Strategy Byte Week 26 - Interest Rate Drivers

Table of Contents

- Recap

- Interest Rate Drivers

- Supply & Demand

- Central Banks

- Inflation

Recap

During Week 25, we explored term structure or yield curve & how it signals the direction in which the economic winds would blow.

A term structure or yield curve is defined as the relationship between the remaining time-to-maturity of debt securities & the yield on those securities.

We then went on to define "Debt Security" & a "Bond" after which we explored the Bond market along with it's impact on the world economy.

Then we explained different types of yield curve :

- Upward sloping or Normal Yield Curve

- Flat Yield Curve &

- Inverted Yield Curve

We explained the relevance of Yield Curve in strategic decisions which involve additional investments or borrowings. Understanding the economic outlook & expected direction of interest rates is critical as it impacts borrowing costs, capital allocation & investment decisions.

How does a yield curve help? It provides signals on:

- Economic Outlook - depending on the type of yield curve signalling the direction of interest rate movement &

- Market Expectations - when a yield curve reflects market expections of future interest rates providing insights into the investors' minds & their outlook on the economy.

This week let us understand some key drivers impacting interest rates in an economy.

Interest Rate Drivers

Let us start from the lowest layer of the equation (including some points discussed in previous weeks where we bring it all under one umbrella of interest rate drivers):

1. Supply & Demand

The primary definition of interest rate is that it is the cost of money (Refer Week 22).

What do we use money for? Primarily for lending, borrowing, investing along with transacting. Supply & Demand for money determines the cost of money viz., interest rates.

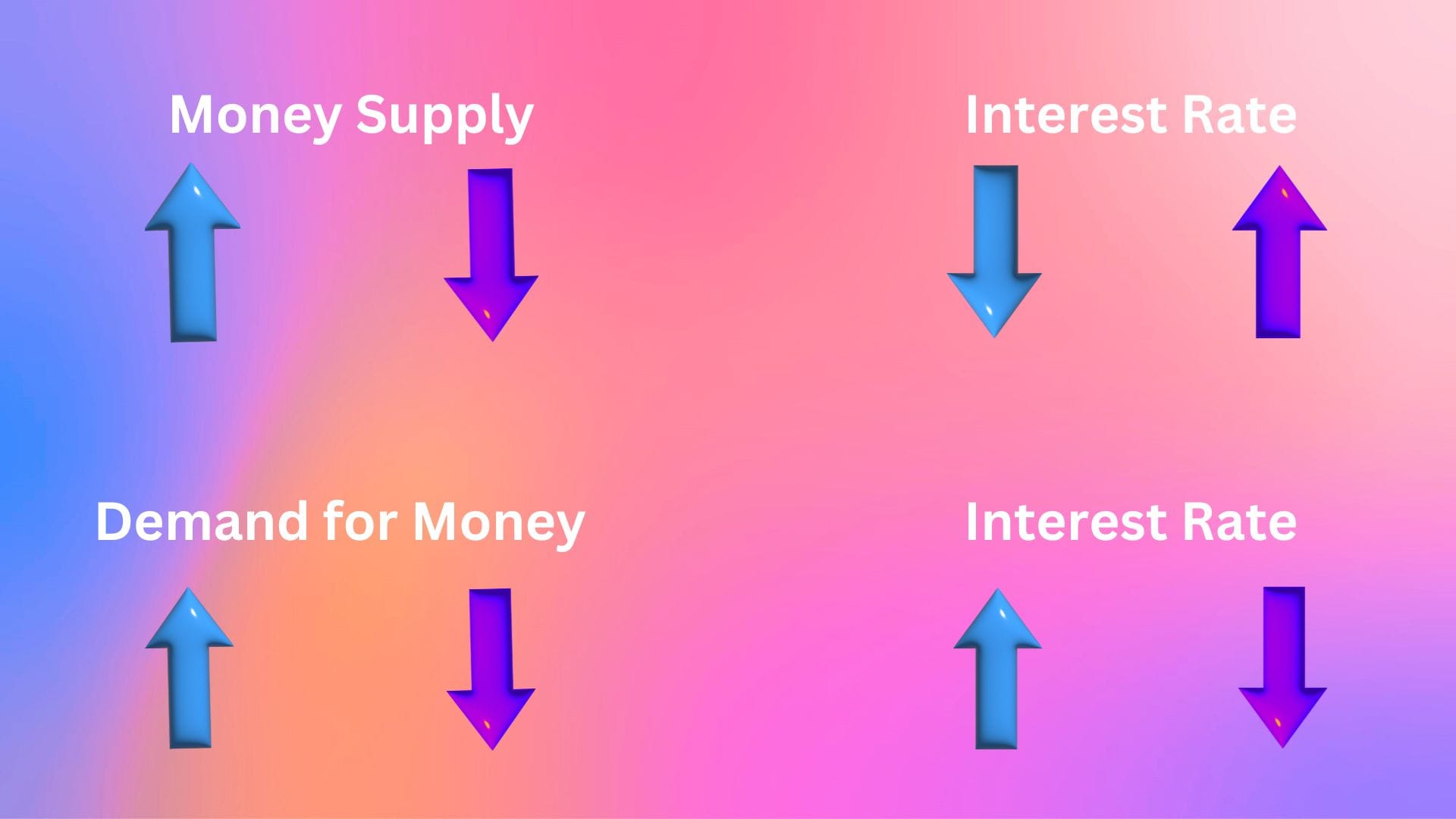

Now, when there are lots of money floating around (or in other words - higher liquidity), there is more cash to lend, borrow or invest in line with demand.

In such a scenario, acquiring money will be easier & hence interest rate which is the cost acquiring this easily available resource will come down.

Imagine the opposite scenario when there is less money floating around (or in other words - lower liquidity or illiquid), there is less cash to lend, borrow or invest. In such a scenario, acquiring money will be tougher & hence interest rate, which is the cost of acquiring this scarce resource, will go up.

Irrespective of liquidity, if there is no demand or avenues to put the liquidity to good use, then also interest rates will come down.

2. Central Banks

Now that we know the level of liquidity determines interest rates, we also discussed in week 23 who controls the supply & demand of liquidity - Central Banks or Monetary Authorities in any economy. How do they carry out this mandate?

2.1 Open Market Operations (OMO)

When the Central Bank, as part of it's monetary policy increases money supply, it injects liquidity into the economy causing interest rates to fall.

Conversely, when the Central Bank reduces money supply, it pulls out liquidity from the economy causing interest rates to rise.

This is done through Open Market Operations by buying or selling Government securities (Refer Week 23 for more details)

2.2 Reserve Requirements

Another way Central Banks control money supply is through banks by mandating Reserve Requirements. We introduced the concept of Reserve Requirements in Week 24. Let us revisit it again,

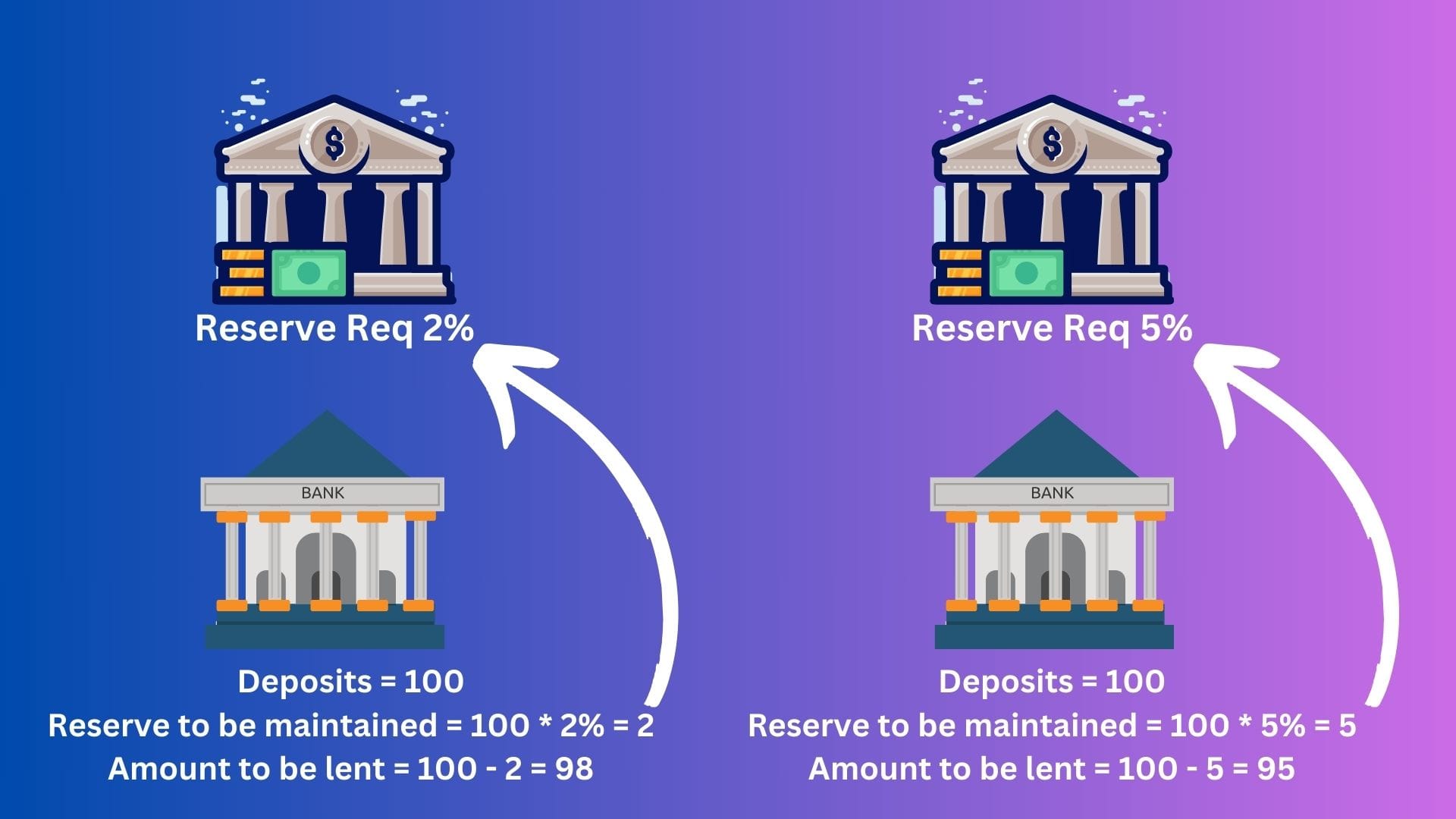

Reserve requirements are central bank regulations that set the minimum amount that a commercial bank must hold in liquid assets. This minimum amount, commonly referred to as the commercial bank's reserve, is generally determined by the central bank on the basis of a specified proportion of deposit liabilities of the bank.

The above liquid assets can be maintained either with itself or with Central Banks. Banks lend money to customers. Even though this is not directly linked to printing of money, money is created indirectly when such lending or credit creation takes place. Thus, reserve requirements limits the amount banks can lend to customers leading to scarcity in supply of money through reduced credit.

When higher reserve requirements are imposed on Banks by Central Banks, banks have to maintain higher balances with Central Bank reducing the amount lent to customers. Conversely, when reserve requirements are reduced, banks can lend more to customers creating more credit & resulting in higher money creation.

The below visual shows a comparison of the quantum of possible lending in different reserve requirement scenarios (2% & 5%) where higher reserve requirements result in lower lending:

2.3 Discount Window

Let us first understand what is the Discount Window facility offered by Central Banks to Banks. (Source : here)

The discount window is a central bank lending facility meant to help commercial banks manage short-term liquidity needs. Banks that are unable to borrow from other banks in the fed funds market can borrow directly from the Central Bank's discount window paying the federal discount rate.

Discount window borrowings tend to be short-term, usually overnight & collateralized. Banks borrow from the discount window when they are experiencing short term liquidity shortfalls & need a quick cash infusion. Hence, discount window borrowing tends to rise during spells of economy wide stress, when all banks are experiencing some degree of liquidity pressure.

The Central Bank adjusts this discount rate to manage liquidity & reserve requirements of Banks to control the money supply. For example, during the 2008 Financial Crisis, the Fed Discount window was used to maintain financial stability by extending lending period from overnight to 30 days & then to 90.

2.4 Set Base Rates

Central Banks can set & influence interest rates by modifying the base rate or the Fed funds rate depending on the economic situation. (Refer Week 23 for a more detailed explanation on base rates).

2.5 Forward Guidance & Perception

See the below statement from Federal Reserve (Source : here)

Dec 16, 2008 - The FOMC lowers it's target for the federal funds rate to a range of 0 to 1/4 percent, which the FOMC considers to be an effective lower bound. In addition, the Committee states that "weak economic conditions are likely to warrant exceptionally low federal funds rate for some time"

This shows the intention of the Federal Reserve to keep interest rates low in the near future. This helps set expectations & affects the behaviour of the population towards investments, borrowing & savings further influencing rate behavior.

3 Inflation

Let us see some recent headlines from the Fed & RBI (Reserve Bank of India):

- "Hopes for interest rate cuts this year by the Fed are steadily failing, with a string of recent remarks by Fed officials underscoring their intention to keep borrowing costs high as long as needed to curb persistently elevated inflation. A key reason for the delay in rate cuts is that the inflation pressures that are bedeviling the economy are being driven largely by lingering forces from the pandemic — for items ranging from apartment rents to auto insurance to hospital prices. Though Fed officials say they expect inflation in those areas to eventually cool, they’ve signaled that they’re prepared to wait as long as it takes." (Source : AP News)

- The Federal Reserve left its key interest rate unchanged at between 5.25% and 5.5% — the highest level in more than a decade — as annual inflation rates continued to stall.In its statement announcing the hold, the central bank said that in recent months, there had been "a lack of further progress" toward its 2% percent inflation goal."Economic activity has continued to expand at a solid pace," it said. "Job gains have remained strong, and the unemployment rate has remained low. Inflation has eased over the past year but remains elevated." (Source : NBCNews)

- Reserve Bank of India Governor Shaktikanta Das-headed rate-setting panel on Thursday concluded its three-day Monetary Policy Committee (MPC) review meeting. RBI left the repo rate unchanged at 6.5 per cent while retail inflation remains near the higher end of the central bank's comfort zone. (Source : Economictimes)

From the above, we can see the primary consideration for raising & lowering rates by the Fed or a Central Bank is inflation. Why do Central Banks consider inflation as a key parameter when deciding on adjusting interest rates?

That is because Central banks are established to foster economic prosperity and social welfare. In this regard, they are given more specific objectives by their governments to meet these goals including inflation related parameters.

Hence, to meet their inflation goals, Central banks either increase, reduce or keep the interest rates untouched. But,

- How does changes in interest rate impact inflation &

- What is inflation &

- How does it impact interest rates & other economic parameters?

Let us explore inflation from next week onwards.