Strategy Byte - Week 48 Industry Analysis - Why?

Table of Contents

- Recap

- Discussion Template

- Value Chain

- Why do we care?

Recap

During week 47 of Strategy Byte, we explored one of Porter's Five Forces - Threat of New Entrants.

It means how easy or tough it is for new entrants to set up shop in a particular industry. We discussed the below environment variables that new entrants should consider :

- Regulatory - Understand the regulatory environment & the related rules governing that industry. Are the regulations onerous to new entrants or not?

- Capital Requirements - Some industries require intensive capital investment upfront while others require minimal capital investments to start their operations.

- Distribution - It may not be easy for new entrants to penetrate existing distribution networks or develop their own as extensive as the current ones.

- Brand Loyalty - How easy is it for new entrants to capture customers from incumbents & woo them over?

- Economies of Scale - refers to the cost advantages that enterprises obtain due to their scale of operations, with cost per unit of output generally decreasing with increasing scale. A new entrant has to achieve the lower cost per unit which the incumbent already achieved through cost efficiencies & investments over the years which is very difficult for the new entrant setting them up for cost disadvantage.

Let us now develop a template on how we will take our discussion forward.

Discussion Template

Let us rewind back to Week 43 where we introduced Industry Analysis. We classified Industry Analysis under two layers :

- Layer 1 - Business / Non-Financial Layer &

- Layer 2 - Financial Layer

Layer 1 - Business / Non-Financial Layer

This layer involves understanding at a minimum

- The industry structure which means how the industry is structured from the beginning of the value chain to the end

- Who are the players in the value chain?

- Who are the competitors? What are their likely reactions to new developments in the market &/or other competitors?

- What are the regulations governing the industry? Is it subject to frequent changes & onerous?

- What are the customer segments & what value add or pain points are the products &/or services solving for those customers?

Layer 2 - Financial Layer

This layer involves understanding

- The unit economics of the industry - which means the cost & revenue patterns in that industry

- The margins earned by the players in the value chain & the potential for sustaining & improving those margins.

I've described it as layers instead of separate sections as they are all inter-related. Inter-related means that in the long run, industry profitability is set by industry structure.

But for our understanding, we will discuss them separately & then integrate them to provide the full picture.

The Analysis Mix

We will analyze the below industries over the next couple of weeks under Layer 1 & 2 using Porter's Five Forces as the starting point (Layer 1 is actually the Five forces) :

- Automotive

- Banking

- Consulting

- Software

- AI

But, before we dive into individual industry sectors, we have to understand the term "Value Chain". What is Value Chain?

Value Chain

The term "Value Chain" was first presented by Michael Porter in his seminal & influential book Competitive Advantage - Creating & Sustaining Superior Performance.

He identifies Value chain

- as a set of activities

- that a firm performs

- to deliver a valuable product or service to the market

In simple terms, a company gets input of raw materials => processes those raw materials => converts them into finished products. All those processing & conversions happen through a set of activities which is called a "Value Chain".

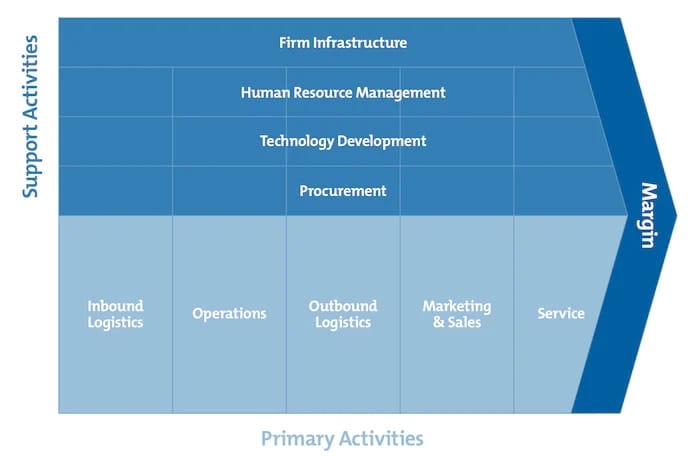

A value chain can be broken down into five primary activities :

- Inbound Logistics - receiving raw materials, warehousing, and managing inventory etc

- Operations - all activities in the process of converting raw materials into a finished product or service

- Outbound Logistics - delivering the final product or service to the end user

- Marketing & Sales - all strategies and activities aimed at incentivizing potential customers to purchase the final product or services, including distribution channel selection, advertising, and pricing

- Post Sales Service - all activities that intend to improve consumer experiences, such as customer services, repairs, or maintenance services

A Value Chain could also include secondary or support activities that facilitate the efficiency of the primary activities, such as procurement, technology research, product development, HR etc.

Porter notes that these activities form a firm’s value chain, each creating and adding value at every stage toward the end product or service. He suggests that a firm must understand its own value chain to develop and sustain a competitive advantage (Porter, 1985).

The Value chain concept can be visualized as below (Source : here)

Why do we care?

Why do we care about Industry Analysis & how important is it to strategy?

Let us use sports as an analogy. There are examples of professional players or teams studying their competitors by watching & rewatching videos of matches they played to understand their strengths &/or weak points. This will give them an idea where they stand vis-a-vis the other teams or players.

So, understanding a company's direct or indirect competitors will give them an idea of where they are placed in the industry vis-a-vis their competitors. Some key reasons to do Industry Analysis are :

- It reveals key advantages & constraints about the industry

- If we want to analyze a company strengths & weaknesses, it requires a baseline & Industry Analysis helps in determining that baseline. For e.g., product quality, pricing levels etc.

- Industry Analysis guides strategic action in

- Positioning the company & products keeping in mind it's competitive advantages

- Guard against disruptive forces brought about by competitors or external environment variables

- Identifying customer segments to serve

- Helps to understand new threats from existing competitors & / or new entrants & / or substitute products.

- Identifying whether the industry itself is subject to disruption internally or from external environment variables like technology etc

It's more like understanding the lay of the land & hence a key component of strategy.

We will start with specific industry sectors from next week.