table below (on the right):

The table on the right classifies costs as variable or fixed which gives more clarity to Jack for decision making. But how will Jack do the modeling & take the right decisions? Let's dive in deep next week with actual models & a dose of Breakeven Analysis: