Finance Byte - Week 6 Coffee Expenses

Table of Contents

- Recap

- Cost & Benefit

- Operating Expense - Same Year Benefit

- Capital Expense - Multi Year Benefit

- Financial Statements

Recap

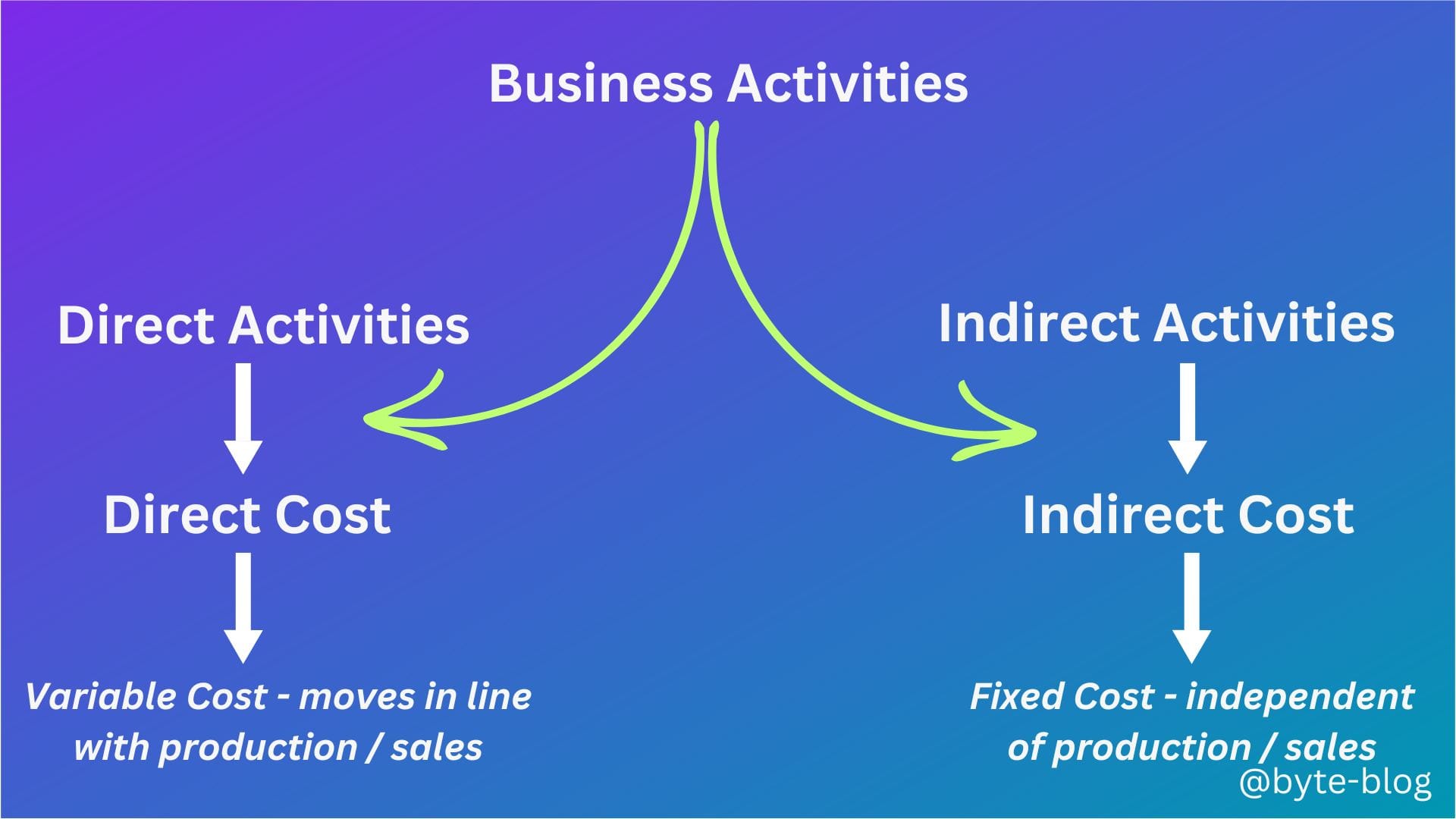

During Week 5, we tracked our learning from business activity to costs. We classified the activities to run Jack's coffee business under two heads :

- Activities to make coffee

- Activities to run & maintain the coffee shop

Since Jack is in the business of making & selling coffee, activities directly related to making coffee are direct activities & costs required to carry out direct activities are called direct costs.

All other activities which are required to keep the business running but not related to coffee making are called indirect activities & the related costs are called indirect costs (e.g., rent, electricity, WIFI charges etc).

Then we moved to Cost Behavior - how costs move in line with items sold or sales.

- Does it move in line with unit sales?

- Is it fixed irrespective of unit sales?

Costs which move in line with unit sales is called variable costs & costs which do not change with unit sales is called fixed costs.

Mapping the above journey from activity to costs :

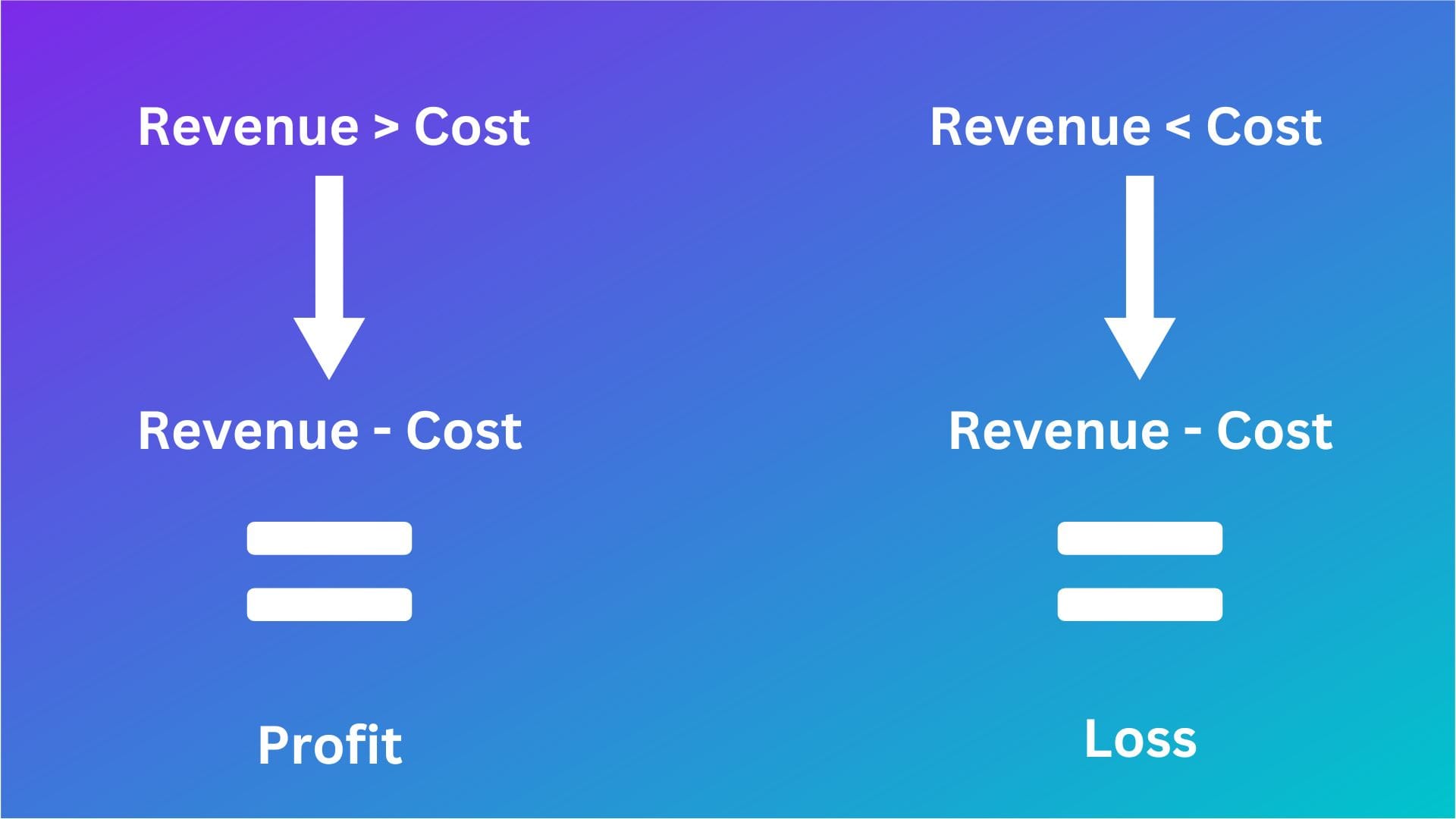

To ensure Jack benefits from his coffee business, the expenses or total costs should always be less than sales or in other words, what he makes from selling coffee should cover all his costs (direct & indirect).

If he make more from his sales than his costs, the positive value remaining after deducting costs from sales is called Profit.

If his sales are less than costs, the negative value or shortfall in sales to cover costs is called Loss.

Visualizing the above :

Let us move to the next step to relate Benefit to Costs

Cost & Benefit

Jack spends money to run his business - Why?

To sell coffee. Why?

To get some benefit out of his business, which is increased sales so that he can increase his profit.

Hence, Benefit = Higher sales

Another benefit which can come from spending is to reduce cost somewhere else (e.g., implementing new ordering system so customers can order online & collect their coffee which reduces the need for more cashiers) & that reduction in cost would bring in higher profits as

Profit = Revenue - Cost

and if costs come down with same or higher revenue, the profits would be higher.

Hence, Benefit = Reduced Cost

So, the benefits from spending money on his business are :

- Increased Revenue &/or

- Reduced Costs

Now, the above benefits can come in the same year or in multiple years. How?

Operating Expense - Same Year Benefit

Let us take one item – Coffee Cups.

To sell coffee, Jack needs paper cups. For that, he has to pay paper cup suppliers the cost of those cups.

What happens to these paper cups? He puts coffee in them & makes the sale. The benefit from spending for coffee cups are instantly realized through the sale of coffee.

We can use this logic for electricity expenses, WIFI charges etc which are required to keep the shop running otherwise no customers will come to Jack's coffee shop & Jack will not be able to sell coffee.

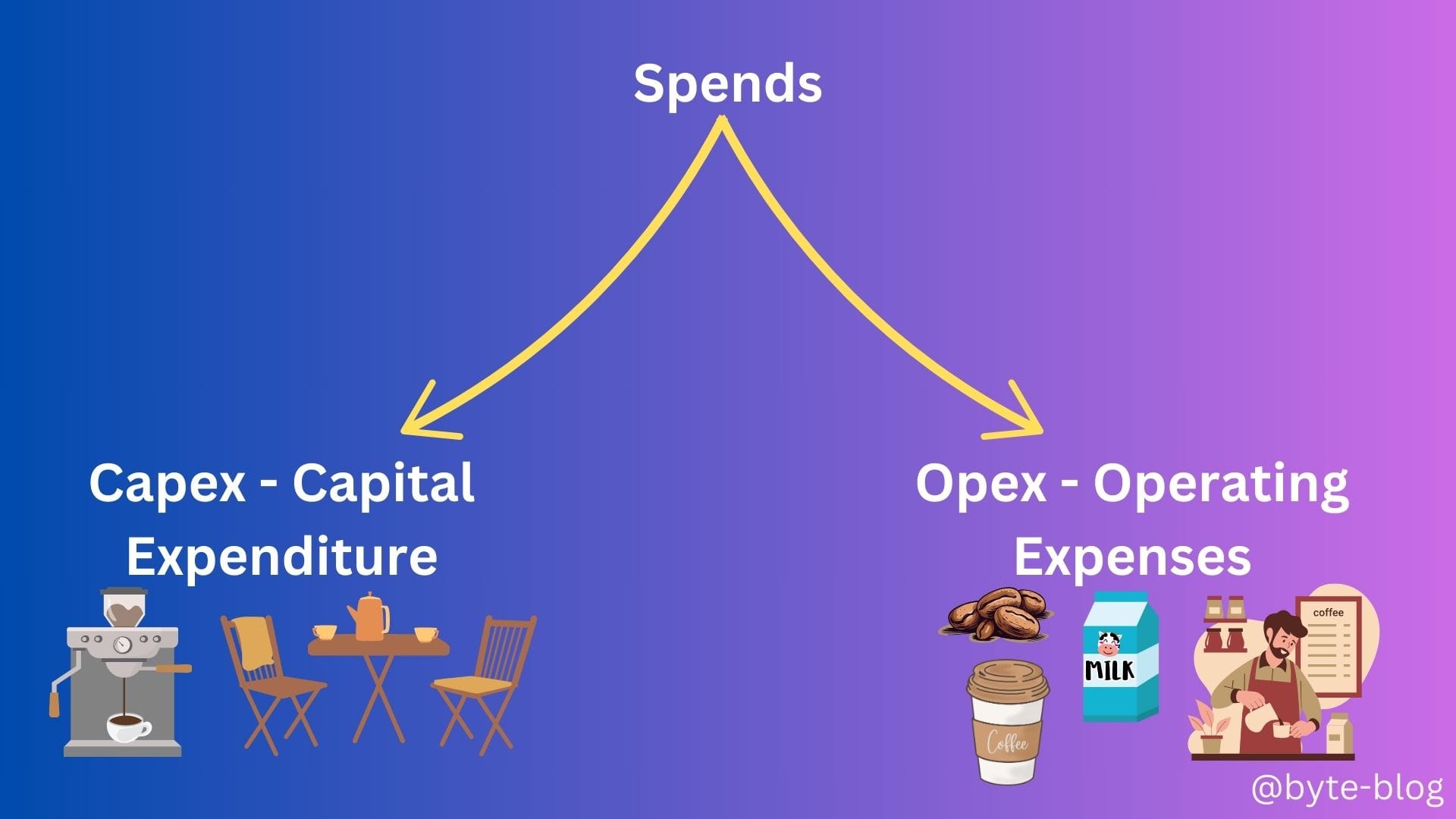

Such expenses or spends which result in immediate benefit or to keep the business running is called Operating Expenses.

Operating expenses, Operating Expenditures, or OPEX, refers to costs incurred by a business for it's operational activities . In other words, operating expenses are the costs that a company must make to perform it's operational activities. (Source : here)

If you remember our discussion flow from last week, we first tracked direct & indirect activities of a company - these are operational activities. These activities keep the business running & contribute to sales.

Capital Expense - Multi Year Benefit

Let us take another item - Coffee Machines. These machines are used to make coffee in Jack's cafe & customers love Jack's coffee.

Unlike paper cups which are disposed off once the coffee is finished, these machines will be used over multiple years to make coffee. Hence, the benefits in terms of sales revenue from purchasing these machines exceed one year.

Such expenses or spends which result in immediate benefit plus extended benefits over multiple years is called Capital Expenditure.

Another way of looking at it is Jack invested some of his money on an asset with a long term view to generate revenue from that asset over multiple years.

Capital Expenditure (Capex) refers to the the funds used by businesses to purchase long-term assets intended over continued use. From purchasing new equipment & machinery to investing in research & development, capex is a key component in a business strategy as it helps ensure that a company remains successful over time.

Capex plays an important role in business growth & helps expand operational capacity. (Source : here)

To summarize the classification above,

- Capital Expenditure (Capex) are long term investments in assets that provide benefits beyond the current year. (actually it's accounting period, but we will take it as a year for now).

- Operating Expenses are day to day expenses required to keep the business running

Why does Jack care about all this classification? - He only knows he has to spend money to run his business & make profits.

But understanding the nuances of spending makes Jack more aware of when the benefits flow back.

But the most important point is the consideration that goes behind deciding on capital expenditure is different from that of operating expenses. Why?

Because capital expenditure decisions involve higher outlay of cash & has more impact on business than operational expenses as it involves multi year consideration. (We will deep dive into Capex Decision making at a later stage - which is an ocean by itself)

Before that, we need to understand how will Jack tie up all his spends & revenue together to understand

- Where his business stands as of a date?

- How did his business perform during a period?

This tying up is done by preparing a three statement model called the Financial Statements.

Financial Statements

Let review what Jack did till now,

- Jack started a cafe

- He invested some initial cash called capital

- He spent money expecting immediate benefits through sales revenue

- He also spent money to buy some equipments (coffee machines) which is expected to give him revenue over the next couple of years

Some questions which Jack would like answers to...

- How does his business look like? Does it meet his expectations?

- What is his revenue?

- What is his operating expenses?

- Is he earning more than his costs?

- Is he able to meet demand & if not, how much does he have to re-invest in more coffee machines to meet demand?

To answer the above & more, Jack hires an accountant to prepare something called Financial Statements. What are financial statements?

Let us deep dive next week into Financial Statements.

(We assume that Jack earns revenue in cash & also spends in cash as it's easier to visualize his earnings & spends. We will change this assumption later.)