Strategy Byte - Week 44 Industry Analysis - Strategic GPS

Table of Contents

- Recap

- Business / Non-Financial Layer

- Financial Layer

- Mental Framework

Recap

During Week 43, we stepped in the next leg of our journey to understand Strategy by introducing "Industry Analysis".

We defined "Industry" as :

A specific group of companies that operate in a similar business sphere & have similar business activities.

Classifying companies under an "Industry" umbrella helps us efficiently analyze the impact of macro economic or market variables as companies under a particular industry will respond to such changes in similar ways.

Then we went one level up to define "Sector" as :

A part of the economy into which various industries consisting of a greater number of companies can be fit, & is larger in comparison. E.g., transportation sector includes automobile, airline, trucking industries etc.

Then, we defined Industry Analysis as

A market assessment tool used by businesses & analysts to understand the competitive dynamics of an industry. It helps them get a sense of what is happening in an industry, e.g, demand - supply, degree of competition, future prospects etc.

Why do companies carry out Industry Analysis? Let us see it from two perspectives

- As an Operator

- As an Investor

An operator is a business professional who oversees the general operations of a company on behalf of the business owner.

As an operator, being better than competition is what helps them to be in the market and run the operations in a VUCA (Volatile, Uncertain, Complex & Ambiguous) environment.

Investors are people or entities that risk their money in various financial assets or ventures with the expectation of earning a return, which they may or may not realize.

As an investor, understanding whether it is worth it to invest in a company is important.

Let us repeat (from last week) on why Industry Analysis is critical?

- Industry analysis shows whether the companies within than industry are efficient in what they do as a whole & also compared to each other. That’s the financial part.

- Efficiency can also be non financial in the quality of their end products or services compared to each other? Which company products have good market potential or not? Do customers love the company products?

- The final aspect of why industry analysis is necessary is to see whether the industry itself is subject to disruption due to new technology or process which will change the way the industry currently operates. The very survival of the industry as it exists is at stake.

Then we classified Industry Analysis under two layers :

- Business / Non-Financial Layer

- Financial Layer

We will elaborate on these two in the coming weeks. But to lay the foundation for our discussion over the next couple of weeks, we will classify them as below.

Business / Non-Financial Layer

The Non-financial layer of Industry Analysis covers the below aspects :

- Industry Structure

- Competitors

- Customers (Segmentation & Value Mapping)

- Regulatory Environment

Financial Layer

The Financial Layer covers :

- Unit Economics

- Value Creation & Capture - Pricing

Now, as I mentioned last week, I refer to these as layers because the concepts are inseparable but cannot mix. Its like oil & water which can be together but never mix. The concepts will be discussed separately but actually are interwoven in reality.

Mental Framework

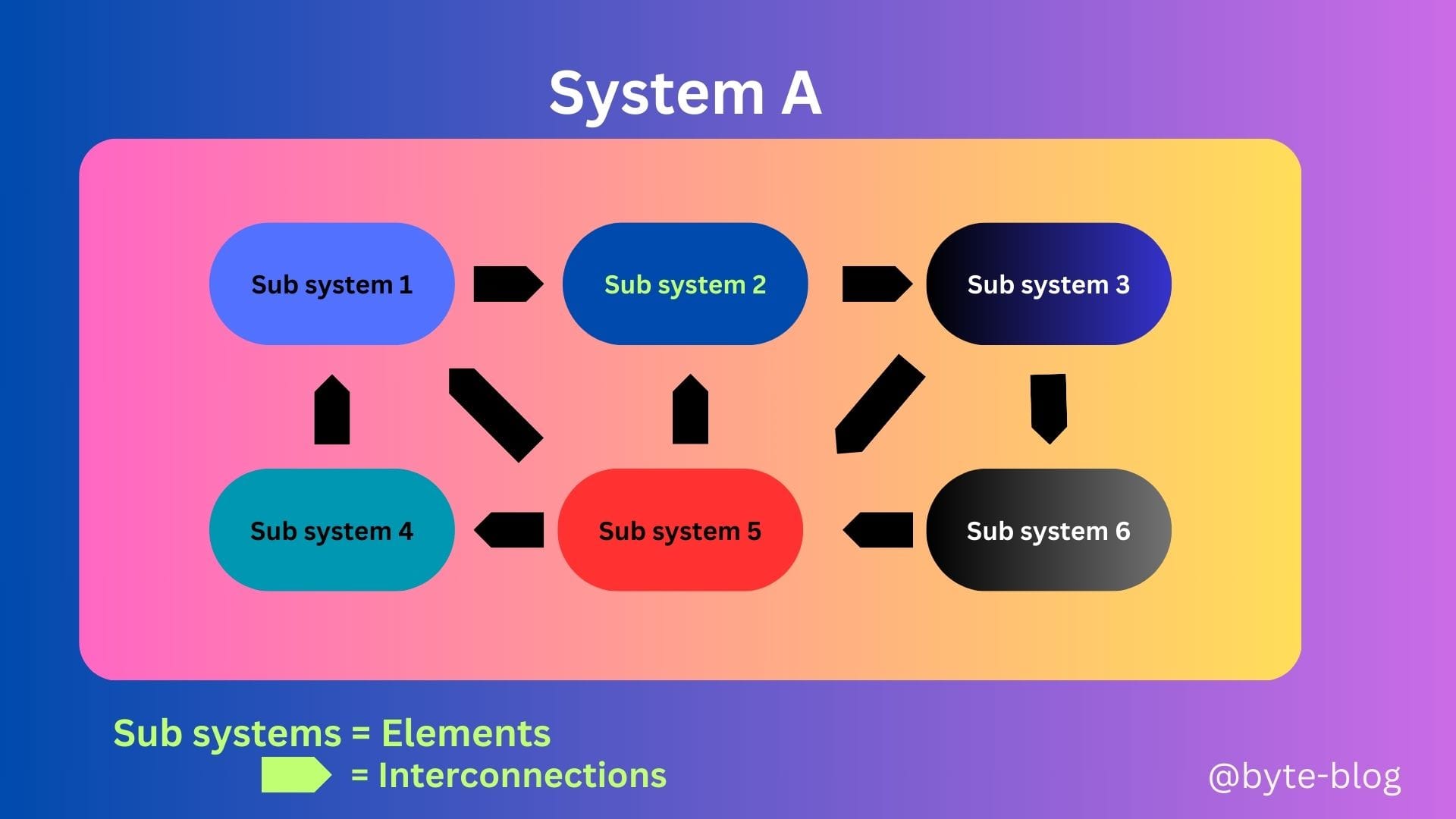

We now need a mental framework to understand the various intricacies of Industry Analysis. For this, we will use "Systems Thinking" which we discussed in Week 3 of Finance Byte. We will not repeat the details here but we will refresh our memory with the below visual :

A System is defined as "an interconnected set of elements that is coherently organized in a way that achieves something". (Source : Thinking in Systems).

So, a system consists of :

- Elements

- Interconnections &

- A Purpose

To put it simply, different units or sub-systems (Elements) interact with each other through connections between them (Interconnections) to achieve a goal or objective (Purpose).

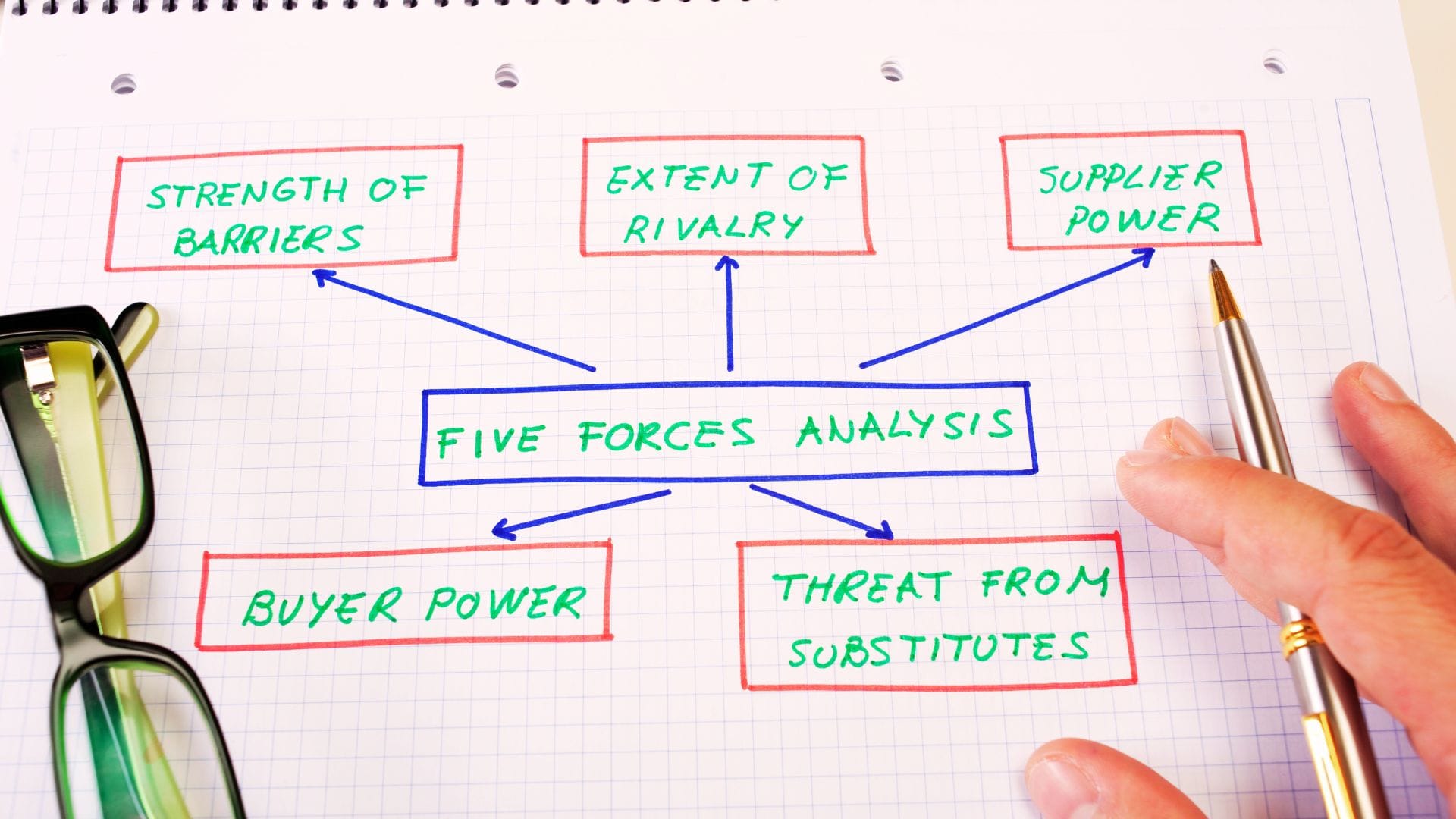

How is systems thinking relevant to Industry Analysis? Well, it is ALL about systems thinking. Let us take Michael Porter's Five Forces as an example in the below visual :

We will explore Michael Porter's Five Forces in detail in the coming weeks & as a matter of fact, it is THE PILLAR which started the thinking behind Industry Analysis under Strategy.

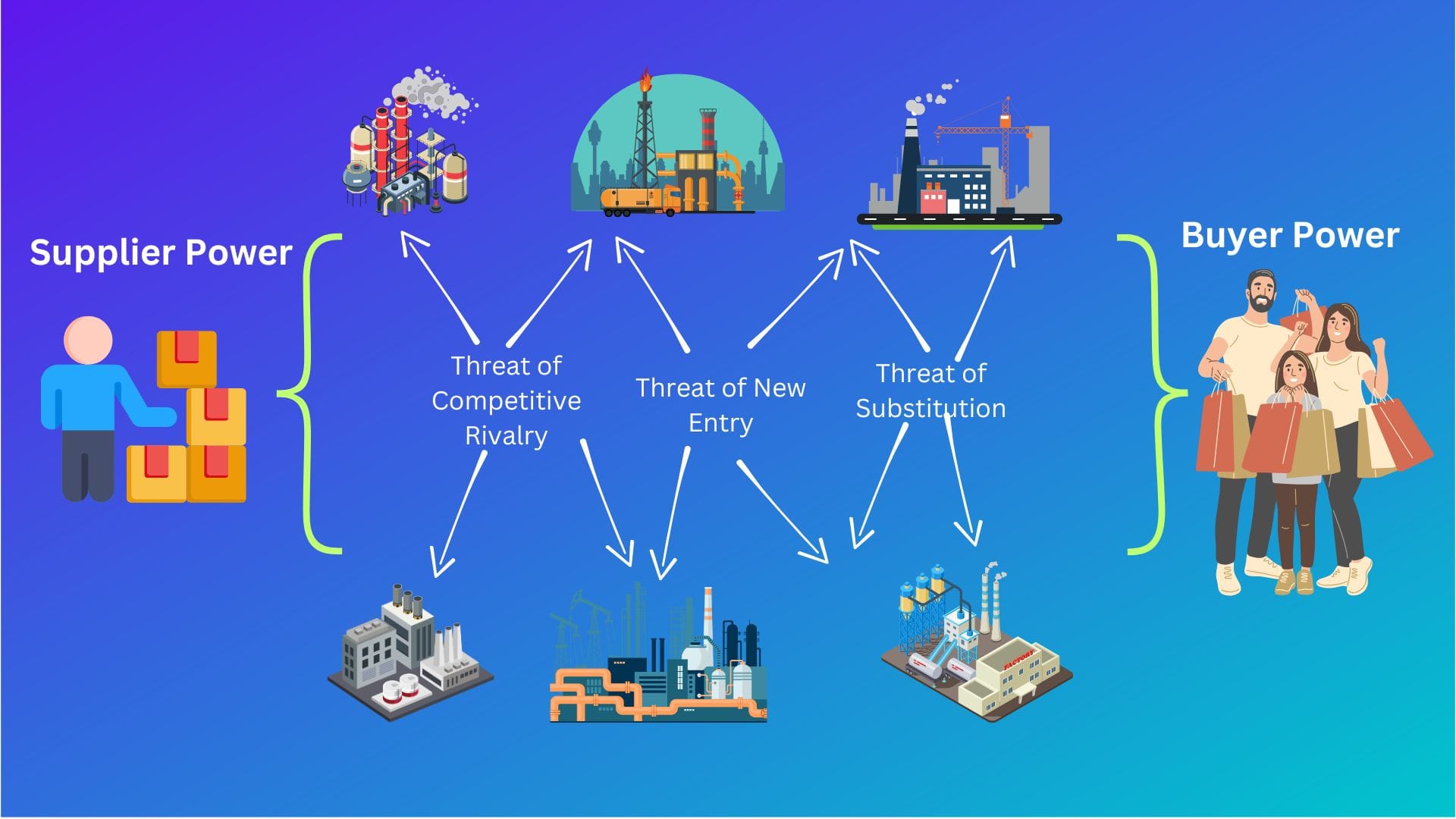

First, a company has a purpose or "Reason for existence" which Roger L Martin in his book "Playing to Win" defines as Winning Aspiration.

To achieve this Winning Aspiration, among other actions, a company interacts with other players or companies from the same or different industries.

We can see above that the Five Forces analysis describes interactions between a company & it's

- Suppliers - Supplier Power

- Customers - Buyer Power

- Peers - Strength of Barrier / Extent of Rivalry / Threat from Substitutes

It is about interaction between the company & it's environment consisting of - Suppliers, Customers, Peers etc.

Understanding how these interactions affect a company & the actions taken by it

- to negate any adverse impacts &

- take advantage of any positive signs

is part of strategy.

The whole industry with the suppliers, customers, peers, competitors etc is a system as visualized below:

Next week, we will discuss the first point - Industry Structure.

Lets dive in !!