Strategy Byte - Week 24 Interest Rate - From Base to Prime

Table of Contents

- Recap

- Headline

- Prime Rate

- Spreads

- Reserve Requirement

Recap

During Week 23, we discussed that Interest rate is the price of money & thus subject to supply & demand of money like any other commodity.

From the supply side,

- An increase in money supply lowers interest rate

- A decrease in money supply raises interest rate

From the demand side,

- An increase in demand for money raises interest rate

- A decrease in demand for money lowers interest rate

On the supply side, a country's Central Bank or Monetary Authority determines the money supply in an economy & is managed through a set of tools known as "Monetary Policy".

On the demand side, a country's Central Bank or Monetary Authority can raise or cut interest rates.

We then explored Central Bank Base rate from where it all starts. The Central Bank or Monetary Authority sets a base rate which serves as a Benchmark for other interest rates in the economy.

Now, let us move forward from the base rate & see where it leads us. Before that, let us see a recent headlines on impact of interest rate policy on exchange rate.

Headline

Japan Amps up intervention threat as Yen hits lowest since 1990 (Source : here)

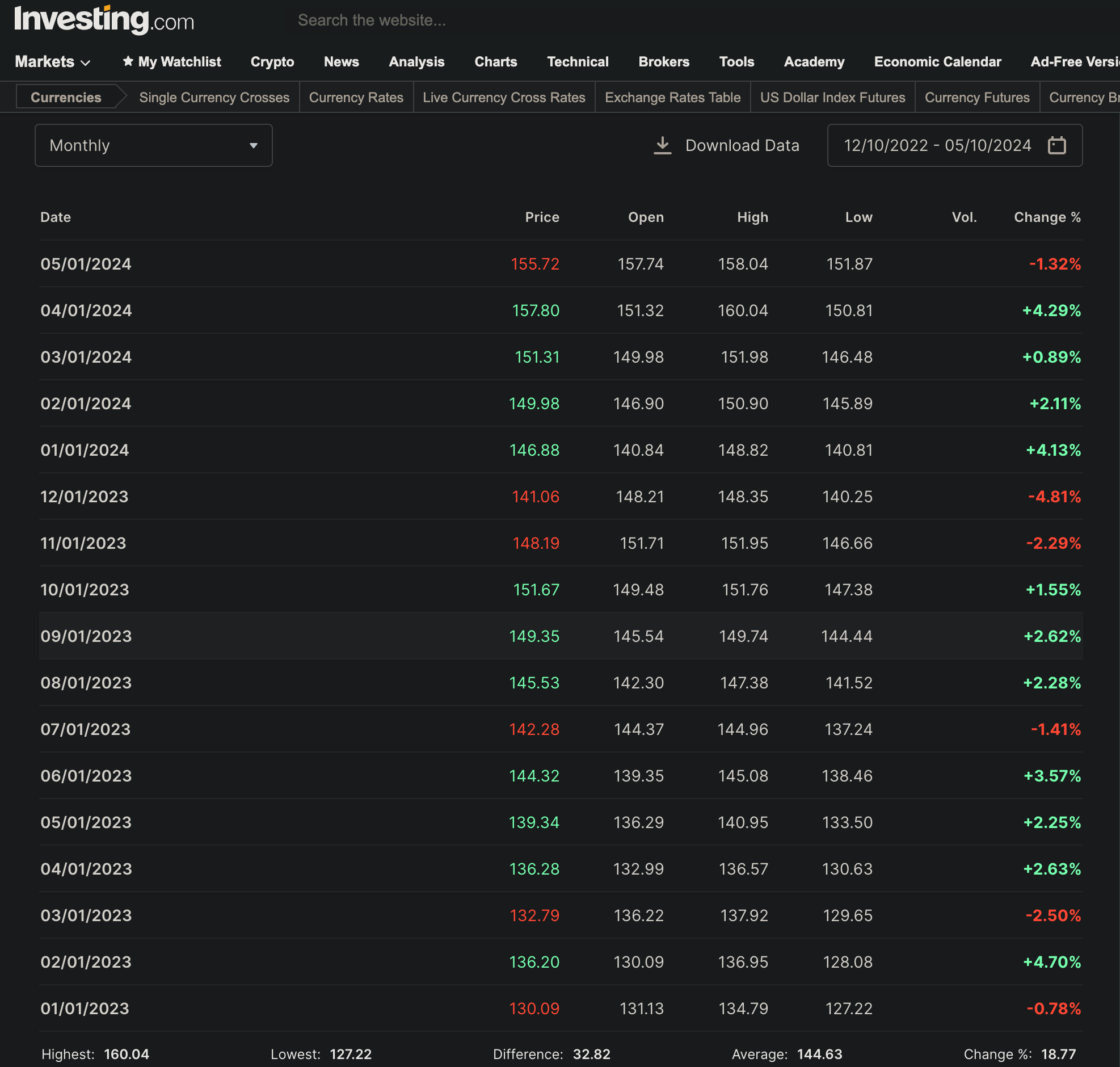

What happened here? - Japanese Yen tumbled to around 160 Yen to a dollar during April 2024. (Chart Source : here).

You can see from the above monthly chart that the rate has significantly dropped from around 130 Yen to a dollar in Jan 2023 to around 156 Yen to a dollar (May 2024). What was the cause for this movement?

One of the reasons being mentioned is due to a major policy decision by the Bank of Japan (BoJ) on holding interest rates. (Source : here)

For years, Bank of Japan (BoJ) kept interest rates extraordinarily low to encourage more inflation in its economy, as well as to boost bank lending & spur demand.

During these times, the JPY has been weakening all these years & in February, in the face of widespread labor shortages & a weakening yen, Germany overtook Japan as the third largest economy.

With low interest rates seen as a key factor in the rapid decline of the yen, last month the BoJ ended the policy of keeping its benchmark interest rate below zero, lifting it's short-term policy rate from -0.1% to between 0 & 0.1%.

After that decision, markets were then focused on the pace of further rate rises. BoJ then announced that it would hold interest rates steady, signalling that further increases weren't imminent. This precipitated another round of sellofs in the yen, putting more pressure on the currency.

It was this wave of sell-ofs that drove the currency down to 160 Yen to the dollar for the first time since 1990. From the above, we can see how interest rate expectations triggered volatility in exchange rates & weakening of the Japanese Yen. The market expected BoJ to increase rates which didn't happen resulting in huge sell-offs further weakening the Yen.

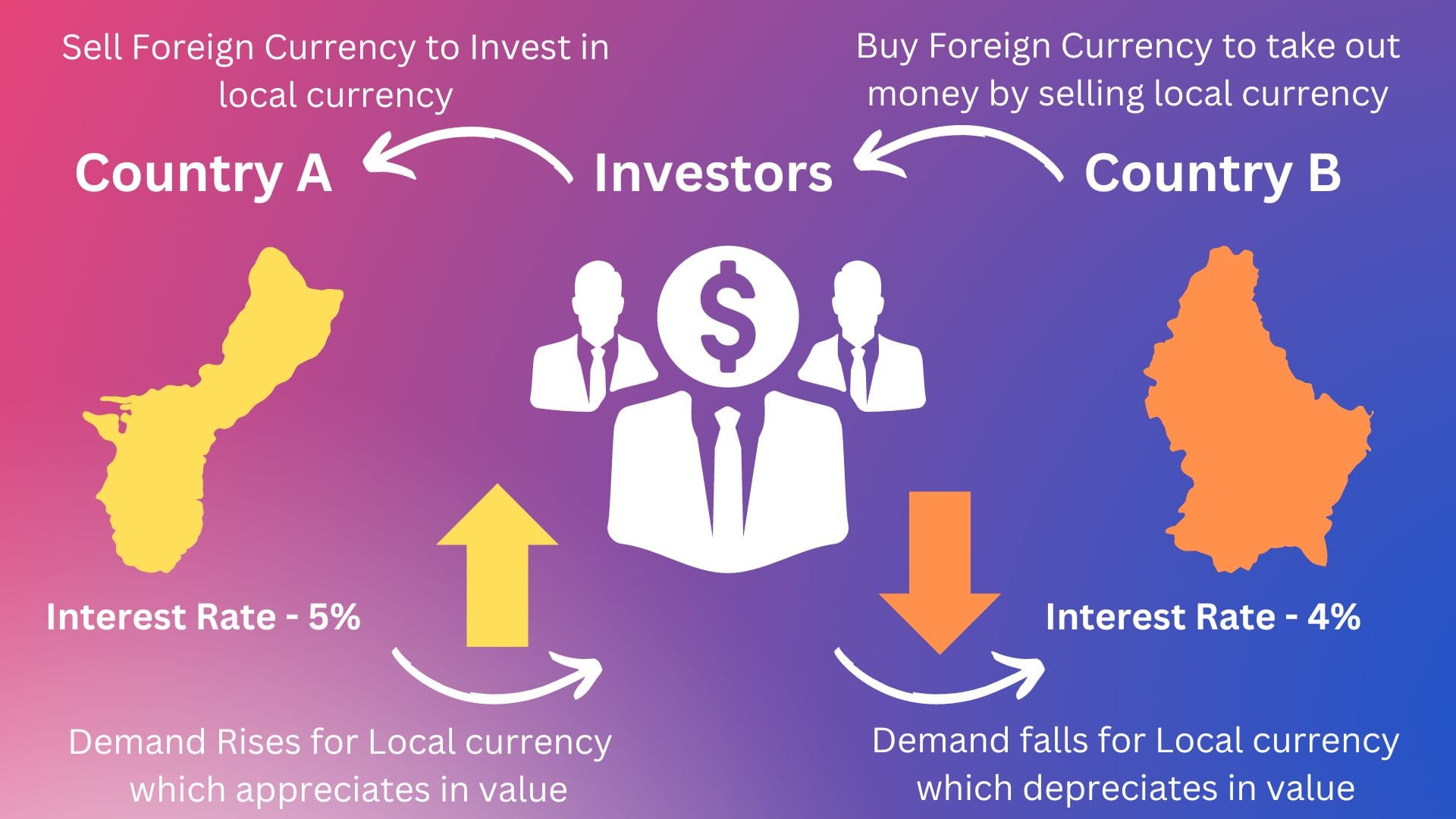

As per Al-Jazeera, "At the moment, investors are being driven to offload the Yen due to the yawning gulf in the interest rates between Japan (0 - 0.1%) & the United States (5.25 - 5.5%). The main driver is the rate differential between the US & Japan"

This reminds us of our diagram from Week 20 on how interest rates drive foreign exchange rates:

With the above in mind, let us now move from base rate & see how it gives rise to other types of interest rates:

Prime Rate

From the base rate set by the Central Bank or Monetary Authority, banks determine their own base rate known as the Prime Rate. What is this Prime Rate?

The Prime rate is the interest rate that commercial banks charge their most creditworthy corporate customers.

It serves as a benchmark for many other loans, meaning that when the prime rate rises or falls, the interest rates on various types of loans, like mortgages, small business loans, and personal loans, are likely to move in the same direction.

The prime rate itself is influenced by the federal funds rate, which is set by the Federal Reserve & is the rates at which banks borrow from & lend to each other overnight.

(Source : here)

So, let us break down the above definition of prime rate - it is the rate at which banks lend to their most credit worthy corporate customers which means customers who are financially strong & less likely to default compared to other customers.

Since they are financially strong & less likely to default, the rates will be the lowest to entice lending to such customers as they are more likely to pay back.

Now, not all customers of a bank are the most credit worthy. The credit worthiness depends on the economic circumstances of a customer & those circumstances differ from that of the most credit worthy customer.

So, this difference in credit worthiness is quantified as a spread & added to the prime rate (more details on spread below) & so the rates on loans lent to these customers are higher than the prime rate taking into consideration

- The customer & their economic circumstances &

- The type of loan offered to the customer

So the prime rates influences all other interest rates like

- Mortgage Interest Rate - The rate at which homeowners borrow money to purchase property

- Credit Card Interest Rate - The rate charged on outstanding credit card balances

- Personal Loan Interest Rate - The rate at which individuals borrow money for personal purposes

- Auto Loan Interest Rate - The rate at which car buyers borrow money to purchase a vehicle

- Business Loan Interest Rate - The rate at which companies borrow money for operational & expansion purposes.

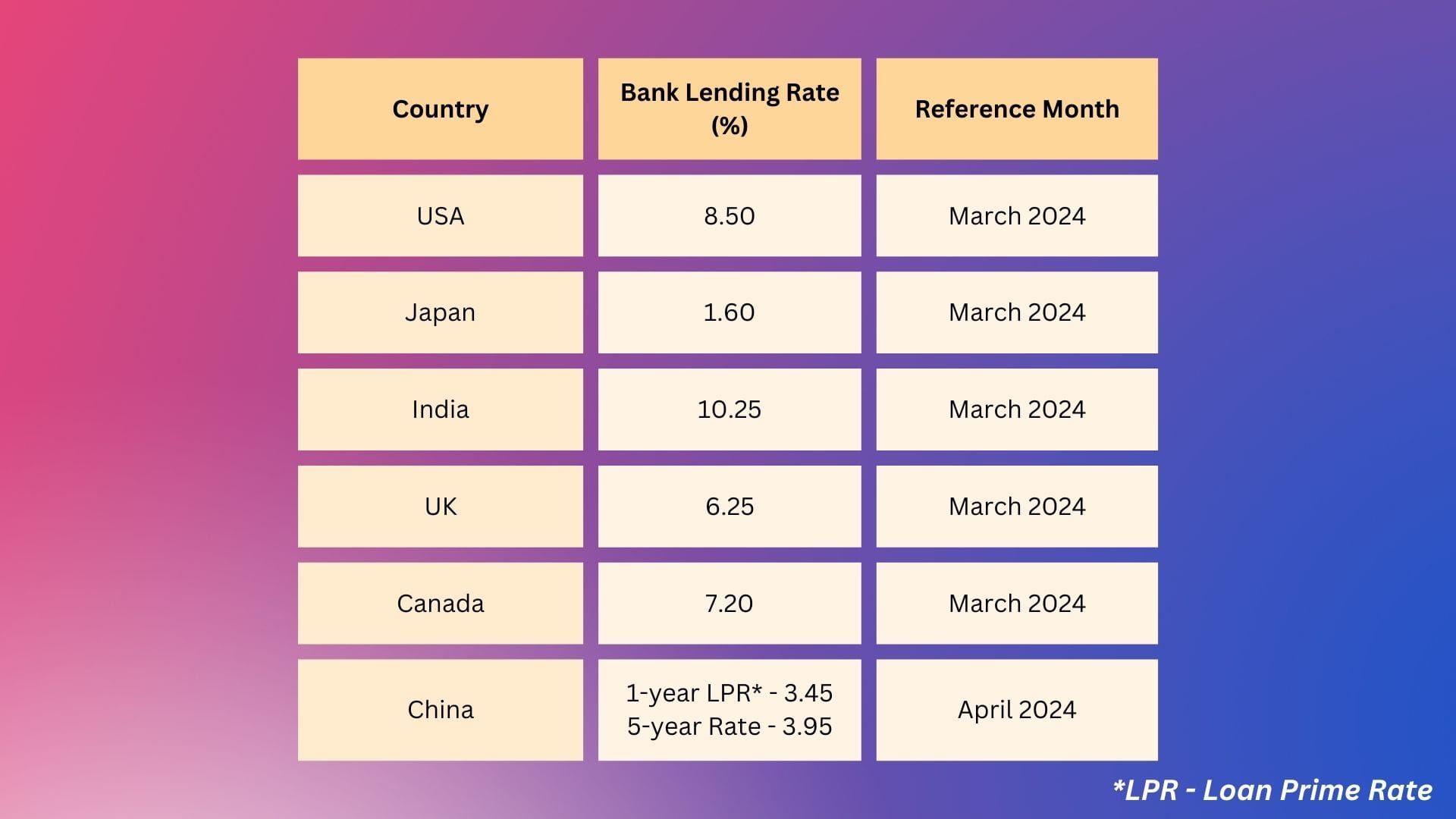

Below are the prime rates of some major economies (Source : here)

Spreads

So, to retrace our steps, we started with Central Bank base rate and then moved on to Prime Rate. To the prime rate, a margin or spread is added taking into consideration multiple factors. The major spreads or margins are:

- Risk of the borrower defaulting - this factor is called Risk Premium. This Premium is added to the prime rate & is higher for customers with low credit score or who pose higher credit risk meaning the chances of defaulting on the loan are higher.

- Operating Cost Margin - Banks typically add a margin to cover operating expenses

- Profit Margin - To ensure banks earn adequate return on their lending, a mark up is added to the prime rate.

For E.g., a high credit worthy borrower in US seeking a loan might be offered an interest rate of say 10% (prime rate + 1.5%) while another borrower with lower credit score might be charged 12% (prime rate + 3.5%).

Thus interest rates reflect the degree of risk on a loan & this risk is included as risk premium.

The type of loan product also impacts spreads & lending rates. For e.g., unsecured loans like personal loans or credit cards where the risk of loss is higher in case of defaults have a much higher margin compared to say, mortgage loans which are adequately secured by property as collateral or security.

Regulatory requirements, competitive environment & market conditions also affect lending rates. On Regulatory requirements, it is important to understand something known as "Reserve Requirements".

Reserve Requirement

We know that banks accepts deposits & lends money to borrowers & makes money from the difference in these activities (along with investment & other services). However, a bank cannot lend money without any limits. They are limited by the reserve requirements which are imposed by Central Banks on Banks. What is this reserve requirement?

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank.

This rate is commonly referred to as the cash reserve ratio or shortened as reserve ratio. Though the definitions vary, the commercial bank's reserves normally consist of cash held by the bank and stored physically in the bank vault (vault cash), plus the amount of the bank's balance in that bank's account with the central bank.

A bank is at liberty to hold in reserve sums above this minimum requirement, commonly referred to as excess reserves. (Source : here)

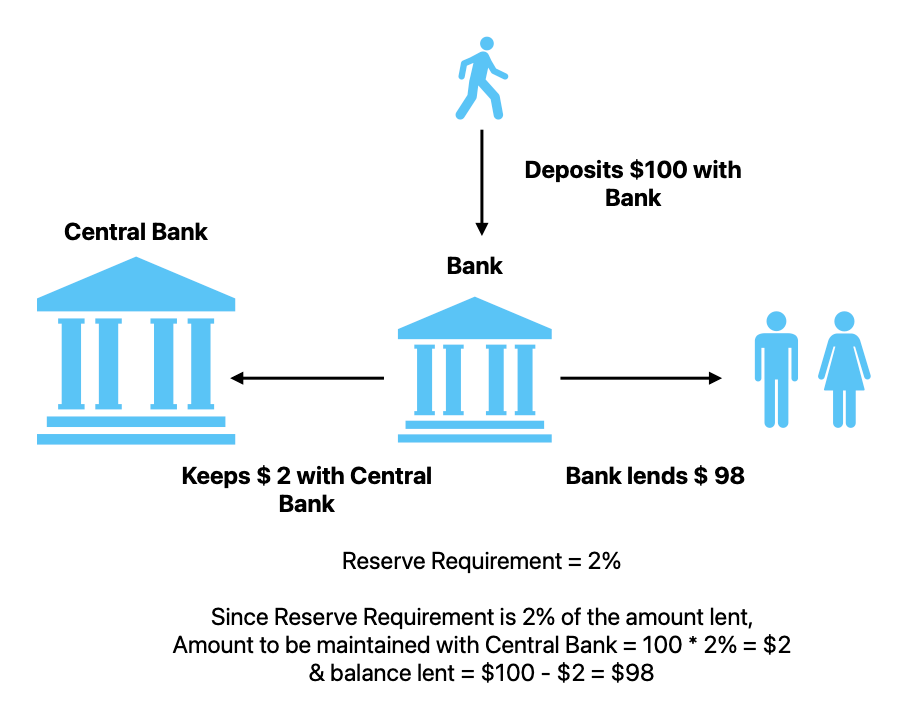

Let us explain with a simple example :

A bank has deposits of $100. The bank cannot use the entire $100 for it's business activities like lending or investments.

Assuming the Central Bank regulations require banks to hold reserves of 2% of their deposits, it means they have to hold either with themselves in their vaults or with Central bank, 2% of $100 = $2.

Thus, after blocking this reserve of $2, the bank can lend the remaining $98.

Visualizing the above,

Central Banks use the reserve requirement ratio as a monetary tool to influence money supply since lower reserve requirements mean the banks can use that money to lend or invest & vice versa for higher reserve requirement where the banks will be constrained to lend as they need to deposit more with Central Banks.

There is one more concept we have to understand on interest rates which is term structure or yield curve which we will explore next week along with what drives interest rates in an economy.