Finance Byte - Week 5 Coffee Costing

Table of Content

- Recap

- Business Activity

- Activity to Cost

- Profit / Loss

Recap

During Week 4, we started our journey to understand finance concepts by following an entrepreneur named "Jack" whose dream is to start a coffee shop. We will follow his journey as well as build on the concepts brick by brick, dream by dream as he embarks on his entrepreneurial adventure.

To make his dream a reality, he invests cash or capital into his business. This amount of initial investment into a business is called "Capital". This is the first transaction undertaken in his business. We defined Capital as :

Assets or resources that are used to produce goods & services.

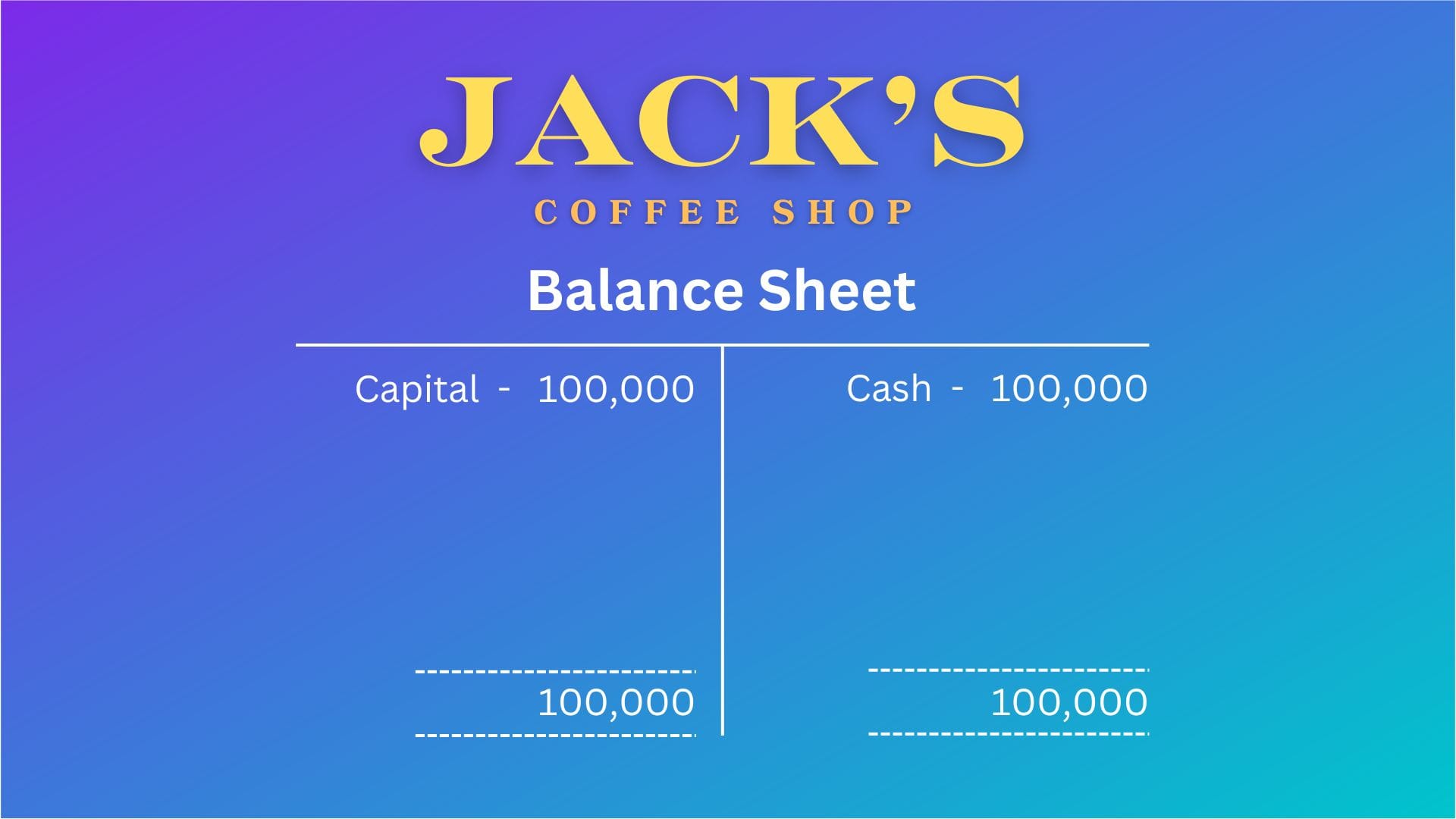

We then visualized the balance sheet as below:

The left side of the balance sheet shows the Source of funds (from where he gets the money) & the right side shows how & where those funds are placed or utilized - Utilization of Funds.

What will he use this capital for ?

- Activities to make coffee

- Activities to run & maintain the coffee shop

Then we explained a transaction impacts more than one of the below statements ;

- Balance sheet

- Income statement

- Cash Flow

Jack entered into the below transactions :

- Rent per month - $ 2,000/-

- Furniture cost - $ 20,000/-

- Coffee machines - $ 10,000/-

- Raw materials for coffee - $ 500 per month

- Other expenses - $ 500/- per month

Assuming all these are paid for in cash (to simplify), below is the cash balance at the end of the month :

Let's move on :

Business Activity

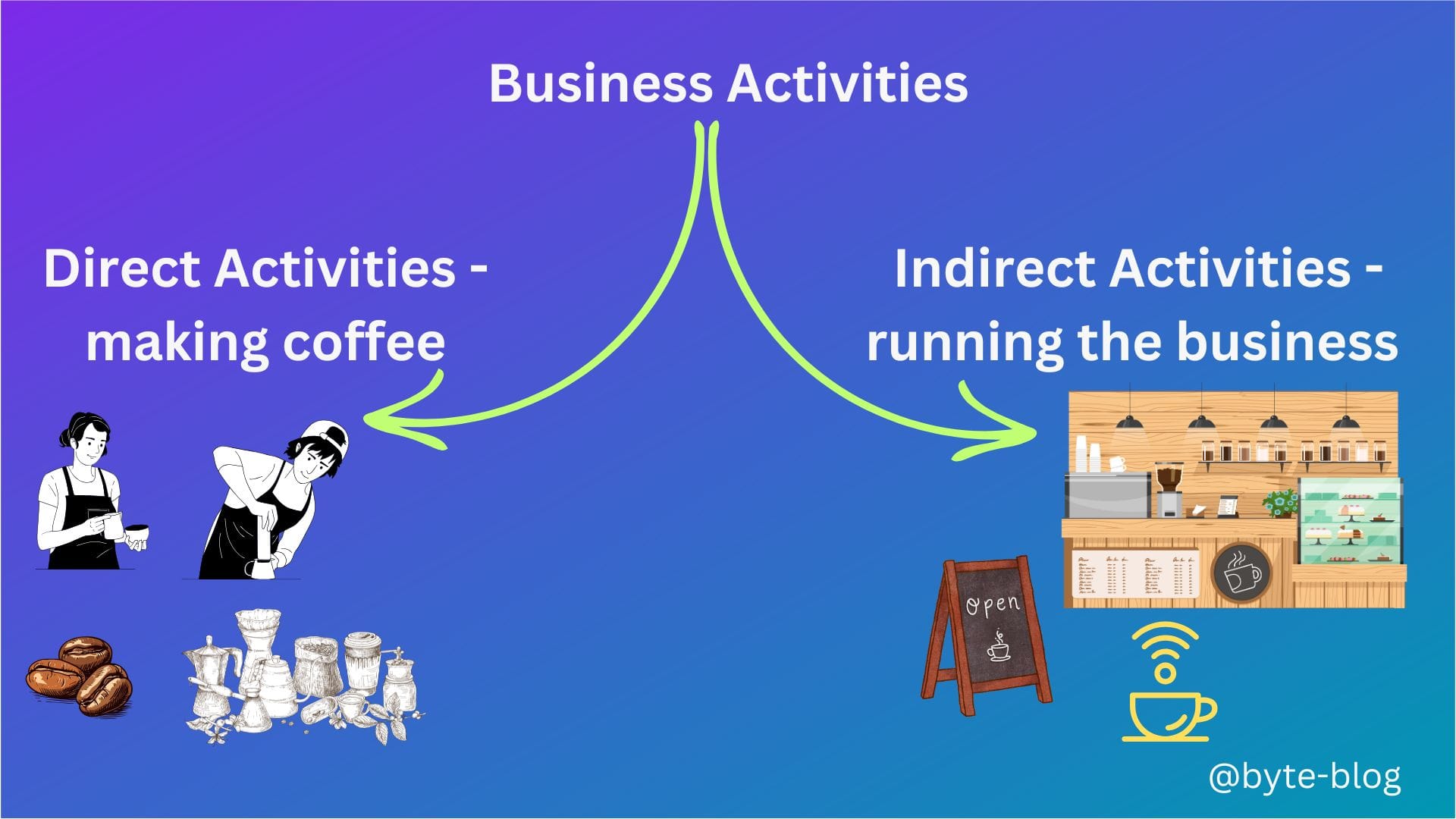

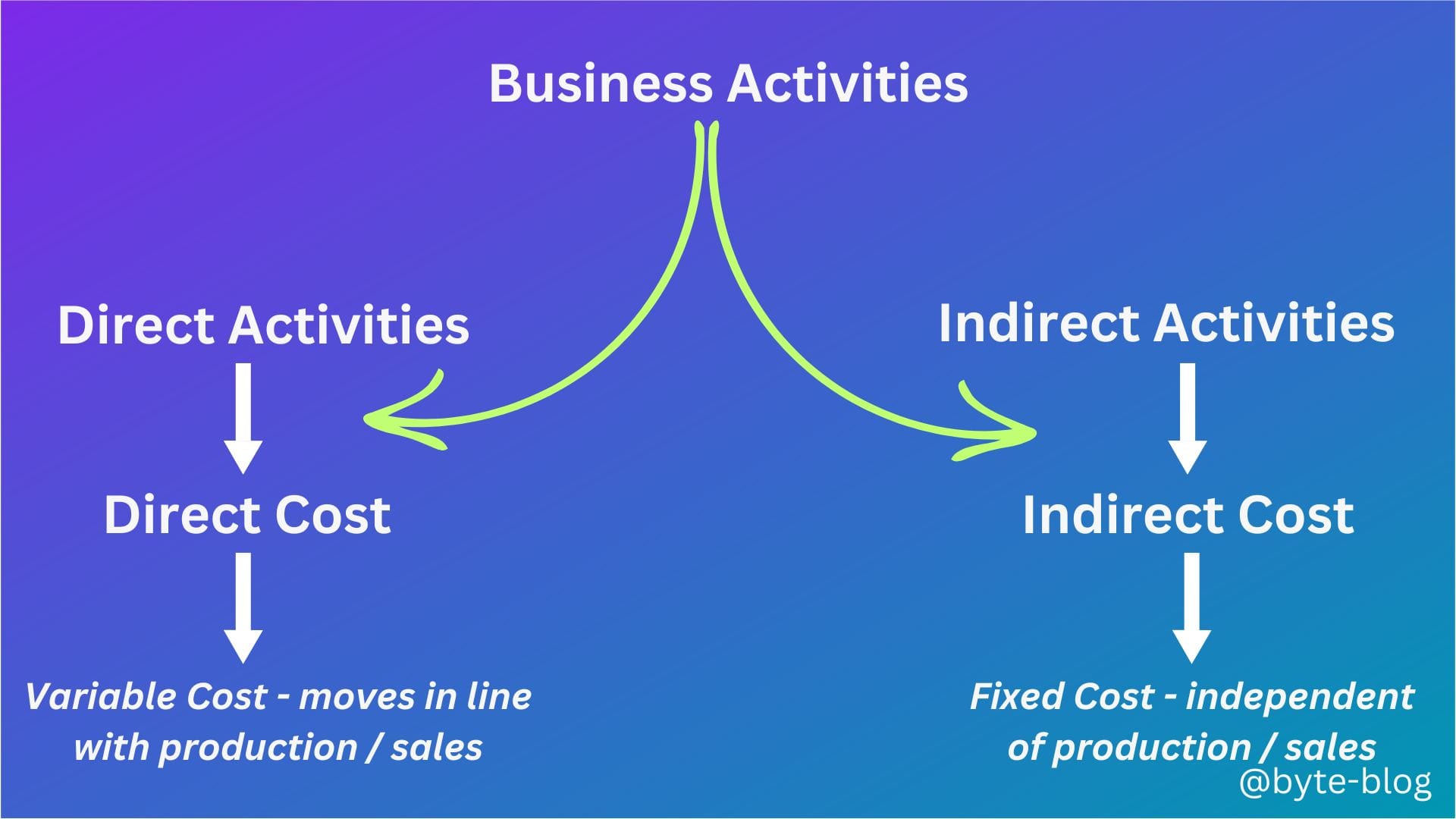

We saw there are two types of activities required to run his business :

- Activities to make coffee

- Activities to run & maintain the coffee shop

Jack is in the business of making & selling coffee in an ambient cafe. That is the product / service that his business sells to customers. An activity carried out to make coffee is a direct activity. Any costs incurred in relation to a direct activity is called direct costs. E.g., of direct costs are material costs (e.g., milk, coffee beans, sugar etc), labor etc.

Now, in addition to making coffee, there are other requirements to run his business. He needs a place & the necessary infrastructure to ensure he is able to consistently produce & sell coffee. Also, his cafe needs to have necessary ambience so that customers keep coming back to enjoy their coffee.

Such activities which are necessary to keep the business going but without any direct involvement in making the coffee is called indirect activity & any costs incurred in relation to an indirect activity is indirect costs. (e.g., rent, electricity, WiFi charges, cafe maintenance etc)

Visualizing the above :

Activity to Cost

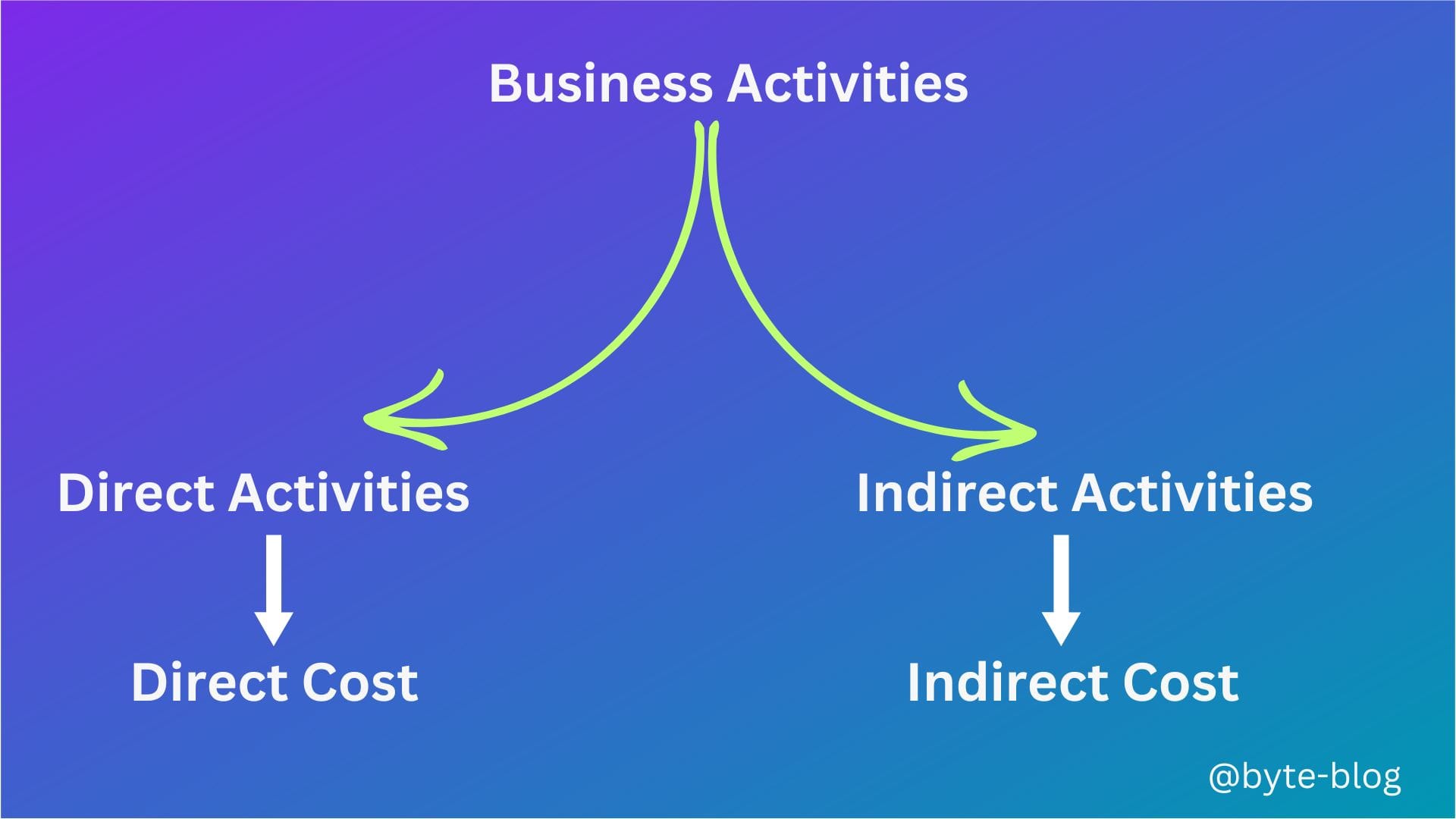

Adding the element of cost,

Now Jack is thinking - "Why do I have to classify costs based on activities to run the business?"

It is important that Jack understands his spending patterns. Understanding his spending patterns means to understand the cost behavior. What is cost behavior?

Let us take the monthly raw material costs - $ 500. Assume the break up is :

Milk - $100

Coffee - $200

Sugar / Creamer etc - $200

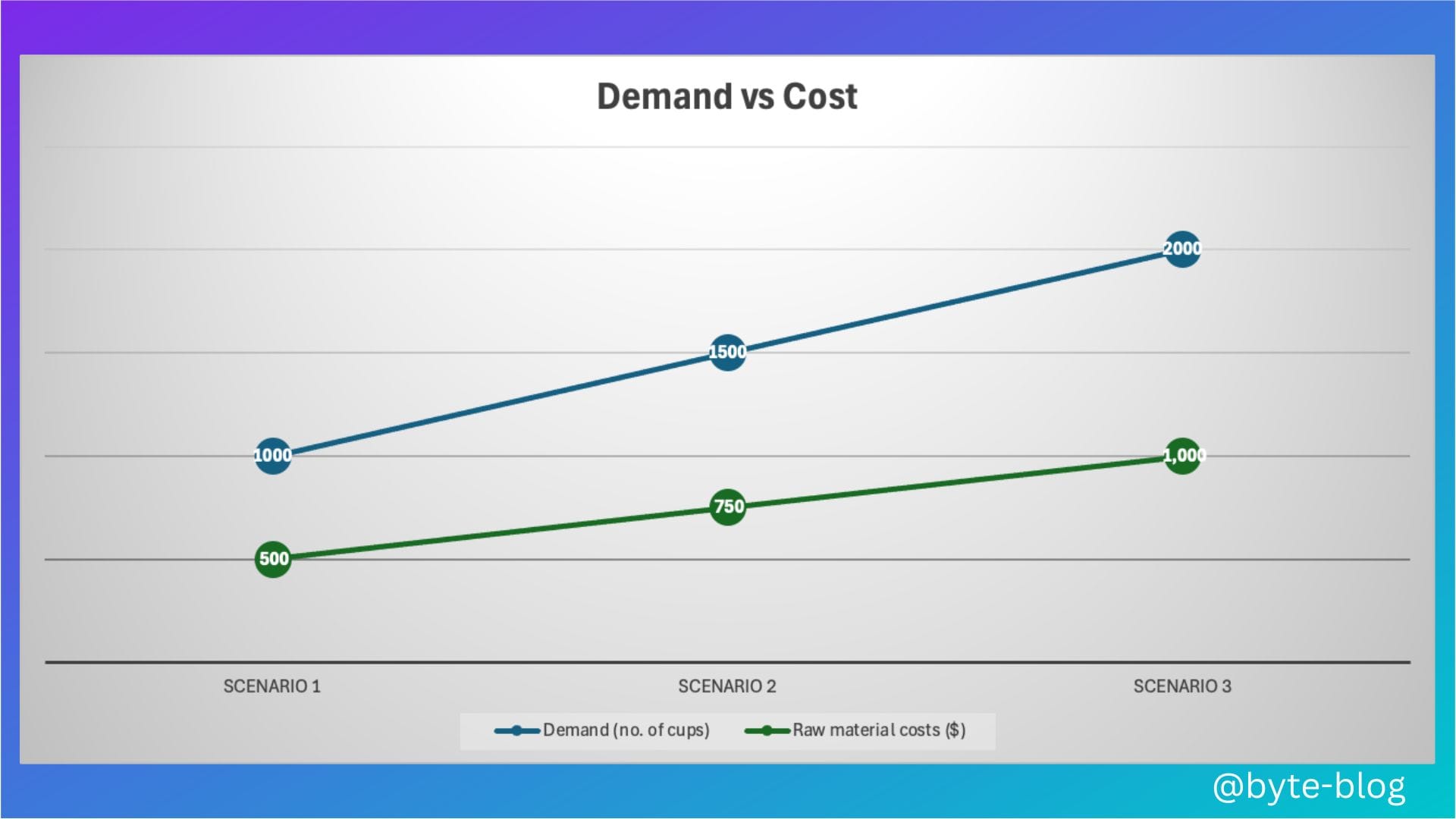

Assume the above quantities of materials are required for 1,000 cups of coffee. If he keeps selling the same quantity of cups every month, he will incur the same cost (assuming no increase in price of materials).

But what if he sells 1,500 or 2,000 cups? Or what if the demand falls to 750 cups? What do you think will happen?

His raw material cost will move in line with sale of coffee cups - meaning if his sales / demand increases, the raw material costs also increase as he will need more raw materials to prepare the additional cups demanded or sold.

On the flip side, if demand falls, then less raw materials are needed & raw material costs fall.

Let us visualize it :

Same logic applies to labor costs. For higher demand or sales, Jack will need to hire more baristas to make coffee. So his labor costs will also move in line with the demand or sales.

This type of cost which moves in line with unit sales is called Variable Cost.

A variable cost is an expense that changes in proportion to how much a company produces or sells. Variable costs increase or decrease depending on a company's production or sales volume - they rise as production increases & falls as production decreases. (Source : here)

Let us take another cost - Rent @ $2,000 per month.

Irrespective of the number of cups sold, rent remains the same at least for 12 months & any increase in rent has nothing to do with the increase or decrease in coffee cups sold. It is more a factor of real estate supply & demand than the business volumes.

Such costs remain at the same level irrespective of coffee cups sold.

This type of costs which do not change with increase or decrease in unit sales is called Fixed Cost.

A fixed cost is a business expense that normally doesn't change with an increase or decrease in the number of goods & services produced or sold by the business. (Source : here)

Adding this to our visual completes the chain from business activities to cost type.

In real life, however, cost behavior is not as black & white as stated above. We will get into that at a later stage.

Why should Jack be bothered about cost classification between direct, indirect, variable or fixed ?? Isn't that too much of a bother for him?

For that, let us ask the question - why is he doing business in the first place?

So that he can earn a living selling coffee. To make a living, he should earn more from his cafe than he spends on it or in other words, his costs should always be less than his earnings.

It is not enough that his cost is less than sales but his business in run in a way that each dollar of cost incurred is justified in line with his business requirements. This means his business is run efficiently.

For e.g., if cost of milk per month is $100 currently & he found another milk supplier who is ready to supply milk at $90 per month, it would make no sense for him to continue with the current vendor. If he moves to the new vendor, his cost of milk will reduce by $10 per month.

To run a business efficiently, understanding each element of cost, it's behavior & ensuring every single dollar spent goes to

- Maintaining &/or increasing his sales &

- Keeping the business running

in the most efficient way possible.

Profit (Loss)

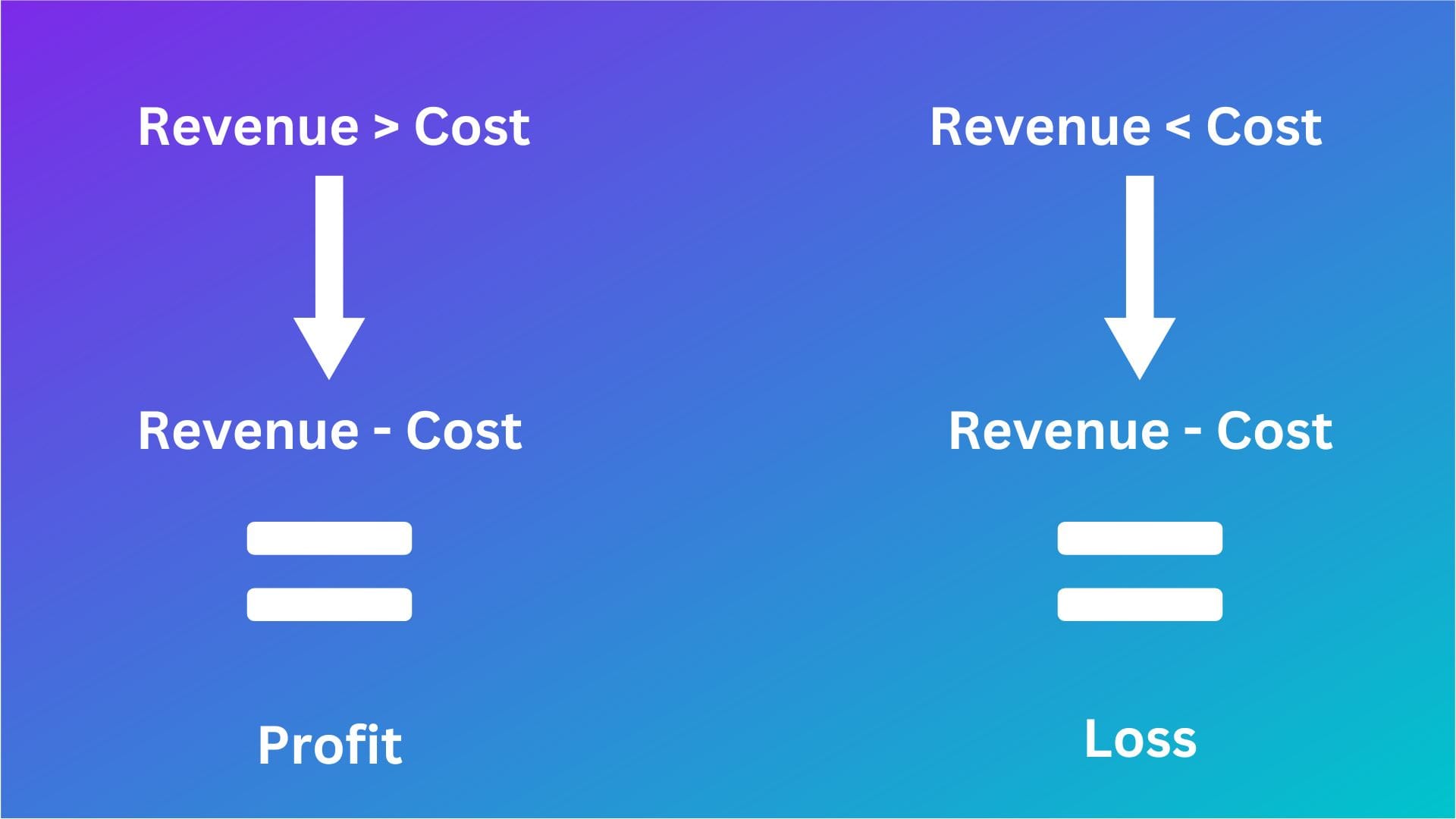

We said above that Jack has to sell cups in a way that his sales earnings is higher than the cost incurred in producing & selling those cups. Then only it makes sense for him to carry on his cafe business.

If he earns more than he spends (costs), the net balance after reducing his earnings from his spends, his business is earning a profit. On the flip side, if he spends more than he earns, his business is running at a loss.

Defining it :

Profit is the value remaining after a company's expenses have been paid. If the value that remains after expenses have been deducted from revenue is positive, the company is said to have a profit, & if the value is negative, then it is said to have a loss. (Source : here)

Visualizing the above :

For e.g, if Revenue = 100, Cost = 50, Profit = 50 or

if Revenue = 100, Cost = 150, Loss = (50)

Now, Jack knows he must track his spends to ensure

- They are less than revenue or earnings &

- They are not more than what they should be

But then, not all spends will result in earnings in the same year. Some expenses might result in income :

- In the same year or

- Over the next couple of years

Not another classification.. Let's leave that for next week!!