Strategy Byte - Week 47 New Entrants

Table of Contents

- Recap

- Threat of New Entrants

- Regulatory

- Capital Requirements

- Distribution

- Brand Loyalty

- Economies of Scale

Recap

During Week 46, instead of just discussing the theory behind Five Forces, we emphasized the mindset required to understand & analyze how the five forces impact a company's strategy.

A company's strategy can be disrupted :

- By Competitors themselves &/or

- By Disruption

Mindset - 1 : Environment

When a company understands it's external environment or the forces affecting it's industry :

- It can fine-tune it's strategy &

- Increase marketshare & boost profitability

which in turn helps it stay ahead of competition

A company can take action to leverage it's competitive advantage & work on it's weak points to ensure it takes the right steps to maximize it's odds of success based on how the Five Forces interact with the company & with each other.

Mindset - 2 : Tension

After we understand the Five Forces, we can see a common thread between them all - they impact one or more of the below critical drivers of any company :

- Revenue

- Costs

There is always a tension (in other words, trade-offs) between these two where the objective is to maximize revenue at minimal costs.

Strategy involves

- Identifying the impact of these Five forces on Revenue &/or costs and

- How to maintain or increase profits

by navigating these forces to a company's advantage

We then discussed the first three of the five forces :

- Rivalry among existing competitors - How companies compete with one another in a particular industry & how this competition impacts profitability through pricing & cost structure for that industry

- Supplier Power - What position do suppliers hold relative to the company & depending on that understanding, the impact on the company's strategic positioning & value capture.

- Buyer Power - How buyer actions impact profitability.

Now, let us analyze the next of the five forces.

Threat of New Entrants

Ever industry has a structure which new entrants analyze to decide from a strategic perspective whether to enter that space or not. It can be

Regulatory

What is the Regulatory environment for that industry space? E.g., the banking industry is subject to numerous regulations by Central Banks to regulate the functioning of banks & financial institutions. Or even highly regulated industries like Defence, chemicals etc are subject to regulations which may require significant investments to enter that space. How frequently are the regulations updated?

Does the new entrant have the necessary expertise & investments to enter this space or are the regulations onerous to deter new entrants?

Capital Requirements

Some industries require high upfront investments to enter that space while others require minimal investments to start their operations. E.g., manufacturing industries require companies to first invest in land, factories, production & distribution facilities whereas software companies require minimal investments to build & scale an application.

Distribution

Each industry has different ways or channels to make their products or services available to customers. For e.g., consumer giants like P & G, Unilever etc have developed well oiled distribution channels for their products depending on the type of product.

Different products have different distribution channels. For e.g. mass market products (products designed to appeal to a broad audience, which are affordable & easily accessible like everyday groceries, basic toiletries, staple food items etc) will be distributed through the general section in supermarkets while premium products (products marketed as superior in design, quality or experience compared to mass market alternatives) are distributed in a premium section in supermarkets or have their own special outlets. It may not be easy for new entrants to penetrate or develop their distribution network as extensive as that of P & G or Unilever etc.

Brand Loyalty

How easy is it for new entrants to capture existing customers from the incumbents & woo them over ? The best example I can think of brand loyalty is Apple. They command strong brand loyalty to the extent of it being a cult & anyone who has used an Iphone or a Macbook would continue with it throughout their lifetime. This brand loyalty also results in higher customer willingness to pay increasing profitability (assuming operational efficiencies).

Economies of Scale

Before we get into Economies of Scale, let us first understand what it is.

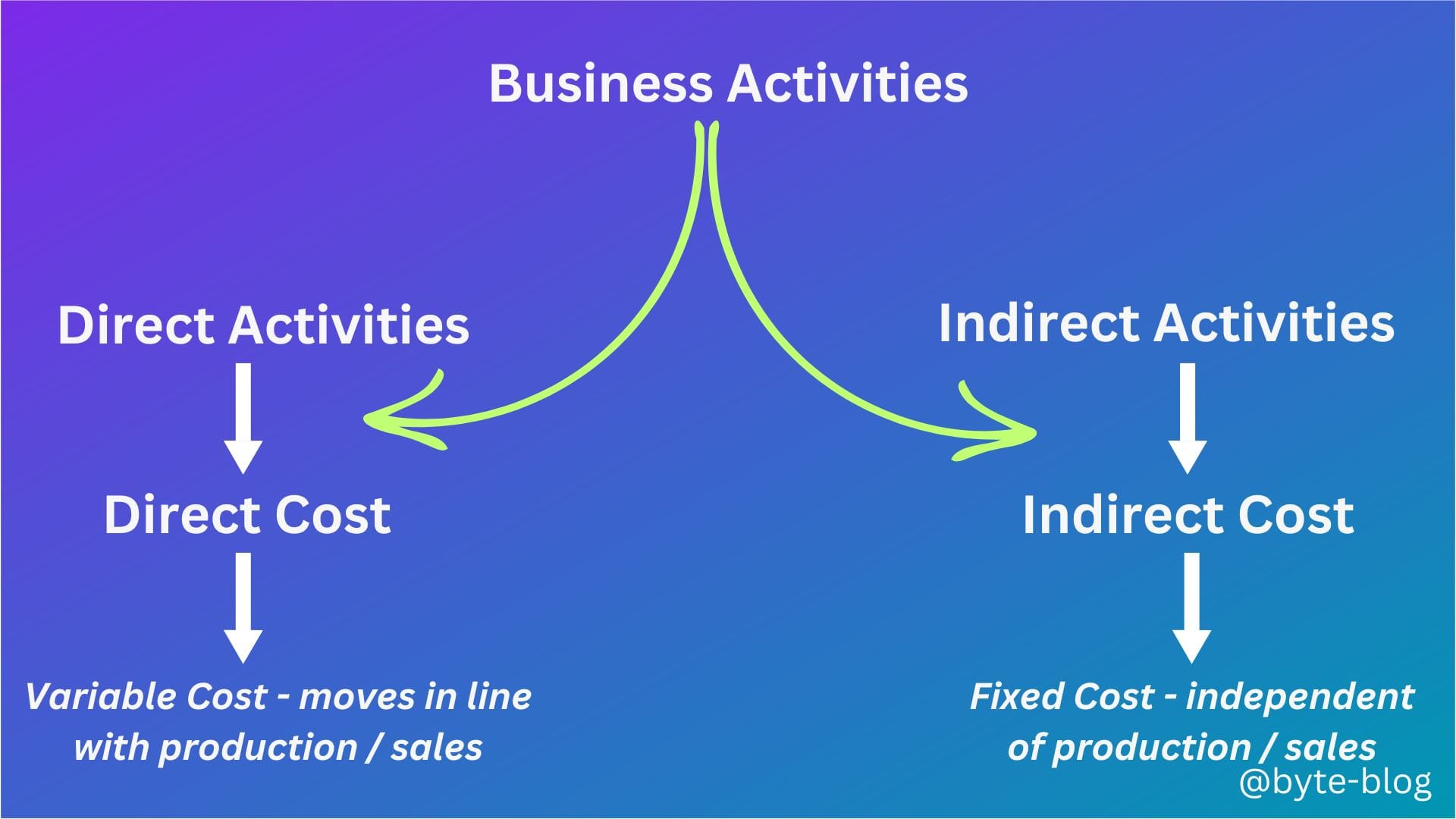

We classified costs in Week 5 of Finance Bytes under :

- Variable Costs - costs which move in line with unit sales is called variable costs. They rise as production increases & falls as production decreases. Eg., raw material costs, electricity costs, transportation costs etc.

- Fixed Costs - costs which do not change with increase or decrease in unit sales is called Fixed Costs. E.g., rent, salaries, administrative expenses etc.

So, what happens when production increases? As per the definition above, variable costs should increase & fixed costs should remain the same. (This is not exactly how it works in real life, but let us go with this for now).

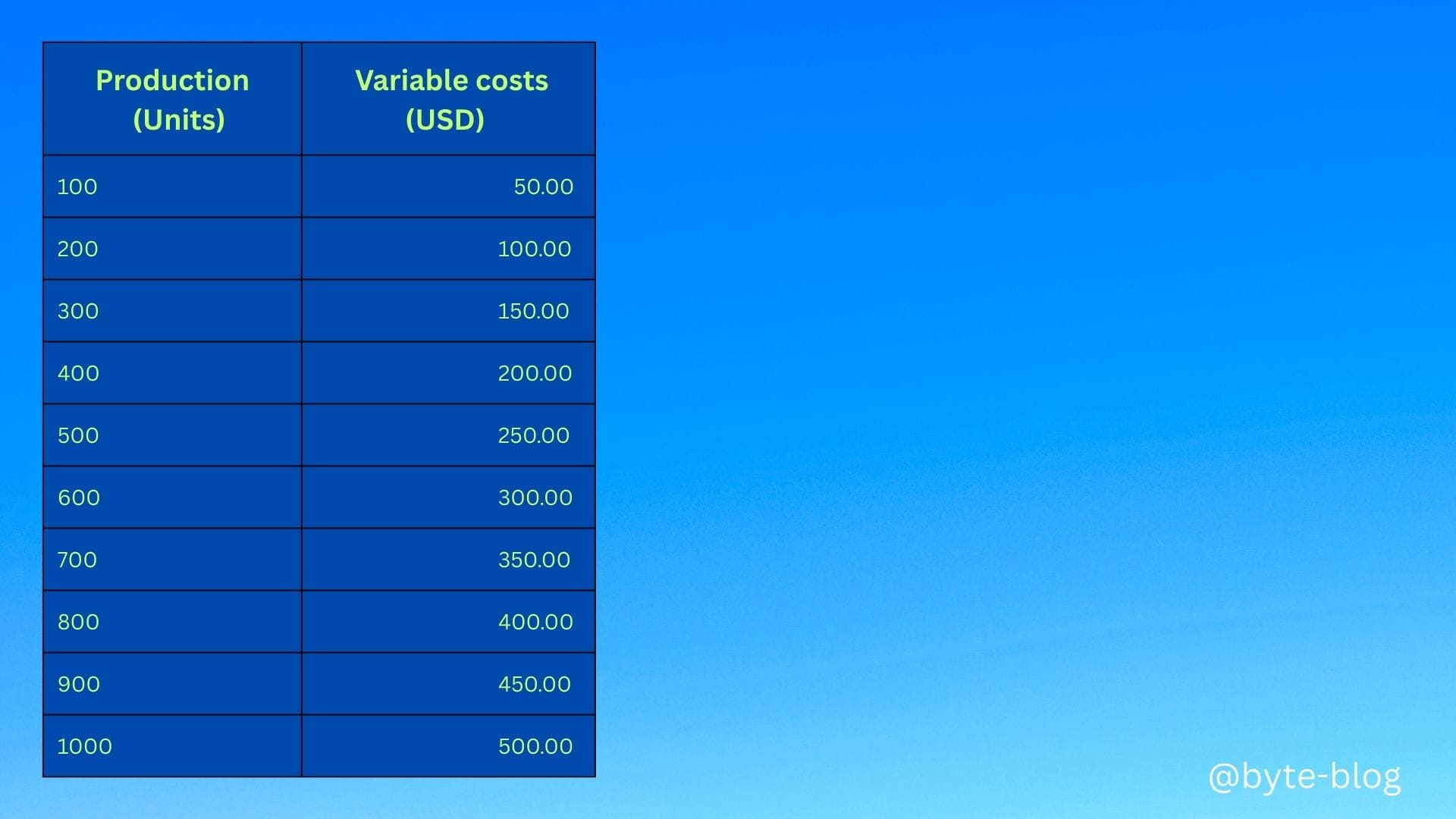

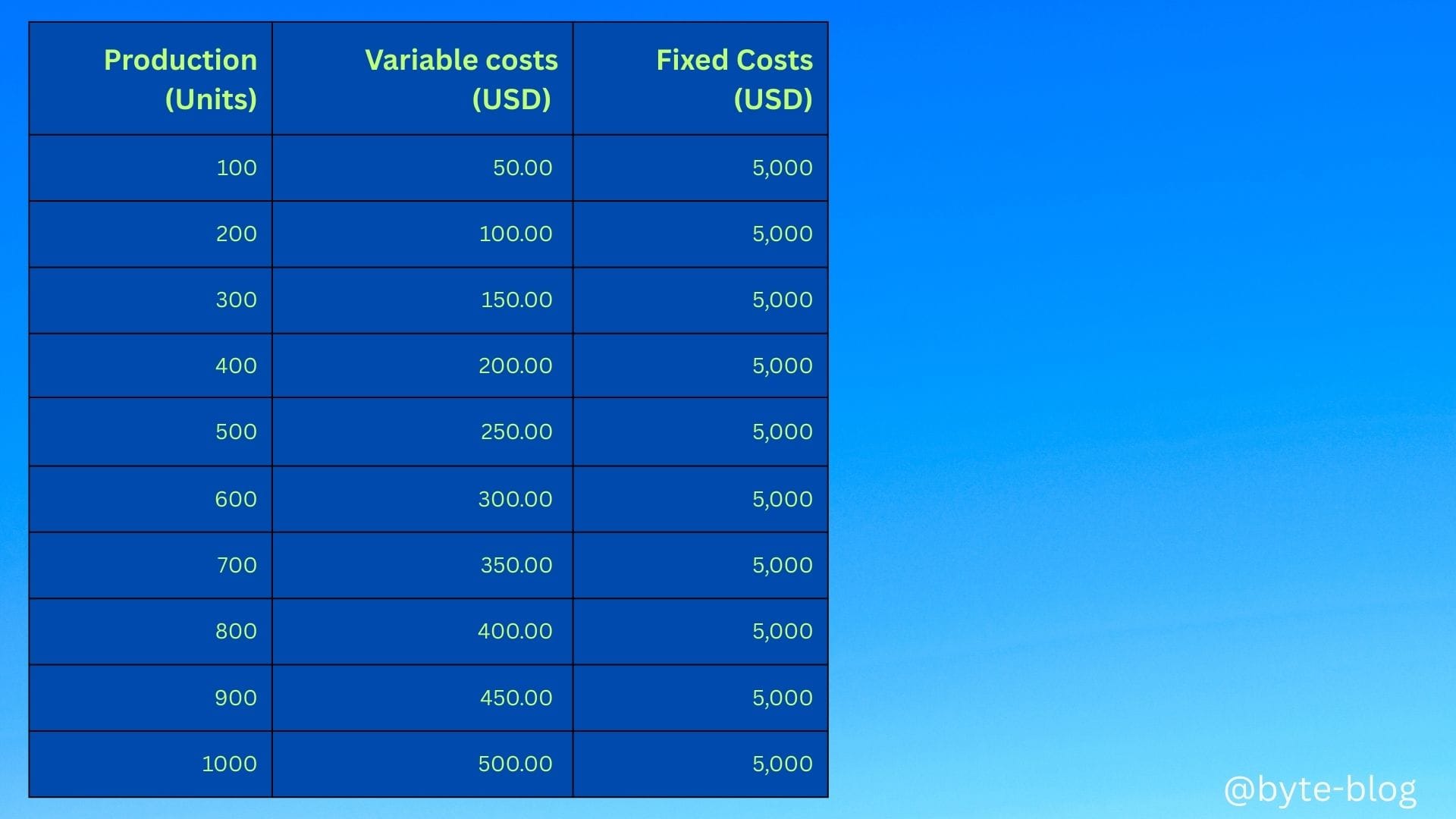

Assuming variable costs at $ 0.5 per unit of production, total variable costs increase with increase in production units.

For fixed costs, it is the cost incurred for that particular period (month, quarter, year) & . Eg., rent, staff salaries, marketing, administrative costs etc. Assume for this company, it is $ 5,000.

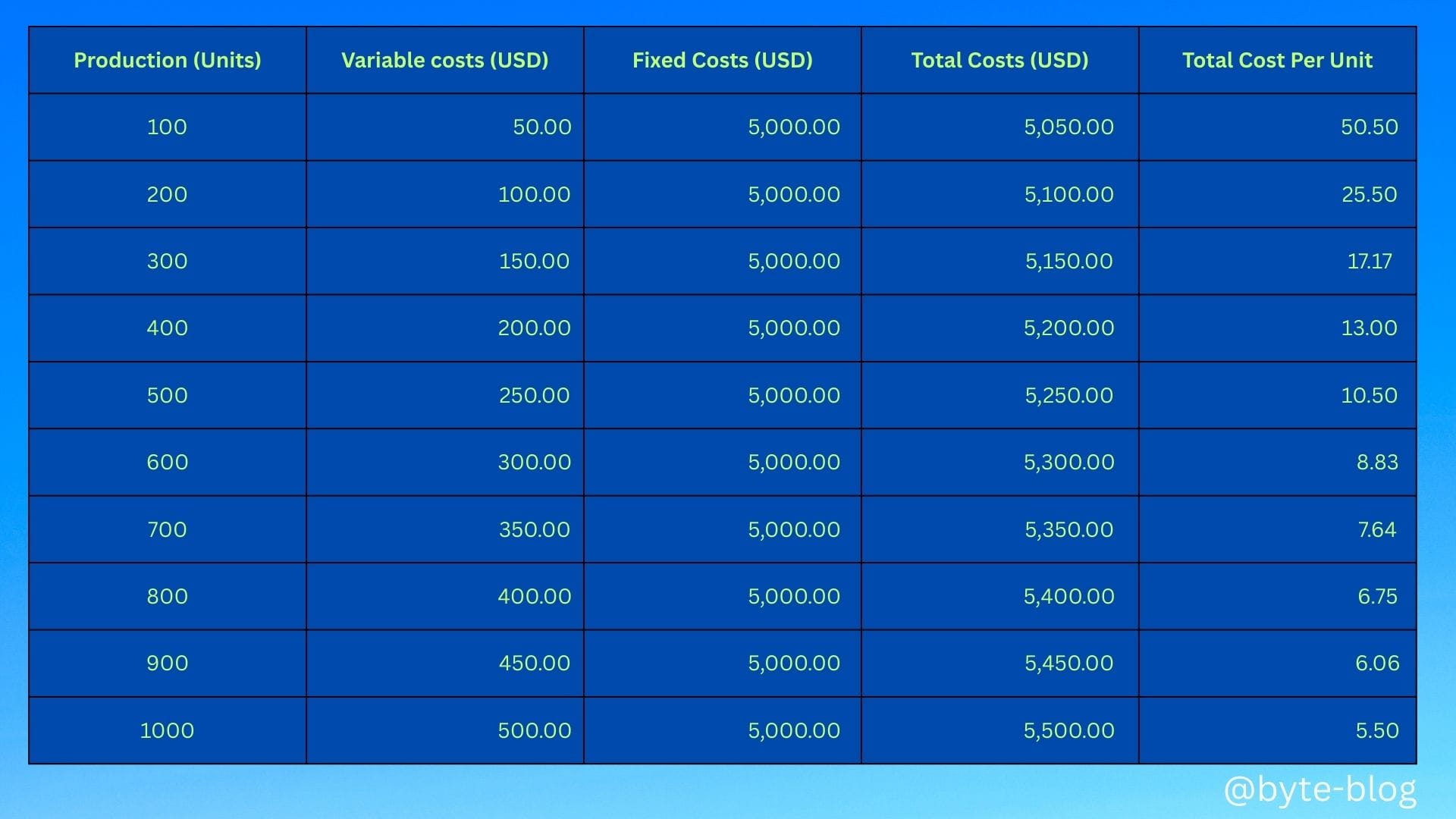

Obviously, the total costs increases in line with production. But then, what would happen to cost per unit?

We can see from the above that cost per unit decreases with increase in production units. This means that a company which has high volumes of sales & has invested in infrastructure or production facilities which spread the fixed costs (which remain constant) to higher number of units, such companies can enjoy higher sales at lesser cost per unit which creates a virtuous loop which means

Higher Unit Sales -> Spread Fixed costs to higher unit sales -> Lower cost per unit -> Higher profitability

This is called Economies of Scale. Let us now define it :

Economies of Scale refer to the cost advantages that enterprises obtain due to their scale of operation, with cost per unit of output generally decreasing with increasing scale. (Source : here)

This happens because fixed costs (e.g., rent, machinery) are spread over a larger output, & operational efficiencies improve with size.

What has this to do with threat of new entrants? A new entrant has to achieve the lower cost per unit which the incumbent already achieved through cost efficiencies & investments to achieve the profit numbers of the incument. That generally does not happen during the initial set up period of the new entrant which puts them at a cost disadvantage.

Thus, the threat of new entrants to such industry spaces is low. For e.g., Amazon leverages economies of scale through its investments in highly advanced distribution network, optimized shipping routes & data analytic systems for demand forecasting.

This allows for efficient inventory management and reduced shipping costs. A new entrant must invest in these technologies & then ensure that it is able to have enough sales volumes to result in the same unit cost as Amazon. It will be very difficult for a new entrant to catch up to Amazon with the time & resources required to achieve the same cost per unit as Amazon.